- Home

- »

- Digital Media

- »

-

Europe Sports Betting Market Size, Industry Report, 2030GVR Report cover

![Europe Sports Betting Market Size, Share & Trends Report]()

Europe Sports Betting Market Size, Share & Trends Analysis Report By Type, By Platform, By Sports Type (Football, Basketball, Baseball, Horse Racing, Cricket, Hockey, Others), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-218-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Europe Sports Betting Market Size & Trends

The Europe sports betting market size was estimated at USD 33.75 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.9% from 2024 to 2030. The rise in e-sports activities in the region is expected to drive the market's growth. Many major regional companies are investing in eSports teams as part of their strategic initiatives to capitalize on the rapidly growing sports betting market, recognizing the potential to attract a younger demographic of bettors who are increasingly interested in eSports competitions. For instance, Honda and HTC sponsored the European eSports team Team Liquid, which won a prize of USD 44.08 million.

Moreover, the presence of popular football clubs such as Barcelona, Manchester United, Liverpool, and others is another factor boosting the growth of the sports betting market in Europe. Features such as the liberty of betting from any location at any time and ease of placing bets using smartphone applications are boosting interest among European customers.

The growing number of eSports audiences offers a significant opportunity for the European sports betting industry. For instance, according to gaming industry data and insights provider Newzoo, the viewership of eSports tournaments and games showed a significant increase of 7.4% in 2020 compared to 2019. Moreover, the rise in eSports betting platforms is further fueling the market growth in the region. For instance, in January 2024, BetFirst, a sportsbook in Europe, boosted its online betting offering by adding eSports wagering to its gambling services store. The site accepts wagering on multiple games like League of Legends, Counter-Strike, PUBG, Call of Duty, and many more, which reaches a wide range of users.

The COVID-19 pandemic positively affected the sports betting market in Europe. The sudden scarcity of betting platforms had affected the wagering of betters initially due to the postponement and cancellation of sports leagues, such as the cancellation of football leagues in countries like Belgium and France or the major tennis events like Wimbledon in the UK during the COVID-19 pandemic. The surge in online gaming adoption during the pandemic, including activities like betting and fantasy sports games such as 20bet, led to a significant increase in sports betting use among Europe's population. As a result, the pandemic has positively impacted market growth, thus fueling widespread adoption and engagement within the region.

The Europe sports betting regulations include a strategy where the Gambling Commission of the UK formed regulations to make gambling safer and fairer by providing licensing to protect their user interests. The Gambling Commission of the UK is evolving its license conditions and code of practices to avoid gambling-related risks. In this way, the bettors are assured that betting would be fair in the region, increasing customer interest.

Online sports betting experienced significant growth due to advancements in real-money gaming. The growth is further propelled by the widespread penetration of the internet and smartphones, making online sports betting more accessible and convenient for individuals in the region. The ease of accessing sports betting platforms via smartphones has increased participation, attracting a broader audience to engage in betting activities.

In the European sports betting industries, encompassing gaming, entertainment, and digital transactions, there has been a notable increase in the utilization of betting platforms. Bettors actively analyze sports events, research statistics, and place wagers on outcomes through both online and offline platforms, aiming to achieve successful predictions and careful bankroll management. This process often needs monitoring results, refining strategies, and committing to ongoing learning endeavors to refine their betting skills.

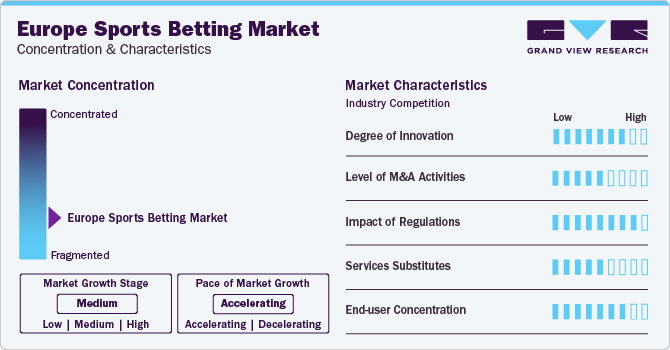

Market Concentration & Characteristics

Europe sports betting market growth stage is medium, and the pace of growth is accelerating. The market is characterized by a rapidly and actively evolving landscape driven by technological advancements, diverse sports options, and a supportive ecosystem. Technological advancements drive innovation in the market, integrating mobile betting apps and live streaming to enhance the customers' user experience.

Government initiatives for sports betting in Europe encompass a range of measures to regulate the industry and ensure responsible gambling practices. Many European countries focus on establishing or refining regulatory frameworks to maintain transparency, fair competition, and legal compliance within the sports betting sector. Licensing requirements are often stringent, emphasizing the need for operators to meet specific standards to operate in the market.

Consumer protection is a key priority, leading to initiatives such as age verification processes, responsible gambling tools, and restrictions on advertising to safeguard individuals from potential harm associated with betting. Governments also actively address issues related to problem gambling by promoting support services, including helplines, counseling, and self-exclusion programs. Anti-money laundering measures are commonly implemented to prevent illicit financial activities within the sports betting industry. Taxation policies may be revised to ensure fair contributions from both operators and consumers. These multifaceted initiatives underscore the commitment to fostering a regulated, secure, and socially responsible sports betting environment across Europe.

The Europe market for sports betting is developing and has a significantly concentrated nature, featuring several global and regional players. The market players are investing in research & development (R&D) to develop advanced solutions and gain a competitive edge. Moreover, they are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change.

Type Insights

Based on type, the market is further divided into exchange betting, fixed odds wagering, live/in play betting, eSports betting, and others. Others include spread betting and parimutuel. The fixed odd wagering segment accounted for the largest revenue share of 27.7% in 2023 and is expected to continue dominating from 2024 to 2030. The popularity of fixed odds betting in Europe has increased due to its straightforward and transparent way of allowing bettors to understand their potential winnings based on the odds set by bookmakers. The availability of a wide range of markets and events with fixed odds allows bettors to choose from various options, enhancing their overall betting experience. The structured nature of fixed-odds betting appeals to experienced and novice bettors as it provides a clear understanding of potential outcomes and risks. Online platforms play a significant role in the growth of fixed odds wagering, providing users easy access to betting options and real-time information.

The eSports betting segment is anticipated to witness the fastest CAGR during the forecast period. The growing popularity of eSports as entertainment, with a dedicated and passionate fan base, contributes to the increased interest in eSports betting. As eSports events gain popularity, betting on them is becoming more common. The accessibility of online platforms enables easy and convenient eSports betting, allowing fans to wager on their favorite teams and players from the comfort of their homes. Esports also offer various games and tournaments, catering to a broad audience with varied preferences. Furthermore, the increasing mainstream recognition of eSports, along with sponsorships, media coverage, and partnerships, contributes to the legitimacy and visibility of eSports betting. With the growing popularity of eSports, an increasing number of individuals in the region are expected to engage in eSports betting, thus driving the growth of the segment in the sports betting market.

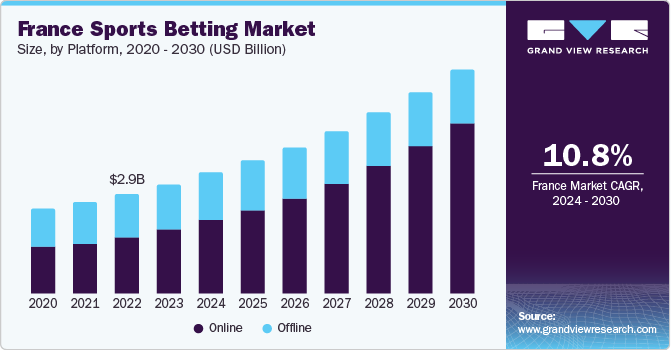

Platform Insights

The online segment held the largest revenue share in 2023. This can be attributed to the rapid digitization of businesses, the increasing number of online betting and gaming apps, and the rising adoption of AI applications. Online platforms offer convenience, allowing users to place bets from the comfort of their homes using computers or mobile devices. This accessibility has significantly expanded the reach of sports betting. Online platforms provide a wide variety of betting options, live betting features, and real-time information, enhancing the overall experience for users. The ability to easily compare odds and explore diverse markets also contributes to the preference for online methods. Additionally, secure payment options and the ease of creating and managing accounts online have contributed to the shift towards online sports betting in Europe.

The offline platform segment is expected to grow significantly during the forecast period. This can be attributed to the unique atmosphere and experience that cannot be replicated online. Betting shops and casinos often provide a social environment where bettors can interact with each other and watch sports events on large screens. This social aspect adds to the overall enjoyment of the betting experience. It may attract customers who value the sense of community, thus driving the growth of the offline segment in the European sports betting market.

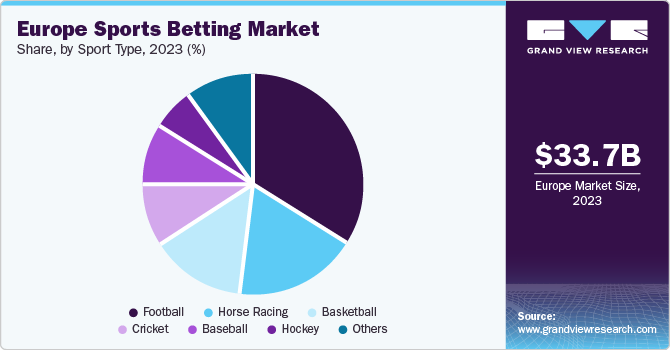

Sports Type Insights

Based on sports type, the market is segmented into football, basketball, baseball, horse racing, cricket, hockey, and others. Football is the most popular sports in the Europe region and the presence of numerous leagues such as English Premier League, La Liga, Serie A, and Bundesliga, contribute to the growth of sports betting in the region. Moreover, the accessibility and availability of football matches contribute to the growth of sports betting in Europe. With football matches taking place regularly throughout the year, spanning various leagues, tournaments, and competitions, there is a continuous stream of betting opportunities for enthusiasts, thus driving the market growth.

The basketball segment is anticipated to grow at a significant CAGR during the forecast period. Basketball betting's popularity in Europe can be attributed to the sport's global appeal, the success of European basketball leagues, and the widespread availability of basketball events for betting. The rise of international competitions like the EuroLeague has increased the visibility and interest in basketball betting. Moreover, the fast-paced nature of basketball, coupled with the excitement of high-scoring games, contributes to its attractiveness for bettors.

Country Insights

UK Sports Betting Market Trends

The UK sports betting market dominated the industry with a revenue share of 34.6% in 2023 and is projected to grow at a CAGR of 10.1% over the forecast period. The presence of well-regulated and established provides a favorable environment for sports betting in the country. The Gambling Act 2005 and subsequent regulatory frameworks have established clear guidelines for operators and ensured consumer protection, integrity, and responsible gambling practices. This robust regulatory framework fosters confidence among bettors, encourages participation in sports betting activities, and contributes to the growth of the sports betting market in the region.

Italy Sports Betting Market Trends

The sports betting market in Italy is expected to grow at the fastest CAGR during the forecast period. Italy has a strong sporting culture, with football being the most popular sport in the country. With football leagues such as Serie A, Serie B, and Coppa Italia, as well as emotional support for the Italian national team, football holds a special place among Italians. This strong association with sports creates a favorable environment for sports betting as fans are eager to engage with their favorite teams and matches via betting.

Key Europe Sports Betting Company Insights

Some of the key market players include Bet365, William Hill, Betfair, Paddy Power, 888sport and Bwin.

-

Bet365 offers in-play betting options, extensive live-streaming services, and a user-friendly interface. The platform provides betting on a wide range of sports, including football, basketball, baseball, and hockey. Bet365 is known for its extensive sports market, featuring over two dozen sports to wager on, and its comprehensive coverage of in-play betting options.

-

William Hill offers a wide range of sports markets and betting options, with live betting available for over 60 sports. It offers betting options in sports, including football, tennis, golf, basketball, baseball, table tennis, and eSports.

Betway, 10Bet, LeoVegas Sport are some of the other market participants.

-

Betway is a leading global entertainment provider in the sports betting and casino sectors. The company offers a wide range of sports events for betting, including football, basketball, soccer, hockey, golf, motorsports, and more. Betway provides a seamless and responsive platform for sports betting, with a strong focus on in-play betting, offering numerous sports markets for live games.

Key Europe Sports Betting Companies:

- Bet365

- William Hill

- Betfair

- Paddy Power

- 888sport

- Bwin

- Unibet

- Ladbrokes

- MGM Resorts International

- Betsson

Recent Developments

- In August 2023, MGM Resorts International, launched its online sports betting and iGaming brand BetMGM in UK. The online platform of BetMGM UK presents customers with compelling new product features, including generous and frequent jackpots, loyalty incentives, sports promotions, and exclusive slot offerings.

- In September 2023, DAZN Bet, a gaming and sports betting subsidiary of sports streaming service DAZN, launched its services in Germany in collaboration with online casino service provider Pragmatic Solutions. DAZN Bet uses Pragmatic's player account management platform, offering features for detecting fraud and meeting anti-money laundering regulations.

Europe Sports Betting Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 36.84 billion

Revenue forecast in 2030

USD 65.54 billion

Growth rate

CAGR of 9.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, type, sports type, region

Regional scope

Europe

Country scope

UK; Germany; France; Italy

Key companies profiled

Bet365; William Hill; Betfair; Paddy Power; 888sport; Bwin; Unibet; Ladbrokes; MGM Resorts International; Betsson

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Sports Betting Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe sports betting marketreport based on platform, type, sports type, and region:

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed Odds Wagering

-

Exchange Betting

-

Live/In Play Betting

-

Esports Betting

-

Others

-

-

Sports Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Football

-

Basketball

-

Baseball

-

Horse Racing

-

Cricket

-

Hockey

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Frequently Asked Questions About This Report

b. The Europe sports betting market size was estimated at USD 33.75 billion in 2023 and is expected to reach USD 36.84 billion by 2024

b. The Europe sports betting market is expected to grow at a compound annual growth rate of 9.9% from 2024 to 2030 to reach USD 66.54 billion by 2030

b. The fixed odd wagering segment accounted for the largest revenue share of 27.7% in 2023 and is expected to continue to dominate the industry over the forecast period. The popularity of fixed odds betting in Europe has increased due to its straightforward and transparent way of allowing bettors to understand their potential winnings based on the odds set by bookmakers.

b. Bet365; William Hill; Betfair; Paddy Power; 888sport; Bwin; Unibet; Ladbrokes; MGM Resorts International; Betsson

b. Many major regional companies are investing in esports teams as part of their strategic initiatives to capitalize on the rapidly growing sports betting market, recognizing the potential to attract a younger demographic of bettors who are increasingly interested in esports competitions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."