- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Europe Protein Supplements Market, Industry Report, 2030GVR Report cover

![Europe Protein Supplements Market Size, Share & Trends Report]()

Europe Protein Supplements Market Size, Share & Trends Analysis Report By Source (Animal-based, Plant-based), By Product, By Application, By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-215-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Europe Protein Supplements Market Trends

The Europe protein supplements market size was estimated at USD 1,441.8 million in 2023 and is expected to grow at a CAGR of 7.2% from 2024 to 2030. The market growth is driven by increasing emphasis on healthy living, growing trend of preventive health care, and rising demand for protein supplements from countries such as the U.K. and Germany is expected to increase market growth over the forecast period. Furthermore, the aging population and growing consumer awareness regarding healthy eating and exercise are expected to drive the demand for protein supplements.

The high disposable income and fast-paced lifestyles of consumers in Europe are expected to further fuel market growth for protein supplements. As a result of busy lifestyles, many consumers are looking for convenient and easy-to-consume sources of protein that can provide them with the necessary nutrients to support their active lifestyles. Another factor that is expected to drive the demand for protein supplements in Europe is the abundant availability of raw materials, particularly dairy-based protein supplements. Europe has a strong dairy industry, and this provides ample raw material to produce high-quality protein supplements.

The protein supplement market has been experiencing significant growth in recent years, and the increasing demand for sports nutritional supplements is one of the major driving factors. Athletes and fitness enthusiasts require a higher protein intake to support their training and exercise routines, and protein supplements provide an easy and convenient way to meet this demand.

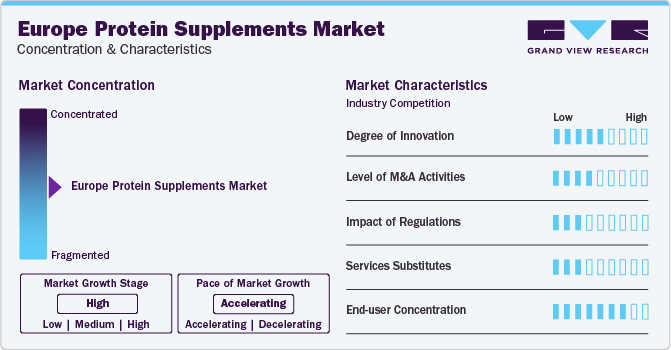

Market Concentration & Characteristics

The Europe protein supplements industry is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Industry players are expanding their businesses by opening new production facilities. This strategy allows them to increase their production capacity, improve the supply chain, and gain a stronger foothold in the market. For instance, in September 2021, Roquette, a company specializing in plant-based ingredients and plant protein development, opened a new center of expertise. The center is located on the company's Vic-Sur-Aisne site in Hauts-de-France and spans over 2,000 square meters. The center is dedicated solely to plant protein research, offering opportunities to develop new proteins, innovative food products, and advanced production technologies.

The industry is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. Many companies are acquiring other players to expand their product portfolios and increase their market share in the U.K. protein supplements industry. For instance, in March 2021, Mondelēz International, a multinational confectionery and snack food company, announced an agreement to acquire a significant majority interest in Grenade, a UK-based performance nutrition company specializing in high-protein bars. The acquisition is part of Mondelēz's strategy to expand its presence in the fast-growing market for healthy and nutritious snack options, especially protein-fortified products.

End-user concentration is a significant factor in the Europe protein supplements industry. Consumers are becoming more conscious of their health and are willing to invest in products that can help them maintain or improve their overall well-being. As a result, the protein supplements market is expected to grow.

Source Insights

Animal-based protein supplements accounted for a revenue share of 58.0% in 2023. The rising demand for high-value proteins is likely to drive market growth. Whey protein is the most popular animal-based protein supplement. The growing demand for whey proteins is attributed to their high nutritional value in enhancing muscle growth, increasing power, and improving immunity. Whey proteins are added to supplements for all age groups, from infants, children, and adolescents to older adults. Furthermore, Whey proteins comprise essential amino acids and leucine, which are known to have a positive impact on human health and are much more easily digestible than many other protein sources.

The plant-based protein supplements are projected grow at a CAGR of 7.7% over the forecast period. Consumer preference for vegan, vegetarian, or flexitarian diets is rising in the region. Increasing awareness regarding the associated risk of cancer, diabetes, and cardiovascular diseases with animal-based proteins is expected to fuel plant protein demand and create room for new product development.Increasing government support for the plant-based proteins industry is also contributing to market growth in Europe. Increasing investments in plant-based protein start-ups and product innovation are two key strategies adopted by key players in the plant-based proteins industry. For instance, DuPont Nutrition and Biosciences expanded its product portfolio with various ingredient solutions, including plant proteins, in 2019. The company is focused on expanding its portfolio to cater to the growing demand for ingredients from the plant-based food and beverage industry.

Product Insights

The protein powder supplements accounted for a revenue share of 55.96% in 2023.Protein powder is derived from various raw materials, including egg, whey, soy, pea, and casein. Growing demand from sports person and gym freaks are expected to boost segment’s growth. Many companies are investing in research and development activities to offer innovative protein powder products that cater to consumers’ specific needs and preferences. For instance, the availability of protein powders that are plant-based, lactose-free, or specifically designed for women or athletes has increased in recent years.

The RTD protein supplements are projected to grow at a CAGR of 7.7% from 2024 to 2030. The increasing demand for sports nutritional supplements and the growing popularity of easily consumable and readily available protein supplements are expected to drive the demand for RTD protein supplements over the forecast period. In August 2022, Optimum Nutrition, a leading sports nutrition company, launched the Gold Standard Protein Shake. The RTD shake contains 24 grams of protein per serving and is available in two flavors-chocolate and vanilla.

Application Insights

The functional food segment accounted for a revenue share of 35.67% in 2023. The aging population and growing consumer awareness regarding healthy eating and exercise are expected to drive the demand for protein supplements in the functional foods application across Europe. This trend is supported by the availability of a wide range of protein supplements in the market. Rising occurrences of cardiovascular diseases owing to inactive and slow lifestyles and fluctuating dietary patterns, especially between the ages of 30 and 40, have driven consumer awareness regarding the importance of omega 3-based nutraceutical products, boosting their adoption.

The sports nutrition segment is expected to grow at a CAGR of 7.5% during the forecast. In sports nutrition, protein supplements are used to manufacture various products such as low-pH clear beverages, nutritional beverages, ready-to-drink protein shakes, and dry mix beverages. All grades of whey proteins-including concentrates, isolates, and hydrolysates-have an excellent digestibility and amino acid profile. However, since hydrolyzed whey proteins are more expensive than their counterparts, most whey supplement manufacturers add a very small quantity of this ingredient to their respective formulas.

Distribution Channel Insights

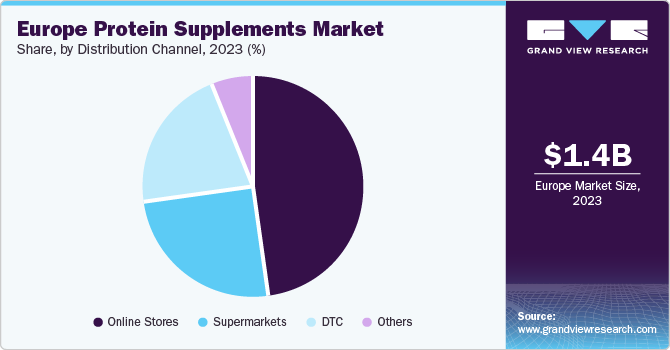

Sales of protein supplements through online stores accounted for a revenue share of 47.7% in 2023. The online distribution channel is a popular choice for consumers of protein supplements. Customer trust plays a crucial role in determining the demand for specific products, and online retailers such as Amazon, Walmart, and eBay increasingly rely on following up with their customers regularly and having their feedback. Furthermore, consumers can save money while purchasing products of their choice online within their budget without compromising on brand and quality. The benefits to customers, including comparison in price range and the availability of numerous brands with customer reviews for the products, further drive the sales of supplements through this channel.

Sales through supermarkets are expected to grow at a CAGR of about of 7.6% from 2024 to 2030. Supermarkets are easily accessible and provide a convenient shopping experience for customers. They offer a variety of protein supplement options under one roof, making it easier for customers to compare and choose the products that best meet their needs. Customers tend to trust established brands, and supermarkets and hypermarkets offer a wide selection of reputable brands in the protein supplements market. This builds customer confidence in the products being sold and can lead to repeat purchases.

Country Insights

Europe protein supplements market is projected to grow at a CAGR of 7.2% over the forecast period. An increasing aging population and growing awareness of protein supplement benefits among the population is expected to drive market growth. Another factor that is expected to drive the demand for protein supplements in Europe is the abundant availability of raw materials, particularly dairy-based protein supplements. Europe has a strong dairy industry, and this provides ample raw material to produce high-quality protein supplements.

Germany Protein Supplements Market Trends

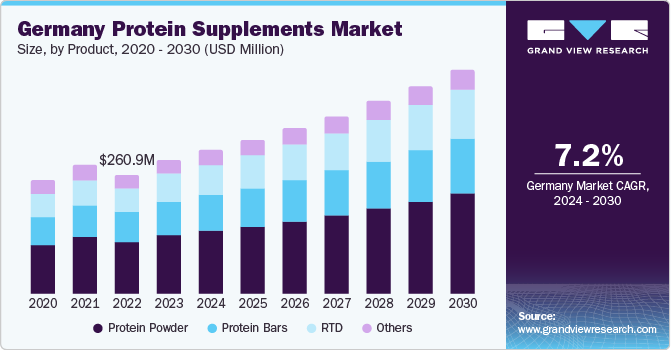

The protein supplements market in Germany is expected to grow at a CAGR of 7.2% as many leading companies in the protein supplements market have a significant presence in Germany, and they continue to invest in product development and marketing to meet the growing demand. Additionally, many new startups are emerging in the market, focused on developing innovative and sustainable products. For instance, in February 2023, Grenade, a U.K.-based sports nutrition brand, launched its Energy Drink and Carb Killa Protein Bars and Shakes in Germany. The launch of these products in Germany reflects the growing demand for sports nutrition products in the country, as well as the wider trend toward healthier and protein-fortified food and beverage options.

UK Protein Supplements Market Trends

Protein supplements market in the UK is expected to grow at a CAGR of 7.0% owing to rising awareness of the importance of a healthy diet and regular exercise for maintaining good health and wellness. This scenario has led to an increased demand for protein supplements, as they are seen as an effective way to support muscle growth and recovery. The number of people following vegan and vegetarian diets in the U.K. has been increasing steadily in recent years. This has led to an increased demand for plant-based protein supplements. Key players and startups are launching new products catering to the growing demand for protein-fortified, plant-based snacks. For instance, in December 2022, Yummo's, a snack company that specializes in high-protein, low-sugar, plant-based snacks, launched Dough Dreamer soft-baked protein cookies. The cookie is designed to provide a nutritious and delicious snack option that is high in protein and low in sugar, making it a popular choice among health-conscious consumers.

Key Europe Protein Supplements Company Insights

Some of the key players operating in the market include WOODBOLT DISTRIBUTION LLC, BPI Sports, and GELITA AG

-

GELITA AG produces and sells products made from collagen proteins. Its product line includes collagen peptides, gelatin, fats, minerals, proteins, and collagens catering to food and pharmaceutical industries. The company was formerly known as DGF Stoess AG and changed its name to GELITA AG in April 2005. It has over 18 production plants and sales office located worldwide. Food and pharmaceutical segments together account for more 85% of the total sales of the company.

-

WOODBOLT DISTRIBUTION LLCfocuses on the innovation, development, and manufacture of general wellness products, sports nutrition, energy supplements, and functional foods. The company provides its products under the nutrabolt. The company manufactures protein powders under its brand “Cellucor” and other brands include FitJoy, Royal Sports Ltd, and Scivation.

Hoogwegt, Nestle, NOW Foods, andOptimum Nutrition are some of the other participants in the Europe protein supplements market,

-

Hoogwegt was founded in 1965 and is headquartered in Netherlands. The company manufactures, markets and sells dairy products. The company’s product portfolio includes milk proteins, whey proteins, casein and caseinate, milk powder alternatives and dairy preparations. The company produced 2 million metric tons of dairy products in 2017 and has its operation in more than 130 countries worldwide.

-

NOW Foods is a family-owned natural foods company, which has over 1,000 products including herbs, natural foods, vitamins, minerals, and natural personal care products marketed under its brands. The company operates through its six business segments, namely supplements, beauty & health, essential oils, sports nutrition, natural foods, and pet health. Moreover, sports nutrition segment manufactures protein powders.

Key Europe Protein Supplements Companies:

- WOODBOLT DISTRIBUTION LLC

- BPI Sports

- GELITA AG

- Hoogwegt

- Nestle

- NOW Foods

- Optimum Nutrition

- International Dehydrated Foods, Inc.

- Jym-Supplement-Science.

- Surthrival

Recent Developments

-

In January 2023, Surthrival introduced the world's first plant-based protein powder that is sourced entirely from wild-foraged black walnuts in the U.S. Through an advanced CO₂ extraction process, the product yields a high concentration of plant-based protein, boasting 17 grams of protein per serving.

-

In October 2022, Optimum Nutrition, a sports nutrition brand of Glanbia, launched a new plant-based protein powder called Gold Standard 100% Plant Protein. The formula is made with 100% vegan ingredients and contains 24 grams of protein to support fitness activities. The launch is in response to the growing trend of plant-based alternatives in the market.

Europe Protein Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,536.2 million

Revenue forecast in 2030

USD 2.33 billion

Growth rate

CAGR of 7.2% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, application, distribution channel, country

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain

Key companies profiled

WOODBOLT DISTRIBUTION LLC; BPI Sports; GELITA AG; Hoogwegt; Nestle; NOW Foods; Optimum Nutrition; International Dehydrated Foods, Inc.; Jym-Supplement-Science.; Surthrival

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Protein Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe protein supplements market report based on source, product, application, distribution channel, and country:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Animal-based

-

Whey

-

Casein

-

Egg

-

Fish

-

Others

-

-

Plant-based

-

Soy

-

Spirulina

-

Pumpkin Seeds

-

Wheat

-

Hemp

-

Rice

-

Pea

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Protein Powders

-

Protein Bars

-

RTD

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Nutrition

-

Functional Foods

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets

-

Online Stores

-

DTC

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the Europe protein supplements market include WOODBOLT DISTRIBUTION LLC; BPI Sports; GELITA AG; Hoogwegt; Nestle; NOW Foods; Optimum Nutrition; International Dehydrated Foods, Inc.; Jym-Supplement-Science.; Surthrival

b. The Europe protein supplements market size was estimated at USD 1,441.8 million in 2023 and is expected to reach USD 1,536.2 million in 2024.

b. The Europe protein supplements market is expected to grow at a compounded growth rate of 7.2% from 2024 to 2030 to reach USD 2.33 billion by 2030.

b. Animal-based protein supplements accounted for a revenue share of 58.0% in 2023. The rising demand for high-value proteins is likely to drive market growth. Whey protein is the most popular animal-based protein supplement. The growing demand for whey proteins is attributed to their high nutritional value in enhancing muscle growth, increasing power, and improving immunity. Whey proteins are added to supplements for all age groups, from infants, children, and adolescents to older adults. Furthermore, Whey proteins comprise essential amino acids and leucine, which are known to have a positive impact on human health and are much more easily digestible than many other protein sources.

b. Key factors that are driving the Europe protein supplements market growth include increasing emphasis on healthy living, growing trend of preventive health care, and rising demand for protein supplements from countries such as the U.K. and Germany is expected to increase market growth over the forecast period. Furthermore, the aging population and growing consumer awareness regarding healthy eating and exercise are expected to drive the demand for protein supplements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."