- Home

- »

- Advanced Interior Materials

- »

-

Europe Powder Coating Equipment Market Size Report 2033GVR Report cover

![Europe Powder Coating Equipment Market Size, Share & Trends Report]()

Europe Powder Coating Equipment Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Pre-treatment, Ovens), By Operation (Manual, Automatic), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-834-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Powder Coating Equipment Market Summary

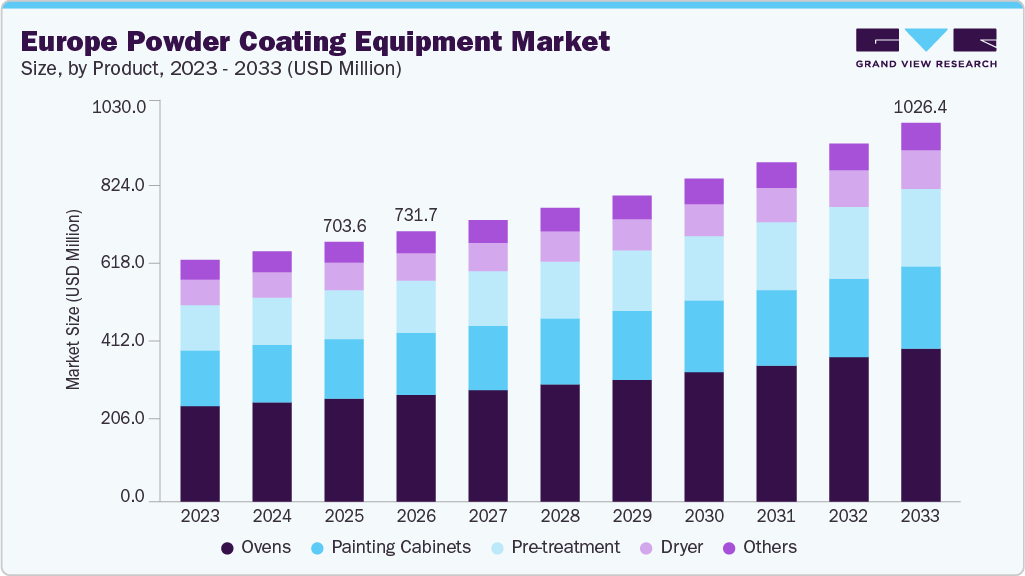

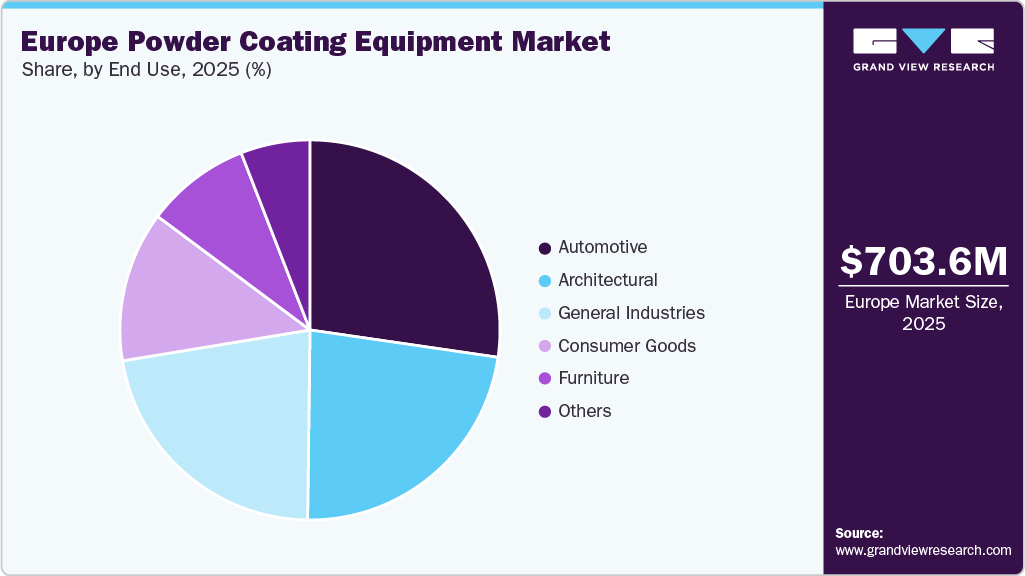

The Europe powder coating equipment market size was estimated at USD 703.6 million in 2025 and is projected to reach USD 1,026.4 million by 2033, growing at a CAGR of 5.0% from 2026 to 2033. Market growth is supported by the steady rise in construction and metal fabrication activities, fostering the demand for high-performance architectural finishes on building components and exterior structures.

Key Market Trends & Insights

- Central Europe dominated the Europe powder coating equipment market with the largest revenue share of 37.3% in 2025..

- By product, the ovens segment led the market in 2025, holding 39.5% of the market share.

- By operation,the aluminum segment is expected to grow at a considerable CAGR of 5.0% from 2026 to 2033 in terms of revenue.

- By end use, the architectural segment is expected to grow at a CAGR of 5.6% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 703.6 Million

- 2033 Projected Market Size: USD 1,026.4 Million

- CAGR (2026-2033): 5.0%

Regulatory pressure to limit solvent emissions has further accelerated the shift from liquid paints to VOC-free powder coatings, making compliance a critical driver of equipment upgrades. The shift toward low-temperature cure, energy-efficient, and sustainable powder chemistries is shaping technology development in the market.

As resin suppliers introduce low-temperature powders, recycled-content polyesters, bio-based resins, and high-durability formulations, equipment manufacturers are redesigning curing ovens with tighter temperature control, faster heat-up rates, and improved airflow uniformity to enable effective curing at 150-170 °C or lower. This trend lowers operational energy use for end users and aligns with the European Union’s broader carbon-reduction objectives across industrial manufacturing.

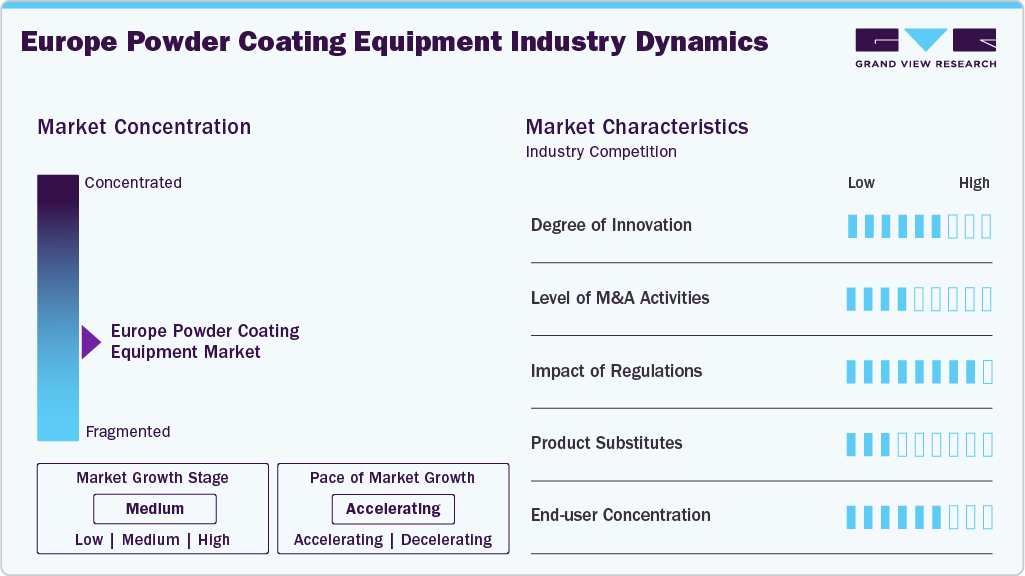

Market Concentration & Characteristics

Industry concentration in the Europe powder coating equipment is fragmented, with a mix of global leaders, strong regional challengers, and numerous niche players and system integrators. A few companies, such as Nordson, Dürr, Gema Switzerland, and WAGNER, provide broad portfolios and pan-European reach, but they compete alongside specialized OEMs and local fabricators that focus on specific countries, industries, or equipment types. This structure keeps competitive intensity high, pricing relatively disciplined, and encourages suppliers to differentiate through technology, service, and project engineering rather than sheer scale alone.

The market shows a high degree of innovation, strongly shaped by automation, digital controls, and low-temperature, energy-efficient curing technologies. European OEMs are integrating PLC-based control cabinets, touchscreen HMIs, programmable recipes, IoT-enabled diagnostics, and advanced electrostatic regulation, while simultaneously redesigning ovens and IR/UV-assisted curing systems to support new low-temperature and sustainable powder chemistries. These developments improve first-pass transfer efficiency, reduce energy consumption, and expand the addressable substrate range, turning technology leadership into a key basis of competition.

Regulation exerts a strong impact on market dynamics, while also shaping the threat from substitutes and end-user structure. VOC and industrial emissions directives, together with REACH, CLP, ATEX, and machinery safety standards, structurally favor powder coating equipment over solvent-based liquid lines by making compliance with liquid systems more costly and complex, thereby underpinning stable long-term demand for powder booths, ovens, and recovery systems.

At the same time, technical limits around curing temperatures and complex geometries ensure that compliant liquid coatings and other finishing methods remain necessary in several applications, creating a moderate but persistent threat of substitutes. On the demand side, end-user concentration is low: equipment sales are distributed across automotive, architectural, general industrial, consumer goods, furniture, and niche sectors, with buying decisions driven by throughput, automation needs, energy costs, and lifecycle economics rather than dependence on any single industry.

Drivers, Opportunities & Restraints

The regulatory environment in Europe strongly favors the adoption of powder coating over solvent-based liquid painting, and this has been a consistent driver for demand in powder coating equipment. Solvent-based systems emit volatile organic compounds (VOCs), which contribute to air pollution and pose worker safety risks. Powder coatings, however, are near-zero-VOC and inherently easier to operate within strict environmental frameworks. Consequently, European manufacturers prefer installing powder coating equipment to maintain compliance without investing heavily in abatement or emission-control systems.

The strong push toward energy efficiency across Europe creates a major opportunity for powder coating equipment manufacturers, especially in the development of next-generation curing technologies. Powder coating lines are energy-intensive, with curing ovens often representing the single largest operational cost. As European energy prices remain structurally high and industries face increasing pressure to reduce their carbon footprint, manufacturers are actively seeking ovens that consume less energy, offer faster heat-up times, and maintain tighter thermal control. This demand opens clear growth potential for OEMs that can deliver advanced convection, IR, or hybrid IR-plus-air systems designed to minimize energy use without compromising coating performance.

Substrate and geometric constraints persist despite strong EU regulatory pressure to reduce VOC emissions and move away from solvent-based coatings. While directives like the VOC Solvent Emissions Directive (1999/13/EC), the Industrial Emissions Directive (IED) 2010/75/EU, and the chemical safety frameworks under REACH (EC 1907/2006) and CLP (EC 1272/2008) push industries toward low-emission technologies, manufacturers dealing with heat-sensitive or complex parts often cannot fully transition to powder coating equipment. Thus, even in a regulatory environment that favors powder coating, these technical limitations restrict market expansion, forcing a portion of European end users to continue investing in compliant liquid-coating alternatives instead of powder coating lines.

Product Insights

The ovens segment held the largest revenue share of 39.5% in 2025 due to its essential role in curing powder coatings and determining final coating performance, finish quality, and durability. As curing requires precise and uniform thermal control, end users place strong emphasis on advanced ovens that support energy efficiency, rapid heat-up, and low-temperature curing technologies. In Europe, high energy costs and strict sustainability expectations further increase demand for efficient and well-insulated curing systems, positioning ovens as the most critical and capital-intensive component of powder coating lines.

Pre-treatment systems form a critical first stage in powder coating lines, ensuring proper adhesion and corrosion resistance through cleaning, phosphating, or conversion coating processes. Demand is driven by stringent durability requirements in automotive, architectural, and heavy-duty applications, increasingly favoring automated multi-stage spray tunnels over basic immersion tanks. Energy-efficient drying, reduced chemical consumption, and closed-loop water treatment systems are shaping procurement decisions.

Operation Insights

The automatic segment held the largest share of 52.9% in terms of revenue in 2025, due to a strong demand for higher throughput, consistent film application, and reduced labor dependence, a significant factor in Europe, where labor costs are high. Automated lines also enable precise electrostatic control and repeatability, improving transfer efficiency and minimizing material waste. In addition, several large-scale users such as appliance manufacturers, metal fabricators, and automotive suppliers prefer automation to meet strict quality standards and comply with VOC-free coating requirements, further driving demand for advanced automated systems.

The semi-automatic powder coating systems offer a balance between manual flexibility and automated consistency, making them well-suited for mid-volume production across consumer goods, industrial components, and customized architectural profiles. They typically combine automated gun triggering or conveyorized movement with operator-controlled adjustments, providing higher transfer efficiency and quality uniformity than manual systems without the capital intensity of fully automated lines. Growing demand for scalable equipment and energy-efficient curing in small to medium enterprises continues to drive the adoption of these hybrid systems in Europe.

End Use Insights

The automotive segment held the largest share of 27.3% in terms of revenue in 2025 due to significant demand for high-volume, consistent, and durable finishes for components such as body parts, wheels, chassis components, and accessories. Powder coating offers superior corrosion resistance, impact strength, and uniform aesthetics, which are essential for vehicle quality and safety. High automation adoption in automotive manufacturing further increases equipment investment, making the segment a major contributor to market revenue.

The architectural market represents a major demand driver for powder coating equipment, supported by extensive use in aluminum extrusions, façades, metal roofing systems, fencing, and structural components. Strict weathering and corrosion resistance standards, including Qualicoat and GSB certifications, require high-performance coating lines with precise curing and consistent film deposition. Expansion in sustainable building materials and high-durability powder formulations is further accelerating investments in advanced pre-treatment, automatic guns, and large-capacity curing systems.

Regional Insights

Central Europe accounted for the largest revenue share of 37.3% of the Europe powder coating equipment market in 2025, due to its strong concentration of industrial production, automotive manufacturing, construction, and metal fabrication facilities. Countries such as Germany, Poland, and Austria host extensive appliance, machinery, and architectural component manufacturing, which drives consistent demand for high-capacity coating lines and automated systems. In addition, strict regional environmental standards encourage the use of VOC-free powder coating and modern recovery technologies, further supporting equipment adoption in the region.

Germany Powder Coating Equipment Market Trends

The powder coating equipment market in Germany held the largest market share in Central Europe and remains one of Europe’s largest markets, supported by advanced automotive, appliance, and industrial machinery manufacturing. High precision and throughput requirements encourage investment in fully automated spray guns, robotic booths, and digitally controlled curing systems. German compliance norms emphasize traceability, process control, and energy efficiency, making technology integration and lifecycle cost reduction central to equipment procurement.

Benelux Powder Coating Equipment Market Trends

The powder coating equipment market in Benelux benefits from dense industrial clusters in metal fabrication, automotive components, and aluminum extrusion, creating steady demand for automated powder coating lines. High environmental compliance standards and limited industrial space encourage compact, energy-efficient ovens, recovery systems, and pre-treatment units. Investments are driven by the replacement of aging lines and upgrades to higher transfer efficiency and recyclable powder systems.

The Netherlands powder coating equipment marketshows steady demand for powder coating equipment due to strong metal fabrication, logistics infrastructure, and a sizeable architectural aluminum industry. Compact automated systems, energy-efficient curing ovens, and smart recovery units are preferred as manufacturers face space constraints and high energy costs. Replacement of older lines is a key driver, with a clear shift toward recyclable powders and automation-ready coating booths.

Scandinavia Powder Coating Equipment Market Trends

The powder coating equipment market in Scandinavia, with strong sustainability policies and high labor costs, pushes end users toward highly automated, low-temperature curing systems with advanced recovery and filtration technologies. Demand is concentrated in architectural metalwork, machinery, offshore equipment, and durable consumer products. The region favors long-life, corrosion-resistant powder coatings, driving adoption of precise curing and consistent electrostatic spray systems.

Sweden powder coating equipment marketdemand is supported by strong industrial manufacturing, construction activity, and a well-established aluminum extrusion sector. The market favors energy-efficient ovens, automated spray systems, and environmentally compliant pre-treatment units due to stringent sustainability standards. Growth in architectural metal fabrication and durable consumer goods continues to drive investment in modern, scalable coating lines.

Eastern Europe Powder Coating Equipment Market Trends

The powder coating equipment market in Eastern Europe shows rapid uptake as manufacturing hubs expand in automotive parts, appliances, and metal furniture. Lower labor costs support a mix of semi-automatic and fully automatic lines, with new facilities increasingly designed for scalability and VOC-free operations. Investments remain cost-sensitive, prioritizing reliable curing performance and vendor support over premium automation features.

Romania powder coating equipment marketgrowth is driven by expanding production of metal furniture, automotive parts, and industrial equipment, attracting both local and foreign investments. Cost-efficient semi-automatic lines dominate, although new factories are increasingly adopting scalable automated curing and powder recovery solutions to meet export standards. EU-aligned regulations are accelerating the shift from liquid coatings to powder systems, boosting demand for more modern, VOC-free lines.

Southern Europe Powder Coating Equipment Market Trends

The powder coating equipment market in Southern Europe is driven by construction metals, furniture fabrication, and lightweight automotive and appliance components. Warm climate economies also support outdoor architectural applications, reinforcing demand for high-durability powder coating systems. End users focus on replacing solvent-based lines to meet EU VOC restrictions while investing selectively in energy-efficient ovens and automated spray solutions.

Italy’s demand is supported by strong furniture manufacturing, decorative metalwork, and architectural façade markets, which require high aesthetic quality and durable finishes. Mid- to high-capacity coating lines are preferred, with a growing shift toward low-temperature powders for heat-sensitive substrates. Italian manufacturers emphasize design flexibility and finish consistency, fostering the adoption of precision electrostatic guns, uniform curing ovens, and versatile pre-treatment systems.

Key Europe Powder Coating Equipment Company Insights

Some of the key players operating in the market include Nordson Corporation and Gema Switzerland GmbH.

-

Nordson Corporation is a global precision technology company with a strong multinational profile, employing over 7,700 people and serving diverse markets ranging from industrial finishing to electronics manufacturing. The company is one of the key market players, offering high-precision spray guns, recovery units, and automated coating systems designed for high-volume, quality-critical applications.

-

Gema Switzerland GmbH operates as part of the Graco Group, which has the scale of a global industrial corporation, while maintaining its own R&D, manufacturing, and application facilities. The company is a major supplier of electrostatic powder equipment with a portfolio ranging from ergonomic manual tools to advanced robotic systems for high-throughput manufacturing.

Key Europe Powder Coating Equipment Companies:

- Nordson Corporation

- Gema Switzerland GmbH

- WAGNER

- Hangzhou Color Powder Coating Equipment Co., Ltd.

- Mitsuba Systems Pvt. Ltd.

- Eastwood Company

- Oven Empire Manufacturing

- Binks (Former MS)

- Luterbach

- Dürr

- DURST Pulverbeschichtungsanlagen GmbH

- Rippert GmbH & Co. KG

- AFOTEK Anlagen für Oberflächentechnik GmbH

- Meeh Pulverbeschichtungs- und Staubfilteranlagen GmbH

- Euroimpianti

- Eurotherm

- Aabo-IDEAL

- ITS group

Recent Developments

-

In December 2025, Dürr enhanced its footprint in Italy by merging its subsidiaries CPM S.p.A. and Olpidürr S.p.A. to form Dürr Systems Italy S.p.A. This unified entity consolidates Dürr’s strengths in final assembly and painting process technologies, improving coordination and operational efficiency.

-

In August 2025, Luterbach AG expanded its footprint by establishing a subsidiary in Germany, one of its key target markets. This move strengthens the company’s local presence, enhances customer support, and supports long-term growth. The new subsidiary enables Luterbach to better serve demand and reinforce its position in the German coatings and surface technology sector.

Europe Powder Coating Equipment Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 731.7 million

Revenue forecast in 2033

USD 1,026.4 million

Growth rate

CAGR of 5.0% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, operation, end use, region

Regional scope

Central Europe; Scandinavia; Benelux; Eastern Europe; Southern Europe

Country scope

Germany; Austria; Switzerland; Poland; Czech Republic; Slovakia; Hungary; Slovenia; Denmark; Norway; Finland; Sweden; Iceland; Belgium; Netherlands; Luxembourg; Romania; Bulgaria; Serbia; Croatia; Italy; Spain; Portugal; Greece; Turkey

Key companies profiled

Nordson Corporation; Gema Switzerland GmbH; WAGNER; Hangzhou Color Powder Coating Equipment Co., Ltd.; Mitsuba Systems Pvt. Ltd.; Eastwood Company; Oven Empire Manufacturing; Binks (Former MS); Luterbach; Dürr; DURST Pulverbeschichtungsanlagen GmbH; Rippert GmbH & Co. KG; AFOTEK Anlagen für Oberflächentechnik GmbH; Meeh Pulverbeschichtungs- und Staubfilteranlagen GmbH; Euroimpianti; Eurotherm; Aabo-IDEAL; ITS group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Powder Coating Equipment Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Europe powder coating equipment market report based on product, operation, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Pre-treatment

-

Dryer

-

Painting Cabinets

-

Ovens

-

Others

-

-

Operation Outlook (Revenue, USD Million, 2021 - 2033)

-

Manual

-

Semi-Automatic

-

Automatic

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer Goods

-

Architectural

-

Automotive

-

General Industries

-

Furniture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

Scandinavia

-

Denmark

-

Norway

-

Finland

-

Sweden

-

Iceland

-

-

Benelux

-

Belgium

-

Netherlands

-

Luxembourg

-

-

Central Europe

-

Germany

-

Austria

-

Switzerland

-

Poland

-

Czech Republic

-

Slovenia

-

Slovakia

-

Hungary

-

-

Eastern Europe

-

Romania

-

Bulgaria

-

Serbia

-

Croatia

-

-

Southern Europe

-

Italy

-

Spain

-

Portugal

-

Greece

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The Europe powder coating equipment market size was estimated at USD 703.6 million in 2025 and is expected to be USD 731.7 million in 2025.

b. The Europe powder coating equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.0% from 2026 to 2033 to reach USD 1,026.4 million by 2033.

b. Central Europe held the largest share of 37.3% in 2025, driven by its strong base of industrial manufacturing, automotive production, and metal fabrication. High output boosts demand for large, automated coating systems, while strict environmental rules further accelerate adoption of VOC-free and energy-efficient powder coating technologies.

b. Some of the key players operating in the Europe powder coating equipment market include Nordson Corporation, Gema Switzerland GmbH, WAGNER, Hangzhou Color Powder Coating Equipment Co., Ltd., Mitsuba Systems Pvt. Ltd., Eastwood Company, Oven Empire Manufacturing, Binks (Former MS), Luterbach, Dürr, DURST Pulverbeschichtungsanlagen GmbH, Rippert GmbH & Co. KG, AFOTEK Anlagen für Oberflächentechnik GmbH, Meeh Pulverbeschichtungs- und Staubfilteranlagen GmbH, Euroimpianti, Eurotherm, Aabo-IDEAL, and ITS group.

b. The Europe powder coating equipment market is driven by stricter environmental regulations that favor VOC-free coating systems, along with rising industrial production in automotive, construction, and metal fabrication. Growing demand for energy-efficient ovens, automation, and high-durability finishes further accelerates investment in advanced powder coating technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.