- Home

- »

- Water & Sludge Treatment

- »

-

Europe Wood Activated Carbon Market Report, 2028GVR Report cover

![Europe Wood Activated Carbon Market Size, Share & Trends Report]()

Europe Wood Activated Carbon Market Size, Share & Trends Analysis Report By Product (Powdered, Granular), By Application (Food and Beverages, Cosmetics, Healthcare), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-649-7

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Bulk Chemicals

Report Overview

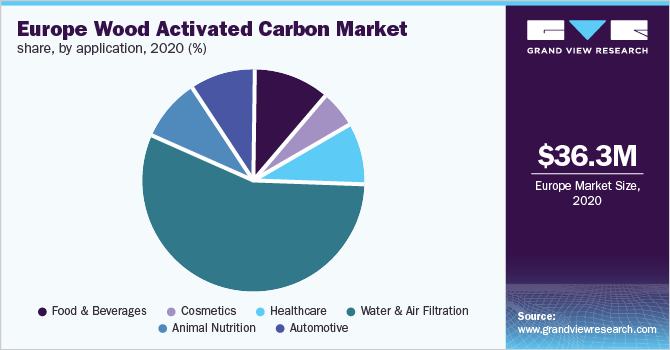

The Europe wood activated carbon market size was valued at USD 36.3 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2021 to 2028. The market is anticipated to be driven by the high efficacy of the wood activated carbon in removing impurities due to its superior adsorbing properties. The market is anticipated to be driven by the high demand from water and air filtration applications and the food and beverages industry. The product is used as a water and air purifier filter and a decolorizing agent in the food and beverage industry. The increased demand for air purifiers due to increasing awareness regarding health concerns can exponentially drive the product demand over the forecast period.

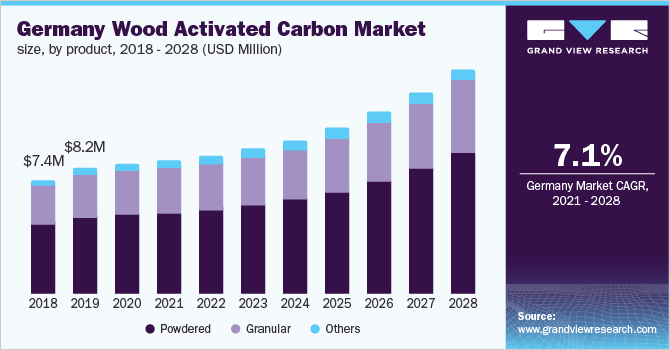

In Germany, the market for wood activated carbon is expected to witness a CAGR of 7.1% from 2021 to 2028. The rising use of powdered activated carbon is in water treatment operations is likely to fuel the growth over the forecast period. Powdered activated wood carbon is a non-toxic fine black powder. It is a tasteless compound with a robust adsorption ability compared to granular activated wood carbon; it poses a greater capacity to remove contaminants and exhibit faster kinetics.

The rising level of air and water pollution has resulted in the implementation of strict waste treatment and pollution control norms by governments across the world. These norms and regulations mandate the industries to adopt environmental-friendly, efficient water treatment, and disposable methods. In Europe, the Wood Activated Carbon Producer Association has been established to represent major producers and monitor compliance with government norms and regulations.

The companies involved in the manufacturing of wood-activated carbon are using raw materials such as waste and agriculture byproducts to produce activated carbon owing to stringent environmental protection regulations. Furthermore, rebates on taxation policy, multiple subsidies, and government expenditure on wastewater treatment are expected to support the market in the coming years.

The market was moderately impacted by the COVID-19 in 2020, owing to the supply-demand restrain in key economies. Furthermore, the pandemic has impacted several end-use industries, which, in turn, has influenced the market growth. However, key end-use applications including water and air filtration, food and beverage, cosmetics, animal nutrition, and automotive are anticipated to fuel the product demand on account of the stability of these industries. Lack of ability to procure raw materials and ingredients from third parties has imposed major challenges and is likely to affect both operational and financial performance of the company.

Product Insights

The powdered segment dominated the market and accounted for the largest revenue share of 68.1% in 2020. This is attributed to its superior pore structure, quick filtering, and high adsorption capacity. In industries like food and beverages, pharmaceuticals, and wastewater treatment, it is used for decolorizing, purifying, and deodorizing.

The product helps to remove or reduce pollutant concentration in the effluent. It is added directly to other processing units such as raw water intakes, gravity filters, rapid mixing ponds, and clarification systems.

Granular Activated Carbon (GAC) is typically used as an adsorbent and a filter medium in water treatment applications. The overall process involves selection, placement, followed by utilization of granular activated carbon in filter adsorbers. Companies such as Calgon Carbon are key players in the formulation of granular activated carbon with the high-intensity technological interface and capital investment in research and development activities.

Application Insights

The water and air filtration application dominated the market and accounted for the largest revenue share of 56.5% in 2020. This high share was attributed to the increased demand for water treatment techniques on account of environmental concerns and stringent regulations. These standards and regulations mandate the industries to adopt environmental-friendly and efficient water treatment and disposable methods.

In the food and beverage industry, wood activated carbon is used to improve purity, appearance, and other sensory characteristics such as taste, odor, and color in various products including fruit juices, carbonated drinks, alcoholic beverages, edible oils, and many others. It is used to purify carbon dioxide for use in carbonated drinks as well as to remove chlorine and ozone in various non-alcoholic and alcoholic industries.

In animal industry, wood-activated carbon is used in animal feed to increase the milk fat content and improve animal body condition. Wood activated carbon is grouped under Pyrogenic Carbonaceous Materials (PCMs), as it has the ability to bind enterotoxins produced by microflora and help maintain gut health in animals. The growing demand for dairy and meat production in Europe is expected to increase the demand for animal feed in the region, which subsequently boosts the demand for wood activated carbon.

Regional Insights

Germany dominated the Europe wood activated carbon market and accounted for the largest revenue share of 23.4% in 2020. This share is attributed to the noteworthy advancements in medical field related to medicine and equipment are providing growth opportunities for wood activated carbon in the country over the forecast period.

The demand for wood-activated carbon in the U.K. is expected to be driven by the cosmetics and food and beverage industries. Rising demand for cosmetics due to increasing awareness regarding personal care and increasing demand for food and beverage products due to the growing trend of consuming ready-to-eat food and fruit juices are the major factors driving the demand for wood activated carbon over the forecast period.

According to the Food and Drink Federation, in 2020, the U.K. food and drink industry accounted for approximately USD 33.0 billion, which is 2.3% up from the previous year. The growth of the industry is driven by its growing demand for food and beverages products in domestic and international market.

Exports are the main contributor to the growth, as in 2019, exports were nearly USD 27.0 billion. Food and drink products are exported to over 220 countries worldwide. The three main export destinations are Ireland, the U.S., and France. Thus, the growing end-use industries such as cosmetics and food and beverage are expected to boost the demand for wood-activated carbon over the forecast period.

Key Companies & Market Share Insights

Most of the players in the market are focusing on differentiating themselves from other players as the market is highly competitive. Manufacturers of wood-based carbon are continuously engaged in expanding their presence in the European market by acquiring small- and medium-sized market players. The companies are increasing prices of products in order to earn a decent profit margin. Some of the prominent players in the Europe wood activated carbon market include:

-

Eurocarb Products Limited

-

Carbon Activated Corporation

-

Chemviron

-

Kuraray Europe GmbH

-

Jacobi Carbons Group

-

Donau Carbon GmbH

-

Calgon Carbon Corporation

-

Gryfskand sp. z o.o.

-

Induceramic

-

Ingevity

Europe Wood Activated Carbon Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 36.9 million

Revenue forecast in 2028

USD 62.7 million

Growth rate

CAGR of 7.1% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2021 to 2028

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

Europe

Country scope

Germany; U.K.; France; Italy; Spain; Benelux; Russia

Key companies profiled

Eurocarb Products Limited; Carbon Activated Corporation; Chemviron; Kuraray Europe GmbH; Jacobi Carbons Group; Donau Carbon GmbH; Calgon Carbon Corporation; Gryfskand sp. z o.o.; Induceramic; Ingevity

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the Europe wood activated carbon market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Powdered

-

Granular

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Food & Beverages

-

Cosmetics

-

Healthcare

-

Water & Air Filtration

-

Animal Nutrition

-

Automotive

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Benelux

-

Russia

-

Frequently Asked Questions About This Report

b. The global Europe wood activated carbon market size was valued at USD 36.3 million in 2020 and is expected to reach USD 36.9 million by 2021.

b. The Europe wood activated carbon market is expected to witness a compounded annual growth rate of 7.1% over the forecast period reach USD 62.7 million by 2028.

b. The powdered wood activated carbon segment dominated the market with a revenue share of 68.1% in 2020. This is attributed to its superior pore structure, quick filtering, and high adsorption capacity.

b. Some prominent players in the global Europe wood activated carbon market include Eurocarb Products Limited, Carbon Activated Corporation, Chemviron, Kuraray Europe GmbH, Jacobi Carbons Group, Donau Carbon GmbH, Calgon Carbon Corporation, Gryfskand sp. z o.o., Induceramic, Ingevity

b. The Europe wood activated carbon market is anticipated to be driven by the high demand from water and air filtration applications and the food & beverages industry. The product is used as a water and air purifier filter and a decolorizing agent in the food and beverage industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."