- Home

- »

- Digital Media

- »

-

Gaming Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Gaming Market Size, Share & Trends Report]()

Gaming Market (2025 - 2030) Size, Share & Trends Analysis Report By Device (Console, Mobile, Computer), By Type (Online, Offline), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-2-68038-289-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gaming Market Summary

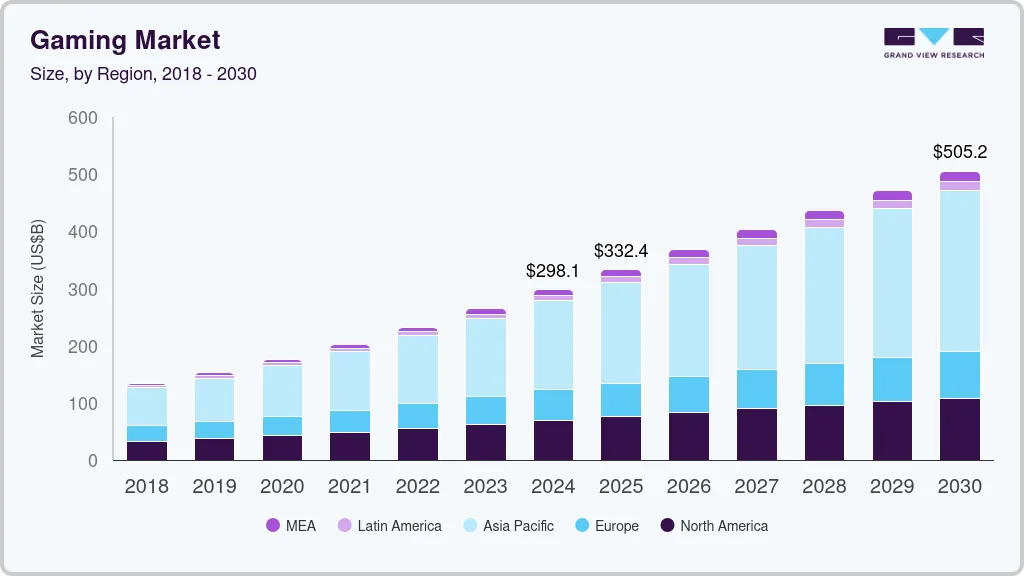

The global gaming market size was estimated at USD 298.09 billion in 2024 and is projected to reach USD 505.17 billion by 2030, growing at a CAGR of 8.7% from 2025 to 2030. Rapid growth in the market is fueled by factors such as the rise of cloud gaming, mobile gaming, advancements in AR/VR technologies, and the increasing popularity of e-sports.

Key Market Trends & Insights

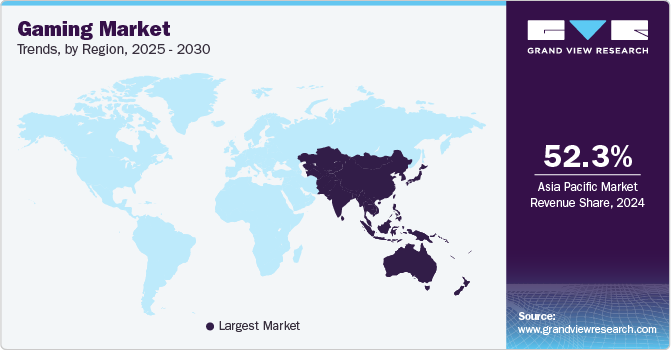

- The gaming market in the Asia-Pacific region is expected to grow at the fastest CAGR of over 9% from 2025 to 2030.

- The U.S. gaming market held a dominant position in the North America region in 2024.

- By device, the mobile segment recorded the largest revenue share of over 46% in 2024.

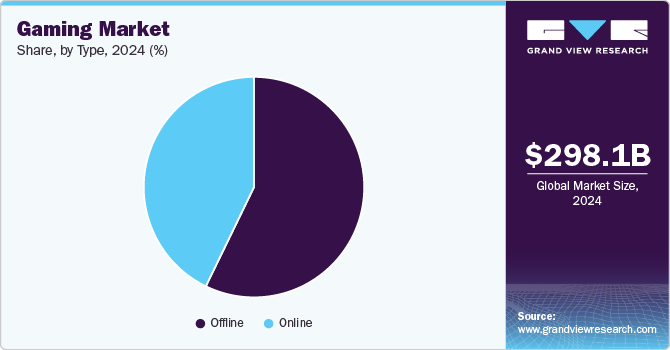

- By type, the offline segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 298.09 Billion

- 2030 Projected Market Size: USD 505.17 Billion

- CAGR (2025-2030): 8.7%

- Asia Pacific: Largest market in 2024

The industry is being transformed by subscription-based models, digital distribution platforms, blockchain technology for in-game assets, and AI-driven innovations, with a more diverse demographic of gamers driving demand, which is expected to present lucrative opportunities for the gaming industry in the coming years.AI and machine learning are playing an increasingly important role in game development. AI is being used to enhance game design, with procedural content generation, adaptive difficulty levels, and intelligent NPC behaviors improving the overall player experience. In addition, AI-driven personalization allows games to adapt to individual players' preferences, creating more engaging and customized experiences. As AI technology continues to evolve, its application in gaming will likely expand, making games more dynamic, intelligent, and responsive to players' actions.

In addition, the rise of virtual reality (VR) and augmented reality (AR) in gaming is another significant trend. With the advancement of VR headsets like Oculus Rift and PlayStation VR, immersive gaming experiences are becoming more mainstream. AR games, such as "Pokemon GO," have also demonstrated the potential of blending the digital and physical worlds. As these technologies improve, they promise to transform how players interact with games, offering more immersive and interactive experiences that were previously unimaginable.

Furthermore, esports has also become a dominant force in the gaming industry, with a rapidly growing audience and increasing investment from major corporations and sponsors. Esports tournaments, such as the "League of Legends World Championship" and "The International" for Dota 2, attract billions of viewers globally. This has led to the rise of esports organizations, professional players, and influencers, driving new revenue streams through advertising, sponsorships, and media rights. The popularity of live-streaming platforms like Twitch and YouTube Gaming has further amplified the esports ecosystem, creating a dynamic environment for both players and fans.

Moreover, increasing mobile internet penetration, especially in emerging markets, has led to a growing demand for mobile games. Mobile gaming needs to adapt to the unique requirements of mobile platforms, including performance optimization, touch controls, and diverse device capabilities. Game engines that provide cross-platform development capabilities, allowing for games to be developed for both mobile and desktop platforms, are becoming increasingly popular in the gaming industry.

Device Insights

The mobile segment recorded the largest revenue share of over 46% in 2024. This surge is fueled by the widespread adoption of smartphones and tablets, coupled with advancements in mobile internet connectivity, particularly 5G technology. The convenience of gaming on the go, combined with a diverse range of game genres catering to various demographics, has made mobile gaming increasingly popular. Furthermore, innovations in game development, such as cloud gaming and cross-platform play, are enhancing the mobile gaming experience and driving user engagement.

The console segment is projected to register a significant CAGR of over 7.5% from 2025 to 2030, primarily driven by the increasing demand for high-quality gaming experiences and exclusive titles. Innovations in hardware, such as enhanced graphics and processing capabilities, are attracting both casual and hardcore gamers. In addition, the rise of online multiplayer games and subscription services such as Xbox Game Pass and PlayStation Plus are expanding the consumer base and encouraging more frequent gaming. The integration of virtual reality (VR) and augmented reality (AR) technologies is also anticipated to enhance user engagement and expand the market in the coming years.

Type Insights

The offline segment accounted for the largest revenue share in 2024. The segment benefits from a loyal customer base that appreciates single-player experiences or local multiplayer games without the need for an internet connection. The offline market is expected to evolve through innovations in game design that enhance replay ability and user engagement. Furthermore, physical game sales remain significant in regions with limited internet access or where online payment systems are less prevalent.

The online segment is anticipated to record the fastest CAGR from 2025 to 2030. This growth is largely attributed to increased internet penetration and the popularity of multiplayer online games. The rise of streaming services and social gaming platforms has also transformed how players interact with games, making online gaming more social and engaging. In addition, advancements in AR and VR technologies are creating immersive online experiences that attract a broader audience.

Regional Insights

North America gaming market globally with a revenue share of 23% in 2024. This expansion is driven by several key factors, including the increased affordability of gaming devices, technological advancements, and the rising popularity of mobile and free-to-play games. The region has seen a surge in mobile gaming, supported by high smartphone penetration and the rollout of 5G technology, which enhances the gaming experience with faster data speeds and lower latency. Major players in the industry are continuously innovating to capture market share, while the growing interest in e-sports is attracting new audiences and investments. In addition, startups are emerging with fresh ideas and platforms that further influence the market landscape. Overall, North America's robust economic foundation and diverse gaming ecosystem position it as a leader in the global gaming industry.

U.S. Gaming Market Trends

The U.S. gaming market held a dominant position in the North America region in 2024. The gaming industry in the U.S. is expected to grow rapidly, driven by the increasing adoption of mobile gaming, cloud gaming services, and the rise of e-sports. The COVID-19 pandemic significantly boosted engagement in immersive gaming experiences, while major companies such as Microsoft Corporation and Electronic Arts, Inc. are expanding their mobile gaming portfolios and launching new consoles.

Europe Gaming Market Trends

The Europe gaming market is expected to grow at a considerable CAGR of over 6% from 2025 to 2030. The region's growth is driven by several factors, including technological advancements, increasing internet penetration, and a strong preference for online gaming experiences. Mobile gaming is becoming increasingly popular due to widespread smartphone adoption. The rise of e-sports has also transformed the landscape, creating new revenue streams through sponsorships and tournaments that engage billions of fans.

The UK gaming market is expected to grow rapidly in the coming years. The growth of this market is driven by its strong digital infrastructure and a vibrant community of developers and gamers. Mobile gaming has emerged as a significant growth driver in recent years, supported by government initiatives like Video Games Tax Relief that enhance access to finance for developers. These measures encourage innovation within the industry while fostering a skilled workforce through educational programs aimed at developing talent in game design and programming.

The Germany gaming market held a substantial market share in 2024. Germany's government has significantly increased its investment in the industry to support startups and mid-sized developers through grants and funding initiatives aimed at fostering innovation. This support has led to a flourishing ecosystem where creativity can thrive. Console gaming remains particularly popular due to high per capita income levels and a well-developed economy that facilitates access to premium gaming experiences. These factors are expected to drive market growth in the coming years.

Asia Pacific Gaming Market Trends

The gaming market in the Asia-Pacific region is expected to grow at the fastest CAGR of over 9% from 2025 to 2030. This growth is primarily driven by the increasing popularity of mobile gaming, which accounts for a significant portion of revenue due to high smartphone penetration rates across countries like China, Japan, and India. The rise of online multiplayer games and e-sports has also contributed to this trend as competitive gaming gains traction among younger demographics.

The Japan gaming market is expected to grow rapidly in the coming years. The gaming industry in Japan is driven by a combination of factors, including rising home improvement projects, growing adoption of smart homes, rapid developments in IT and wireless communication, and growing advancements in technologies such as artificial intelligence (AI) and the Internet of Things (IoT).

The gaming market in China is primarily driven by the dominance of mobile gaming in the country. With more than 70 billion gamers in the country, the user base is rapidly expanding, particularly among younger demographics who favor mobile and social gaming experiences. The rise of eSports has further propelled the gaming industry, with major tournaments and streaming platforms gaining immense popularity. Chinese game developers are thriving domestically and are also making significant inroads into international markets.

Key Gaming Company Insights

Some of the key players operating in the gaming industry include Sony Group Corporation and Microsoft Corporation, among others.

-

Sony Group Corporation is a multinational conglomerate that offers a diverse range of products and services, including electronics, gaming, entertainment, and financial services. In the gaming peripheral market, Sony has made a name for itself with its PlayStation gaming consoles and accessories. PlayStation is a line of gaming consoles developed and owned by Sony. The first PlayStation console was released in 1994, and since then, Sony has released several iterations of the console, including the PlayStation 2, PlayStation 3, PlayStation 4, and the latest PlayStation 5.

-

Microsoft Corporation is a multinational technology company that offers a wide range of software, hardware, and gaming-related products and services. In the gaming peripheral market, Microsoft Corporation has made a name for itself with its Xbox gaming consoles and accessories. Xbox is a line of gaming consoles developed and owned by Microsoft Corporation. The first Xbox console was released in 2001, and since then, Microsoft Corporation has released several iterations of the console, including the Xbox 360, Xbox One, and the latest Xbox Series X/S.

Some of the emerging market players in the gaming industry include Rovio Entertainment Corporation and Tencent Holdings, Ltd., among others.

-

Rovio Entertainment Ltd is a mobile games company known for its iconic Angry Birds franchise, which has achieved over 5 billion downloads worldwide. The company focuses on creating player-centric gaming experiences that foster joy and imagination while also expanding its brand into animations and consumer products. The company operates multiple studios across Europe and Canada, emphasizing sustainability and a commitment to diversity, equity, and inclusion within its workforce.

-

Tencent Holdings, Ltd. is a global technology conglomerate known for its diverse range of internet-related services and products. The company connects over one billion users worldwide through its popular communication platforms, including WeChat and QQ, which facilitate messaging, social networking, and various digital services. The company is also recognized as the world's largest video game vendor by revenue, with a portfolio that includes both in-house developed games and stakes in numerous gaming companies.

Key Gaming Companies:

The following are the leading compfreelance platformsies in the gaming market. These compfreelance platformsies collectively hold the largest market share freelance platformsd dictate industry trends.

- Activison Blizzard, Inc.

- Apple, Inc.

- The Walt Disney Company

- Electronic Arts, Inc.

- Microsoft Corporation

- Nintendo Co., Ltd

- Rovio Entertainment Corporation

- Sega Enterprises, Inc.

- Sony Corporation

- Tencent Holdings Ltd

Recent Developments

-

In November 2024, Apple, Inc. launched five new games, enhancing its family-friendly gaming service. Notable titles include Skate City: New York, Talking Tom Blast Park, and FINAL FANTASY IV (3D REMAKE), which features updated graphics and gameplay enhancements. These games are designed for various play styles, from solo experiences to multiplayer fun, and are available on multiple Apple devices without ads or in-app purchases.

-

In May 2024, Rovio Entertainment Corporation announced the launch of Angry Birds for Automotive, making the iconic game available on select cars with Google built-in, such as the Volvo EX90. Players can download the game directly from Google Play, which features cloud-saving functionality for those with a Red’s Club account, allowing them to continue their game seamlessly between mobile devices and their car's infotainment system.

-

In November 2023, Activision Blizzard launched the new mobile game Warcraft Rumble during BlizzCon 2023. This free-to-play action strategy game is now available worldwide on Android and iOS platforms, following a soft launch in select regions earlier in the year.

Gaming Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 332.37 billion

Revenue forecast in 2030

USD 505.17 billion

Growth Rate

CAGR of 8.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Mexico; Egypt; Jordan; Saudi Arabia; U.A.E.

Key companies profiled

Activision Blizzard, Inc.; Apple, Inc.; The Walt Disney Company; Electronic Arts, Inc.; Microsoft Corporation; Nintendo Co., Ltd.; Rovio Entertainment Corporation; Sega Enterprises, Inc.; Sony Corporation; Tencent Holdings Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gaming Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gaming market report based on device, type, and region:

-

Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Console

-

Mobile

-

Computer

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Jordan

-

-

Frequently Asked Questions About This Report

b. The global gaming market was valued at USD 298.09 billion in 2024 and is expected to reach USD 332.37 billion in 2025.

b. The global gaming market is expected to grow at a compound annual growth rate of 8.7% from 2025 to 2030 to reach USD 505.17 billion by 2030.

b. By region, Asia Pacific dominated the gaming market with a share of more than 52% in 2024. This is attributable to the rising number of professional gamers in the region.

b. Some key players operating in the gaming market include Microsoft Corporation; Nintendo; Rovio Entertainment Corporation; NVIDIA Corporation; Valve Corporation.; PlayJam Ltd.; Bluestack Systems, Inc.; and Sony Corporation among others.

b. Key factors that are driving the market growth include the emergence of next-generation video game consoles, the growing number of gamers across the globe, and technological proliferation in the gaming industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.