- Home

- »

- Water & Sludge Treatment

- »

-

Europe Waste Management Market, Industry Report, 2030GVR Report cover

![Europe Waste Management Market Size, Share & Trends Report]()

Europe Waste Management Market Size, Share & Trends Analysis Report By Service Type (Collection, Transportation, Disposal), By Waste Type, By Country And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-209-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Europe Waste Management Market Trends

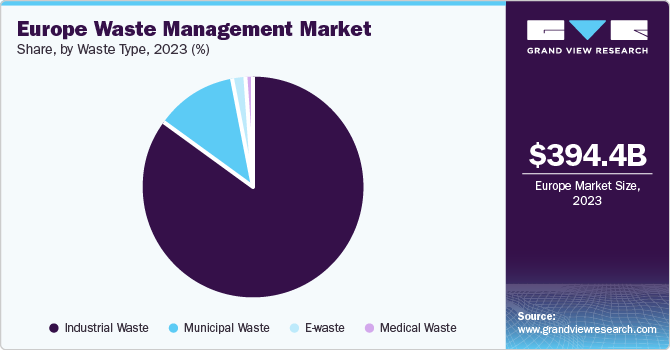

The Europe waste management market size was estimated at USD 394.4 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2030. Europe accounted for 29.1% of the global waste management market. The growth of the Europe waste management market is driven by several factors. The rising population and increased globalization have increased waste generation. Europe, being a highly industrialized region, witnesses substantial waste production across various sectors. The rising population, urbanization, and economic activities contribute to this trend. As waste volumes escalate, the demand for efficient waste management solutions intensifies. As the region continues to prioritize waste reduction and resource recovery, the market is poised for steady growth in the coming years.

The Europe waste management market is expected to grow steadily over the forecast period, mainly driven by a combination of environmental consciousness, regulatory initiatives, and the need for sustainable waste handling. The European Union (EU) actively promotes a circular economy, emphasizing resource efficiency, recycling, and waste reduction.

By setting targets for composting, recycling, and recycled content in plastic bottles, the EU aims to minimize waste generation and enhance recycling practices. The EU’s circular economy plan encourages better product design to facilitate reuse and recycling. By mandating recycled content in plastic bottles and restricting single-use plastics, the EU fosters sustainable practices.

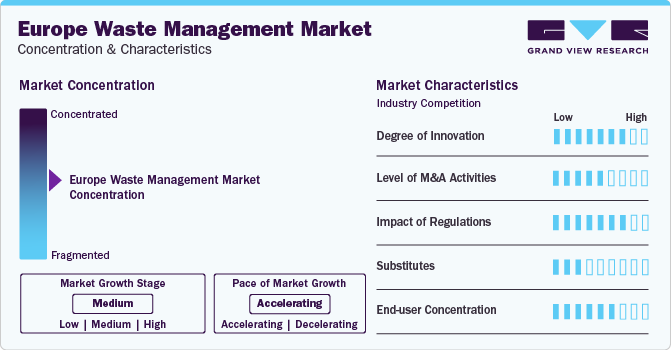

Market Concentration & Characteristics

The waste management industry in Europe has witnessed incremental innovation over the years. While there have been improvements in waste collection, recycling processes, and treatment technologies, radical breakthroughs are relatively rare. Innovations include advancements in smart waste collection, sensor-based sorting, and energy recovery from waste.

Europe is committed to reducing its reliance on fossil fuels and transitioning to renewable energy sources. Waste-to-energy (WtE) technologies align with this goal. Waste-to-energy plants convert waste into electricity or heat, contributing to the circular economy. The large presence of WtE facilities in Europe propels market growth.

European Union regulations significantly influence waste management practices. The EU has set ambitious targets for raising municipal waste recycling to 65% by 2035 and 70% by 2050, reducing plastic waste, and promoting a circular economy. By mandating recycled content in plastic bottles, banning certain single-use plastics, and encouraging better product design, the EU aims to minimize waste generation and promote sustainable practices. However, compliance with regulations can be challenging for waste management companies, especially regarding waste treatment methods and emissions control.

Service Type Insights

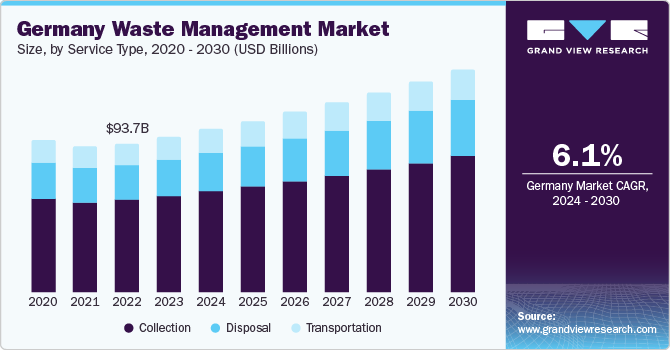

The collection segment dominated the Europe waste management market in 2023 with around 61.7% revenue share. This strong performance is primarily driven by the high demand for efficient and reliable waste collection services from various waste generators, including households, industries, and municipalities.

The disposal segment, while being the second largest, is expected to exhibit the fastest growth with a CAGR of 6.2% from 2024 to 2030. This growth can be attributed to the increasing need for safe and sanitary waste disposal, particularly for hazardous and infectious waste. Advances in waste disposal technologies, such as waste-to-energy, also contribute to the segment’s growth.

The transportation segment is projected to grow steadily during the forecast period. As the waste management market expands, there will be a greater demand for efficient and sustainable transportation services connecting collection points to disposal and recycling stations.

Waste Type Insights

The industrial waste segment dominated the Europe market with around 85.4% revenue share in 2023. This dominance is attributed to the high volume and variety of industrial waste generated by sectors such as manufacturing, construction, mining, and agriculture.

Despite having a mere 1.6% market share in 2023, the E-waste segment is expected to be the fastest-growing segment from 2024 to 2030, with a CAGR of 8%. The rapid increase in consumption and disposal of electronic appliances, including mobile phones, computers, TVs, and other devices, drives the growth of this segment.

The municipal waste segment was the second-largest in 2023. It is expected to grow with a CAGR of more than 6% during the forecast period. Factors contributing to its growth include rising population, urbanization, and consumerism in Europe.

The medical waste segment was the smallest in 2023. However, it is also projected to grow steadily due to increasing healthcare activities and stricter regulations regarding safe disposal.

Country Insights

Europe market include France, Italy, and Spain, which together account for almost 40% of the market share. These countries have also adopted various measures to enhance waste management performance, such as implementing extended producer responsibility schemes, promoting waste prevention and separation, and supporting waste-to-energy projects.

The rest of Europe, which comprises smaller and emerging markets, is also expected to witness steady growth as they strive to comply with EU waste legislation and targets and benefit from EU funds and initiatives for waste management.

Germany Waste Management Market Trends

Germany is the dominant player in the waste management market, accounting for almost 24% market share in 2023. The country has a well-established management system that prioritizes waste prevention, reuse, and recycling over disposal. Germany also has the highest municipal waste recycling rate (69.1%) in the world. Moreover, Germany is also expected to be the fastest-growing in the Europe market with a CAGR of 6.1% from 2024 to 2030.

UK Waste Management Market Trends

The UK is the second largest market in Europe. The UK has made significant improvements in waste management practices over the recent years, especially in terms of reducing landfilling and increasing recycling. It is also projected to be the second fastest market, as it aims to achieve a circular economy and net-zero emissions by 2050.

Key Europe Waste Management Company Insights

The Europe waste management market is characterized by medium market concentration. Several major players dominate the industry, but there is room for smaller and regional players. Key players include companies like Veolia, Suez, FCC, and Remondis. These companies operate across multiple European countries and provide a wide range of waste management services.

The UK Competition and Market Authority (CMA) asked Veolia to sell three businesses after an in-depth merger investigation concluded the merger of Suez and Veolia gave rise to competition concerns. This highlights the government regulations making sure the market does not become monopolistic and competition exists among various service providers.

Key Europe Waste Management Companies:

- FCC Environmental Services

- SUEZ

- Veolia

- Renewi

- Biffa PLC

- Saica Group

- Coventa Holding Corporation

- Indver

- Viridor

- REMONDIS SE & Co. KG

- Fortum

Recent Developments

-

In December 2023, FCC Servicios Medio Ambiente reached an agreement to acquire the business of Urbaser’s affiliate in the UK. This will enable FCC to extend its product and service offering and improve the value proposal for its customers.

-

In April 2022, Remondis acquired numerous Veolia and Suez sites, assets and customers across Australia. This will help REMONDIS return to the South Australian market and broadly boost its resources.

-

In January 2023, Covanta acquired Globalcycle and Global Remediation Services. With these acquisitions, Covanta aims to enhance its ability to provide more last-mile sustainability solutions to eliminate unwanted byproducts and convert them into value-based materials.

Europe Waste Management Market Scope

Report Attribute

Details

Market size value in 2024

USD 413.6 billion

Revenue forecast in 2030

USD 573.3 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Service type, waste type, country

Key companies profiled

FCC Environmental Services, Suez, Veolia, Renewi, Biffa PLC, Saica Group, Coventa Holding Corporation, Indver, Viridor, Remondis se & co, Fortum

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Waste Management Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe waste management market report based on service type, waste type, and region:

-

Service Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Collection

-

Transportation

-

Disposal

-

-

Waste Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Municipal Waste

-

Medical Waste

-

Industrial Waste

-

E-waste

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Frequently Asked Questions About This Report

b. Europe waste management market size was estimated at USD 394.4 million in 2023 and is expected to reach USD 413.6 billion in 2024.

b. Europe waste management market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.6% from 2024 to 2030 to reach USD 573.3 billion by 2030.

b. The collection segment dominated the Europe waste management market in 2023 with around 61.7% revenue share. This strong performance is primarily driven by the high demand for efficient and reliable waste collection services from various waste generators, including households, industries, and municipalities.

b. Some of the key players operating in the Europe waste management market include FCC Environmental Services, Suez, Veolia, Renewi, Biffa PLC, Saica Group, Coventa Holding Corporation, Indver, Viridor, Remondis se & co, Fortum among others.

b. The rising population and increased globalization have increased waste generation. Europe, being a highly industrialized region, witnesses substantial waste production across various sectors. The rising population, urbanization, and economic activities contribute to this trend.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."