- Home

- »

- Advanced Interior Materials

- »

-

Europe Timber Construction Connectors Market Report, 2030GVR Report cover

![Europe Timber Construction Connectors Market Size, Share & Trends Report]()

Europe Timber Construction Connectors Market Size, Share & Trends Analysis Report By Product (Timber to Timber, Timber to Masonry, Others), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-143-8

- Number of Report Pages: 49

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

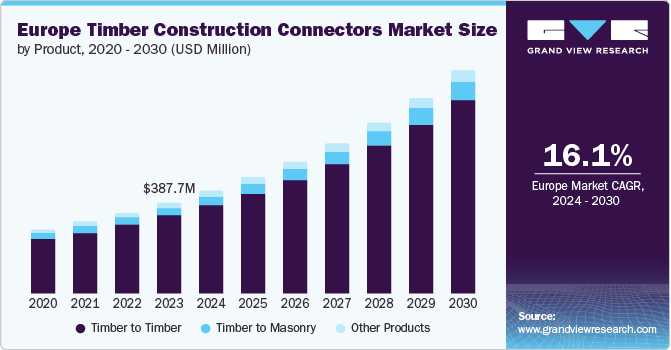

The Europe timber construction connectors market size was valued at USD 387.7 million in 2023 and is projected to grow at a CAGR of 16.1% from 2024 to 2030. This growth can be attributed to the growing demand for wood-based construction. The eco-friendly nature of wood structures, along with its benefits, such as reduced CO2 emissions, reduced carbon consumption, and biophilic design, is expected to drive the construction projects and, thus, benefit the growth of the market.

Wood frame and heavy timber buildings require durable and rigid fastening components to keep the beams and panels intact along with the design. Timber connectors are assemblies that can connect two or more wooden components with metal plates and fasteners such as nails, screws, and dowels. Therefore, a rise in the demand for wood-based residential and commercial construction projects is expected to increase the demand for connectors.

Construction connectors category includes nails, screws, bolts, dowels, plates, rings, and others. Production processes for components mentioned above are different owing to the varied dimensions and sizes of products. Nails are the most commonly used connectors in timber construction. These products are widely available in commercial markets and are easy to use and, thus, have high penetration in timber constructions. The tensile strength of nails of 600N/mm2 provides excellent properties to connectors.

Industrial-grade adhesives used in wood bonding operations may hamper the demand for timber connectors. These adhesives include phenol-resorcinol-formaldehyde (PRF), phenol-formaldehyde (PF), resorcinol-formaldehyde adhesive (RF), moisture-curing polyurethane adhesive (PU or PUR), amino resin-based (melamine-urea-formaldehyde adhesive (MUF)), and emulsion polymer isocyanate adhesive (EPI).

Germany is expected to be the largest contributor to the total share of Europe's timber construction connector market over the forecast period. This can be attributed to the high penetration of wood-based houses in the country and the increasing trend of eco-friendly constructions. In 2023, the government of Germany introduced the Housing Construction Campaign to deal with rising prices and the shortage of housing in the country. This is expected to aid the growth of the construction industry and support the demand for timber connectors.

Prominent manufacturers have been adopting various strategies, such as new product developments, partnerships & collaborations, and expansions, to maximize their market penetration and cater to the changing technological requirements of end-use industries. Moreover, companies are investing continuously in R&D to develop customized hangers and holding plates that can be connected without fasteners.

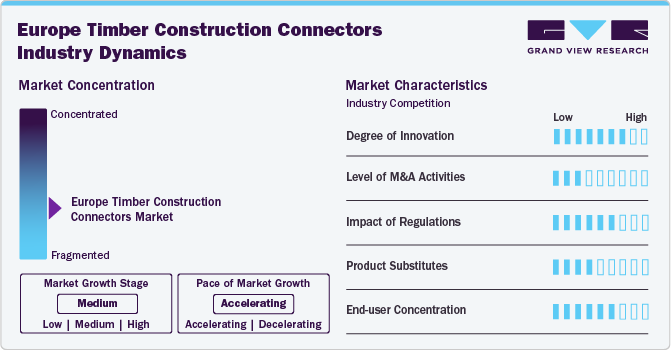

Market Concentration & Characteristics

The market growth stage is medium, with an accelerating pace. The industry is fragmented because many large and small-scale players with significant production capacities of different types of timber construction connectors are involved. The players in the market compete on the basis of product quality, services, and regional presence.

Technological advancements in manufacturing of connectors have raised the precision level to split rings and tooth plates. Heat treatment for manufactured rings provides advanced durability and capacity of enhanced tensile strength. Moreover, dimensional nailing plates in timber construction are manufactured with light-gauged mild steel that is pre-punched with holes for specified nails.

The market has witnessed the imposition of standards regarding the material, timber structure, and strength of connectors in timber construction projects.Timber is set to displace other emission-intensive building materials like cement and steel. Thus, EUROPEAN STANDARD., BSI (British Standards Institution), and a few others lay down the rules, regulations, and standards that govern the timber construction connectors market in Europe.

Product Insights

Based on product, the market is segmented into timber to timber connectors, timber to masonry connectors and others. Timber to timber connectors led the market in 2023 with a revenue share of 85.7%. Split rings that are inserted in grooves that have already been cut are included in these types of connectors used in building applications.

These rings are placed in split-shaped grooves between several pieces of lumber. They lessen tension at structural connecting locations. The ring mechanism of timber-to-timber connectors permits the development of synchronized bearings at the inner surface of rings while the remaining part is fixed in the outer wall.

Timber to masonry connectors is anticipated to grow at a CAGR of 15.1% over the forecast period. The key components used for connecting timber to masonry include angle brackets, joist hangers, restraint straps, and other standard plates. These products are manufactured in a variety of shapes and sizes to match the requirements of construction projects, as beam size is not specified across wood construction.

Specialized hangers are commercially available and can be used as mild joints with insulated concrete forms in wooden structures. They can also be used to attach heavy wooden beams with masonry walls to ensure the strength of the overall wooden structure.

Application Insights

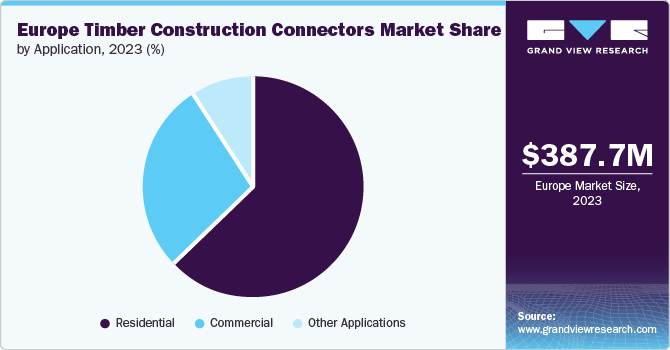

Residential application accounted for the largest share of the market in 2023 and is further expected to grow at a CAGR of 16.2% over the forecast period. Timber is sustainable and aesthetically pleasing in residential applications. Therefore, increasing awareness regarding timber construction is projected to drive wooden construction significantly in the upcoming years and further support the demand for timber construction connectors in the region.

Germany and Sweden have a significant number of active wooden constructions, especially for single-family residential homes. They are likely to upscale projects in line with the growing demand from end-users. Positive trends in the wooden construction segment in Europe are expected to create a wide scope for timber construction, which is expected to have a positive impact on the market.

Commercial application is expected to grow at the fastest CAGR of 16.8% over the forecast period. Modern trends for aesthetic improvements have penetrated the utilization of wooden structural components in various commercial units, which is supporting the demand for timber construction connectors.

Commercial construction covers large buildings or a cluster of buildings that require large wooden beams and frames. These wooden components require strong bonding materials to keep the building structures intact. Moreover, growing environmental concerns coupled with initiatives taken by multinational organizations to reduce Co2 levels have increased the adoption of wood-based construction, thereby increasing the product demand.

Regional Insights

Germany Timber Construction Connectors Market Trends

The Germany timber connectors market dominated the European region with a revenue of USD 109.6 million in 2023. The market is further expected to grow at a CAGR of 13.5% over the forecast period with significant investment in infrastructure and building & construction sectors. The government of Germany has commenced several initiatives to develop the housing market in the country. This is anticipated to boost the growth of construction industry, thereby bolstering the demand for timber construction connectors.

France Timber Construction Connectors Market Trends

The timber construction connectors market in France is anticipated to grow at the fastest CAGR of 16.8% over the forecast period. A gradual reduction in corporate tax, coupled with supporting financing conditions, is projected to boost business investments in France. These trends are anticipated to drive the construction of commercial buildings in the country, thereby augmenting the demand for wood-based construction.

Moreover, the government of France has mandated the inclusion of 50% wood in new public buildings by 2022, thus supplementing the demand for wood structures in construction applications and supporting the demand for timber construction connectors in the country.

Russia Timber Construction Connectors Market Trends

The wooden construction industry in Russia is expected to witness rapid expansion over the forecast period owing to a rise in the demand for single houses, individual buildings, and abundant availability of raw materials for wood construction. As per the reports by Nordregio Magazine (Nordic & Northwest Russia cooperation on wood and construction), single wooden housing units in Russia occupy over 22% of the construction projects, which is equivalent to 76 million square meters of area. The wooden construction has maintained the demand for timber construction connectors in the country.

Key Timber Construction Connectors Company Insights

Some of the key players operating in the market include Simpson Strong-Tie Company, Inc., MiTek, Inc., and Knapp GmbH.

-

Simpson Strong-Tie Company, Inc. is a manufacturer of high-quality wood and concrete construction products that are designed to make building structures safe and highly secure. The company operates through three business segments, namely Wood Construction Products, Concrete Construction Products, and Engineering & Design Services.

-

MiTek, Inc., is a supplier of products and services to the building components industry. It develops software and invents solutions that enable the industry to optimize the balance between off-site and on-site. It specializes in state-of-the-art BIM (Building Information Modeling) software, industrial equipment, facility management solutions, and building products used in the construction industry.

E.u.r.o.Tec GmbH, Cullen Timber Engineering Connectors, and BPC Building Products Limited are some of the emerging market participants in the market.

-

E.u.r.o.Tec GmbH is engaged in the development, production, and sale of products for the construction sector. The company also specializes in the manufacture of products related to stamping and bending technology, cold forming, injection molding, and extrusion technology.

-

BPC Building Products Limited has experience in the manufacturing and supply of products to builders, merchants, distributors, and retailers across the UK and Ireland. It offers a range of tried and tested products that are recognized throughout the industry as being easy to use, trouble-free, and long-lasting.

Key Europe Timber Construction Connectors Companies:

The following are the leading companies in the Europe timber construction connectors market. These companies collectively hold the largest market share and dictate industry trends.

- Simpson Strong-Tie Company, Inc.

- MiTek, Inc.

- Knapp GmbH

- E.u.r.o.Tec GmbH

- BPC Building Products Limited

- Cullen Timber Engineering Connectors

- GH Baubeschlöge GmbH

- Pitzl Metallbau GmbH & Co. KG

- BeA Timber Connectors

- BTS Befestigungselemente-Technik GmbH

Recent Developments

-

In December 2022, Simpson Strong-Tie Company, Inc. launched an aluminum concealed beam hanger, which is designed for mass timber construction. The beam hanger is designed to support loads up to 20 kips. The product is aimed to provide versatility and easy installation to help end users build safer & stronger structures faster.

Europe Timber Construction Connectors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 437.9 million

Revenue forecast in 2030

USD 951.6 million

Growth Rate

CAGR of 16.1% from 2024 to 2030

Base year for estimation

2023

Actual estimates/Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

Europe

Country scope

UK, Germany, France, Norway, Finland, Denmark, Sweden

Key companies profiled

Simpson Strong-Tie Company, Inc., MiTek, Inc., Knapp GmbH, E.u.r.o.Tec GmbH, BPC Building Products Limited, Cullen Timber Engineering Connectors, GH Baubeschlöge GmbH, Pitzl Metallbau GmbH & Co. KG, BeA Timber Connectors, BTS Befestigungselemente-Technik GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Timber Construction Connectors Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe timber construction connectors market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Timber to Timber

-

Timber to Masonry

-

Other Products

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Norway

-

Finland

-

Denmark

-

Sweden

-

-

Frequently Asked Questions About This Report

b. The Europe timber construction connectors market size was estimated at USD 387.7 million in 2023 and is expected to reach USD 437.9 million in 2024.

b. The Europe timber construction connectors market is expected to grow at a compound annual growth rate of 16.1% from 2024 to 2030 to reach USD 951.6 million by 2030.

b. The residential application segment of the market accounted for the largest revenue share of 63.2% in 2023 owing to rising construction of residential units across the region on account of increasing population. Furthermore, growing trend of wood construction in residential units is further supporting the demand for timber construction connectors.

b. Some of the key players operating in the Europe timber construction connectors market include Simpson Strong-Tie Company, Inc., MiTek, Inc., Knapp GmbH, E.u.r.o.Tec GmbH, BPC Building Products Limited, and Cullen Timber Engineering Connectors.

b. The key factors that are driving the Europe timber construction connectors market includes growing construction industry in the Europe coupled with use of wood in construction sector owing to its eco friendly nature.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."