- Home

- »

- Clinical Diagnostics

- »

-

Filter Integrity Test Market Size, Share, Industry Report, 2033GVR Report cover

![Filter Integrity Test Market Size, Share & Trends Report]()

Filter Integrity Test Market (2026 - 2033) Size, Share & Trends Analysis Report By Test Method (Forward Flow Test, Bubble Point Test, Pressure Hold Test, Water Intrusion Test), By Mode (Automated, Manual), By Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-127-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Filter Integrity Test Market Summary

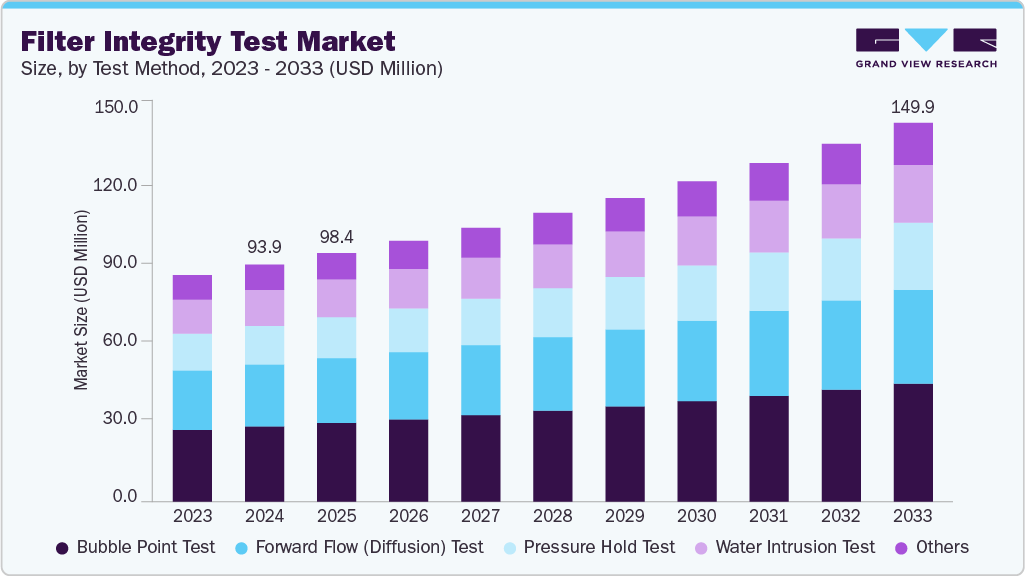

The global filter integrity test market size was estimated at USD 98.43 million in 2025 and is projected to reach USD 149.92 million by 2033, growing at a CAGR of 4.76% from 2026 to 2033. The increasing demand for food & beverage and biopharmaceuticals sectors, technological innovations and automation, regulatory compliance & GMP requirements, and growing emphasis on product safety & risk reduction are key drivers of the market's growth.

Key Market Trends & Insights

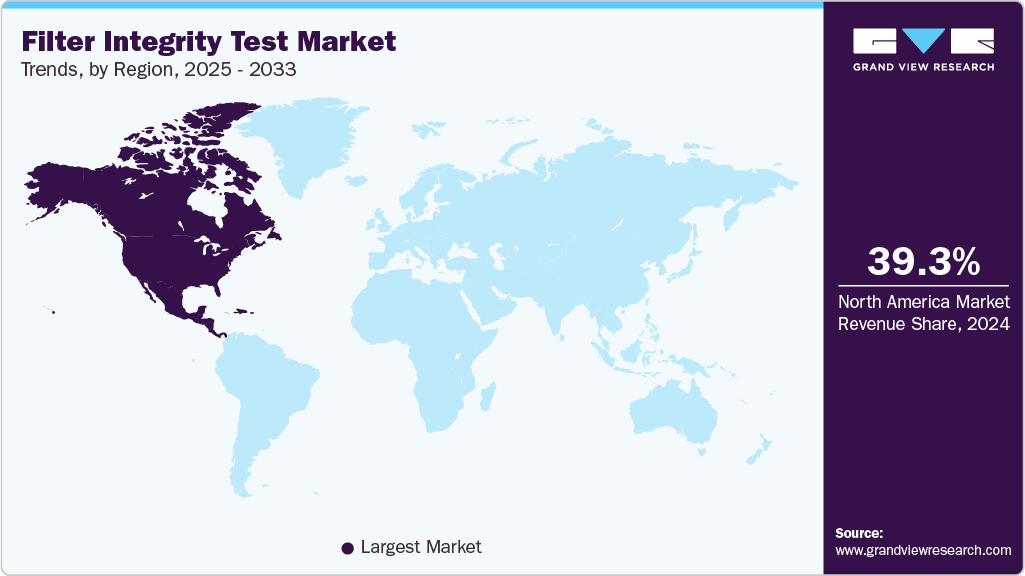

- North America filter integrity test market dominated the global market and accounted for the largest revenue share of 39.18% in 2025.

- The U.S. led the North American market and held the largest revenue share in 2025.

- Based on the test method, the bubble point test segment dominated the global market with a revenue share of 31.46% in 2025.

- Based on mode, the automated segment held the largest revenue share of 88.83% in 2025.

- Based on type, the liquid filter integrity test accounted for the largest market share of 74.08% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 98.43 Million

- 2033 Projected Market Size: USD 149.92 Million

- CAGR (2026-2033): 4.76%

- North America: Largest Market in 2025

- Asia Pacific: Fastest growing market

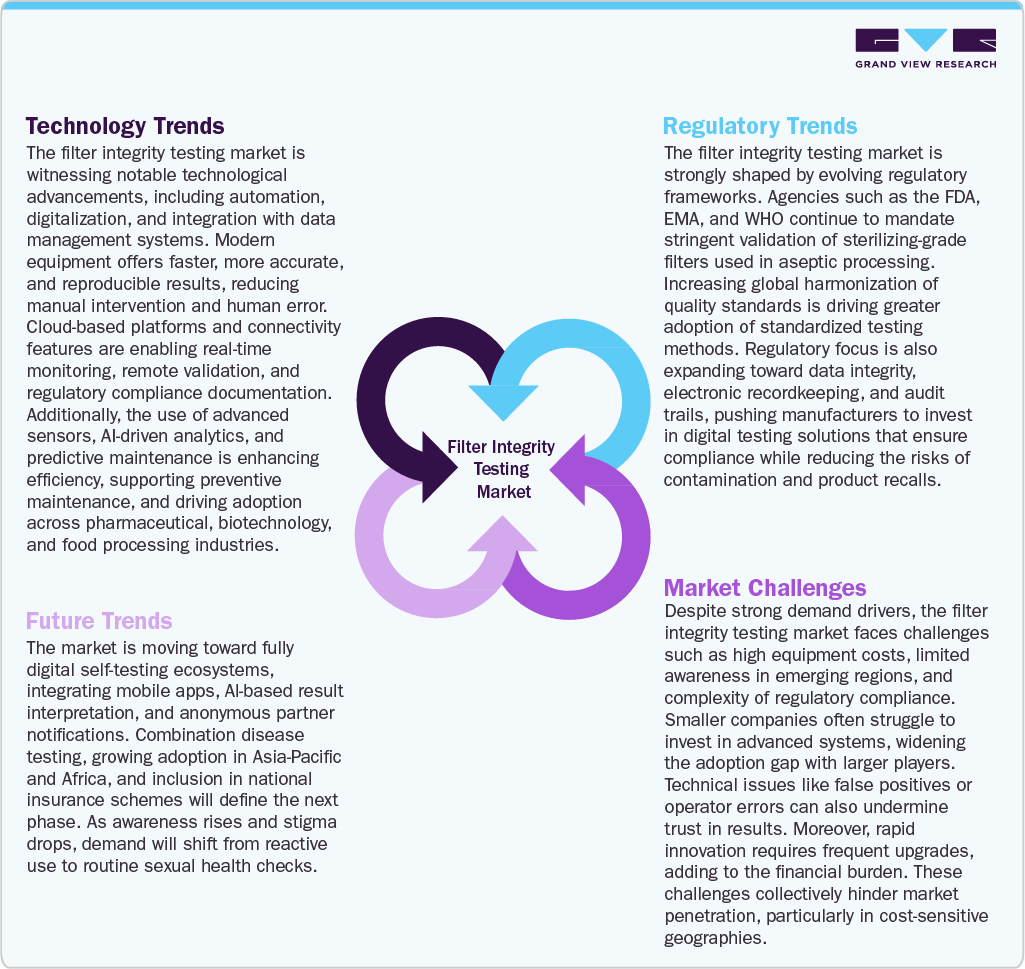

These industries heavily depend upon sterile filtration to provide the safety, purity, and quality of their products, and thus, integrity testing becomes a mandatory step. In order to comply with ever-tighter food safety regulations, producers are turning to innovative filter integrity testing techniques, including bubble point, diffusion, and pressure-hold tests. For instance, in August 2025, United Breweries Ltd, which owns beer brands such as Kingfisher and Heineken, reported a USD 10.21 million investment to open a canned beer manufacturing line at its Nizam Brewery in India, its foray into the canned beer market.The industry is expanding rapidly, primarily driven by the growth of automation and testing technologies that enhance speed, accuracy, and compliance in critical applications such as pharmaceuticals and biotechnology. Additionally, old-fashioned manual and semi-automated testing are being replaced with sophisticated systems that are more streamlined and minimize human error. An example is Meissner's AccuFlux Integrity Tester, which utilizes high-precision mass flow meters and the proprietary TransVector algorithm. This automated process dramatically shortens test times versus comparable systems from other vendors, specifically answering the need of the industry for quicker turnaround in sterile manufacturing. These outcomes indicate that AccuFlux beats the competition consistently, reducing test times by as much as 63% in bubble point testing and over 50% in diffusive flow testing. Time savings like these are vital in biomanufacturing, where filter validation delays can disrupt a production line.

Furthermore, aside from speed, automation entails greater compliance. For example, IoT-enabled testers are integrated into Manufacturing Execution Systems (MES), with data integrity and real-time monitoring. Meanwhile, AI-based systems interpret past diffusion trends to forecast filter failures, moving maintenance from a reactive to a proactive approach. Regulatory agencies such as the FDA and EMA now promote automated, validated approaches, supporting the implementation of these technologies.

The industry is witnessing robust growth, propelled by regulatory compliance and Good Manufacturing Practices (GMP) requirements. Across pharmaceuticals, biotechnology, and food & beverage industries, regulatory authorities enforce strict quality standards, making filter integrity testing mandatory to validate sterile filtration processes.

In the biopharmaceutical sector, sterile filtration is crucial for the production of vaccines, monoclonal antibodies, recombinant proteins, and injectables. Regulatory agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the World Health Organization (WHO) mandate that sterilizing-grade filters undergo validated integrity testing both before and after use. For example, FDA’s 21 CFR Parts 210 and 211 outline current GMP requirements for drug manufacturing, requiring sterility assurance throughout the process. Similarly, the EMA’s Annex 1 (Manufacture of Sterile Medicinal Products) specifies that filter integrity testing is a regulatory requirement for sterile drug production.

Market Concentration & Characteristics

The market for filter integrity test reflects moderate innovation due to automation, digitization, artificial intelligence and machine learning analytics, and inline/real-time monitoring. These technologies enable improved efficiency, accuracy, and predictability in key processes, particularly in highly regulated sectors such as pharmaceuticals and the food and beverage industry.

Mergers and acquisitions (M&A) are increasingly defining the industry by merging large players, fostering innovation, and building capabilities. Heightened regulatory requirements and the growing need for biopharmaceuticals and other sterile products are raising the level of competition and propelling market consolidation.

The industry has a strong regulatory impact since it plays a critical role in ensuring product purity and customer safety in highly regulated markets. Regulatory authorities require stringent validation and verification, and noncompliance can result in severe consequences, including product recalls, punitive fines, and damage to patient safety.

Product growth in the global filter integrity test market is medium, i.e., a strategy for focused innovation as opposed to extensive, fast-paced diversification. Major product innovations occur in those areas providing new benefits, such as greater automation, portability, and digital integration. However, overall product expansion is constrained by high equipment costs and complex regulatory compliance across different regions, which can make new technologies prohibitive for smaller companies and emerging markets.

North America is at the forefront of implementing filter integrity testing, with the U.S. being spurred by the fast pace of biopharmaceutical sector. The growing demand for biologics, monoclonal antibodies, and cell and gene therapies has increased dependence on sterile filtration process operations, where integrity testing is critical for ensuring product quality and regulatory compliance. With rigorous FDA regulations and sterility assurance requirements at each step of biological manufacturing, organizations are investing heavily in modern manufacturing facilities and filtration technologies, generating robust demand for integrity testing solutions across the country.

Test Method Insights

On the basis of the test method, the bubble point test accounted for the largest market share of 31.46% in 2025, and it is anticipated to grow at a significant CAGR over the forecast period. The bubble point test helps verify that the filters can withstand the pressure required for the pharmaceutical manufacturing process without causing any leakage or contamination, thereby protecting the product's quality and safety. For instance, the bubble point test is a critical procedure in the biotechnology industry, where filters are utilized to separate and purify biological substances. In biopharmaceutical production, this test ensures that filters maintain the necessary pressure levels during sterilization and filtration without compromising product sterility and purity.

The pressure hold test segment is anticipated to experience the fastest growth during the forecast period, primarily driven by its advantages as a non-destructive testing method in the filter integrity test industry. This method enables the accurate detection of leaks or defects without damaging the filter, thereby ensuring product sterility and process reliability. Growing regulatory scrutiny from agencies such as the FDA and EMA has increased the adoption of validated integrity testing procedures across the biopharmaceutical and food industries. Furthermore, ongoing technological advancements in automation, data analytics, and sensor accuracy are improving test efficiency and consistency, reducing human error, and supporting compliance with stringent quality assurance standards globally.

Mode Insights

Based on mode, the automated segment accounted for the largest market share of 88.83% in 2025. This is due to its simplicity, cost-effectiveness, and efficacy in maintaining filter integrity in less essential applications. It is accessible without requiring extensive equipment or specialist knowledge. After installation and flushing, a particular pressure is applied to the filters, followed by the closure of the air feed valve. After a predetermined amount of time, the pressure is measured, and the pressure decay (starting pressure minus final pressure) is calculated. This test is based on the diffusional flow permitted at a certain pressure below the bubble point, and the allowable pressure decay is computed accordingly. It provides a simple and cost-effective way to ensure filter integrity, eliminating the need for expensive equipment or specialized expertise.

In addition, the automated segment is the fastest-growing segment due to drivers such as the need for data traceability, consistency, and enhanced accuracy. Automation reduces the risk of human error, supports high-throughput testing in pharmaceutical and biotechnology manufacturing, and ensures compliance with stringent regulatory requirements.

Type Insights

Based on type, the liquid filter integrity test accounted for the largest market share of 74.08% in 2025. High use of the forward flow (diffusion) test and bubble point test has led to the segment's leading position in the market. These tests are essential for checking the integrity and performance of filters used in liquid filtration systems across industries. Their increasing adoption highlights the need for effective removal of contaminants and the maintenance of product quality and safety standards. This reinforces the importance of liquid filter integrity testing in the market.

The air filter integrity test segment is projected to register the fastest CAGR during the forecast period, driven by the implementation of strict regulatory standards and the growing emphasis on maintaining contamination-free, sterile environments in pharmaceutical, biotechnology, and semiconductor industries. The rising adoption of HEPA and ULPA filters in cleanrooms, laboratories, and critical manufacturing areas further fuels demand. Additionally, advancements in aerosol photometry and automated testing systems are enhancing accuracy, efficiency, and compliance with global quality standards.

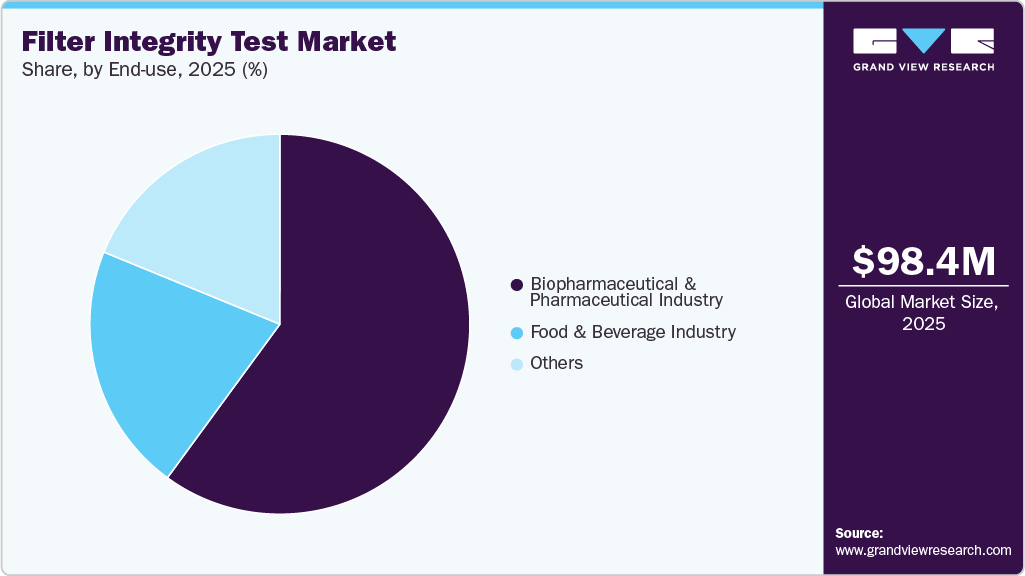

End-use Insights

The biopharmaceutical & pharmaceutical industry dominated the market in 2025, accounting for a 60.05% share, due to the CDMOs demand multi-brand method libraries to accommodate client-specified filters from Sartorius, Merck, Pall, or Parker, and want analytics to trend marginal tests before they become deviations. Gene therapy and mRNA platforms add complexity, including short turnaround, cold operations, and single-use assemblies, so testers now offer faster stabilization and leak discrimination. Recent developments include testers with OPC UA connectivity for seamless MES link-up, remote diagnostics to cut downtime, and standardized WIT methods for PTFE vent filters on lyophilizers.

Furthermore, the food and beverage industry is expected to show the fastest CAGR over the forecast period, driven by increasing consumer demand for minimally processed and preservative-free products. Manufacturers are prioritizing filtration-based sterilization to maintain product safety and extend shelf life without compromising quality. Stringent food safety regulations and standards, such as HACCP and FDA guidelines, are further encouraging the adoption of integrity testing. Ensuring sterility assurance, contamination control, and process validation has become essential, thereby accelerating the implementation of advanced filter integrity testing solutions across the global food processing sector.

Regional Insights

North America filter integrity test market dominated the global market and accounted for the largest revenue share of 39.18% in 2025. The North America filter integrity test industry is projected to grow steadily due to strong regulatory oversight and the region’s dominance in biopharmaceutical manufacturing. Agencies like the U.S. Food and Drug Administration (FDA) and Health Canada mandate pre-use and post-use integrity testing of sterilizing-grade filters, ensuring patient safety and product sterility. The expanding pipeline of biologics, monoclonal antibodies, and vaccines in the U.S. has increased reliance on sterile filtration, which directly fuels demand for integrity testing systems. For example, large vaccine manufacturers, including those producing COVID-19 and flu vaccines, perform routine pre-use post-sterilization integrity tests (PUPSIT) on filters to meet cGMP requirements, reinforcing adoption across the market.

U.S. Filter Integrity Test Market Trends

The U.S. filter integrity testing industry is being propelled by technological innovation and evolving regulatory expectations. As the U.S. strengthens its position as a leader in biologics, vaccines, and cell and gene therapies, integrity testing-particularly Pre-Use Post-Sterilization Integrity Testing (PUPSIT)-is gaining traction as a critical quality measure. These tests help manufacturers meet global standards while minimizing contamination risks and avoiding costly recalls. The integration of automated testing solutions into Good Manufacturing Practice (GMP) environments further ensures efficiency, compliance, and reliability.

For instance, in May 2025, Parker Bioscience Filtration, a division of Parker Hannifin, launched the SciLog NFF+ PF, a compact, multipurpose normal flow filtration system equipped with onboard PUPSIT functionality. By addressing the complexities of PUPSIT-such as reducing manual handling, operator errors, and product waste-this system supports safer and more streamlined biopharmaceutical production. Such innovations are setting new industry benchmarks, positioning the U.S. FIT market for sustained growth in the years ahead.

Europe Filter Integrity Test Market Trends

The filter integrity test industry in Europe is expected to increase significantly, owing to strict regulatory requirements and the expansion of key end use industries. Pre-Use Post-Sterilization Integrity Testing (PUPSIT) has become mandatory in the pharmaceutical industry, according to EU GMP Annex 1 requirements. PUPSIT ensures that product filters are tested for integrity after installation and sterilization, but before use, to verify that no damage was caused during handling or sterilization. This procedure is critical to maintaining sterility assurance and patient safety. In addition, a second integrity test is performed once the batch is completed to validate the filter's correct state. These requirements place filter integrity testing at the center of sterile manufacturing processes, driving the demand for advanced, automated testing solutions that can minimize risk and improve compliance in pharmaceutical production.

The UK filter integrity test industry is steadily increasing, mainly mostly to the expansion of pharmaceutical manufacturing and quality assurance infrastructure. As the demand for sterility assurance in biologics, vaccines, and sophisticated medications develops, integrity testing becomes more crucial in manufacturing processes. For instance, in May 2025, Intertek reported that it would expand its Good Manufacturing Practice (GMP) pharmaceutical services laboratory in Melbourn, United Kingdom. The project added 6,000 square feet of purpose-built laboratory and office space, increasing the facility's overall area to 46,000 square feet. Such expenditures reflect the country's strong emphasis on developing pharmaceutical capabilities while also ensuring compliance with stringent regulatory norms, both of which promote the use of filter integrity testing solutions.

The filter integrity test industry in Germany is expanding steadily, driven by the country's strong emphasis on innovation and the adoption of modern technology in pharmaceutical manufacture. As one of Europe's leading biopharmaceutical production hubs, Germany has experienced a considerable growth in demand for dependable filter integrity testing solutions, particularly with the growing production of biologics, vaccines, and sterile pharmaceuticals. This expansion is aided by severe regulatory requirements, such as adherence to EU GMP Annex 1, which emphasizes strong sterility assurance and requires integrity testing at important phases of drug manufacturing.

Asia Pacific Filter Integrity Test Market Trends

The filter integrity test industry in the Asia Pacific is expanding rapidly, with predictions indicating a high single-digit CAGR over the coming decade. This impetus is being fueled by significant biopharmaceutical expansion in nations such as China, India, South Korea, and Singapore, where investments in biologics, vaccines, and sterile injectables have increased dramatically. Pharmaceutical and contract manufacturing organizations (CMOs) are being pushed to integrate advanced integrity testing solutions as regulatory harmonization with EU GMP Annex 1 increases and global quality standards become more widely adopted. Beyond pharmaceuticals, the burgeoning food and beverage sector-particularly dairy, bottled water, and nutraceuticals-is implementing integrity testing to assure microbiological safety and product consistency, broadening the addressable market in APAC.

The Japan filter integrity test industry is growing steadily, driven by the country's expanding biopharmaceutical sector, improvements in sterile manufacturing, and stricter regulations. Japan's strong position in biologics, vaccines, and advanced therapies is raising the need for dependable sterility assurance systems. Integrity testing is becoming an essential step in aseptic production. The market is also supported by significant domestic investments in biopharma infrastructure. For example, in December 2023, AGC announced plans to enhance its biopharmaceutical CDMO capabilities at the Yokohama Technical Center in Tsurumi-ku, Yokohama. The project involves an investment of about 50 billion Japanese yen. It will first offer development services for gene and cell therapies in 2025, followed by development and manufacturing services for mRNA pharmaceuticals, biologics based on mammalian cell culture, and advanced therapies in 2026. This major expansion underscores the growing demand for innovative filtration and sterility assurance technologies in Japan.

The filter integrity test industry in China is rapidly expanding. This growth is being driven by a substantial increase in biopharmaceutical manufacturing, vaccine production, and sterile injectables. Sterility assurance is becoming increasingly important as a result of tougher requirements that match international standards, such as EU GMP Annex 1 and China's NMPA (National Medical Products Administration) GMP guidelines. Integrity testing, particularly pre-use and post-sterilization integrity testing (PUPSIT), has become an important component of aseptic procedures. The industry is further boosted by China's prominence as a key hub for vaccines, monoclonal antibodies, and biosimilars, all of which require stringent sterility requirements.

Latin America Filter Integrity Test Market Trends

The filter integrity test industry in Latin America is experiencing gradual but steady growth, supported by the expansion of the pharmaceutical, biotechnology, and food & beverage sectors across the region. Countries such as Brazil and Argentina serve as major pharmaceutical hubs, driving demand for sterility assurance tools that comply with both regional regulations and international GMP standards. The rising production of vaccines, biosimilars, and injectable drugs, coupled with growing export activity, has increased reliance on filter integrity testing to ensure compliance with quality and safety benchmarks. This trend has been further accelerated by pandemic-related investments, which strengthened vaccine and biologics manufacturing capacity across Latin America.

Middle East and Africa Filter Integrity Test Market Trends

The filter integrity test (FIT) industry in the Middle East and Africa is experiencing steady growth, driven largely by the region’s expanding pharmaceutical manufacturing capacity and increasing healthcare investments. Governments and private stakeholders are prioritizing local drug production and biotechnology research to reduce dependency on imports. For example, Saudi Arabia’s Vision 2030 initiative emphasizes local pharmaceutical production, while South Africa’s biopharmaceutical sector is receiving significant government support. These efforts are strengthening demand for robust quality assurance processes such as FIT.

Key Filter Integrity Test Company Insights

The global market features several key players driving innovation and adoption. Leading companies include Merck KGaA, Sartorius AG, Parker Hannifin Corp, and PALL Corporation, among others. These firms are heavily investing, rapidly evolving with continuous product innovation, geographic expansion, and strategic collaboration.

Key Filter Integrity Test Companies:

The following are the leading companies in the filter integrity test market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Sartorius AG

- Parker Hannifin Corp

- PALL Corporation

- Donaldson Company, Inc.

- Pentair Ltd.

- 3M

- Meissner Filtration Products, Inc.

- Beijing Neuronbc Laboratories Co., Ltd.

- Brother Filtration

- Analytical Technologies Limited

- Thermo Fisher Scientific, Inc.

Recent Developments

-

In April 2025, Parker launched the SciLog NFF+ PF, a compact, fully automated normal flow filtration system with built-in Pre-Use Post-Sterilization Integrity Testing (PUPSIT), designed to streamline sterile filtration workflows and ensure compliance with EU GMP Annex 1 and FDA Part 11.

-

In July 2025, Donaldson enhanced its German food & beverage lab in Haan by adding a fully automated Clean-In-Place (CIP) Test Bench and in-house bacterial retention testing per ASTM F838-20, improving the speed and realism of filter validation under actual process conditions.

-

In February 2025, Thermo Fisher announced a definitive agreement to acquire Solventum’s Purification & Filtration business. Thermo Fisher said the acquisition would broaden its upstream/downstream bioproduction portfolio (complementing media and single-use technologies), accelerate growth in bioprocessing, and create operational synergies.

Filter Integrity Test Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 103.31 million

Revenue forecast in 2033

USD 149.92 million

Growth rate

CAGR of 4.76% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test method, mode, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Merck KGaA; Sartorius AG; Parker Hannifin Corp; PALL Corporation; Donaldson Company, Inc.; Pentair Ltd.; 3M; Meissner Filtration Products, Inc.; Beijing Neuronbc Laboratories Co., Ltd.; Brother Filtration; Analytical Technologies Limited; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Filter Integrity Test Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global filter integrity test market report based on test method, mode, type, end-use, and region:

-

Test Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Forward Flow (Diffusion) Test

-

Bubble Point Test

-

Pressure Hold Test

-

Water Intrusion Test

-

Others

-

-

Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Automated

-

Manual

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Liquid Filter Integrity Test

-

Air Filter Integrity Test

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical & Pharmaceutical Industry

-

Food & Beverage Industry

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include rising demand for biopharmaceuticals, presence of stringent safety regulatory guidelines, growing awareness with respect to product purity and stability requirements across several industries, and multiple benefits associated with filter integrity testing.

b. The global filter integrity test market size was estimated at USD 98.43 million in 2025 and is expected to reach USD 103.31 million in 2026.

b. The global filter integrity test market is expected to grow at a compound annual growth rate of 4.76% from 2025 to 2033 to reach USD 149.92 million by 2033.

b. Some of the filter integrity test market opportunities include a rise in emerging opportunities in untapped regions and continuous growth of automated filter integrity tests.

b. Some key players operating in the filter integrity test market include Merck KGaA; Sartorius AG; Parker Hannifin Corp; PALL Corporation; Donaldson Company, Inc.; Pentair Ltd.; 3M; Meissner Filtration Products, Inc.; Beijing Neuronbc Laboratories Co., Ltd.; Surway Filter; Analytical Technologies Limited; Thermo Fisher Scientific, Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.