- Home

- »

- Beauty & Personal Care

- »

-

Eyelash Serum Market Size, Share & Growth Report, 2030GVR Report cover

![Eyelash Serum Market Size, Share & Trends Report]()

Eyelash Serum Market (2024 - 2030) Size, Share & Trends Analysis Report By Ingredient (Conventional, Organic), By Type (Lash Primer, Prostaglandins, Peptides), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-418-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Eyelash Serum Market Summary

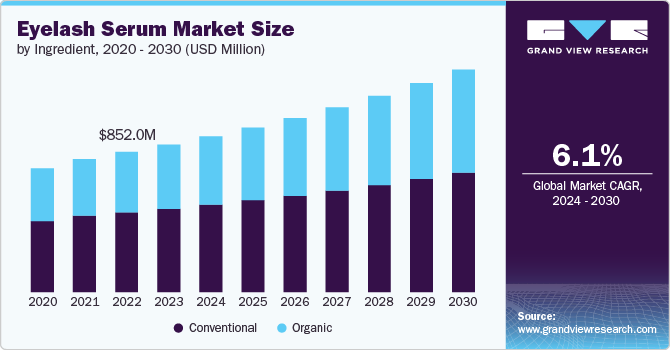

The global eyelash serum market size was estimated USD 897.9 million in 2023 and is projected to reach USD 1.35 billion by 2030, growing at a CAGR of 6.1% from 2024 to 2030. The eyelash serum market has experienced significant growth over the past decade, driven by the increasing popularity of non-invasive beauty treatments and a growing consumer preference for enhancing natural beauty.

Key Market Trends & Insights

- The Eyelash serum market in North America accounted for a revenue share of around 23% in 2023.

- The U.S. Eyelash serum market accounted for a revenue share of around 81% of the North America revenue in 2023.

- By ingredient, the conventional eyelash serum segment accounted for a revenue share of over 56% in 2023.

- By type, the prostaglandins eyelash serum segment accounted for a revenue share of over 44% in 2023.

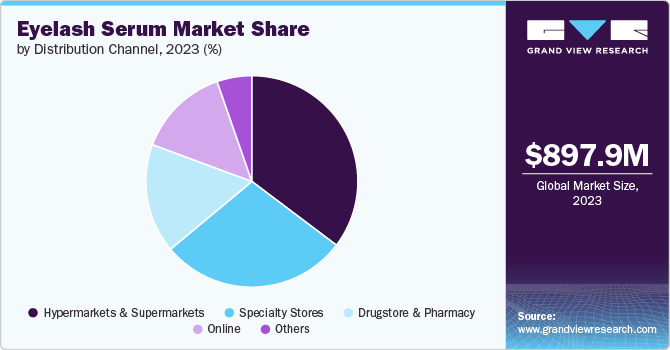

- By distribution channel, the hypermarkets and supermarkets segment accounted for a revenue share of over 35% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 897.9 Million

- 2030 Projected Market Size: USD 1.35 Billion

- CAGR (2024-2030): 6.1%

- Asia Pacific: Largest market in 2023

Eyelash serums, which are designed to promote the growth, thickness, and overall health of eyelashes, have gained widespread acceptance among consumers, particularly in regions such as North America, Europe, and parts of Asia-Pacific. One of the key factors contributing to the popularity of eyelash serums is the shift in consumer behavior towards more natural and non-invasive beauty solutions. As the beauty industry evolves, consumers are increasingly seeking products that deliver effective results without the need for expensive or invasive procedures such as eyelash extensions or false lashes. This trend has been particularly pronounced among younger demographics, including Millennials and Gen Z, who are more inclined towards products that emphasize self-care and natural beauty enhancement.

The growth of the eyelash serum market has been further fueled by the rise of social media and influencer marketing. Platforms like Instagram, YouTube, and TikTok have played a crucial role in popularizing eyelash serums, with beauty influencers and celebrities endorsing these products to millions of followers. This has not only raised awareness about the benefits of eyelash serums but has also created a strong demand for products that promise longer, thicker, and healthier lashes.

Recent trends in the eyelash serum market have seen a growing emphasis on product safety and the use of natural ingredients. As consumers become more health-conscious and aware of potential side effects associated with certain ingredients, there has been a noticeable shift towards formulations that are free from harmful chemicals such as parabens, sulfates, and prostaglandins. Prostaglandins, in particular, have been a subject of controversy due to their association with side effects such as eye irritation and changes in iris color. In response, many brands have introduced peptide-based serums, which are seen as a safer alternative that still delivers effective results.

A notable example of innovation in this space is the launch of Grande Cosmetics' GrandeLASH-MD Lash Enhancing Serum, which has become one of the best-selling eyelash serums on the market. This product is formulated with vitamins, peptides, and amino acids, which work together to promote the appearance of longer, thicker lashes in as little as 4-6 weeks. The success of GrandeLASH-MD has been attributed to its effective formulation, as well as the brand's strategic use of social media marketing and influencer partnerships.

Another key player in the market, Latisse, offers a prescription-strength serum that contains bimatoprost, a prostaglandin analog known for its effectiveness in promoting lash growth. Despite its popularity, Latisse has faced challenges due to concerns over potential side effects, leading to a growing interest in alternative products that use safer ingredients. This has opened the door for new entrants in the market, particularly those offering clean beauty products that align with consumer demand for natural and non-toxic formulations.

The clean beauty movement has significantly influenced the eyelash serum market, with many consumers now favoring products that are ethically sourced, cruelty-free, and environmentally sustainable. Brands such as Neora have responded to this trend by developing serums that are dermatologist-tested, hypoallergenic, and free from harsh chemicals. Neora Advanced Eyelash Conditioner, for example, has gained popularity not only for its efficacy but also for its commitment to ethical practices, including donations to breast cancer research initiatives.

Ingredient Insights

The conventional eyelash serum accounted for a revenue share of over 56% in 2023. Conventional eyelash serums remain a dominant segment in the market, largely driven by their established reputation for delivering effective results in enhancing lash length and thickness. These serums often contain potent ingredients like prostaglandins and peptides, which are key to their efficacy. The demand for conventional serums is supported by widespread consumer trust in well-known brands like Latisse, which has become a staple in the beauty industry.

The demand for organic eyelash serum is projected to grow at a CAGR of 7.0% from 2024 to 2030. The organic eyelash serum segment is gaining traction as more consumers shift towards clean beauty products that align with their health-conscious lifestyles. Organic serums typically exclude synthetic chemicals, parabens, and sulfates, appealing to consumers who prefer natural ingredients and are wary of potential side effects from conventional products. Brands like Plume and Babe Lash have capitalized on this trend by offering serums that are certified organic and free from harmful additives. The growing awareness of sustainability and the environmental impact of beauty products further drives the demand for organic options.

Type Insights

The prostaglandins eyelash serum accounted for a revenue share of over 44% in 2023. Prostaglandins are powerful compounds that play a significant role in the eyelash serum market, particularly in products designed for rapid and noticeable lash growth. Brands like Latisse dominate this segment, although the market is seeing increased competition from alternative formulations that promise similar results with fewer risks.

The demand for lash primer is projected to grow at a CAGR of 7.0% from 2024 to 2030. Lash primers, often used as a base coat before mascara or lash serum application, have carved out a niche in the eyelash enhancement market. While not as dominant as serums, lash primers are valued for their ability to prepare and protect lashes, making them a complementary product in many beauty routines. The market for lash primers is driven by the growing trend of multi-step beauty regimens, with consumers seeking products that enhance the overall performance of their lash care routines.

Distribution Channel Insights

The hypermarkets and supermarkets segment accounted for a revenue share of over 35% in 2023. The hypermarkets and supermarkets segment plays a crucial role in the distribution of eyelash serums, particularly in reaching a broad consumer base. These retail channels offer the convenience of one-stop shopping and often carry a wide range of beauty products, including affordable and mid-range eyelash serums. The accessibility and visibility of these products in large retail chains like Walmart and Target drive impulse purchases and cater to consumers who prefer in-store shopping experiences.

The online sales is projected to grow at a CAGR of 8.0% from 2024 to 2030. The online segment in the eyelash serum market has seen substantial growth, driven by the convenience of e-commerce and the increasing shift towards digital shopping. Consumers are drawn to the ease of browsing, comparing products, and reading reviews, which help them make informed purchasing decisions. Major online platforms like Amazon, Sephora, and brand-specific websites have become key sales channels, offering a wide range of products, exclusive deals, and subscription models that encourage repeat purchases.

Regional Insights

The Eyelash serum market in North America accounted for a revenue share of around 23% of the global revenue in 2023. The eyelash serums market in North America is driven by the growing beauty and wellness industry, with increasing consumer demand for longer, fuller lashes as part of their cosmetic routines. Additionally, the market is fueled by the rising popularity of non-invasive beauty treatments and the influence of social media trends, where visible results and product endorsements play a significant role in consumer purchasing decisions. The U.S. is the leading contributor to this market, with brands like Grande Cosmetics, Latisse, and Neora dominating the market. The region's well-established beauty industry, combined with a high demand for premium products, has made it a lucrative market for eyelash serum brands.

U.S. Eyelash Serum Market Trends

The U.S. Eyelash serum market accounted for a revenue share of around 81% of the North America revenue in 2023. The U.S. is the leading contributor to this market, with brands like Grande Cosmetics, Latisse, and Neora dominating the market. The region's well-established beauty industry, combined with a high demand for premium products, has made it a lucrative market for eyelash serum brands. Moreover, the market is characterized by a wide range of products, from high-end serums to more affordable options, catering to diverse consumer preferences.

Asia Pacific Eyelash Serum Market Trends

The Eyelash serum market in Asia Pacific accounted for revenue share of around 45% of the global revenue in 2023. The Asia-Pacific region is emerging as a key growth market for eyelash serums, driven by increasing beauty consciousness, and the influence of K-beauty trends. Countries like South Korea and Japan are at the forefront of this growth, with consumers showing a strong preference for innovative and high-performance beauty products. The region's fast-paced beauty industry, coupled with a growing e-commerce sector, is expected to drive further expansion of the eyelash serum market in the coming years.

Europe Eyelash Serum Market Trends

Europe Eyelash serum market is projected to grow at a CAGR of 5.3% from 2024 to 2030. In Europe, the eyelash serum market is also growing steadily, with countries like the UK, Germany, and France leading the way. The European market is characterized by a preference for high-quality, dermatologist-recommended products, and a strong inclination towards clean beauty. The region's stringent regulations on cosmetic products have also led to the development of safer and more effective formulations, which are well-received by consumers.

Key Eyelash Serum Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Eyelash Serum Companies:

The following are the leading companies in the eyelash serum market. These companies collectively hold the largest market share and dictate industry trends.

- E.l.f. Cosmetics Inc.

- Grande Cosmetics LLC

- JB Cosmetics Group

- L’Oréal S.A.

- LVMH Group

- Pacifica Beauty

- Uklash

- Neora

- Shiseido Company, Limited

- Skin Research Laboratories

Recent Developments

-

In June 2024, UKLASH, launched an advanced peptide-based lash serum. It is developed in collaboration with expert formulators and biologists with over 55 years of experience. The serum is designed for individuals seeking long-term lash enhancement. It supports lash growth with a formulation that includes 99% natural and 22% organically derived ingredients, featuring a blend of six targeted peptides.

-

In April, 2024, Neora, a global leader in holistic beauty and wellness, announced the launch of their latest product, Lash Lush, a lash and brow serum designed to deliver visible results within four weeks.

Eyelash Serum Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 947.5 million

Revenue forecast in 2030

USD 1.35 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

E.l.f. Cosmetics Inc.; Grande Cosmetics LLC; JB Cosmetics Group; L’Oréal S.A.; LVMH Group; Pacifica Beauty; Uklash; Neora; Shiseido Company, Limited; Skin Research Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Eyelash Serum Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global eyelash serum market based on ingredient, type, distribution channel, and region.

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Prostaglandins

-

Lash Primer

-

Peptides

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets and Supermarkets

-

Specialty Stores

-

Drugstore and Pharmacy

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.