- Home

- »

- Next Generation Technologies

- »

-

Europe Virtual Events Market Size, Industry Report, 2030GVR Report cover

![Europe Virtual Events Market Size, Share & Trends Report]()

Europe Virtual Events Market (2024 - 2030) Size, Share & Trends Analysis Report By Event Type, By Component, By Industry Vertical, By Application, By End-use, By Establishment Size, By Use-case, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-279-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Virtual Events Market Size & Trends

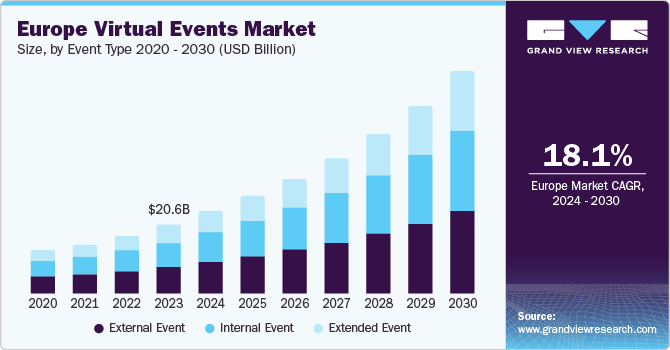

The Europe virtual events market size was estimated at USD 20.6 billion in 2023 and is projected to grow at a CAGR of 18.1% from 2024 to 2030. This growth can be attributed to several key factors including the ongoing digital transformation across various industries, coupled with the increasing adoption of cloud-based solutions, propelling the demand for virtual events. Furthermore, the recent pandemic has necessitated the shift from physical to virtual spaces, accelerating market growth. Additionally, advancements in Artificial Intelligence (AI) and machine learning technologies are enhancing the virtual event experience, thereby attracting more users. Lastly, the growing need for companies to reduce their carbon footprint is also encouraging the adoption of virtual over physical events.

The Europe virtual events market accounted for 26.2% of the revenue share of the global virtual events market in 2023.Regulatory frameworks in Europe have a significant impact on this market. For instance, the EU Council Directive 2022/542, adopted in April 2022, stipulates that from January 1, 2025, the supply of a virtual event is taxable in the country where the consumer resides or is established. This regulation could influence the pricing strategies of virtual event providers and potentially affect market growth. Moreover, the Consumer Rights Directive mandates clear information on terms and conditions, refund policies, and cancellation rights for customers. This regulation ensures transparency and protects consumers, which could enhance trust and boost participation in virtual events.

The Digital Services Act, which came into full force in February 2024, imposes new responsibilities on online platforms with users in the EU, aiming to better protect those users and their rights. This could impact the operation of platforms hosting virtual events, requiring them to ensure user safety and data privacy. The EU is strategically shaping its approach to virtual worlds (metaverses) by funding development and prioritizing user protection. This ensures a competitive landscape for EU businesses, especially SMEs, and positions the EU as a leader in the innovative virtual events market.

Event Type Insights

The external events held the largest market share, accounting for 39.4% of the total revenue in 2023. External events typically include trade shows, exhibitions, fairs, festivals, product launches, and other events that are primarily targeted toward an external audience. These platforms allow companies to reach a global audience without the constraints of geographical location and travel restrictions. Moreover, companies can save on costs related to venue booking, travel, accommodation, and logistics, making virtual external events a more economical choice.

The extended events segment is projected to witness the fastest growth in terms of revenue with a CAGR of 18.9% from 2024 to 2030. The high growth rate of this segment can be attributed to the increasing demand for continuous learning and professional development opportunities. The ongoing improvements in virtual event technologies, such as AI-powered personalization and immersive VR experiences, are enhancing the user experience in extended events, further driving their growth.

Service Insights

The communication segment held the largest market share in 2023, accounting for 34.8% of the total revenue. This dominance can be attributed to the significant rise in digitally simulated gatherings, which are transforming the communication landscape. The growing adoption of Unified Communication as a Service (UCaaS)-based solutions by various organizations and enterprises, allows employees and other resources to virtually engage with all business proceedings, thereby realizing a more efficient and effective workflow.

The training segment is predicted to experience the fastest growth in terms of revenue, with a CAGR of 19.7% from 2024 to 2030. The surge in virtual simulation platforms can be ascribed to their ability to optimize time and resource allocation for businesses. Unlike traditional in-person events, virtual simulations offer asynchronous participation, enabling users to access recordings and materials at their convenience, fostering a more flexible learning or training experience.

Establishment Size Insights

Small and Medium-sized Businesses (SMBs) have been pivotal in the Europe virtual events market, securing the largest revenue share in 2023. It accounted for 50.7% of the market's revenue, indicating their substantial engagement in virtual events. This dominance can be attributed to the cost-effectiveness and scalability that virtual events offer, allowing SMBs to host and participate in global events without the hefty expenses associated with physical venues. The flexibility and reach provided by virtual platforms have enabled SMBs to expand their presence and compete on a larger scale, contributing to the overall growth of the market.

On the other hand, the large institutions segment is expected to demonstrate the second-fastest growth in revenue, with a CAGR of 16.8% from 2024 to 2030. Large institutions are increasingly adopting virtual events as a strategic tool for global outreach, internal training, and stakeholder engagement. The integration of advanced technologies such as AI, AR, and VR into these events has further enhanced their appeal, offering immersive and interactive experiences that rival traditional in-person events.

End-use Insights

Enterprise events held the largest market share in 2023, accounting for 54.2% of the total revenue. This dominance can be attributed to the pervasive adoption of collaborative and communication technologies across diverse sectors like retail & e-commerce, healthcare, manufacturing, construction, and education. Recognizing the efficiency gains, companies are swiftly integrating virtual simulation platforms to optimize time and resource allocation. The inherent scalability, cost-effectiveness, and global accessibility of virtual events make them a compelling proposition for enterprises aiming to connect seamlessly with clients, partners, and employees across geographical boundaries.

The educational institutions segment is predicted to witness the fastest growth in revenue with a CAGR of 19.3% from 2024 to 2030. Academic institutions are increasingly recognizing the potential of virtual events in conferences, webinars, and student engagement strategies. This adoption of virtual platforms facilitates the dismantling of geographical barriers, enabling institutions to deliver enriching experiences to a global audience of students, faculty, and researchers. However, the successful implementation of virtual events hinges on overcoming technical hurdles. These hurdles can include network issues, software glitches, and compatibility problems, all of which can negatively impact the user experience and hinder the broader adoption of virtual events.

Application Insights

The exhibitions and trade shows segment held a significant market position in 2023, accounting for the largest revenue share of 30.8%. The dominance can be attributed to the versatility of virtual platforms in hosting large-scale exhibitions, product showcases, and industrial trade events. These virtual events allow exhibitors to attend without worrying about logistical challenges related to physical venues. The ability to showcase products, engage with potential clients, and facilitate networking opportunities virtually has made them preferable for enterprises.

The conference segment is predicted to witness the fastest growth in revenue with a CAGR of 19.0% from 2024 to 2030. Virtual conferences have become prominent in facilitating knowledge dissemination, professional networking, and ongoing career development. Their widespread adoption is driven by accessibility, cost-efficiency, and the flexibility they offer attendees. The inclusion of real-time engagement tools like live sessions, dynamic Q&A functions, and designated virtual networking spaces fosters a more enriching and interactive conference experience for attendees.

Industry Vertical Insights

The Information Technology (IT) segment of the Europe virtual events market held the largest share in 2023, accounting for 20.4% of the revenue. This dominance can be attributed to the widespread use of collaboration and communication tools across various industries. IT's integral role in facilitating virtual events through advanced technologies such as UCaaS has been pivotal. The adoption of digital platforms that allow remote participation irrespective of location, and the convergence of AI, AR, and VR have significantly contributed to this sector's growth.

The Banking, Financial Services, and Insurance (BFSI) sector is projected to experience the fastest growth, with a CAGR of 20.3% from 2024 to 2030. This rapid growth is driven by the sector's increasing reliance on virtual platforms for conducting business and engaging with clients in a digital space. The shift towards virtual events has been further accelerated by the COVID-19 pandemic, which necessitated remote interactions and highlighted the effectiveness of virtual platforms in maintaining business continuity.

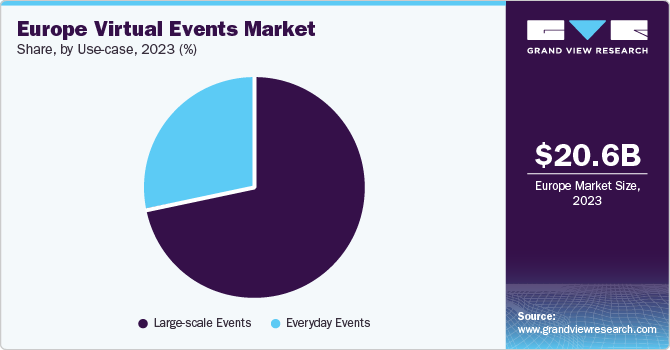

Use-case Insights

Large-scale events dominated the market, accounting for an impressive 71.9% of the total revenue share in 2023. Large-scale events refer to major conferences, global summits, trade shows, and exhibitions that attract a substantial number of participants. These events often involve thousands of attendees, multiple sessions, and extensive networking opportunities. The popularity of large-scale virtual events has surged due to their ability to connect people globally without geographical constraints. Companies, organizations, and industry leaders host such events to showcase products, share knowledge, and foster collaboration. The adoption of advanced virtual platforms, including features like interactive booths, live streaming, and personalized experiences, has contributed to their dominance in the market.

The everyday events segment is projected to experience the fastest revenue growth, with a predicted CAGR of 19.1% from 2024 to 2030. Everyday events encompass a wide range of activities, including team meetings, training sessions, webinars, product launches, and internal company gatherings. Unlike large-scale events, everyday events are more frequent and cater to specific audiences. The surge in remote work, digital collaboration, and hybrid work models has amplified the demand for everyday virtual events. Organizations now rely on virtual platforms to conduct routine business operations, engage employees, and enhance productivity. As companies embrace flexible work arrangements, the need for seamless virtual communication and efficient event management continues to grow.

Country Insights

Germany Virtual Events Market Trends

The virtual events market in Germanydominated the Europe region in 2023, accounting for 22.9% of the total revenue. The virtual corporate events industry in Germany encompasses planning, organizing, and executing corporate events in a virtual or online format. The adoption of virtual event platforms and technologies has been accelerated since the COVID-19 pandemic, leading to widespread transition from physical to virtual events due to travel restrictions and social distancing measures.

Italy Virtual Events Market Trends

The Italy virtual event marketis predicted to experience the fastest growth in revenue with a CAGR of 19.4% from 2024 to 2030. The market is driven by continuous technological advancements and the country’s strong position in national tech strength. Italy, along with other European countries like Norway, Finland, Sweden, the Netherlands, Denmark, and Switzerland, contributes to the development of advanced technologies and software for industries, including virtual event solutions.

Key Europe Virtual Events Company Insights

The Europe virtual events market is characterized by a robust and expanding structure, fueled by the region’s rapid digital transformation and the integration of advanced technologies.

Key Europe Virtual Events Companies:

- Hopin

- InEvent, Inc.

- Pathable

- Hubilo Technologies Inc.

- ubivent GmbH

- Cvent Inc.

- Zoom Video Communications, Inc.

- EventMobi

- Dorier Group

- Compass Group PLC

Recent Developments

-

In February 2024, Hopin initiated a voluntary liquidation of its UK parent company in conjunction with a strategic headquarters relocation to Delaware, U.S. This action aligns with their ongoing corporate consolidation efforts, aiming to streamline capital structure and operational processes for enhanced overall business efficiency.

-

In June 2023, Zoom announced localized data storage in the European Economic Area (EEA), for paying customers. Customers can choose to store specific meetings, webinars, and chat data in EEA data centers (initially Frankfurt). Limited data sharing with U.S. teams for exceptional circumstances (e.g., trust & safety) remains possible. A dedicated European technical support team will be established for these customers.

Europe Virtual Events Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 66.0 billion

Growth rate

CAGR of 18.1% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Event type, component, establishment size, end-use, application, industry vertical, use-case, country

Country scope

Germany; France; Italy; UK

Key companies profiled

Hopin, InEvent, Inc., Pathable, Hubilo Technologies Inc., ubivent GmbH, Cvent Inc., Zoom Video Communications, Inc., EventMobi, Dorier Group, Compass Group PLC

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Virtual Events Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe virtual events market report based on event type, service, establishment size, end-use, application, industry vertical, use-case, and country:

-

Event Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Internal Event

-

External Event

-

Extended Event

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Communication

-

Recruitment

-

Sales & Marketing

-

Training

-

-

Establishment Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Institutions

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Educational Institution

-

Corporate

-

Government

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Conferences & Conventions

-

Exhibitions & Trade Shows

-

Seminars & Workshops

-

Corporate Meetings & Training

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Consumer Electronics

-

Healthcare

-

Information Technology

-

Manufacturing

-

Media & Entertainment

-

Telecom

-

Others

-

-

Use-case Outlook (Revenue, USD Million, 2018 - 2030)

-

Everyday Events

-

Large-scale events

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

France

-

Italy

-

UK

-

Frequently Asked Questions About This Report

b. The Europe virtual events market size was estimated at USD 20.6 billion in 2023 and is expected to reach USD 24.69 billion in 2024

b. The Europe virtual events market is expected to grow at a compound annual growth rate of 18.1% from 2024 to 2030 to reach USD 66.0 billion by 2030

b. The enterprise events segment dominated the market with a share of 54.2% in 2023, it is attributed to the the pervasive adoption of collaborative and communication technologies across diverse sectors like retail & e-commerce, healthcare, manufacturing, construction, and education.

b. Some key players operating in the Europe virtual events market include Hopin, InEvent, Inc., Pathable, Hubilo Technologies Inc., ubivent GmbH, Cvent Inc., Zoom Video Communications, Inc., EventMobi, Dorier Group, Compass Group PLC

b. Factors such as ongoing digital transformation across various industries, coupled with the increasing adoption of cloud-based solutions, propelling the demand for virtual events are driving the Europe virtual events market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.