- Home

- »

- Next Generation Technologies

- »

-

Eyewear Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Eyewear Market Size, Share & Trends Report]()

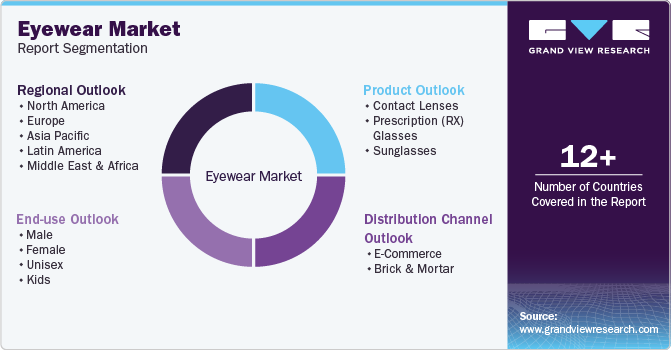

Eyewear Market Size, Share & Trends Analysis Report By Product (Contact Lenses, Spectacles, Sunglasses), By Distribution Channel, By End-Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-018-7

- Number of Pages: 171

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Technology

Eyewear Market Size & Trends

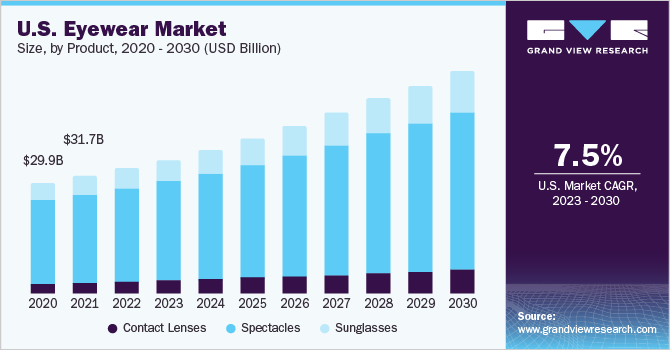

The global eyewear market size was valued at USD 183.36 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.5% from 2023 to 2030. The changing lifestyle patterns and increasing adoption of luxurious accessories among millennials strongly favor market growth. Encouraged by the strongly rising product demand, eyewear makers are focusing on developing attractive and affordable eyewear. They are introducing new designs and patterns to quickly respond to the current fashion trends and attract fashion enthusiasts. Continuous efforts by leading market players to acquire new customers and retain existing ones are positively influencing the market growth for eyewear.

Latest fashion trends compel eyewear companies to introduce new products to appeal to consumer demand. For instance, in September 2022, De Rigo Vision S.p.A launched the very first phygital eyewear style, the Crypto King$ Limited Edition a luxury eyewear, in partnership with the PHILIPP PLEIN brand. This partnership aims to offer high-quality products along with unique aesthetics and powerful innovations. This limited edition came with 1,000 phygital frames, and every pair will have its serial number accompanied by a special box featuring a video screen.

The increased brand awareness by means of marketing eyewear on various social media platforms, virtual try-on, and proliferation of eyewear e-commerce platforms has further contributed to global eyewear market growth. Eyewear companies are advertising on popular social media platforms such as Instagram, Twitter, and Facebook, which offer them an opportunity to analyze audience preferences, thereby offering specially curated products. These online eyewear market platforms help companies incorporate innovative marketing strategies such as influencer and affiliate marketing to make their business more profitable.

The emergence of the COVID-19 crisis has also positively impacted the market. As a result of the implementation of remote working models and online learning due to lockdown restrictions, people spent more time on smartphones, laptops, and desktops. The longer screen times forced consumers to spend on anti-fatigue and vision correction glasses, allowing eyewear companies to increase their sales of blue light-canceling and anti-fatigue lenses.

Market Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. This can be attributed to various factors, such as the increasing prevalence of vision problems and eye conditions, leading to greater demand for corrective products such as glasses and contact lenses. Additionally, the growing popularity of glasses as a fashion accessory, particularly among younger consumers, is helping to drive demand for designer frames and sunglasses.

The eyewear market is seeing an increasing number of merger and acquisition (M&A) activities by the leading players underlying a dynamic industry landscape. The highly competitive nature of the eyewear market makes it difficult for companies to maintain profitability and market share growth on their own. By partnering or acquiring other companies, they can gain access to new technologies, distribution channels, or customer bases that can help them stay ahead of the competition.

The eyewear market is also subject to increasing regulatory scrutiny. Regulatory bodies such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are responsible for setting standards and guidelines for the manufacture, distribution, and marketing of eyewear products, including glasses, contact lenses, and sunglasses. The US FDA requires that all contact lenses be approved as safe and effective medical devices before they can be sold to consumers. Similarly, the EMA requires that contact lenses meet certain standards for quality and safety before they can be marketed in the European Union.

End-user concentration is a significant factor in the eyewear market. The high cost of luxury eyewear products can make them less accessible to the average consumer. Companies in this segment may need to rely on a smaller number of high-spending consumers to maintain profitability. Many consumers have strong preferences for certain eyewear brands based on factors such as quality, style, or celebrity endorsements and are willing to pay a premium for products that meet their specific preferences.

Product Insights

The spectacles segment accounted for a revenue share of over 75% in 2022, which can be credited to the increased product demand due to the rising prevalence of computer vision syndrome (CVS). CVS is caused due to the rising use of mobile phones and digital screens among the global population. The growing trend of online learning and smart eyewear technology, especially during the pandemic, has led to an increase in CVS cases among children, driving the adoption of anti-glare and anti-fatigue glasses. In 2020, Essilor reported a 39% increase in demand for kids’ anti-reflective and anti-fatigue lenses owing to e-learning spike in their key markets. The pandemic accelerated the purchase of protective children’s eyewear as screen exposure went up due to remote education. Moreover, the growing popularity of clear eyeglasses and bright translucent glasses has also augmented the demand for spectacles.

The contact lenses segment captured a notable revenue share in 2022 and is expected to grow significantly over the coming years, aided by the emergence of advanced products such as light-adaptive lenses and multifocal toric lenses. These modern lenses quickly and smoothly adapt to different lighting conditions, which reduces irritation and dryness often caused by normal contact lenses. The ongoing research and development of contact lenses with improved aesthetics and quality will further support the segment’s growth.

Distribution Channel Insights

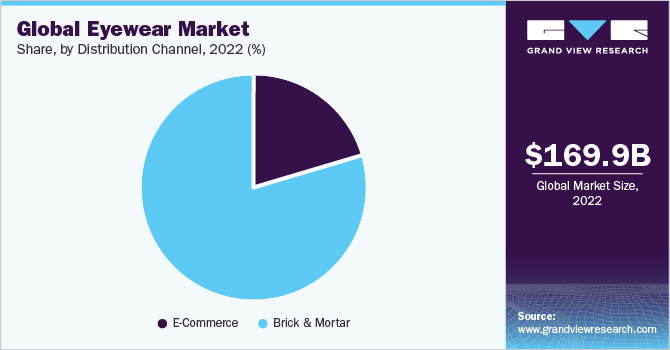

The brick-and-mortar segment dominated the market, capturing a higher revenue share in 2022. This can be attributed to the increasing awareness regarding regular eye checkups and the usage of eyeglasses, prompting their sale from brick-and-mortar stores. Several companies are focusing on expanding their stores to gain a competitive edge in the market. For instance, November 2023, Cult Swedish brand entered in Indian market in collaboration with BRDG Group. The brand’s collection features 11 signature silhouettes to cater to an array of tastes. The segment witnessed a slight decline in revenue share during the pandemic due to lockdown restrictions in several countries. However, the lifting of these restrictions in subsequent months and higher consumer preference for physical stores is expected to favor segment growth in the coming years.

Online services gained massive traction during the pandemic as people were forced to practice social isolation. In addition, the heightened adoption of smart devices, lucrative discounts offered, and the ability to compare prices and features positively influence the growth of the e-commerce channel. The e-commerce segment is anticipated to grow at a faster pace over the forecast period as several key companies have partnered with leading e-commerce service providers to expand their reach and target a larger consumer base. The proliferation of e-commerce has revolutionized the eyewear market, enabling various eyewear bands to showcase their product catalog for a variety of end-users, including males, females, kids, and unisex customers, and offer convenient and hassle-free shopping experiences through online eyewear platforms. Besides, e-commerce websites also allow users to provide reviews about products, which improves the user experience and helps companies understand consumer preferences, thus stimulating segment expansion.

Regional Insights

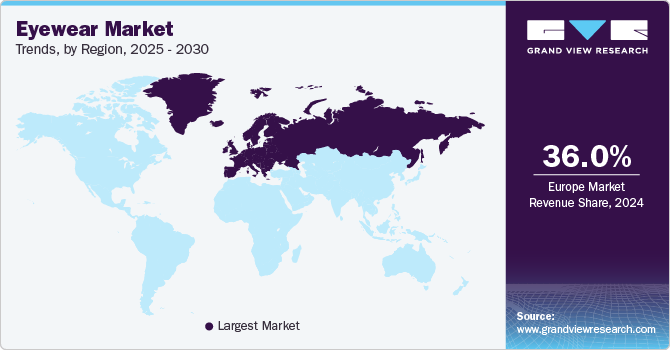

Europe dominated the eyewear market by capturing a revenue share of nearly 37% of the global eyewear market in 2022, owing to the increasing demand for eyewear, such as sunglasses, colored contact lenses, smart eyewear, and frames as fashion accessories, by consumers. The European eyewear market is a hub for various major fashion brands, such as Gucci, Prada, TOM FORD, and Christian Dior, creating a lucrative space for the eyewear market. Moreover, the market is highly regulated as sunglasses and eyewear products are considered personal protective equipment (PPE) in EU countries, mandating suppliers to adhere to the directives.

North America held a significant revenue in 2022, owing to the well-established e-commerce sector in the region, which has helped improve the user experience regarding eye power consultation and spectacle selection. The American Academy of Ophthalmology has set guidelines that help eye clinics, and doctors provide appointments and telemedicine visits. The availability of these services, coupled with increased local production in the region, creates multiple growth prospects for the market.

Recent Development

-

In December 2023, Carl Zeiss Meditec AG acquired Dutch Ophthalmic Research Center (International) B.V. (D.O.R.C.) from the investment firm Eurazeo SE, Paris, France. The acquisition will enhance and complement ZEISS Medical Technology’s broad ophthalmic portfolio and range of digitally connected workflow solutions for addressing a wide variety of eye conditions, including retinal disorders, cataracts, glaucoma, and refractive errors.

-

In October 2023, Bausch + Lomb announced the U.S. launch of SeeNa, an ophthalmic diagnostic system for refractive cataract patients that is fully integrated with Bausch & Lomb’s Eyetelligence surgical planning software to help streamline surgical planning and information flow.

-

In October 2023, Alcon announced the launch of TOTAL30 Multifocal, the monthly Water Gradient multifocal contact lens. The lenses have begun to roll out in the United States and in select international markets.

-

In September 2023, The Fielmann Group acquired SVS Vision. These acquisitions constitute an important milestone in the internationalization that the German family business pursues with its Vision 2025 growth strategy.

Key Eyewear Companies:

- Johnson & Johnson Vision Care, Inc.

- ESSILORLUXOTTICA

- CooperVision

- Carl Zeiss AG

- Bausch & Lomb Inc.

- Safilo Group S.p.A.

- Charmant Group

- Chemilens (CHEMIGLAS Corp.)

- CIBA VISION

- De Rigo Vision S.p.A

- Fielmann AG

- HOYA Corporation

- JINS, Inc.

- Marchon Eyewear, Inc.

- Marcolin S.p.A

- QSpex Technologies

- Rodenstock GmbH

- Seiko Optical Products Co., Ltd.

- Shamir Optical Industry Ltd.

- Silhouette International Schmied AG

- Warby Parker

- Zenni Optical, Inc.

Eyewear Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 183.36 billion

Revenue forecast in 2030

USD 323.77 billion

Growth Rate

CAGR of 8.5% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Million Units and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Russia; Netherlands; Sweden; China; Japan; India; South Korea; Australia; Vietnam; Singapore; Brazil; Argentina; Saudi Arabia; UAE; Turkey; Egypt; South Africa

Key companies profiled

Johnson & Johnson Vision Care, Inc.; ESSILORLUXOTTICA; CooperVision; Carl Zeiss AG; Bausch & Lomb Inc.; Safilo Group S.p.A.; Charmant Group; Chemilens (CHEMIGLAS Corp.); CIBA VISION; De Rigo Vision S.p.A; Fielmann AG; HOYA Corporation; JINS, Inc.; Marchon Eyewear, Inc.; Marcolin S.p.A; QSpex Technologies; Rodenstock GmbH; Seiko Optical Products Co., Ltd.; Shamir Optical Industry Ltd.; Silhouette International Schmied AG; Warby Parker; Zenni Optical, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Eyewear Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global eyewear market report based on product, distribution channel, end-use, and region:

-

Product Outlook (Revenue, USD Million, Volume, Million Units; 2018 - 2030)

-

Contact Lenses

-

Premium Contact Lenses

-

Mass Contact Lenses

-

-

Spectacles

-

Spectacles Frame

-

Spectacles Frame, by Type

-

Premium Spectacle Frames

-

Mass Spectacle Frames

-

-

Spectacles Frame, by Style

-

Round

-

Square

-

Rectangle

-

Oval

-

Others

-

-

Spectacles Lenses

-

-

-

Sunglasses

-

Sunglasses, by Lens Type

-

Polarized Sunglasses

-

Non-Polarized Sunglasses

-

-

Sunglasses, by Lens Material

-

CR-39

-

Polycarbonate

-

Polyurethane

-

Others

-

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

E-Commerce

-

Brick & Mortar

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

Unisex

-

Kids

-

-

Regional Outlook (Revenue, USD Million, Volume, Million Units; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Netherlands

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Vietnam

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Turkey

-

Egypt

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global eyewear market size was valued at USD 169.90 billion in 2022 and is expected to reach USD 183.36 billion in 2023

b. The global eyewear market is expected to grow at a compound annual growth rate of 8.5% from 2023 to 2030 to reach USD 323.77 billion by 2030.

b. The spectacle segment dominated the eyewear market with a revenue share of 55.6% in 2022. This is attributable to the technical improvements to increase levels of comfort and durability in spectacle manufacturing.

b. Some of the key players in the global eyewear market include Bausch and Lomb Inc.; Carl Zeiss AG; Charmant Group; CooperVision; Warby Parker; and EssilorLuxotttica.

b. Key factors that are driving the eyewear market growth include the growing number of ophthalmic disorders, awareness regarding eye examinations, and perception of eyewear as a fashion accessory.

Table of Contents

Chapter 1 Eyewear Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Information Procurement

1.3.1. Information analysis

1.3.2. Market formulation & data visualization

1.3.3. Data validation & publishing

1.4. 1.4 Research Scope and Assumptions

1.4.1. List to Data Sources

Chapter 2 Eyewear Market: Executive Summary

2.1. Eyewear Market Snapshot

2.2. Eyewear Market- Segment Snapshot (1/2)

2.3. Eyewear Market- Segment Snapshot (2/2)

2.4. Eyewear Market- Competitive Landscape Snapshot

Chapter 3 Eyewear Market: Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.1.1. Increasing prevalence of vision impairment and eye related disorders

3.3.1.2. Growing demand for fashionable and trendy eyewear

3.3.1.3. Rising awareness about eye protection and safety

3.3.2. Market Restraint Analysis

3.3.2.1. Low awareness in developing countries may hinder market expansion.

3.3.2.2. Limited distribution channels for premium eyewear brands may restrict.

3.3.3. Industry Opportunities

3.4. Industry Analysis Tools

3.4.1. Porter’s analysis

3.4.2. Macroeconomic analysis

3.5. Eyewear Market Trends Analysis

3.5.1. Spring/Summer Eyewear and Winter Eyewear Trends

3.5.1.1. Spring/Summer Trends

3.5.1.2. Fall/Winter Trends

3.5.2. Eyewear License Valuation

3.6. Impact of COVID-19 on Eyewear Industry

3.6.1. Strategies Adopted by Key Companies

3.6.1.1. EssilorLuxottica

3.6.1.2. Safilo Group S.p.A

3.6.1.3. Alcon (CIBA Vision)

3.6.2. Impact of COVID-19 on E-Commerce Distribution Channel

3.6.3. Impact of COVID-19 on Cancellation of Eyewear Events

3.6.4. Effect on Manufacturing and Supply Chain Activities

Chapter 4. Eyewear Market: Product Estimates & Trend Analysis

4.1. Product Movement Analysis & Market Share, 2022 & 2030

4.2. Eyewear Market Estimates & Forecast, By Product (Million Units)

4.3. Eyewear Market Estimates & Forecast, By Product (USD Million)

4.3.1. Contact Lenses

4.3.1.1. Premium Contact Lenses

4.3.1.2. Mass Contact Lenses

4.3.2. Spectacles

4.3.2.1. Spectacles Frame

4.3.2.1.1. Spectacles, by Frame Type

4.3.2.1.1.1. Premium Spectacle Frame

4.3.2.1.1.2. Mass Spectacle Frame

4.3.2.1.2. Spectacles, by Frame Style

4.3.2.1.2.1. Round

4.3.2.1.2.2. Square

4.3.2.1.2.3. Rectangle

4.3.2.1.2.4. Oval

4.3.2.1.2.5. Others

4.3.2.2. Spectacles Lenses

4.3.3. Sunglasses

4.3.3.1. Sunglasses, by Lens Type

4.3.3.1.1. Polarized Sunglasses

4.3.3.1.2. Non-Polarized Sunglasses

4.3.3.2. Sunglasses, by Lens Material

4.3.3.2.1. CR-39

4.3.3.2.2. Polycarbonate

4.3.3.2.3. Polyurethane

4.3.3.2.4. Others

Chapter 5. Eyewear Market: Distribution Channel Estimates & Trend Analysis

5.1. Distribution Channel Movement Analysis & Market Share, 2022 & 2030

5.2. Eyewear Market Estimates & Forecast, By Distribution Channel (USD Million)

5.2.1. E-Commerce

5.2.2. Brick & Mortar

Chapter 6. Eyewear Market: End-Use Estimates & Trend Analysis

6.1. End-Use Movement Analysis & Market Share, 2022 & 2030

6.2. Eyewear Market Estimates & Forecast, By End-Use (USD Million)

6.2.1. Male

6.2.2. Female

6.2.3. Unisex

6.2.4. Kids

Chapter 7. Regional Estimates & Trend Analysis

7.1. Eyewear Market by Region, 2022 & 2030

7.2. North America

7.2.1. North America Eyewear Market Estimates & Forecasts, 2018 - 2030 (USD Million)

7.2.2. U.S.

7.2.3. Canada

7.2.4. Mexico

7.3. Europe

7.3.1. Europe Eyewear Market Estimates & Forecasts, 2018 - 2030 (USD Million)

7.3.2. U.K.

7.3.3. Germany

7.3.4. France

7.3.5. Italy

7.3.6. Spain

7.3.7. Russia

7.3.8. Netherlands

7.3.9. Sweden

7.4. Asia Pacific

7.4.1. Asia Pacific Eyewear Market Estimates & Forecasts, 2018 - 2030 (USD Million)

7.4.2. China

7.4.3. Japan

7.4.4. India

7.4.5. South Korea

7.4.6. Australia

7.4.7. Vietnam

7.4.8. Singapore

7.5. South America

7.5.1. South America Eyewear Market Estimates & Forecasts, 2018 - 2030 (USD Million)

7.5.2. Brazil

7.5.3. Argentina

7.6. Middle East & Africa (MEA)

7.6.1. MEA Eyewear Market Estimates & Forecasts, 2018 - 2030 (USD Million)

7.6.2. Saudi Arabia

7.6.3. UAE

7.6.4. Turkey

7.6.5. Egypt

7.6.6. South Africa

Chapter 8. Eyewear Market - Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company Categorization

8.3. Participant’s Overview

8.4. Financial Performance

8.5. Product Benchmarking

8.6. Company Market Share Analysis, 2022

8.7. Company Heat Map Analysis

8.8. Strategy Mapping

8.8.1. Expansion/Divestiture

8.8.2. Collaborations/Partnerships

8.8.3. New Product Launches

8.8.4. Contract

8.9. Company Profiles

8.9.1. Bausch + Lomb Corporation

8.9.1.1. Participant’s Overview

8.9.1.2. Financial Performance

8.9.1.3. Product Benchmarking

8.9.1.4. Recent Developments

8.9.2. Zeiss Group

8.9.2.1. Participant’s Overview

8.9.2.2. Financial Performance

8.9.2.3. Product Benchmarking

8.9.2.4. Recent Developments

8.9.3. Charmant Inc.

8.9.3.1. Participant’s Overview

8.9.3.2. Financial Performance

8.9.3.3. Product Benchmarking

8.9.3.4. Recent Developments

8.9.4. Chemiglas Corporation

8.9.4.1. Participant’s Overview

8.9.4.2. Financial Performance

8.9.4.3. Product Benchmarking

8.9.4.4. Recent Developments

8.9.5. CIBA Vision (Alcon)

8.9.5.1. Participant’s Overview

8.9.5.2. Financial Performance

8.9.5.3. Product Benchmarking

8.9.5.4. Recent Developments

8.9.6. CooperVision Limited

8.9.6.1. Participant’s Overview

8.9.6.2. Financial Performance

8.9.6.3. Product Benchmarking

8.9.6.4. Recent Developments

8.9.7. De Rigo Vision S.p.A.

8.9.7.1. Participant’s Overview

8.9.7.2. Financial Performance

8.9.7.3. Product Benchmarking

8.9.7.4. Recent Developments

8.9.8. ESSILORLUXOTTICA

8.9.8.1. Participant’s Overview

8.9.8.2. Financial Performance

8.9.8.3. Product Benchmarking

8.9.8.4. Recent Developments

8.9.9. Fielmann AG

8.9.9.1. Participant’s Overview

8.9.9.2. Financial Performance

8.9.9.3. Product Benchmarking

8.9.9.4. Recent Developments

8.9.10. HOYA Corporation

8.9.10.1. Participant’s Overview

8.9.10.2. Financial Performance

8.9.10.3. Product Benchmarking

8.9.10.4. Recent Developments

8.9.11. JINS Inc.

8.9.11.1. Participant’s Overview

8.9.11.2. Financial Performance

8.9.11.3. Product Benchmarking

8.9.11.4. Recent Developments

8.9.12. Johnson & Johnson Vision Care Inc.

8.9.12.1. Participant’s Overview

8.9.12.2. Financial Performance

8.9.12.3. Product Benchmarking

8.9.12.4. Recent Developments

8.9.13. Marchon Eyewear Inc.

8.9.13.1. Participant’s Overview

8.9.13.2. Financial Performance

8.9.13.3. Product Benchmarking

8.9.13.4. Recent Developments

8.9.14. Marcolin S.p.A.

8.9.14.1. Participant’s Overview

8.9.14.2. Financial Performance

8.9.14.3. Product Benchmarking

8.9.14.4. Recent Developments

8.9.15. Prada S.p.A

8.9.15.1. Participant’s Overview

8.9.15.2. Financial Performance

8.9.15.3. Product Benchmarking

8.9.15.4. Recent Developments

8.9.16. Rodenstock GmbH

8.9.16.1. Participant’s Overview

8.9.16.2. Financial Performance

8.9.16.3. Product Benchmarking

8.9.16.4. Recent Developments

8.9.17. Safilo Group S.p.A.

8.9.17.1. Participant’s Overview

8.9.17.2. Financial Performance

8.9.17.3. Product Benchmarking

8.9.17.4. Recent Developments

8.9.18. Seiko Optical Products Co. Ltd.

8.9.18.1. Participant’s Overview

8.9.18.2. Financial Performance

8.9.18.3. Product Benchmarking

8.9.18.4. Recent Developments

8.9.19. Shamir Optical Industry Ltd.

8.9.19.1. Participant’s Overview

8.9.19.2. Financial Performance

8.9.19.3. Product Benchmarking

8.9.19.4. Recent Developments

8.9.20. Silhouette International Schmied AG

8.9.20.1. Participant’s Overview

8.9.20.2. Financial Performance

8.9.20.3. Product Benchmarking

8.9.20.4. Recent Developments

8.9.21. Warby Parker

8.9.21.1. Participant’s Overview

8.9.21.2. Financial Performance

8.9.21.3. Product Benchmarking

8.9.21.4. Recent Developments

8.9.22. Zenni Optical Inc.

8.9.22.1. Participant’s Overview

8.9.22.2. Financial Performance

8.9.22.3. Product Benchmarking

8.9.22.4. Recent Developments

List of Tables

Table 1 Eyewear Market - Key Market Driver Impact

Table 2 Type of Eyewear Trends in Spring/Summer

Table 3 Eyewear Market - Key Market Restraint Analysis

Table 4 Type of Eyewear Trends in Spring/Summer

Table 5 Type of Eyewear Trends in Fall/Winter

Table 6 Type of Licenses and Their Valuation

Table 7 Methods of Valuation with Pros and Cons

Table 8 Eyewear Market Volume Estimates and Forecast, By Product, 2018 - 2030 (Million Units)

Table 9 Eyewear Market Revenue Estimates and Forecast, By Product, 2018 - 2030 (USD Billion)

Table 10 Eyewear Market Revenue Estimates and Forecast, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 11 Eyewear Market Revenue Estimates and Forecast, By End-Use, 2018 - 2030 (USD Billion)

Table 12 Recent Developments & Impact Analysis, By Key Market Participants

Table 13 Company Heat Map Analysis

Table 14 Key Companies Undergoing Expansions/Divestures.

Table 15 Key Companies Undergoing Collaborations.

Table 16 Key Companies Launching New Products

Table 17 Key Companies Engaged in Merger & Acquisition

List of Figures

Fig. 1 Eyewear Market Segmentation

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Market Snapshot

Fig. 7 Segment Snapshot

Fig. 8 Competitive Landscape Snapshot

Fig. 9 Eyewear Market Value, 2022 - 2030 (USD Billion)

Fig. 10 Eyewear Market - Industry Value Chain Analysis

Fig. 11 Market Dynamics

Fig. 12 Workplace Injuries Involving the Eyes

Fig. 13 Eyewear Market: PORTER’s Analysis

Fig. 14 Eyewear Market: PESTEL Analysis

Fig. 15 Handcrafted Eyewear Manufacturing Process

Fig. 16 Innovation by Eyewear Startups

Fig. 17 Eyewear Market, by Product: Key Takeaways, 2018 - 2030, Revenue (USD Billion)

Fig. 18 Eyewear Market, by Product: Market Share, 2022 & 2030

Fig. 19 Contact Lenses Market Estimates & Forecasts, 2018 - 2030 (USD Million, and Million Units)

Fig. 20 Spectacles Market Estimates & Forecasts, 2018 - 2030 (USD Million, and Million Units)

Fig. 21 Sunglasses Market Estimates & Forecasts, 2018 - 2030 (USD Million, and Million Units)

Fig. 22 Eyewear Market, by Distribution Channel: Key Takeaways, 2018 - 2030, Revenue (USD Billion)

Fig. 23 Eyewear Market, by Distribution Channel: Market Share, 2022 & 2030

Fig. 24 E-Commerce Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 25 Brick & Mortar Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 26 Eyewear Market, by End-Use: Key Takeaways, 2018 - 2030, Revenue (USD Billion)

Fig. 27 Eyewear Market, by End-Use: Market Share, 2022 & 2030

Fig. 28 Male Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 29 Female Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 30 Unisex Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 31 Kids Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 32 Eyewear market by region, 2022 & 2030, Revenue (USD Million)

Fig. 33 Regional marketplace: Key takeaways (1/2)

Fig. 34 Regional marketplace: Key takeaways (2/2)

Fig. 35 North America eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 36 U.S. eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 37 Canada eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 38 Mexico eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 39 Europe eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 40 Germany eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 41 U.K. eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 42 France eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 43 Italy eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 44 Spain eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 45 Russia eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 46 Netherlands eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 47 Sweden eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 48 Asia Pacific eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 49 China eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 50 Japan eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 51 India eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 52 South Korea eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 53 Australia eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 54 Vietnam eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 55 Singapore eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 56 South America eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 57 Brazil eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 58 Argentina eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 59 MEA Eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 60 Saudi Arabia eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 61 UAE eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 62 Turkey eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 63 Egypt eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 64 South Africa eyewear market estimates & forecast, 2018 - 2030 (Revenue, USD Million, Volume, Million Units)

Fig. 65 Key Company Categorization

Fig. 66 Company Market Share Analysis, 2022

Fig. 67 Strategic frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Eyewear Product Outlook (Revenue, USD Million, Volume, Million Units; 2018 - 2030)

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Eyewear Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- E-Commerce

- Brick & Mortar

- Eyewear End-Use Outlook (Revenue, USD Million; 2018 - 2030)

- Male

- Female

- Unisex

- Kids

- Eyewear Regional Outlook (Revenue, USD Million, Volume, Million Units; 2018 - 2030)

- North America

- North America Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- North America Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Others

- North America Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- U.S.

- U.S. Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- U.S. Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- U.S. Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- U.S. Eyewear Market, By Product

- Canada

- Canada Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Canada Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Canada Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Canada Eyewear Market, By Product

- Mexico

- Mexico Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Mexico Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Mexico Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Mexico Eyewear Market, By Product

- North America Eyewear Market, By Product

- Europe

- Europe Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Europe Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Europe Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Germany

- Germany Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Germany Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Germany Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Germany Eyewear Market, By Product

- U.K.

- U.K. Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- U.K. Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- U.K. Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- U.K. Eyewear Market, By Product

- France

- France Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- France Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- France Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- France Eyewear Market, By Product

- Italy

- Italy Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Italy Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Italy Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Italy Eyewear Market, By Product

- Spain

- Spain Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Spain Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Spain Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Spain Eyewear Market, By Product

- Russia

- Russia Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Russia Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Russia Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Russia Eyewear Market, By Product

- Netherlands

- Netherlands Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Netherlands Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Netherlands Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Netherlands Eyewear Market, By Product

- Sweden

- Sweden Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Sweden Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Sweden Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Sweden Eyewear Market, By Product

- Europe Eyewear Market, By Product

- Asia Pacific

- Asia Pacific Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Asia Pacific Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Asia Pacific Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- China

- China Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- China Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- China Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- China Eyewear Market, By Product

- Japan

- Japan Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Japan Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Japan Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Japan Eyewear Market, By Product

- India

- India Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- India Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- India Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- India Eyewear Market, By Product

- South Korea

- South Korea Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- South Korea Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- South Korea Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- South Korea Eyewear Market, By Product

- Australia

- Australia Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Australia Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Australia Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Australia Eyewear Market, By Product

- Vietnam

- Vietnam Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Vietnam Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Vietnam Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Vietnam Eyewear Market, By Product

- Singapore

- Singapore Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Singapore Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Singapore Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Singapore Eyewear Market, By Product

- Asia Pacific Eyewear Market, By Product

- South America

- South America Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- South America Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- South America Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Brazil

- Brazil Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Brazil Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Brazil Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Brazil Eyewear Market, By Product

- Argentina

- Argentina Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Argentina Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Argentina Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Argentina Eyewear Market, By Product

- South America Eyewear Market, By Product

- MEA

- Middle East and Africa Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Middle East and Africa Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Middle East and Africa Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Saudi Arabia

- Saudi Arabia Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Saudi Arabia Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Saudi Arabia Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Saudi Arabia Eyewear Market, By Product

- UAE

- UAE Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- UAE Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- UAE Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- UAE Eyewear Market, By Product

- Turkey

- Turkey Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Turkey Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Turkey Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Turkey Eyewear Market, By Product

- Egypt

- Egypt Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- Egypt Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- Egypt Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- Egypt Eyewear Market, By Product

- South Africa

- South Africa Eyewear Market, By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Frames, by Type

- Spectacle Lenses

- Spectacle Frames

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

- Sunglasses, by Lens Type

- Contact Lenses

- South Africa Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

- South Africa Eyewear Market, By End-Use

- Male

- Female

- Unisex

- Kids

- South Africa Eyewear Market, By Product

- Middle East and Africa Eyewear Market, By Product

- North America

Eyewear Market Dynamics

Driver: Awareness regarding eye examinations

A large number of people in developing countries suffer from vision deficiencies, which go unnoticed and uncorrected. But the rising concern about good eye health and protection in these countries is expected to propel the market growth. People do not have access to eye examination centers or awareness regarding corrective measures for visual inaccuracies in rural areas. The increasing eye care awareness campaigns by governments and private institutions is also expected to play an important role in driving the growth of the eyewear industry. This presents a considerable opportunity for market participants to ensure the establishment of diagnostic centers. The demand for eye protection has fueled contact lenses and sunglasses sales. This trend is expected to resonate through the forecast period.

Driver: Growing number of ophthalmic disorders

The growing number of ophthalmic disorders is also expected to impact the market. For instance, presbyopia is a condition commonly observed in the older population due to the progressive diminishing of the eye’s ability to focus on objects. As the correction of presbyopia involves the usage of corrective eyewear, the rapid increase in population has led to a corresponding increase in the number of presbyopes, in turn fueling the eyewear market. Lifestyle changes due to growing urbanization, particularly in developed markets, are a major propeller for the increased usage of corrective eyewear. With the advent of modern healthcare and technology, there has been an increase in the share of the older population on account of the increasing life expectancy rate.

Restraint: Data security and privacy concerns

Refractive surgeries such as LASIK and PRK (Photorefractive keratectomy) may pose a challenge to market growth as these procedures correct a person’s vision and attempt to provide a permanent substitute to corrective eyewear. The propensity of this procedure to improve the quality of life is expected to impact the contact lenses market negatively over the forecast period. Since these surgeries eliminate the use of prescription eyewear altogether, there are a number of benefits as far as users or consumers are concerned. These include convenience, reduction in long-term costs as well as boosting overall aesthetic appearance. LASIK and related procedures may hamper corrective contact lenses demand. If users are not satisfied with the results of these surgeries, they can opt to use custom gas permeable or hybrid contact lenses to improve vision.

What Does This Report Include?

This section will provide insights into the contents included in this eyewear market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Eyewear market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Eyewear market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the eyewear market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for eyewear market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of eyewear market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Eyewear Market Categorization:

The eyewear market was categorized into three segments, namely product (Contact Lenses, Spectacles, Sunglasses), distribution channel (E-Commerce, Brick & Mortar), and region (North America, Europe, Asia Pacific, South America, and Middle East & Africa).

Segment Market Methodology:

The eyewear market was segmented into products, distribution channels, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The eyewear market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into ten countries, namely, the U.S.; Canada; Mexico; the UK; Germany; China; India; Japan; Vietnam; Brazil.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Eyewear market companies & financials:

The eyewear market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Alcon: Alcon offers its products and services to over 140 countries worldwide. The company research, manufactures, distributes, and sells a whole range of eye care products. It operates with two key segments- Surgical and Vision Care.

-

Bausch & Lomb Incorporated: Bausch & Lomb is a manufacturer and provider of eye care products such as contact lenses, contact lens care solutions, eye drops for curing dry eyes, allergies and redness, eye vitamins, vision accessories, and ophthalmic surgical devices.

-

Charmant Group: Charmant Group is a manufacturer and provider of sunglasses, optical spare parts, and optical frames. The company offers products through its in-house and licensed brands.

-

CHEMIGLAS Corp.: CHEMIGLAS Corp. provides products under the brand Chemilens, which is a manufacturer and distributor of glass and plastic lenses. The company offers a broad product portfolio of lenses, including free-form lenses, progressive focus lenses, functional lenses, and a single lens, which are used in numerous applications.

-

CooperVision: CooperVision deals with the distribution and manufacturing of soft contact lenses and related products and services. The company specializes in lenses for presbyopia, astigmatism, and visual dryness serving patients and practitioners.

-

De Rigo S.p.A: De Rigo S.p.A designs, produces, and distributes high-quality eyewear products. Its product portfolio includes sunglasses, eyeglasses, and related components.

-

EssilorLuxottica: EssilorLuxottica specializes in designing, producing, and marketing ophthalmic lenses, prescription glasses, optical equipment, and sunglasses. EssilorLuxottica aims to generate awareness regarding eye care.

-

Fielmann AG: Fielmann AG is a German company that manufactures plastic and mineral lenses as per the order and later fits them into the frames in its grinding plant.

-

HOYA Corporation: HOYA Corporation is a Japanese med-tech company engaged in the healthcare and information technology fields providing intraocular lenses, eyeglasses, optical lenses, medical endoscopes, and critical components of the LCD panels, semiconductor devices, and HDDs

-

JINS, Eyewear US, Inc.: JINS, Eyewear is engaged in planning, production, and distribution of high-quality, crafting stylish and innovative eyewear products. The company sells its lightweight and functional eyewear products online.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Eyewear Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2018 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Eyewear Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-