- Home

- »

- Biotechnology

- »

-

Fetal Bovine Serum Market Size And Share Report, 2030GVR Report cover

![Fetal Bovine Serum Market Size, Share & Trends Report]()

Fetal Bovine Serum Market Size, Share & Trends Analysis Report By Application (Drug Discovery, In-vitro Fertilization, Vaccine Production, Cell-based Research, Diagnostics, Others), By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-071-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Fetal Bovine Serum Market Size & Trends

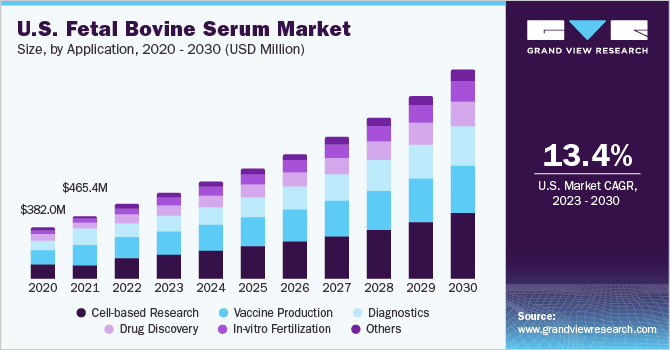

The global fetal bovine serum market size was valued at USD 1.57 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.1% from 2023 to 2030. Factors such as the expansion of the biopharmaceutical industry in developing countries as well as established markets is expected to spur the demand for fetal bovine serum (FBS) in coming years. Furthermore, increasing R&D activities and expenditure by key players for the introduction of new products in the market are some of the major factors driving the market growth. Moreover, the increasing application of fetal bovine serum in drug discovery, and vaccine production is leading to a rise in demand for fetal bovine serum products. The COVID-19 pandemic had a positive impact on the global market. The pandemic led to a heightened demand for the development of vaccines to curb the spread of the virus and reduce its severe effects. Fetal bovine serum is extensively used in developing vaccines and therefore rise in demand for vaccine development had a direct impact on the market and led to an increase in sales of fetal bovine serum. For instance, according to the data from the Ministry of Commerce,India imported close to USD 0.28 million worth of cattle serum products over 2019-20 for the production of COVID-19 vaccines.

In addition, the fetal bovine serum is also used in a number of other applications such as drug discovery, cell-based research, diagnostics, etc. The rising focus of the pharma industry to develop and introduce new drugs in the market due to the rising prevalence of acute and chronic diseases is also augmenting the growth of the market. According to a research study published in January 2023, between 2012 and 2021, FDA approved an average of 44 drugs per week skewed upwards by the 50+ annual tally between 2018 and 2021. Overall, it was a golden decade, with 445 new biologics and small molecule medicines, up 76% from the previous ten years.

The expansion of the biopharmaceutical industry in developing countries as well as established markets is creating lucrative opportunities and leading to a rise in the adoption rate of fetal bovine serum. For instance, according to a report and survey of Biopharmaceutical and Manufacturing Capacity and Production published in 2021, there were about 1900 facilities worldwide with an estimated capacity of more than 17.3 million liters, including over 720 facilities with more than 2000 L capacity.

On the other hand, although cell culture is vital in biological research, the high cost of fetal bovine serum makes it an expensive process which is limiting the growth of the market. Market players are therefore developing cost-effective alternatives. For instance, Cytiva markets two products that can be used as an alternative to fetal bovine serum, this includes Hyclone Bovine Growth Serum and Hyclone Calf Serum. Another factor limiting the growth of the market is the increasing preference by manufacturers to develop serum-free media. This is due to the number of problems that can be caused by animal serum in cell culture such as high costs associated with raw materials and post-production processing and heightened regulatory concerns as a result of the potential for contamination by adventitious agents present in animal serum.

Application Insights

In 2022, vaccine production segment dominated the global market by generating USD 448.6 million in revenues. FBS is a commonly used supplement in vaccine manufacturing. It is a rich source of growth factors and nutrients that promote cell growth and proliferation, which are essential for the production of certain types of vaccines. The advent of COVID-19 pandemic resulted in increased research activities for vaccine development. This resulted in a sudden increase in the demand for FBS for vaccine manufacturing and research.

In-vitro fertilization is expected to emerge as the most lucrative segment of all. The segment is expected to grow at a CAGR of 16.5% from 2023 to 2030. FBS provides essential nutrients, hormones, and growth factors that are necessary for the growth and development of embryos. It is often used in combination with other supplements, such as human serum albumin, to optimize embryo culture conditions and improve embryo quality. Increasing number of IVF cycles being done across the globe, the demand for FBS is expected to grow in the coming years.

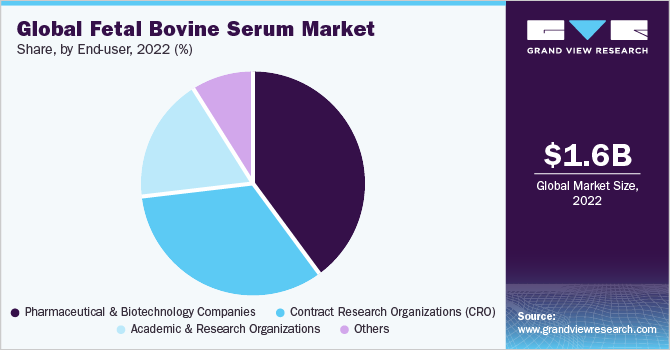

End-user Insights

The pharmaceutical & biotechnology companies segment held the highest market share of 40.4% in 2022. This is due to the increasing adoption of fetal bovine serum in drug development. The increasing prevalence of chronic diseases like cancer demands elevated research activities and the rising adoption of fetal bovine serum for this purpose by pharmaceutical and biotechnology companies is driving the segment growth.

The Contract Research Organizations (CRO’s) segment is anticipated to register the fastest CAGR of 15.6% from 2023 to 2030. The adoption of CRO offers various benefits that will help the manufacturer to conduct a successful clinical development program which represents lucrative growth opportunities for this segment over the forecast period. Factors such as better global reach, the presence of necessary resources in place and easy delegation of duties and functions to the CRO are driving the growth of the segment. Due to these advantages, an increasing number of manufacturers are opting to hand over research programs to CRO’s rather than doing it in-house which is helping the segment gain significant growth and sustain a relatively stronger position in the market.

Regional Insights

North America dominated the global market with a share of 38.0% in 2022. Increasing expenditure on R&D by government agencies is one of the major factors contributing towards the growth of the market. The U.S. is considered to have the strongest R&D ecosystem in the world. For Instance, according to a news article published in July 2022, the biotechnology industry grew its research and development expenditure by 94% from 2016 to 2021, to a total of USD 88.6 billion. Additionally, other factors such as a rise in focus to develop biopharmaceutical products, the presence of established players in the region, and strong healthcare infrastructure is also driving the market growth.

The Asia Pacific is anticipated to undergo maximum growth with a CAGR of 15.6% from 2023 to 2030. This is due to the increasing number of biopharmaceutical manufacturers in developing countries like India, South Korea, and China. These companies are experiencing rapid growth by serving their domestic and regional markets. Other factors include the rising number of academic institutes and clinical research organizations within the region.

Key Companies & Market Share Insights

The fetal bovine serum market is highly competitive with the presence of both well-established as well as emerging small and mid-sized players. Well-established players are trying to maintain their strong position in the market by carrying out various strategic initiatives. Key players in the market are focusing on expanding their presence through market consolidation activities such as mergers and acquisitions, partnerships and collaborations, etc.

For instance, in December 2021, Thermo Fisher, Inc. acquired PPD, Inc., a U.S.-based manufacturer of clinical research services to the pharma and biotech industry. Through this acquisition, the company aims to enhance its offering to biotech and pharma customers. Some of the prominent players in the global fetal bovine serum market include:

-

Thermo Fisher Scientific Inc.

-

Sartorius AG

-

Danaher Corporation

-

Merck KGaA

-

HiMedia Laboratories

-

Bio-Techne

-

PAN-Biotech

-

Atlas Biologicals, Inc.

-

Rocky Mountain Biologicals

-

Biowest

Fetal Bovine Serum Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.81 billion

Revenue forecast in 2030

USD 4.56 billion

Growth rate

CAGR of 14.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand;South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Sartorius AG; Danaher Corporation; Merck KGaA; HiMedia Laboratories; Bio-Techne; PAN-Biotech; Atlas Biologicals, Inc.; Rocky Mountain Biologicals; Biowest

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fetal Bovine Serum Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global fetal bovine serum market based on application, end-user, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery

-

In-vitro Fertilization

-

Vaccine Production

-

Cell-based Research

-

Diagnostics

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations (CRO)

-

Academic And Research Organizations

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fetal bovine serum market size was estimated at USD 1.57 billion in 2022 and is expected to reach USD 1.81 billion in 2023.

b. The global fetal bovine serum market is expected to grow at a compound annual growth rate of 14.1% from 2023 to 2030 to reach USD 4.56 billion by 2030.

b. North America dominated the fetal bovine serum market with a share of 38.0% in 2023. This is attributable to increased demand for research regarding the COVID-19 vaccine within the region.

b. Some key players operating in the fetal bovine serum market include Thermo Fisher Scientific Inc.; Sartorius AG; Danaher Corporation; Merck KGaA; HiMedia Laboratories; Bio-Techne; PAN-Biotech; Atlas Biologicals, Inc.; Rocky Mountain Biologicals; Biowest

b. Key factors that are driving the fetal bovine serum market growth include increasing Increasing R&D activities and expenditure for the introduction of new biopharmaceuticals along with the increasing application of FBS in drug discovery

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."