- Home

- »

- Advanced Interior Materials

- »

-

Global Feldspar Market Size, Industry Report, 2020-2027GVR Report cover

![Feldspar Market Size, Share & Trends Report]()

Feldspar Market (2020 - 2027) Size, Share & Trends Analysis Report By End-use (Glassmaking, Ceramics, Pottery), By Region (North America, Europe, Asia Pacific, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68038-897-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global feldspar market size was valued at USD 1.61 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2020 to 2027. The growth of the market is largely influenced by the dynamics of the glass and ceramics industries. The distinctive chemical constituents present in the product, such as potassium oxide, sodium oxide, and alumina, play a key role in promoting its usage across the glass and ceramics sector. The product is largely used in its ground form between 20 mesh to 200 mesh in glassmaking and ceramics filler application. Feldspar demand in China has observed significant growth over the last decade. The alumina content within the product offers excellent corrosion resistive properties and alkalis provide heat resistance. Owing to such excellent properties, the product is largely used in glassmaking.

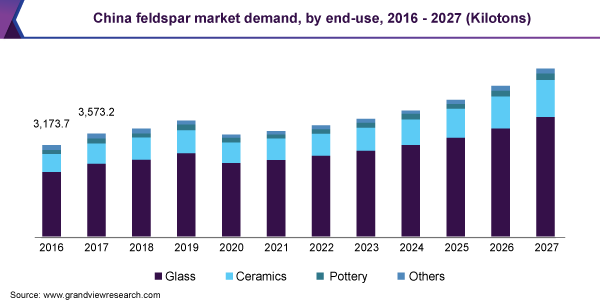

The glass making in China observed steady growth owing to the strong demand from the domestic flat glass sector. The flat glass sector in China was primarily driven by the rising production of automotive vehicles. China leads automotive production by a considerable margin not only in the Asia Pacific region but also at the global platform. As of 2019, China’s share in automotive production is 52.2% in the Asia Pacific and 28.0% on a global scale, as per the statistics provided by the OICA.

The primary reason behind, such a significant regional shift for automotive production was the accelerating economic development fueled by exponential government spending in China. Furthermore, the abundance of lower-wage workers' availability in China propelled automotive manufacturers to expand their production base in the country. Thus, strong growth in the end-use sector positively influenced the dynamics of glass making, which, in turn, provided a strong platform for the growth of the feldspar industry in the country.

However, with the emergence of coronavirus and rapidly rising cases in the country over the first quarter of 2020 halted the industrial operations across the country. Despite the emergence of the global pandemic, the industrial activities in the country resumed in the second quarter of 2020. The key end-use sectors of the glass industry including construction and automotive sectors are likely to observe a downward trend. This is likely to restrain the market growth of feldspar in the country over the short term period.

End-use Insights

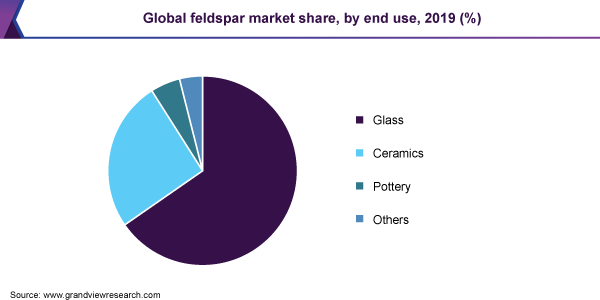

The glassmaking segment led the market and accounted for more than 71.0% share of the global volume in 2019. The segment growth is largely influenced by the dynamics of the automotive, construction, and packaging industries. Glassmaking in the Asia Pacific region flourished owing to the steady demand from the aforementioned end-use sectors, especially in countries such as India and China. For instance, owing to the steady development in the production of automotive vehicles, the glassmaking sector of India observed the growth of nearly 3.5% from 2016 to 2018, thereby positively influencing the growth of the feldspar marketspace in India.

Ceramics emerged as the second-largest end-use segment in 2019. The product is used in its ground form as filler in the manufacturing of ceramic products. The stable consumption of ceramic products has positively influenced the feldspar market growth. However, the emergence of global pandemic and lockdown imposed on construction sites is anticipated to restrain the growth of the ceramics segment over the short term period.

Increasing demand for ceramic tiles, particularly in residential and commercial construction, around the globe is projected to boost the growth of the ceramics industry over the forecast period. Ceramic tiles are used for various purposes, including flooring and walls. They are a combination or mixture of clay and other minerals, such as feldspar, sand, and quartz, which are hardened by heat. Thus, the growth of the ceramics industry is directly related to the growth of the global feldspar marketspace.

Regional Insights

Asia Pacific dominated the market and accounted for over 48.0% share of global revenue in 2019. The presence of strong glassmaking and ceramics sector in the region is likely to sway the market growth of feldspar in the Asia Pacific region. The region has observed steady economic growth owing to the flourishing economies of China and India. Both countries are among the largest markets for the construction and automotive sectors. This will provide a stable platform for the maturing of the glassmaking industry, which, in turn, is likely to push the growth of feldspar market space in the Asia Pacific region.

The European region is projected to emerge as the second-largest regional market for feldspar. The region is a key producer of the product and holds significant reserves of minerals across Italy and Turkey. Italy and Turkey are among the largest producers of mined products in the European region. In terms of consumption, both countries possess strong glassmaking and ceramics sector. As per the stats released by the United States Geological Survey (USGS), in 2019, the total production of mineral by Turkey has evaluated around 7,500 kilotons as of 2018.

North America region is projected to register the second-highest CAGR of 3.9% in terms of volume from 2020 to 2027. The U.S. is expected to emerge as the key regional market as the country accounted for 67.9% share of the total volume. The U.S. production of feldspar increased from 470 kilotons in 2016 to 550 kilotons in 2018 as per the stats published by the USGS in 2019. The key feldspar producing states in the U.S. were North Carolina, Oklahoma, California, Virginia, and Idaho.

Central & South America is projected to observe the slowest growth over the forecast period. Due to the emergence of the pandemic and an increasing number of infected victims in Brazil, the region is undergoing tremendous economic turmoil. In addition, the region is afflicted by geopolitical stress in key countries, such as Columbia and Venezuela, thereby hampering industrial activities in the region.

Middle East and Africa accounted for a small revenue share in 2019. The region is anticipated to observe steady growth over the forecast period, primarily driven by the gulf countries. The economic development, coupled with strong construction activities in the Gulf States, such as Saudi Arabia, UAE, and Oman, positively influenced the consumption trends of feldspar in the region.

Key Companies & Market Share Insights

The industry participants are widely focused on reducing production costs through the employment of smart automation techniques and adopting sustainable mining practices. The competition within the industry is projected to remain high with global vendors and regional vendors competing at various levels. Ascending demand for glass products in architecture, automotive, and solar applications is prompting the key players to expand their target markets and footprints in the Asia Pacific. Hence, investments in acquisitions and capacity expansions are the key strategies adopted by the market players. Other than the key players, several other market players have also been investing in strengthening their position and business. Some of the prominent players in the feldspar market include:

-

I-Minerals Inc.

-

Quarzwerke GmbH

-

Micronized South Africa Limited

-

Imerys

-

Eczacıbaşı Holding A.Ş.

-

Adolf Gottfried Tonwerke GmbH

-

LB MINERALS, Ltd.

-

Sibelco

-

QUARTZ Corp

-

Sun Minerals

Feldspar Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.41 billion

Revenue forecast in 2027

USD 2.35 billion

Growth Rate

CAGR of 4.9% from 2020 to 2027

Market demand in 2020

20,406.4 kilotons

Volume forecast in 2027

31,562.9 kilotons

Growth Rate

CAGR of 3.7% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; Italy; Turkey; China; India; Brazil

Key companies profiled

I-Minerals Inc.; Quarzwerke GmbH; Imerys; Eczacıbaşı Holding A.Ş.; LB MINERALS, Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the global, country, and regional levels, and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global feldspar market report on the basis of end-use and region:

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Glassmaking

-

Ceramics

-

Pottery

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

Turkey

-

Russia

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global feldspar market size was estimated at USD 1.61 billion in 2019 and is expected to reach USD 1.41 billion in 2020.

b. The feldspar market is expected to grow at a compound annual growth rate of 4.9% from 2020 to 2027 to reach USD 2.35 billion by 2027.

b. Glassmaking dominated the feldspar market with a revenue share of 65.5% in 2019, owing to the distinctive properties of the product in providing superior chemical resistivity.

b. Some of the key players operating in the feldspar market are I-Minerals Inc., Quarzwerke GmbH, Micronized South Africa Limited, Imerys, Eczacıbaşı Holding A.Ş., Adolf Gottfried Tonwerke GmbH, LB MINERALS, Ltd., Sibelco, QUARTZ Corp, and Sun Minerals.

b. The key factors that are driving the feldspar market include growing product demand in the manufacturing of glass and ceramics products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.