- Home

- »

- Animal Health

- »

-

Europe Veterinary Pharmaceuticals Market Size Report, 2030GVR Report cover

![Europe Veterinary Pharmaceuticals Market Size, Share & Trends Report]()

Europe Veterinary Pharmaceuticals Market Size, Share & Trends Analysis Report By Animal Type (Companion Animals, Livestock Animals), By Mode Of Administration, By Product, By Distribution Channel, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-629-7

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

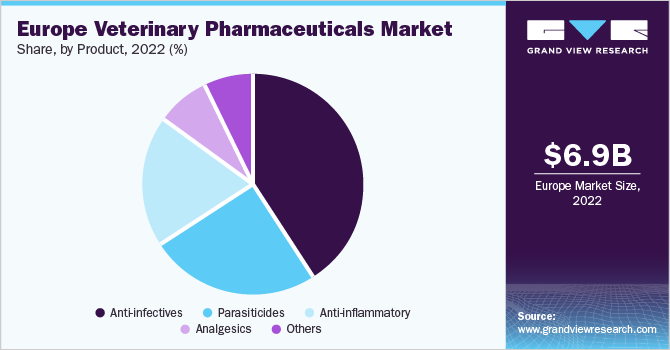

The Europe veterinary pharmaceuticals market size was estimated at USD 6.9 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. The growing awareness about zoonoses, the humanization of pets, the availability of pet insurance, and R&D initiatives by market players are the key factors anticipated to fuel market growth in the coming years. Boehringer Ingelheim, for instance, initiated over 450 clinical studies in 2020. The company received over 240 product authorizations that included approval for Aservo Equihaler in the EU for the alleviation of severe equine asthma.

Zoonoses, an infectious disease that can be transmitted between animals and humans, have played a significant role in driving the market growth. The spread of zoonotic diseases, such as avian influenza and bovine tuberculosis, has raised concerns about public health and animal welfare, prompting increased demand for veterinary medicines. According to the European Centre for Disease Prevention and Control (ECDC), in 2022 human contagions with influenza virus A(H1N2)v and A(H1N1)v of pig origin were detected in two European countries: Germany and Netherlands, respectively.

The impact of the COVID-19 pandemic on the European market was varied. The adverse effects included dampened demand, operational hurdles, and low sales. This was a result of movement restrictions, quarantine protocols implemented by governments, and deferred or canceled veterinary visits due to lockdowns. For instance, MSD’s (Merck) animal health division registered an estimated negative impact of approximately USD 100 million during 2020, whereas Elanco witnessed a 25% decline in revenue during Q2 2020. Elanco’s food animal products segment was the most affected due to pressured producer economics, processing plant closures, and reduced food service demand. Reduced demand for brands administered in veterinary clinics, notably vaccines, impacted the companion animal segment.

However, companies also recorded increased demand for pet medications and the adoption of telehealth. Boehringer Ingelheim, for instance, experienced a rise in product sales in the companion animal segment despite restricted access to veterinary clinics due to lockdown measures. However, the company reported a drastic decline in demand for its livestock products due to the closures of slaughterhouses and restaurants. In addition, the pandemic propelled the use of online channels, thus impacting customer buying patterns and promoting curb-side or virtual vet visits. As per Boehringer Ingelheim, therapeutic innovation is anticipated to boost the growth in the animal health business in the future.

Pharmaceutical drugs sold as prescription medications to treat pets may be needed for the short term or as lifelong medication to improve the quality of life. As per AnimalhealthEurope, European households spent over EUR 2.7 billion on veterinary medicines in 2019. To help pet owners, offset the high costs of veterinary medications and treatment, insurance companies have started offering custom or tiered pet insurance plans. Pet insurance policies provide wide coverage including medication, tests, surgery, and diagnostics. For instance, Agria, the largest pet insurance provider in Sweden, provides coverage for several veterinary care procedures including prescription medicines as well as drugs purchased through online channels. The rising adoption of pet insurance is thus expected to fuel the market growth.

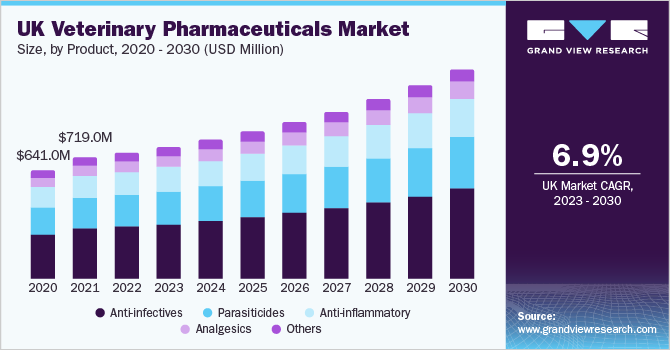

The government played a crucial role in fostering the growth of the market. Governments across Europe have implemented favorable regulatory frameworks, such as streamlining approval processes and ensuring compliance with safety and quality standards. In addition, they increased their expenditure on research and development of advanced veterinary medicines coupled with funding from other departments and organizations is estimated to boost the growth of the market over the forecast period. In 2020, the UK’s total expenditure on veterinary medicine was USD 15.3 million which increased to USD 29.6 million in 2022.

The availability and use of generic veterinary medicines are also growing as per the European Group for Generic Veterinary Products (EGGVP). This is owing to the expiry of patents and increasing R&D activities by small, medium, and large-sized market players to leverage the opportunity and increase their market share. The formulation patent for Draxxin (a product of Zoetis) containing the active ingredient tulathromycin expired in late 2020 in Europe and other key markets. Generic tulathromycin products are now marketed in several key markets such as Canada, Mexico, Europe, and Australia. Norbrook, based in the UK, follows a product model that mainly involves using molecules already established in the pharmaceutical industry. The company’s R&D strategy focuses on offering its customers a balanced portfolio of veterinary pharmaceutical products by being the first generic to the market wherever possible.

Animal Type Insights

In terms of animal type, the companion animals segment held the largest revenue share in 2022. The dominance is attributed to the rising prevalence of infections in pets and the rising awareness among pet parents. As per a 2021 study published in the BMC Veterinary Research Journal, the prevalence of common disorders diagnosed in dogs in the UK was found to be 14.10% for dental disorders and 12.58% for skin disorders. AnimalhealthEurope reported the overall sale of veterinary medicine for pets increased to 47.3% in 2022 compared to 42.4% in 2020.

The livestock animals segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is attributed to the increasing meat consumption and increasing standards for quality and safety. In May 2021, Inovet, headquartered in Belgium, invested in new facilities in France, in response to the continued high demand for livestock medicines as well as for an increase in its production capacity. The new facilities include a sterile solution plant and new QC and R&D microbiology laboratories. In October 2022, the Re-Livestock program was launched by Horizon Europe, to create integrated strategies for various dairy, beef, and pig systems, as well as for various geographical regions, considering climate change. It will bring together scientific knowledge and collaboration across diverse fields, including farm management, animal welfare, breeding, and nutrition, as well as environmental, socioeconomic assessment, and policy analysis.

Mode of Administration Insights

In terms of mode of administration, the parenteral segment held the largest revenue share in 2022. Parenteral administration involves delivering drugs directly into the animals’ body through routes such as intravenous, intramuscular, or subcutaneous injections. The advantage of rapid and targeted drug delivery, enhanced bioavailability and better control over dosages resulted in market dominance. The market growth is driven by rapid product launch and development. For instance, in September 2022, Boehringer Ingelheim launched Fencovis, the first vaccine to stop E. coli F5- and bovine rotavirus-induced calf diarrhea and lessen the severity of coronavirus-induced calf diarrhea.

As per the MSD Vet manual, the oral route of administration is frequently used in companion and food animals. The dosage forms include tablets, powders, capsules, boluses, granules, solutions, pastes, and suspensions. The oral route is also the most widely used in cattle, pigs, and poultry to administer pharmaceuticals. New oral administration methods for flea and tick control products are further improving pet care as these can offer a simpler and more convenient form of administration for pet owners.

The use of modified-release delivery systems such as intraluminal boluses is also gaining traction in ruminants to deliver parasiticides, anti-bloat agents, production enhancers, and nutritional supplements. Dipping livestock animals is one of the most popular modes of administration amongst farmers. This is owing to the method’s efficiency in administering treatments such as those against ectoparasites. In addition, pour-on solutions and injectables help reduce the potential impact on the environment.

Distribution Channel Insights

In terms of distribution channel, the veterinary hospitals and clinics segment held the largest revenue share in 2022. The dominance of the segment is attributed to the higher footfall in veterinary hospitals and clinics. In 2018, Mars Petcare- the largest operator of veterinary hospitals expanded into Europe with the acquisition of AniCura, a chain of 200+ veterinary clinics and hospitals with operations in Norway, Denmark, Sweden, Austria, Switzerland, Germany, Spain, Italy, the Netherlands, France, Portugal, and Belgium. In addition, the growth of the market can also be attributed to the increasing pet ownership and awareness regarding animal healthcare.

The digital or e-commerce segment is anticipated to grow at the fastest CAGR over the forecast period. This is owing to the rising digitalization in the animal health industry, changing customer preferences, adoption of veterinary telehealth, and usage of e-commerce platforms as the preferred platform for purchases. Elanco reported a shift in the purchasing behavior of veterinarians, farmers, and pet parents to online channels. The company has thus identified continuous digital ecosystem enhancement as a key growth driver. In September 2022, the European Union (EU) launched the standard logo for the selling of veterinary pharmaceuticals by online pharmacies and retailers in EU nations. The logo attests to the legitimacy of the websites and ensures the security of the products.

Product Insights

In terms of product, the anti-infective segment held the largest revenue share in 2022 and is also estimated to grow at the fastest CAGR over the forecast period. The growth can be attributed to the increasing product developments and initiatives by market players. The parasiticides segment held the second-largest share in 2022. This was attributed to the high incidence of ectoparasitic and endoparasitic infections in animals and the wide availability of products. According to the research published by BioMed Central Ltd for the Western European Region, 22.8% of dogs had an intestinal parasite, while Giardia was the most commonly detected parasite. In addition, in September 2022, Zoetis launched APOQUEL chewable tablets in the UK. These tablets provide fast and effective relief from canine dermatitis.

In 2020, the anti-infectives and parasiticides segments of Zoetis together accounted for 36% of the company’s revenue. This was followed by the company’s dermatology segment and other pharmaceutical products. However, growing initiatives by key public health and regulatory agencies to regulate and reduce the use of antimicrobials in animals may restrict the market growth for certain product segments. The Committee for Medicinal Products for Veterinary Use (CVMP) is tasked with taking forward the EU’s One Health Action Plan against antimicrobial resistance by implementing the provisions of the Veterinary Medicines Regulation.

Country Insights

The UK dominated the market in 2022 with the largest revenue share of 10.75%. In January 2021, the EU and the UK struck a provisional free-trade agreement. This ensured that the two sides could continue to trade goods without quotas or tariffs. Key details of the future relationship, however, remain uncertain, such as trade-in services. This prevented a “no-deal” Brexit, which could have significantly damaged the country’s economy. The British Veterinary Association (BVA) campaigned against a no-deal Brexit as it would leave the country with no time to transition and adjust. The BVA has also developed a set of key recommendations to secure the best possible outcome of Brexit for animal health that covers the following: animal welfare; veterinary medicines; veterinary workforce; food hygiene and safety; R&D; and trade.

The Netherlands is anticipated to grow at the fastest CAGR of 9.4% during the forecast period. Some key factors contributing to the growth of the Netherlands market include the high awareness among pet owners regarding their pet’s health, high standards for securing food sources by safeguarding the health of livestock animals, and the presence of key companies such as Norbrook, Chanelle Pharma, and Boehringer Ingelheim. According to a survey by GlobalPETS, from 2020 to 2022, 150,000 households in the Netherlands got a new pet. Among them 80,000 were dogs and 70,000 were cats.

Key Companies & Market Share Insights

The Europe market for veterinary medicines is competitive. Market players implement various strategic initiatives to expand their product portfolio, boost R&D, increase production capabilities, and widen their distribution network. Some of the strategic initiatives undertaken to achieve growth objectives include product development and launches, partnerships, mergers & acquisitions, and the expansion of the global footprint. In September 2022, Zoetis Ltd. announced the acquisition of Jurox, a manufacturer and distributor of commercial and companion animal health products, with its operations in Australia and regional offices in the UK, the U.S., New Zealand, and Canada.

According to Boehringer Ingelheim, the future of pet care is digital and integrated. In May 2020, the company launched PetPro Tele+, in response to the COVID-19 pandemic as a standalone and telemedicine version of PetPro Connect. Large companies are thus investing in allied technologies and offerings to provide a comprehensive and integrated portfolio to their customers. Smaller market players are focused on developing and launching products from their key product lines.

In July 2020, Calier launched Dynacan spot-on for ferrets, cats, and dogs. This added to the company’s antiparasitic products portfolio. In August 2020, Elanco Animal Health Incorporated acquired Bayer Animal Health. The acquisition is expected to HELP Elanco in expanding its scale & capabilities, thereby positioning it as one of the leaders in the durable and attractive animal health industry. Some prominent players in the Europe veterinary pharmaceuticals market include:

-

Merck & Co., Inc.,

-

Ceva

-

Vetoquinol

-

Zoetis Services LLC

-

Boehringer Ingelheim International GmbH

-

Elanco

-

Virbac

-

Calier

-

Bimeda Corporate

-

Prodivet Pharmaceuticals SA/NV

Europe Veterinary Pharmaceuticals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7. 25 billion

Revenue forecast in 2030

USD 11.85 billion

Growth rate

CAGR of 7.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, product, mode of administration, distribution channel, country

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain; Poland; Netherlands; Hungary; Denmark; Sweden; Portugal

Key companies profiled

Merck & Co., Inc.; Ceva; Vetoquinol; Zoetis Services LLC; Boehringer Ingelheim International GmbH; Elanco; Virbac; Calier; Bimeda Corporate; Prodivet pharmaceuticals sa/nv

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Veterinary Pharmaceuticals Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe veterinary pharmaceuticals market report based on animal type, product, mode of administration, distribution channel, and country:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others (Small Mammals, Birds)

-

-

Livestock Animals

-

Pigs

-

Cattle

-

Sheep & Goats

-

Others (Poultry, Aquatics)

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Mode of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Parenteral

-

Topical

-

Others (Inhalation, Carrier)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Pharmacies & Retail Stores

-

Digital or E-commerce

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Poland

-

Netherlands

-

Hungary

-

Denmark

-

Sweden

- Portugal

-

-

Frequently Asked Questions About This Report

b. The Europe veterinary pharmaceuticals market size was estimated at USD 6.9 billion in 2022 and is expected to reach USD 7.25 billion in 2023.

b. The `Europe veterinary pharmaceuticals market is expected to grow at a compound annual growth rate of 7.3% from 2023 to 2030 to reach USD 11.85 billion by 2030.

b. The U.K. dominated the Europe veterinary pharmaceuticals market with a share of 10.75% in 2022. This is attributable to an increase in pet ownership and pet insurance.

b. Some key players operating in the Europe veterinary pharmaceuticals market include MSD, Ceva, Vetoquinol S.A., Zoetis, Boehringer Ingelheim GmbH, Elanco, Virbac, Calier, Bimeda, Inc., and Prodivet Pharmaceuticals sa/nv.

b. Key factors that are driving the Europe veterinary pharmaceuticals market growth include growing pet ownership, increasing livestock population, and rising adoption of pet insurance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."