- Home

- »

- Medical Devices

- »

-

Fiducial Markers Market Size, Global Industry Report, 2020-2027GVR Report cover

![Fiducial Markers Market Size, Share & Trends Report]()

Fiducial Markers Market (2020 - 2027) Size, Share & Trends Analysis Report By Modality (Ultrasound, CT/CBCT), By Product (Gold, Gold Combination), By Application (Prostate, Lung, Breast Cancer), By End User, And Segment Forecasts

- Report ID: GVR-4-68038-219-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fiducial Markers Market Summary

The global fiducial markers market size was valued at USD 101.8 million in 2019 and is projected to reach USD 142.0 million by 2027, growing at a CAGR of 4.2% from 2020 to 2027. Growing incidence of various types of cancer such as lung, prostate, and breast, and increasing adoption of radiotherapy for oncology treatments is expected to contribute to the market growth.

Key Market Trends & Insights

- North America held the largest share of the global market in 2019.

- Based on the product, the gold segment held the largest share in 2019.

- Based on modality, CT/CBCT segment held the largest market share in 2019.

- Based on end user, the hospital segment held the largest market share in the past.

Market Size & Forecast

- 2019 Market Size: USD 101.8 Million

- 2027 Projected Market Size: USD 142.0 Million

- CAGR (2020-2027): 4.2%

- North America: Largest market in 2019

- Asia Pacific: Fastest growing market

Fiducial markers are placed in or near a tumor during the radiotherapy procedure to locate the tumor for providing accurate radiation dosage. There have been several technological advancements to develop an advanced navigation system for proper placement of the product. For instance, SPiN System’s advanced navigation technology by Veran Medical Technologies helps locate the target to place the fiducial marker appropriately for radiation or resection. This technology also provides a 3D view of fiducials and generates the report for proper diagnosis and treatment.

Growing awareness about targeted radiotherapy techniques, such as image-guided radiotherapy, intensity-modulated radiotherapy, and stereotactic radiosurgery, is expected to contribute to the adoption of fiducial markers. Owing to the complications and adverse effects associated with chemotherapy and targeted drug therapy, preference for radiotherapy is expected to show a steep rise during the forecast period.

Radiotherapy is recommended as a parallel or palliative therapy with other treatment procedures for various types of cancers. For instance, in breast cancer (stage 1 and 2), most of the patients are prescribed with breast-conserving surgery and radiotherapy sessions. In addition, increased funding by various governments and social organizations for the research related to fiducial markers and cancer is expected to spur the market growth.

However, complications associated with product implantation and usage may hinder its adoption. As per NCBI, patients who underwent transrectal fiducial marker insertion for prostate cancer image-guided therapy suffered from Haematuria, haematospermia rectal bleeding, and dysuria.

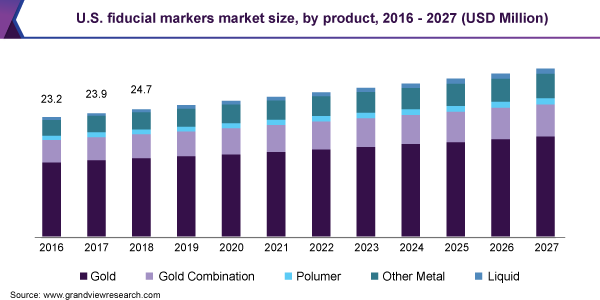

Product Insights

Based on the product, the market is segmented into gold, gold combination, polymer, other metals, and liquid. The gold segment held the largest share in 2019 owing to the accurate visibility and superior stability of these products across several imaging modalities. Gold fiducial markers also come in combination with other metals, such as titanium, platinum, and nickel, for enhanced efficiency. For instance, when combined with titanium stripes, these markers enhance the visibility in MRI images.

Major companies are investing more in R&D to design products with improved efficiency. For instance, IBA Dosimetry GmbH launched a linear pure gold fiducial marker, called Visicoil, a unique helical shaped product with a hollow core that reduces the incidence of common complications, such as marker migration and artifacts. The polymer segment is also expected to register significant growth over the forecast period. The lower cost of these products than other metal markers is expected to contribute to the segment growth. On the other hand, liquid fiducial markers are expected to experience the fastest CAGR during the forecast period.

Modality Insights

Based on modality, the market is segmented into CT/CBCT, ultrasound, X-ray, and MRI. CT/CBCT segment held the largest market share in 2019 and is expected to register a healthy CAGR over the forecast period. Low dose exposure, ease of integration with existing radiotherapy equipment, and orthogonal imaging features of CBCT are the major factors contributing to the segment growth.

The ultrasound modality segment is expected to experience the fastest CAGR over the forecast period. Lower radiation toxicity of this modality than other imaging modalities is the key factor contributing to the segment growth. Moreover, the ability of fiducial markers with ultrasound modality to provide real-time volumetric information with organ tracking makes them suitable for monitoring inter and intrafraction organ motion, due to which they are widely used in the treatment of breast, prostate, and liver cancer.

MRI modality segment is expected to register a notable growth during the forecast period. Fiducial markers with MRI modality provide reliable and accurate details of the soft tissues during the treatment of complex cases, such as orthotopic prostate tumors. Furthermore, the growing adoption of an MRI-based LINAC system is expected to boost the segment growth.

Application Insights

The prostate cancer segment held the largest market share in 2019 and is projected to expand further at a healthy CAGR over the forecast period. Growing product adoption in the treatment of prostate cancer is the key factor driving the segment growth. The lung cancer segment is expected to witness the fastest growth during the forecast period.

Factors responsible for the segment growth include rising incidence of lung cancer and technological advancements for the development of enhanced fiducial markers for better treatment of the disease. For instance, Beacon FNF by Medtronic PLC is a pre-loaded gold fiducial marker system that reduces the risk of commonly reported complications, such as pneumothorax, to a greater extent.

The breast cancer segment is also expected to register a significant CAGR over the forecast period. Rising awareness about the efficiency of external beam radiation therapy in the treatment of breast cancer and increased funding are the factor projected to foster the segment growth.

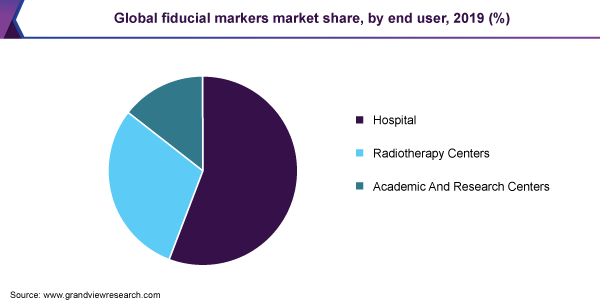

End-user Insights

Based on end user, the market is segmented into hospitals, radiotherapy centers, and academic research centers. The hospital segment held the largest market share in the past. The availability of advanced radiotherapy equipment in these healthcare settings is expected to contribute to the segment growth. The radiotherapy centers segment held the second-largest market share and is expected to register the fastest CAGR over the forecast period. Rising preference for radiotherapy centers over hospitals is boosting the segment growth.

Academic and research centers is anticipated to be the second fastest-growing segment during the forecast period. Active participation of federal and non-government organizations to develop strategies to deliver efficient cancer care has resulted in an increasing number of public and government funding in cancer research driving the segment growth. For instance, in 2019 the NIH and NCI have received public funding of USD 39.1 billion and USD 6.14billion respectively for cancer research.

Regional Insights

North America held the largest share of the global market in 2019. The strong presence of major market participants, streamlined reimbursement policies, and public health programs are the key factors expected to drive the region’s growth. Moreover, the rising adoption of advanced radiotherapy procedures and imaging modalities will boost the product demand in the region, thereby supporting market growth.

Europe held the second-largest market share in 2019. In Europe, over 3.2 million people are diagnosed with cancer every year. Breast and colorectal cancer are the most prevalent due to the increasing aging population and rising cases of obesity. In addition, increasing CE approval of various fiducial markers is also expected to contribute to the regional market growth. For example, in March 2020, liquid fiducial marker BioXmark by Nanovi A/S received CE approval.

The Asia Pacific is expected to register the fastest growth over the forecast period. Highly unmet clinical needs coupled with increasing number of cancer care initiatives, especially in China and India, are expected to boost the region’s growth. For instance, in 2019, the Chinese government relieved additional tax on 16 imported goods, which also include medical LINAC systems.

Key Companies & Market Share Insights

Key players have adopted various strategic initiatives to strengthen their market position and product portfolio. For instance, IBA Dosimetry GmbH offers its linear fiducial markers in both titanium and gold type. Other competitive strategies undertaken by companies include active participation in conferences, seminars, and other promotional events to raise awareness about the available products. Some of the prominent players in the fiducial markers market include:

-

CIVCO Radiotherapy

-

IZI Medical Products

-

Naslund Medical AB

-

Medtronic PLC

-

QlRad, Inc.

-

QFIX

-

Boston Scientific Corp.

-

Nanovi A/S

-

Eckert & Ziegler

-

IBA Dosimetry GmbH.

Fiducial Markers Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 106.2 million

Revenue forecast in 2027

USD 142.0 million

Growth Rate

CAGR of 4.2% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million/billion and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, modality, application, end-user, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, U.K., Germany, France, Italy, Spain, Russia, Switzerland, The Netherlands, Sweden, Belgium, Japan, China, India, South Korea, Thailand, Indonesia, Philippines, Taiwan, Malaysia, Singapore, Brazil, Mexico, Argentina, Colombia, Chile, South Africa, Saudi Arabia, UAE, Kuwait, Israel

Key companies profiled

CIVCO Radiotherapy; IZI Medical Products; Naslund Medical AB; Medtronic PLC; QlRad, Inc.; QFIX; Boston Scientific Corp.; Nanovi A/S; Eckert & Ziegler; IBA Dosimetry GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global fiducial markers market report on the basis of product, modality, application, end user, and region:

-

Product Outlook (Volume, Units; Revenue, USD Million, 2016 - 2027)

-

Gold

-

Gold Combination

-

Polymer

-

Other Metal

-

Liquid

-

-

Modality Outlook (Revenue, USD Million, 2016 - 2027)

-

CT/CBCT

-

MRI

-

Ultrasound

-

X-Ray

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Breast Cancer

-

Lung Cancer

-

Prostate Cancer

-

Head and Neck Cancer

-

Other

-

-

End-user Outlook (Revenue, USD Million, 2016 - 2027)

-

Hospitals

-

Radiotherapy Center

-

Academic and Research Center

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Switzerland

-

The Netherlands

-

Sweden

-

Belgium

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Indonesia

-

Philippines

-

Taiwan

-

Malaysia

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global fiducial markers market size was estimated at USD 101.8 million in 2019 and is expected to reach USD 106.2 million in 2020.

b. The global fiducial markers market is expected to grow at a compound annual growth rate of 4.2% from 2020 to 2027 to reach USD 141.9 million by 2027.

b. North America dominated the fiducial markers market with a share of 30.52% in 2019. This is attributable to rising acceptance to radiotherapy procedures, increasing prevalence of prostate cancer, and the presence of streamlined reimbursement policies.

b. Some key players operating in the fiducial markers market include CIVCO Radiotherapy, IZI Medical Products, Naslund Medical AB, Medtronic, QlRad Inc., QFIX, Boston Scientific Corporation, Nanovi A/S, Eckert & Ziegler, and IBA Dosimetry.

b. Key factors that are driving the market growth include the growing awareness about targeted radiotherapy techniques, such as image-guided radiotherapy, intensity-modulated radiotherapy, and stereotactic radiosurgery. These are the primary application area of fiducial markers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.