- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Fiberglass Pipes Market Size, Share, Industry Report, 2030GVR Report cover

![Fiberglass Pipes Market Size, Share & Trends Report]()

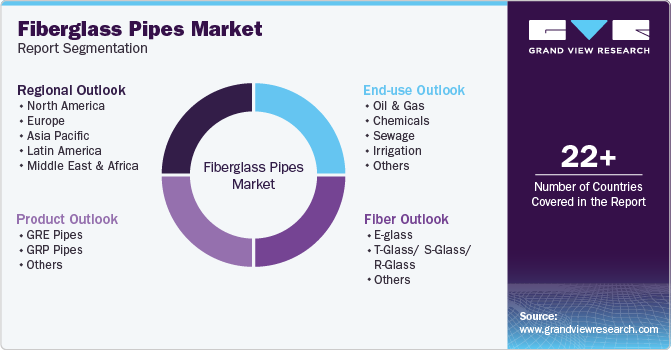

Fiberglass Pipes Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (GRE Pipes, GRP Pipes), By Fiber (E-Glass, T-Glass), By End-use (Oil & Gas, Chemicals, Sewage, Irrigation), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-989-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fiberglass Pipes Market Summary

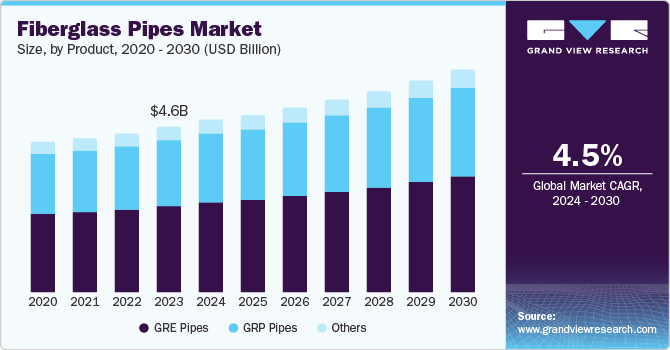

The global fiberglass pipes market size was estimated at USD 4.59 billion in 2023 and is projected to reach USD 6.17 billion by 2030, growing at a CAGR of 4.5% from 2024 to 2030. Fiberglass pipes are used in several industrial applications, including the storage of corrosive materials and the handling of other materials in corrosive environments.

Key Market Trends & Insights

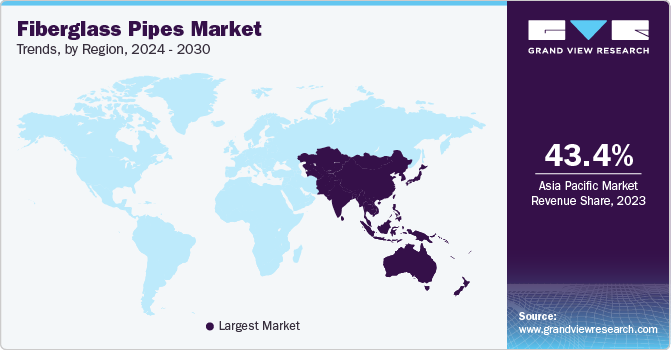

- Asia Pacific fiberglass pipes market dominated with a market share of 43.4% in 2023.

- China fiberglass pipes market held a substantial share of Asia Pacific in 2023.

- By product, the GRE pipes segment dominated in 2023 with a share of 51.4%.

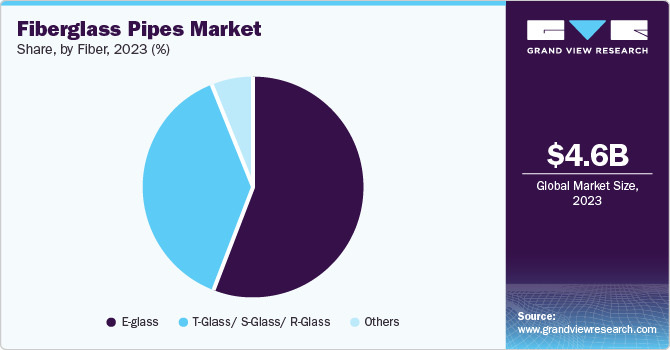

- By fiber, the E-glass segment dominated in 2023 with a revenue share of 55.9%.

- By end-use, the oil and gas segment dominated in 2023 with a share of 40.6%.

Market Size & Forecast

- 2023 Market Size: USD 4.59 Billion

- 2030 Projected Market Size: USD 6.17 Billion

- CAGR (2024-2030): 4.5%

- Asia Pacific: Largest market in 2023

It is modern-day equipment with emerging industrial applications. For instance, the demand for fiberglass pipes in the oil and gas, chemicals, and irrigation industries remains high throughout the year. The product is popular and is known for its high corrosion resistance, lightweight, fire resistance, and strength. The increased demand for oil and gas has led to an increase in onshore and offshore projects, contributing to its popularity.

According to the American Chemical Council, chemical production is estimated to grow 3.4% in 2024. The growing demand in the chemical industry globally has resulted in market growth. Fiberglass pipes provide hardness, brittleness, temperature resistance, transparency, easy installation, and corrosion resistance. Fiberglass pipes transport corrosive liquids such as acids, solvents, and alkalis. Their non-porous nature helps avoid chemical absorption, lowering the risk of contamination. The smooth texture of fiberglass pipes reduces chemical deposits. Hence, fiberglass pipes are being increasingly adopted in the chemical industry.

Furthermore, the oil and gas sector has also aided the market growth. Population growth and rising demand for energy resources have led to a global rise in onshore and offshore projects. The properties offered by fiberglass pipes are perfect for the challenging environment of onshore and offshore plants. There is an increased adoption of fiberglass pipes for gas and crude oil transportation as they offer corrosion resistance and prevention against leakages. Therefore, these factors are attributed to the growth of the fiberglass pipes market.

Product Insights

The GRE pipes segment dominated in 2023 with a share of 51.4%. The rising demand for GRE pipes in the chemical industry drives the segment's growth. When GRE pipes are reinforced with epoxy resins, they resist various chemicals such as acids, solvents, and alkalis and offer high strength. Furthermore, the rising implementation of GRE pipes in the oil and gas industry has also pushed growth, as the pipes are corrosive-resistant and reliable in harsh onshore and offshore environments.

The GRP pipes segment is expected to grow at a CAGR of 4.8% during the forecast period. The segment growth is attributed to the rising adoption of GRP pipes in applications such as chemical processing, oil and gas transport, and wastewater treatment. GRE pipes are more cost-effective than other fiberglass pipe types. They are also versatile and manufactured according to the reinforcement material needs.

Fiber Insights

The E-glass segment dominated in 2023 with a revenue share of 55.9%. Growth in the electrical and electronic sectors and the rising adoption of E-glass in manufacturing various components have led to market growth. E-glass provides excellent electrical resistance and insulation. It is usually used as a conduit to protect electrical cables against damage. Furthermore, the rising use of E-glass to insulate pipes transferring hot and cold fluids drives the segment growth.

The T-Glass/S-Glass/R-Glass segment is expected to grow at a CAGR of 4.7% during the forecast period. The market growth is due to the properties offered by glasses, such as high-temperature resistance and high strength-to-weight ratio. T-Glass pipes are used for applications that involve high temperatures. S-Glass pipes are used in applications that require high mechanical strength. R-glass pipes are used in various chemical processing applications. Hence, the increased utility of these pipes according to their respective properties in multiple industries attracts demand.

End-use Insights

The oil and gas segment dominated in 2023 with a share of 40.6% due to an increase in oil and gas production projects and an increased adoption of fiberglass pipes. The increased adoption is due to the properties offered by fiberglass pipes, such as resistance to corrosion, lightweight nature, high strength, and durability. These properties ensure efficient and safe transportation of crude oil and natural gas.

The chemicals segment is expected to grow at a CAGR of 5.0% during the forecast period. The rising implementation of fiberglass pipes for various chemical applications such as transporting corrosive liquids and handling toxic substances. Fiberglass pipes are resistant to many acids and their non-porous properties handle various chemicals that reduce the risk of contamination. Furthermore, the rising use of fiberglass pipes in wastewater treatment facilities encourages the use of chemicals.

Regional Insights

Asia Pacific fiberglass pipes market dominated with a market share of 43.4% in 2023. The market is growing due to the region's rapid industrial growth and urbanization. There is an increased demand for fiberglass pipes for infrastructure developments such as wastewater plants, oil and gas pipelines, and various chemical factories. Furthermore, increased usage of fiberglass pipes for construction, transportation, and power generation has further aided market growth in this region.

China Fiberglass Pipes Market Trends

China fiberglass pipes market held a substantial share of Asia Pacific in 2023 pertaining to the various industries in the country such as water and wastewater systems, oil and gas, chemical, and more. The presence of major manufacturing companies in the country aids in mitigating the demand for fiberglass pipes in these industries. Furthermore, increased production capacity and technological advancements have further led to growth in this country.

Europe Fiberglass Pipes Market Trends

Europe fiberglass pipes market held a market share of 21.0% in 2023 due to rapid infrastructure developments and rising demand for fuels such as natural gas and oil. Properties such as high strength, corrosion resistance, chemical resistance, and more have led to increased adoption of fiberglass pipes in various industrial sectors of the region. Moreover, the long lifespan and low maintenance of fiberglass pipes have also increased the adoption of fiberglass pipes in European countries emphasizing sustainability.

The UK fiberglass pipes market is expected to grow rapidly due to the rise in onshore and offshore platforms and chemical factories. Fiberglass pipes' corrosion resistance and high strength properties have increased their adoption in these industries. Furthermore, the rising use of fiberglass pipes in various infrastructure projects, such as bridges, tunnels, and roads, has also increased market growth.

North America Fiberglass Pipes Market Trends

The North American fiberglass pipes market was identified as a lucrative region in this industry in 2023. The presence of major oil, gas, and chemical industries aids the market growth. The population growth has triggered the demand for fuel and rapid urbanization has increased the number of oil and gas projects in the region. Oil and gas facilities are adopting fiberglass pipes as they provide high strength, low maintenance, and resistant to chemicals, heat, and pressure.

The U.S. fiberglass pipes market is expected to grow in the forecast period due to the rising adoption of fiberglass pipes in water and wastewater facilities and an increase in the pipeline network of oil and natural gas across the country; rapid urbanization has led to growth in the chemical sector of the country leading to an increased demand for fiberglass pipes.

Key Fiberglass Pipes Company Insights

Some major companies in the fiberglass pipes market are PPG Industries, Inc., Future Pipe Industries., Chemical Process Piping Pvt. Ltd., Saudi Arabian Amiantit Co., and more. Companies focus on offering products with improved quality and competitive pricing to compete with major market players and improve their market expansion strategies.

-

PPG Industries, Inc. manufactures and supplies paints, coatings, and specialty materials. It also offers packaging coatings, traffic solutions, piping, and more services. The company mainly serves construction, transportation, consumer products, and others.

-

Future Pipe Industries designs, manufactures, and offers installation services for fiberglass pipe systems. It serves customers in oil and gas, industrial, marine, and water.

Key Fiberglass Pipes Companies:

The following are the leading companies in the fiberglass pipes market. These companies collectively hold the largest market share and dictate industry trends.

- PPG Industries, Inc.

- Future Pipe Industries.

- Chemical Process Piping Pvt. Ltd

- Saudi Arabian Amiantit Co.

- NOV

- Russel Metals Inc.

- Amiblu Holding GmbH

- ANDRONACO INDUSTRIES

- Enduro

- Gruppo Sarplast

Recent Developments

-

In March 2023, NOV received an order from Cadeler to manufacture and supply Bondstrand glass-reinforced epoxy (GRE) piping systems for the wind turbine installations. The company will manufacture nearly 1300m of Bondstand 2000M and 2440 series piping systems having diameters ranging from 2 inches to 36 inches. The pipes are usually utilized for water generators, cooling water, ballast, and more.

Fiberglass Pipes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.75 billion

Revenue forecast in 2030

USD 6.17 billion

Growth Rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, fiber, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Saudi Arabia

Key companies profiled

PPG Industries, Inc.; Future Pipe Industries.; Chemical Process Piping Pvt.Ltd.; Saudi Arabian Amiantit Co.; NOV; Russel Metals Inc.; Amiblu Holding GmbH; ANDRONACO INDUSTRIES.; Enduro; Gruppo Sarplast.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fiberglass Pipes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fiberglass pipes market report based on product, fiber, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

GRE Pipes

-

GRP Pipes

-

Others

-

-

Fiber Outlook (Revenue, USD Million, 2018 - 2030)

-

E-glass

-

T-Glass/ S-Glass/ R-Glass

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemicals

-

Sewage

-

Irrigation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.