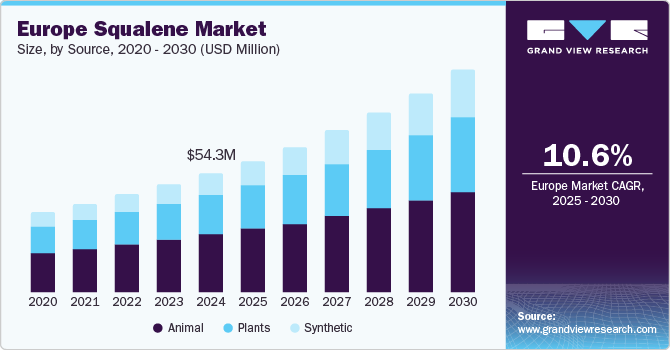

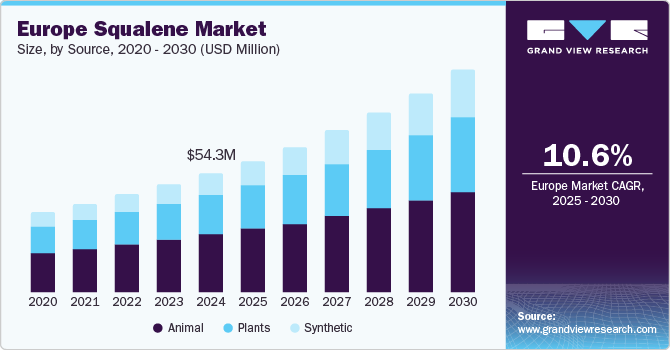

Market Size & Trends

The Europe squalene market size was valued at USD 54.3 million in 2024 and is expected to grow at a CAGR of 10.6% from 2025 to 2030. The market is projected to grow with the rising demand for natural and sustainable products in the beauty and wellness sectors. Consumers are increasingly opting for eco-friendly and plant-based products, particularly in skincare, cosmetics, and dietary supplements. Furthermore, the market is expected to record growth in sourcing, formulation, and marketing of squalene, particularly in countries such as France, Germany, and the UK, where the beauty and wellness industries have a strong foothold.

According to a report published by Labiotech in May 2022, shark liver oil is a rich source of squalene, and approximately 90% of the total global demand is destined for cosmetic products. However, as around 3,000 sharks are required to produce just one ton of squalene, the consumption of shark liver oil has raised environmental concerns. This has led to a shift from animal-derived sources to plant-based sources such as olives, sugarcane, wheat germ, and amaranth oil, which produces a rich amount of squalene.

Growing awareness regarding the health benefits of squalene in boosting immunity and reducing inflammation has expanded its application scope in the nutraceuticals market. Companies such as Evonik Industries AG and Kuraray Co., Ltd. are expected to invest in innovation and consistent research & development to provide efficient and cost-effective plant-based production technologies such as hydrogenation of natural squalene and fermentation technology.

Due to the rising consumer demand for plant-based ingredients, the beauty and skincare industries are increasingly integrating squalene in varied products ranging from moisturizers to serums. Various regulatory bodies have imposed regulations to ensure the safety, quality, and sustainability of products containing squalene. To comply with these regulations, products containing squalene must undergo safety assessments and labeling requirements. These steps by the regulatory bodies promote ethical sourcing practices and consumption of natural and sustainable ingredients.

Source Insights

The animal source segment dominated the market with the largest revenue share of 46.3% in 2024, owing to the accessibility and cost-effectiveness of animal-derived squalene. The demand for squalene has increased due to its wide range of applications in cosmetics, pharmaceuticals, and food industries. Shark liver oil was the dominant source segment as it is a rich source of squalene. The oil is used as a moisturizing base and is also beneficial for reducing inflammation. It also provides health benefits such as lowering cholesterol levels and the risk of heart disease. Manufacturers such as Maruha Nichiro Corporation and efpbiotek prefer using squalene derived from animals in pharmaceutical and cosmetic applications. Furthermore, regulatory approvals and technological advancements have improved the efficiency and cost-effectiveness of sourcing squalene from animals.

The synthetic sources segment is expected to grow at the fastest CAGR of 10.8% over the forecast period, owing to the advancements in biotechnological processes with the rising demand for cost-effective and scalable production methods. The demand for cruelty-free and vegan cosmetics, dietary supplements, and pharmaceutical products is increasing. Synthetic sources also provide a solution that addresses environmental concerns associated with sourcing squalene from animals and deforestation linked to plant-based options.

End Use Insights

The personal care & cosmetics segment dominated the market and accounted for the largest revenue share of 70.3% in 2024 due to surging demand for natural ingredients. The shift toward enhancing non-toxic, plant-based, and sustainable products has steered manufacturers to incorporate squalene into personal care and cosmetic formulations. Topical creams consisting of squalene impart hydration and nourishment while improving skin elasticity. Therefore, the use of squalene in cosmetic formulations has gained popularity in the market.

The pharmaceuticals segment is expected to grow at the fastest CAGR of 10.8% over the forecast period, owing to the recognition of the therapeutic benefits of squalene. Squalene is mainly used in vital formulations such as vaccines as an immunologic adjuvant. In addition, it helps enhance antioxidants and reduce inflammation, making it a useful ingredient for chronic conditions such as arthritis and skin disorders. Therefore, the usage of squalene in the pharmaceutical industry is expected to grow over the coming years.

Country Insights

The Germany squalene market held the largest revenue share of 33.6% in 2024, which can be attributed to the strong presence of industries, such as pharmaceuticals and healthcare, in the country. The country has a high demand for high-quality products containing squalene, such as moisturizing, anti-aging, and antioxidant properties. Moreover, the rising focus on natural personal care products has increased the adoption of squalene in cosmetic formulations and vaccines in the pharmaceutical sector. For instance, in December 2022, Evonik launched PhytoSquene, squalene derived from amaranth oil, which is suitable for vaccines and other pharmaceutical applications. It complies with European Pharmacopoeia specifications and contains no risk of pathogenic transmission. Therefore, the country is positioned as a key player in promoting sustainability and innovation of squalene products.

Portugal Squalene Market Trends

The Portugal squalene market is expected to grow at the fastest CAGR of 11.2% over the forecast period due to the abundant cultivation of olives in the country and its growth as a key producer of plant-derived squalene. Olive oil is a natural source of squalene used in applications such as cosmetics, pharmaceuticals, and personal care products. The country focuses on sustainability and improving green technologies, aligning with consumer trends favoring natural and cruelty-free products. These factors are expected to favor the growth of the squalene market in Portugal over the coming years.

Key Europe Squalene Company Insights

Some of the key companies in the European squalene market are efpbiotek, Gracefruit Limited, KURARAY CO., LTD., Maruha Nichiro Corporation, and Evonik Industries AG (Wilshire Technologies Inc.).

-

Gracefruit Limited is a UK-based company that produces and supplies natural ingredients for the cosmetics, personal care, and pharmaceutical industries. The company focuses on sustainable sourcing and development of squalene derived from plants and ensures that the production process is aligned with the standards set by the European market.

-

KURARAY CO., LTD. is a chemical manufacturing company that produces synthetic and plant-based squalene alternatives. The company has been developing sustainable solutions for producing squalene by using plant sources and addressing the consumer demand for eco-friendly and cruelty-free ingredients.

Key Europe Squalene Companies:

- efpbiotek

- Gracefruit Limited.

- KURARAY CO., LTD.

- Maruha Nichiro Corporation

- Evonik Industries AG (Wilshire Technologies Inc.)

Recent Developments

-

In November 2022, DKSH extended the distribution agreement with efpbiotek. The partnership leveraged DKSH’s extensive distribution network, marketing capabilities, sales, and logistics to efpbiotek. The agreement was expected to aid efpbiotek in marketing its products for the personal care industry and its food supplement and fish oil products in the key markets of the UK and Ireland.

-

In February 2020, Evonik Industries AG acquired Wilshire Technologies Inc., which supplies phytochemicals and derivatives to the cosmetic and pharmaceutical industries. In addition, the acquisition enhanced Evonik’s Care Solutions business by expanding its portfolio with sustainable and renewable ingredient technologies, such as plant-based cholesterol.

Europe Squalene Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 60.0 million

|

|

Revenue forecast in 2030

|

USD 99.1 million

|

|

Growth Rate

|

CAGR of 10.6% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD Million, Volume in Tons, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Source, end use, country

|

|

Regional scope

|

Europe

|

|

Country scope

|

UK, Germany, France, Italy, Spain, Russia, Portugal, Benelux

|

|

Key companies profiled

|

efpbiotek; Gracefruit Limited.; KURARAY CO., LTD.; Maruha Nichiro Corporation; Evonik Industries AG (Wilshire Technologies Inc.)

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Europe Squalene Market Report Segmentation

This report forecasts revenue & volume growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe squalene market report based on source, end use, and country:

-

Source Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

Animals

-

Plants

-

Amaranth Oil

-

Olive Oil

-

Rice Bran Oil

-

Others

-

Synthetic

-

End Use Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Portugal

-

Benelux