- Home

- »

- Advanced Interior Materials

- »

-

Extrusion Machinery Market Size, Industry Report, 2030GVR Report cover

![Extrusion Machinery Market Size, Share & Trends Report]()

Extrusion Machinery Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Metal), By Type (Single-screw, Twin Screw), By End-use (Construction, Packaging), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-018-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Extrusion Machinery Market Summary

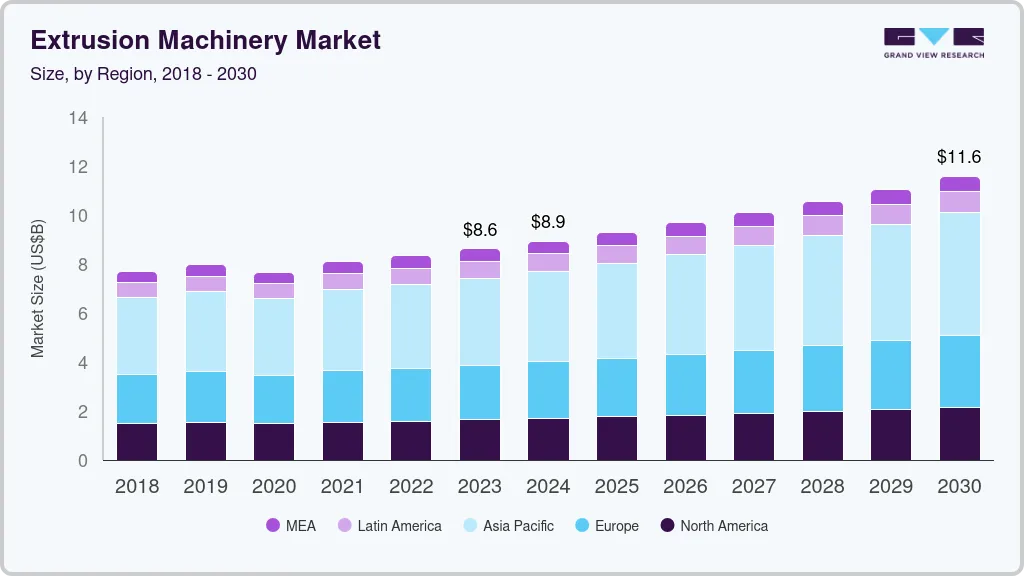

The global extrusion machinery market size was valued at USD 8.93 billion in 2024 and is projected to reach USD 11.58 million by 2030, growing at a CAGR of 4.5% from 2025 to 2030. This growth can be attributed to the Increasing demand for plastic and metal products, particularly in the construction industry, which is a significant contributor.

Key Market Trends & Insights

- The Asia Pacific extrusion machinery market dominated the global market and accounted for the largest revenue share of 41.5% in 2024.

- The extrusion machinery market in China led the Asia Pacific market and accounted for the largest revenue share in 2024.

- By material, the plastics segment dominated the global extrusion machinery industry and accounted for the largest revenue share of 77.2% in 2024.

- By type, the single-screw segment led the market and held the largest revenue share of 62.7% in 2024

Market Size & Forecast

- 2024Market Size: USD 8.93 Billion

- 2030 Projected Market Size: USD 11.58 Billion

- CAGR (2025-2030): 4.5%

- Asia Pacific: Largest market in 2024

In addition, high investments in manufacturing capabilities and infrastructure development are boosting market expansion. Furthermore, the rise of advanced technologies, including automation and smart manufacturing processes, enhances efficiency and product quality. Moreover, the growing focus on recycling and sustainable practices is prompting manufacturers to adopt innovative extrusion solutions, further fueling market growth.Extrusion machinery shapes materials, typically plastics or metals, by forcing them through a die to create specific profiles or forms. The rising demand for plastic products across various sectors significantly influences the expansion of the extrusion machinery market. Packaging, construction, and automotive industries increasingly utilize plastics due to their lightweight nature, durability, and cost-effectiveness. As urbanization progresses and disposable incomes rise, the need for plastic products continues to grow, propelling the extrusion machinery market forward.

In addition, ongoing technological advancements are crucial in shaping the industry. Manufacturers are heavily investing in research and development to enhance the efficiency and versatility of their extrusion machines. Furthermore, the integration of automation, sensors, and data analytics allows for optimized production processes, reduced waste, and improved product quality. These innovations boost productivity and lead to significant cost savings for manufacturers, making extrusion machinery a more appealing option.

Moreover, there is a growing emphasis on sustainability within the market. With increasing awareness about plastic waste and its environmental impact, consumers and governments are pushing for more sustainable practices. Consequently, manufacturers are compelled to adopt measures that minimize their carbon footprint. This has led to developing energy-efficient machinery and biodegradable materials in response to consumer demand for environmentally friendly options.

Material Insights

The plastics segment dominated the global extrusion machinery industry and accounted for the largest revenue share of 77.2% in 2024. This growth can be attributed to the increasing demand for plastic products across various industries. The construction, automotive, and packaging sectors are particularly influential, as they rely heavily on extruded plastic components for their operations. In addition, the trend towards sustainability has prompted manufacturers to incorporate recycled materials into their production processes, further boosting demand. Furthermore, advancements in extrusion technology enhance efficiency and product quality, making plastic extrusion machinery more appealing to manufacturers seeking to optimize their production capabilities.

The metal segment is expected to grow at a CAGR of 4.1% over the forecast period, owing to the rising demand for lightweight and high-strength metal components in the aerospace, automotive, and construction industries. In addition, the shift towards using extruded metal parts is driven by their ability to meet stringent performance and safety standards while reducing overall weight. Furthermore, technological innovations in extrusion processes allow for greater precision and customization of metal products. Moreover, as industries increasingly focus on improving energy efficiency and reducing emissions, the adoption of advanced metal extrusion machinery is expected to rise significantly, supporting market growth.

Type Insights

The single-screw segment led the market and held the largest revenue share of 62.7% in 2024, primarily driven by simplicity and cost-effectiveness. These extruders are widely used across various industries to produce plastic films, pipes, and automotive components. In addition, their compact design and low noise emissions make them attractive for manufacturers seeking efficient operations. Furthermore, single-screw extruders are known for their continuous output and ease of operation, enhancing their appeal in production environments and driving increased adoption.

The twin-screw segment is expected to grow at a CAGR of 5.3% from 2025 to 2030, owing to its superior process flexibility and efficiency. These machines can simultaneously handle multiple processes, such as mixing, melting, and cooling, making them ideal for complex applications. In addition, the energy efficiency of twin-screw extruders, reportedly consuming less power than single-screw models, also contributes to their growing popularity. Furthermore, technological advancements have improved their compounding capabilities and material feeding systems, making them increasingly attractive to manufacturers aiming for high productivity and quality in their production processes.

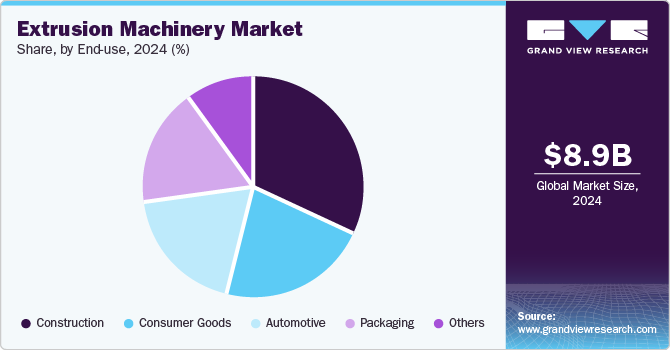

End-use Insights

The construction segment held the dominant position in the market, with the largest revenue share of 31.6% in 2024, driven by the increasing demand for extruded materials in various building applications. In addition, as urbanization accelerates and infrastructure projects expand, the need for durable and cost-effective construction materials like pipes, window frames, and cladding rises. Extrusion machinery plays a crucial role in producing these components efficiently and at scale. Furthermore, the focus on sustainable building practices encourages the use of eco-friendly extruded materials, further propelling market growth in this sector.

The packaging segment is expected to grow at a CAGR of 5.3% over the forecast period due to the rising demand for flexible and rigid plastic packaging solutions. As e-commerce expands, manufacturers seek efficient and innovative packaging options to meet consumer needs. Furthermore, extrusion machinery is essential for producing lightweight, durable packaging materials that enhance product protection while reducing waste. Moreover, advancements in extrusion technology allow for the creation of customized packaging solutions, driving further adoption and growth in this segment as companies prioritize sustainability and efficiency.

Regional Insights

The Asia Pacific extrusion machinery market dominated the global market and accounted for the largest revenue share of 41.5% in 2024, primarily driven by rapid industrialization and urban development. In addition, countries such as China and India are investing heavily in infrastructure projects, increasing the demand for extruded products in construction and packaging. Furthermore, the rise of e-commerce is boosting the need for efficient packaging solutions. Technological advancements in extrusion processes further enhance productivity and quality, making the region a key player in the global market for extrusion machinery.

The extrusion machinery market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, fueled by its extensive manufacturing capabilities and strong demand for plastic products. In addition, the country's rapid urbanization and ongoing infrastructure projects create a substantial need for extruded materials, particularly in the construction and automotive sectors. Furthermore, government initiatives promoting advanced manufacturing technologies encourage investments in modern extrusion machinery.

Europe Extrusion Machinery Market Trends

Europe extrusion machinery market is expected to grow at a CAGR of 4.3% over the forecast period, owing to an increased emphasis on sustainability and energy efficiency. The region's stringent environmental regulations encourage manufacturers to adopt advanced extrusion technologies that minimize waste and reduce energy consumption. Furthermore, the automotive and construction industries increasingly rely on extruded components to meet performance standards while enhancing product durability. Moreover, the presence of established players and ongoing innovations further solidified Europe's position as a significant market for extrusion machinery.

The extrusion machinery market in Germany dominated Europe and held the largest revenue share in 2024, driven by its strong engineering expertise and advanced manufacturing capabilities. In addition, the demand for high-quality extruded products in sectors such as automotive, packaging, and construction drives growth in this market. Furthermore, German manufacturers also focus on automation and Industry 4.0 technologies to improve production efficiency. Moreover, the country's commitment to sustainability pushes companies to invest in eco-friendly extrusion solutions, ensuring continued growth in this sector.

North America Extrusion Machinery Market Trends

The North America extrusion machinery market is expected to grow substantially over the forecast period due to increasing demand from various industries, including construction, automotive, and packaging. In addition, the region's focus on innovation drives manufacturers to adopt advanced technologies that enhance production efficiency and product quality. Furthermore, the trend towards lightweight materials in automotive applications is boosting the use of extruded components. Moreover, the presence of key industry players further supports market expansion as they invest in new technologies to meet evolving consumer demands.

The growth of the extrusion machinery market in the U.S. is expected to be driven by the robust demand from sectors such as packaging and construction. Furthermore, the shift towards sustainable practices has led manufacturers to seek advanced extrusion solutions that reduce waste and energy consumption. Moreover, technological advancements are enabling greater customization and efficiency in production processes. The U.S. government's support for infrastructure development also contributes to an increased need for extruded materials, positioning the country as a significant player in the global extrusion machinery market.

Key Extrusion Machinery Company Insights

Key global extrusion machinery industry companies include BC Extrusion Holding GmbH, Davis Standard, Graham Engineering, and others. These players are adopting various strategies to enhance their competitive edge. These include expanding product portfolios and distribution networks, investing in research and development for technological advancements, and forming strategic partnerships or alliances. In addition, companies are focusing on sustainability by integrating eco-friendly technologies and materials into their offerings.

-

Milacron specializes in the designing and manufacturing of advanced plastic processing equipment. The company offers a comprehensive range of products, including single and twin screw extruders, dies, and downstream equipment. The company operates across various segments, focusing on applications such as sheet production, pipe manufacturing, and specialized profiles.

-

Davis-Standard produces a wide array of equipment, including single-screw and twin-screw extruders, as well as specialized dies and ancillary machinery. The company operates primarily in the plastics and rubber industries, providing tailored solutions for applications such as film production, pipe extrusion, and profile manufacturing.

Key Extrusion Machinery Companies:

The following are the leading companies in the extrusion machinery market. These companies collectively hold the largest market share and dictate industry trends.

- KraussMaffei

- Milacron

- The Japan Steel Works, LTD.

- NFM / Welding Engineers, Inc.

- BC Extrusion Holding GmbH

- WENGER MANUFACTURING

- Davis Standard

- Extrusion Technik USA, Inc.

- Graham Engineering

- AMUT S.P.A.

Recent Developments

-

In January 2024, Davis-Standard successfully acquired Extrusion Technology Group (ETG), including battenfeld-cincinnati, exelliq, and Simplas. This strategic move enhances Davis-Standard's position in the global market, combining innovative technologies and expertise.

-

In November 2023, KraussMaffei unveiled the relaunch of its ZE 28 BluePower laboratory extruder at the Fakuma trade fair, enhancing its extrusion machinery lineup. This new twin-screw extruder features a design tailored to customer needs, emphasizing efficiency and ease of operation.

Extrusion Machinery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.29 billion

Revenue forecast in 2030

USD 11.58 billion

Growth Rate

CAGR of 4.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, China, India, Japan, Australia, Germany, UK, France, Italy, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

KraussMaffei; Milacron; The Japan Steel Works, LTD.; NFM / Welding Engineers, Inc.; BC Extrusion Holding GmbH; WENGER MANUFACTURING; Davis Standard; Extrusion Technik USA, Inc.; Graham Engineering; AMUT S.P.A.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Extrusion Machinery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global extrusion machinery market report based on material, type, end-use, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Metal

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-Screw

-

Twin Screw

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Consumer Goods

-

Automotive

-

Packaging

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.