Report Overview

The global fermented tea market size was valued at USD 3.9 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 15.8% from 2021 to 2028. Rising awareness towards gut health and improvement of immunity levels, rise in disposable income, and inclination towards organic products are expected to drive the market. Additionally, the pandemic has accelerated the demand for immunity-boosting products. Also, consumers are preferring sparkling drinks as a substitute over alcohol as it provides a similar amount of tartness. In 2020, Kombucha Brewers International (KBI) released code practices for kombucha manufacturers to create transparency among consumers.

Companies in the industry are increasing their production abilities by expanding their product line and partnering with retail stores and supermarkets to increase their presence in the market. The rising usage of teas as meal accompaniment is also helping companies to expand their reach in bars and taverns. Several grocery stores also offer fermented drinks in aisles with other vegan and organic products. Several players in the market have partnered with retail outlets such as Whole Foods, Walmart, and many others. Supermarkets and local stores offer customers a wide range of brands and flavors. For example, Whole Foods in New York has collaborated with local sellers for providing flavors such as watermelon basil kombucha on tap.

The growing interest in probiotic foods is driving the demand for fermented tea. For example, as per Loving Foods, close to 50,000 residents in the U.K. search the internet for fermented foods such as sauerkraut and kimchi. Rising initiatives to curb the sale of sugary drinks have led to a rise in sales for sugar-free beverage offerings in the country. Customers in the country are preferring beverages that promote sustainability and veganism. Also, as per Food Spark, supermarkets and the regional stores in the region are keen on displaying fermented foods and beverages on the aisles. Several beverage buyers are looking for plant-based fermented products and new emerging products in this space. Overall, these above factors are fueling the demand for fermented teas in the country.

Product Insights

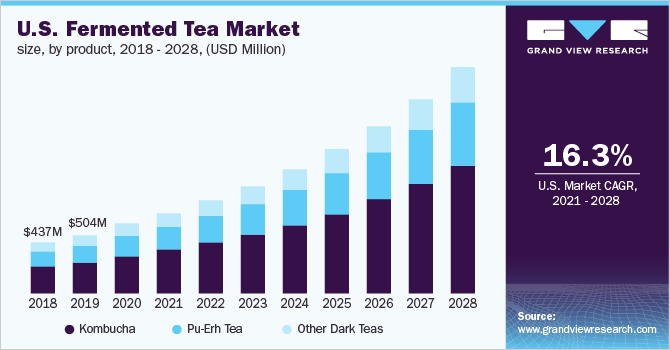

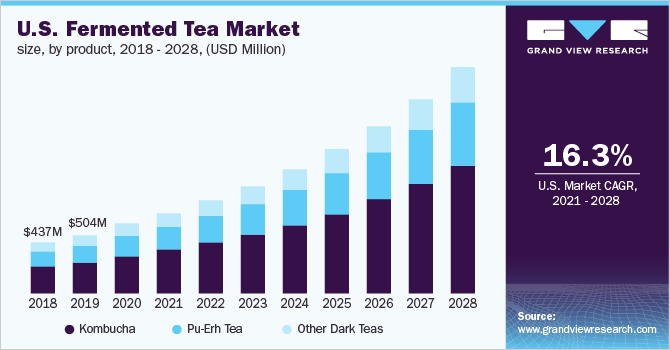

The kombucha segment dominated the market and accounted for the largest revenue share of 59.9% in 2020. The segment held the majority of the share owing to the rising demand for RTD drinks and teas. Kombucha manufacturers are increasingly partnering with retail stores such as Costco and Whole Foods to distribute their products. Additionally, the emergence of e-commerce is acting as a major tool for companies to increase their presence in the fermented tea market. Factors such as aging, diet, and stress are leading to digestive ailments, bloating, and other issues regarding immunity. There is increasing awareness regarding the health benefits possessed by probiotic foods. The rise in ailments overconsumption of artificial beverages is also promoting the overall market growth.

Distribution Channel Insights

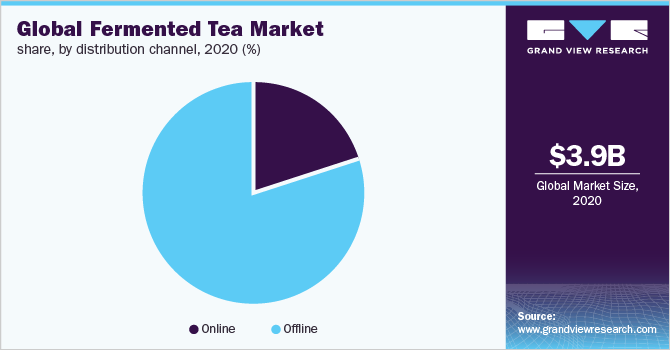

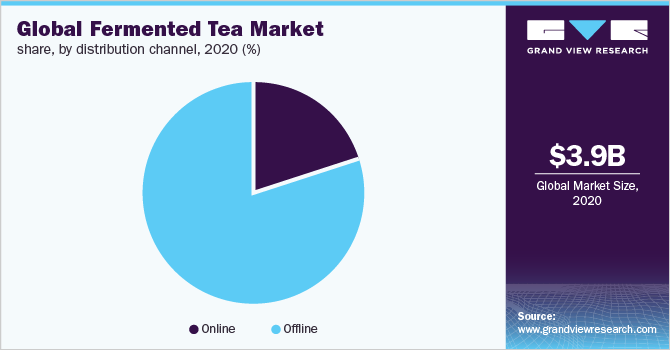

The offline channel segment dominated the fermented tea market and accounted for the largest revenue share of 77.3% in 2020. Distribution channels such as retail stores, supermarkets, and other small stores offer consumers the products at a lower price owing to purchasing power. In addition, the availability of fermented tea in various flavors and brands at local stores and supermarkets is driving the offline segment. For instance, Whole Foods in New York has collaborated with other sellers to provide new flavors including watermelon basil kombucha. The rising influence of social media and ecommerce channels is helping producers to operate efficiently.

The online segment is expected to witness the highest CAGR over the forecast period. The advent of online shopping and e-commerce has helped several companies during the pandemic to shift their presence. Younger consumers and millennials are keen to try different kinds of complex flavors. The presence of e-commerce channels and online tea factories provide consumers with a wide range of fermented teas from several regions. Wild Kombucha, a U.S.-based company, launched a one-stop online shop to offer consumers a wide range of food and beverage products.

Regional Insights

Asia Pacific dominated the market for fermented tea and accounted for the largest revenue share of 29.6% in 2020. The rise in disposable income and rising populace are serving as major opportunities for the key players in the market. Regions such as India, Sri Lanka, and other regions are attracting key players to expand their operations in these markets. Additionally, the rise in consumption of fermented foods such as kimchi, kefir, probiotic shots is also favoring the demand for fermented teas in the region. Growing awareness regarding the health benefits of the ingredients present in the tea is driving product demand in the region.

On the other hand, North America is anticipated to witness the fastest CAGR over the forecast period owing to the presence of several key players in the region. Growing health awareness among individuals, growing demand for probiotic products, and changing lifestyles are driving demand for fermented tea in the region. In addition, the growing inclination towards innovative non-alcoholic beverages is expected to propel market growth in the region. Companies in the region are constantly innovating and launching new products which include natural ingredients. In 2021, GT’s Living Foods inaugurated a science advisory board for driving awareness towards fermented foods during the pandemic.

Key Companies & Market Share Insights

Key companies in the industry face high competition owing to the growing consumer demand for fermented teas. Key players are focusing on the improvement of kombucha products and teas and are increasingly partnering with social media and e-commerce channels to gain significant market share. Some of the prominent players in the global fermented tea market are :

Fermented Tea Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2021

|

USD 4.5 billion

|

|

Revenue forecast in 2028

|

USD 12.6 billion

|

|

Growth rate

|

CAGR of 15.8% from 2021 to 2028

|

|

Base year for estimation

|

2020

|

|

Historic data

|

2016 - 2018

|

|

Forecast period

|

2021 - 2028

|

|

Quantitative Units

|

Revenue in USD million and CAGR from 2021 to 2028

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors and trends

|

|

Segments covered

|

Product, distribution channel, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central and South America; MEA

|

|

Country scope

|

U.S.; U.K.; Germany; China; India; Brazil; Saudi Arabia

|

|

Key companies profiled

|

Buddha Teas; KeVita; Live Soda LLC; Humm Kombucha; GT’s Living Foods; Mandala Tea; Menghai Tea Factory; Born Teas; Hunan Provincial Baishaxi Tea Industry Co., Ltd.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For this study, Grand View Research has segmented the global fermented tea market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Kombucha

-

Pu-Erh Tea

-

Other dark teas

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

- Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

Europe

-

Asia Pacific

-

Central & South America

-

Middle East & Africa