- Home

- »

- Animal Health

- »

-

Europe Veterinarians Market Size And Share Report, 2030GVR Report cover

![Europe Veterinarians Market Size, Share & Trends Report]()

Europe Veterinarians Market Size, Share & Trends Analysis Report By Sector (Private, Public), By Age Group (<40 Years, 40-60 Years), By Animal Type (Companion, Livestock), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-086-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

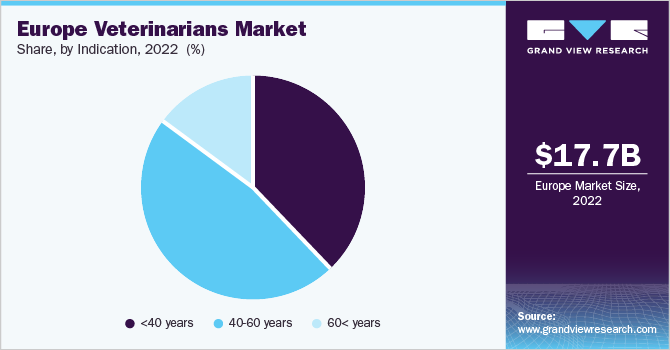

The Europe veterinarians market size was valued at USD 17.66 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.56% from 2023 to 2030. Increasing demand for veterinary specialists, uptake of veterinary services, corporatization of veterinary practices, humanization of pets, and pet expenditure are some of the key factors propelling the market growth. In February 2023, for instance, the veterinary practice of Dr. Paulus in Saarbrücken, Germany, was merged into IVC Evidensia DACH Group. Similarly, in November 2022, the small animal practice of Dr. Angela Schulenburg and Dr. Guido Spitz in Eutin, Germany, was merged into the IVC Evidensia DACH Group.The growing employment opportunities are a key factor fueling the market. Veterinarians can work in private veterinary practices.

The COVID-19 pandemic adversely impacted the market with limited access, the closure of clinics, and a fall in demand.Some practices experienced a decline in revenue due to reduced patient visits and canceled elective procedures.Veterinarians faced increased stress and emotional challenges during the pandemic. The demands of working in a healthcare setting, managing client expectations, and coping with uncertainties took a toll on the mental health and well-being of veterinary professionals. Veterinary education also faced disruptions during the pandemic as institutions had to adapt to remote learning and virtual teaching methods, impacting hands-on practical training. The market, however, recovered gradually during 2021 as the underlying drivers remained unchanged.

The increasing demand for veterinarians with specialization and advanced skills is a key market driver. There is an increasing need for veterinarians with specialized skills and expertise in areas, such as orthopedics, cardiology, oncology, dentistry, and exotic animal medicine. Veterinary medicine has also witnessed significant advancements in diagnostic tools, treatment options, and surgical techniques. Veterinarians can pursue postgraduate studies or participate in continuing education programs to acquire these specialized skills. Vimian - a key European animal health company, hosts education and training for veterinary professionals to enable professional development, increase the quality of care, and drive sales & market growth.

Over 11,000 veterinary professionals participated in one or several of the company’s training in 2022.Technological advancements are also propelling the demand for veterinary professionals and their services. Digital record-keeping systems, telemedicine, remote monitoring devices, and advanced imaging techniques have improved the efficiency and effectiveness of veterinary services. Veterinarians are increasingly adopting these tools to increase their service offerings and client base. In 2022, Pets at Home-a UK-based pet care company reported a total of over 95,000 remote consultations conducted every year via its telehealth business. It also reported an increasing uptake of veterinary telehealth, triage, and ancillary services.

Sector Insights

The private sector segment dominated the market with a share of over 50% in 2022. This is owing to increasing corporatization across the region and the creation of larger practice groups that employ a significant number of veterinary professionals.Pets at Home Plc, for example, owns about 388 First Opinion small animal veterinary practices across the UK in conjunction with its Joint Venture Partners. It also operates 55 First Opinion practices that are company owned and managed.AniCura is another group that represents a family of 450 animal hospitals and clinics in Europe that employ about 4,000 veterinarians.

IVC Evidensia, on the other hand, is a leading provider of veterinary services in Europe. It operates via its network of over 2,500 clinics and hospitals that employ more than 41,000 veterinarians, referral specialists, nurses, and support staff. The others segment is projected to grow at the fastest CAGR of about 8% over the forecast years. It comprises veterinarians working in the academic sector, industry research, etc. In January 2022, the Royal Veterinary College in the UK partnered with the University of Pennsylvania’s School of Veterinary Medicine and MARS Equestrian to launch a scholarship program for equine health research. Similar supportive initiatives are expected to contribute to the segment's growth.

Age Group Insights

In terms of age group, the 40-60 years segment accounted for the largest share of over 45% of the market in 2022. The <40 years segment, on the other hand, is anticipated to grow at the highest rate of over 8% during the forecast period. As per a 2019 study published in the Irish Veterinary Journal in 2022, veterinarians in the age group of 40-60 years were found to be the largest number of registered veterinary practitioners with the Veterinary Council of Ireland. About 15.5% of registered veterinary practitioners were born in the 1960s, about 22% were born in the 1970s, and an estimated 26% were born in the 1980s.

There is a general trend of a relatively young veterinary workforce across the Europe region. Many veterinary professionals are in the early to mid stages of their careers. The number of veterinary graduates has been on the rise in recent years. Veterinary schools across Europe have been producing a larger number of graduates to meet the growing demand for veterinary services. This influx of new graduates has contributed to a younger veterinary workforce.Veterinary education programs too have evolved to align with the changing needs of the profession.

Animal Type Insights

By animal type, the companion animals segment held the largest share of the total market in 2022 while the livestock segment is projected to grow at the fastest rate of about 8% over the forecastyears. This is owing to factors, such as increasing pet population, expenditure, pet humanization, consumption of meat & dairy products, and awareness about animal health. The rising pet ownership, expenditure, & humanization of pets leads to a higher demand for veterinary services, and thus veterinary professionals.Furthermore, aging pets require more specialized care, leading to an increased demand for veterinarians experienced in managing age-related health issues.European countries also have strict regulations in place to ensure the safety and well-being of animals used in food production.

Veterinary professionals play a crucial role in ensuring compliance with these regulations, conducting inspections, and monitoring animal health in livestock farming. The enforcement of these regulations drives the demand for veterinarians in the food industry.The One Health concept recognizes the interconnectedness of human health, animal health, and the environment. This approach highlights the need for collaboration between human health professionals and veterinarians to address zoonotic diseases and other health issues. The growing recognition of the One Health approach leads to an increased demand for veterinarians working in public health, research, and disease control.

Country Insights

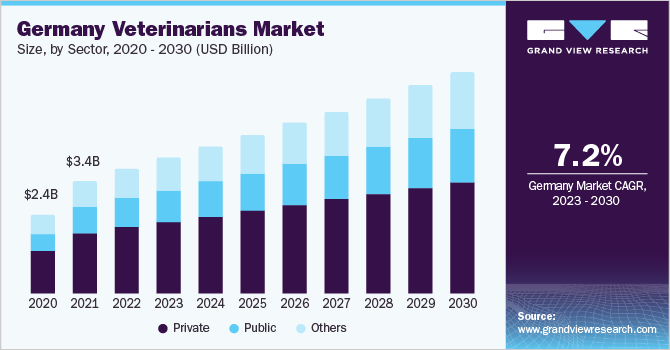

Germany dominated the market in 2022 with a revenue share of over 20% in 2022. Factors attributing to this share include the high pet population, significant livestock population, growing demand for veterinary services, increasing demand in R&D, regulatory affairs, etc. For instance, there is a shift towards preventive healthcare in the veterinary field. Pet owners are increasingly seeking regular wellness visits and preventive measures, such as vaccinations, parasite control, dental care, and nutrition counseling. This emphasis on preventive care helps detect and address health issues early on, leading to an increased demand for veterinary services.

Denmark is projected to grow at the highest CAGR of over 8% in the coming years. Denmark has one of the region’s highest average revenues per veterinarian, according to the Federation of Veterinarians of Europe. In fact, as per the Economic Research Institute (ERI), the average annual salary of veterinarians in Denmark was estimated at about USD 102,000 in 2022.The high salary levels in the country make it one of the most appealing destinations in Europe for both domestic and international veterinarians seeking attractive financial compensation for their skills and expertise.

Europe Veterinarians Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19.38 billion

Revenue forecast in 2030

USD 32.2 billion

Growth rate

CAGR of 7.56% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, growth factors, industry dynamics and trends

Segments covered

Sector, age group, animal type,country

Regions covered

Europe

Country Scope

U.K.; Germany; Italy; France; Spain; Austria; The Netherlands; Switzerland; Poland; Denmark

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Veterinarians Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Europe veterinarians market based on sector, age group, animal type, and country:

-

Sector Outlook (Revenue, USD Million, 2018 - 2030)

-

Private

-

Public

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

<40 years

-

40-60 years

-

60< years

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animals

-

Livestock Animals

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

The Netherlands

-

Austria

-

Poland

-

Denmark

-

Switzerland

-

Rest of Europe

-

Frequently Asked Questions About This Report

b. The Europe veterinarians market size was estimated at USD 17.66 billion in 2022 and is expected to reach USD 19.38 billion in 2023.

b. The Europe veterinarians market is expected to grow at a compound annual growth rate of 7.56% from 2023 to 2030 to reach USD 32.29 billion by 2030.

b. Germany dominated the market by region with a share of over 20% in 2022. Factors attributing to this share include the high pet population, significant livestock population, growing demand for veterinary services, increasing demand in R&D, regulatory affairs etc.

b. By animal type, the companion animals segment held the largest share of the total market in 2022. This is owing to factors such as increasing pet population, expenditure, pet humanization, consumption of meat & dairy products, and awareness about animal health.

b. Key factors that are driving the market growth include increasing demand for veterinary specialists, uptake of veterinary services, corporatization of veterinary practices, humanization of pets, and pet expenditure.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."