- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Fiber Supplements Market Size, Share, Growth Report, 2030GVR Report cover

![Fiber Supplements Market Size, Share & Trends Report]()

Fiber Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Form (Powder, Tablet), By Distribution Channel (Hypermarkets & Supermarkets, Pharmacy & Drug Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-397-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fiber Supplements Market Summary

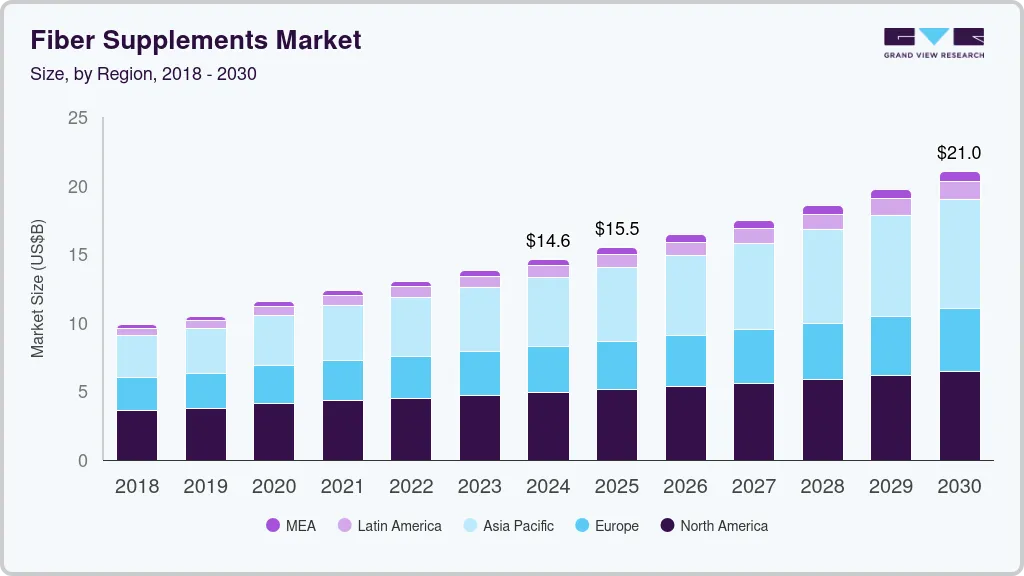

The global fiber supplements market size was estimated at USD 14.60 billion in 2024 and is projected to reach USD 21.02 billion by 2030, growing at a CAGR of 6.3% from 2025 to 2030. The market is experiencing significant growth due to a combination of factors related to health awareness, lifestyle changes, and dietary trends.

Key Market Trends & Insights

- North America dominated the global fiber supplements market with the largest revenue share, and is expected to grow at a CAGR of 5.5% from 2024 to 2030.

- The fiber supplements market in the U.S. led the North America market and held the largest revenue share in 2023.

- By form, the powder segment led the market, holding the largest revenue share of 44.16% in 2023.

- By distribution channel, the online segment is expected to grow at the fastest CAGR of 7.2% from 2024 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 14.60 Billion

- 2030 Projected Market Size: USD 21.02 Billion

- CAGR (2025-2030): 6.3%

- North America: Largest market in 2023

One of the primary drivers is the increasing recognition of the benefits of dietary fiber in maintaining digestive health. As consumers become more educated about the role of fiber in preventing constipation, reducing the risk of colorectal cancer, and supporting overall gut health, there is a heightened demand for supplements that can help meet daily fiber needs.Another important factor is the rise in chronic health conditions such as obesity, diabetes, and heart disease, which have been linked to poor dietary habits and low fiber intake. As people seek to manage these conditions through diet, fiber supplements are becoming a popular choice for their role in promoting satiety, controlling blood sugar levels, and improving cardiovascular health.

Additionally, the growing trend toward personalized nutrition and the desire for convenience has spurred the fiber supplements market. Busy lifestyles often make it challenging for individuals to consume adequate amounts of fiber through whole foods alone. Fiber supplements offer a practical solution for those looking to enhance their diet without the need for extensive meal planning or preparation.

Moreover, the market is being driven by innovation, and a broader range of fiber supplement products is now available. From traditional soluble and insoluble fibers to more advanced formulations with added prebiotics and probiotics, consumers have access to a diverse array of options tailored to their specific health needs and preferences. This variety not only appeals to a wider audience but also supports ongoing market growth as new products and formulations continue to emerge.

Form Insights

Powdered fiber supplements accounted for a share of 44.16% of the global revenues in 2023. Powders can be easily mixed into a variety of beverages or foods, allowing for customizable dosing and integration into daily routines. This form also often offers a higher concentration of fiber compared to other forms, such as capsules or tablets, making it a more efficient choice for individuals aiming to increase their fiber intake. Additionally, powder supplements generally have a longer shelf life and can be more cost-effective, further enhancing their appeal.

Tablet fiber supplements are anticipated to grow at a CAGR of 6.0% from 2024 to 2030. Tablets are easy to carry, store, and consume, offering a no-mess, no-mixing solution for those who need to increase their fiber intake. Additionally, tablets provide a consistent dose, which can be more

Distribution Channel Insights

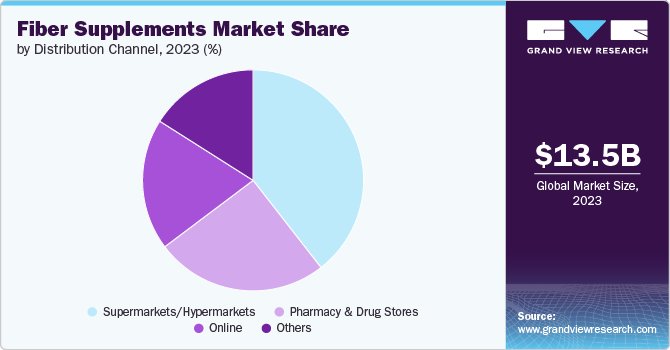

Sales through supermarkets/hypermarkets accounted for a share of 39.47% of the global revenues in 2023. These retail formats offer a broad range of products, including fiber supplements, often at competitive prices and with frequent promotions. Their extensive reach and high foot traffic enable consumers to easily purchase fiber supplements as part of their regular shopping routines, contributing significantly to their share of market revenues.

Sales through online distribution channels are anticipated to grow at a CAGR of 7.2% from 2024 to 2030. Consumers are increasingly seeking dietary solutions that support gut health and overall wellness, and online shopping offers a broad range of options, user reviews, and easy access to products that might not be available locally. Additionally, the rise of personalized nutrition and digital health tools has contributed to the heightened demand for fiber supplements.

Regional Insights

North America fiber supplements market is expected to grow at a CAGR of 5.5% from 2024 to 2030. The market is driven by increasing consumer awareness of digestive health, the rising prevalence of gastrointestinal disorders, and a growing emphasis on preventive healthcare. Additionally, the demand is supported by trends toward healthier eating habits, including higher fiber intake for weight management and overall wellness, as well as the expanding availability of a variety of fiber supplement products that cater to different dietary needs and preferences.

U.S. Fiber Supplements Market Trends

The fiber supplements market in the U.S. is expected to grow at a CAGR of 5.8% from 2024 to 2030. In the U.S. the rise in sedentary lifestyles and processed food consumption has further boosted the demand for fiber supplements as a convenient way to improve dietary fiber intake. Additionally, strong marketing efforts, a broad range of product offerings, and growing availability in retail and online channels also contribute to the market's expansion.

Asia Pacific Fiber Supplements Market Trends

The fiber supplements market in Asia Pacific held a share of over 18.02% of the global market in 2023. The region's diverse dietary habits and a shift toward healthier eating are driving the demand for fiber supplements. Additionally, increasing urbanization and the expansion of the retail sector, along with educational campaigns on the benefits of dietary fiber, are contributing to the market's growth.

Europe Fiber Supplements Market Trends

The fiber supplements market in Europe is driven by a growing focus on health and wellness, heightened awareness of the benefits of dietary fiber for digestive and overall health, and a trend toward preventive healthcare. The aging population and rising incidence of chronic diseases are also contributing factors. Additionally, regulatory support for health claims related to fiber and increased availability of a wide range of fiber supplement products across various retail channels are supporting market growth.

Key Fiber Supplements Company Insights

The market for fiber supplements is highly competitive, with a range of companies offering various forms. Many big players are increasing their focus on new form launches, partnerships, and expansion into new markets to compete effectively.

Key Fiber Supplements Companies:

The following are the leading companies in the fiber supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Robinson Pharma, Inc.

- Renew Life

- Benefiber

- Citrucel, Metamucil

- Walgreens

- Now

- Garden of Life

- Renew Life

- Yerba Prima

- Nature’s Bounty

Recent Developments

-

In May 2024, Manitoba Harvest, a leading hemp food manufacturer, launched a new bioactive fiber supplement called Hemp Seed Fiber, which features BrightSeed's upcycled hemp hulls. The supplement is designed to provide a natural source of dietary fiber and promote overall gut health. BrightSeed, a food technology company, has developed a process to upcycle hemp hulls, which are typically considered waste products, into a functional ingredient that can be used in various food and supplement applications.

-

In May 2023, Nestlé India launched Resource Fiber Choice, a new product aimed at improving gut health, which contains Partially Hydrolyzed Guar Gum (PHGG), a prebiotic dietary fiber known for relieving constipation. This plant-derived fiber is gentle on the body and is complemented by immuno-nutrients, providing a significant daily allowance of essential vitamins and minerals. Given that one in four urban Indians experiences gut-related issues due to factors like inadequate fiber intake and poor eating habits.

Fiber Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.48 billion

Revenue forecast in 2030

USD 21.02 billion

Growth rate (revenue)

CAGR of 6.3% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, U.K., Spain, Italy, France, China, India, Japan, Australia, South Korea Brazil, South Africa, Saudi Arabia

Key companies profiled

Robinson Pharma, Inc., Renew Life, Benefiber, Citrucel, Metamucil, Walgreens, Now, Garden of Life, Renew Life, Yerba Prima, Nature’s Bounty

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fiber Supplements Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fiber supplements market report on the basis of form, distribution channel and region.

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Tablet

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Pharmacy & Drug Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central and South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global fiber supplements market size was estimated at USD 13.5 billion in 2023 and is expected to reach USD 14.28 billion in 2024.

b. The global fiber supplements market is expected to grow at a compounded growth rate of 5.9% from 2024 to 2030 to reach USD 20.2 billion by 2030.

b. Powder fiber supplements accounted for a share of 44.16% of the global revenues in 2023. Powders can be easily mixed into a variety of beverages or foods, allowing for customizable dosing and integration into daily routines. This form also often offers a higher concentration of fiber compared to other forms, such as capsules or tablets, making it a more efficient choice for individuals aiming to increase their fiber intake. Additionally, powder supplements generally have a longer shelf life and can be more cost-effective, further enhancing their appeal.

b. Some key players operating in the fiber supplements market are Robinson Pharma, Inc., Renew Life, Benefiber, Citrucel, Metamucil, Walgreens, Now, Garden of Life, Renew Life, Yerba Prima, Nature’s Bounty

b. The fiber supplements market is experiencing significant growth due to a combination of factors related to health awareness, lifestyle changes, and dietary trends. One of the primary drivers is the increasing recognition of the benefits of dietary fiber in maintaining digestive health. As consumers become more educated about the role of fiber in preventing constipation, reducing the risk of colorectal cancer, and supporting overall gut health, there is a heightened demand for supplements that can help meet daily fiber needs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.