- Home

- »

- Next Generation Technologies

- »

-

Finance Cloud Market Size, Share & Trends Report, 2030GVR Report cover

![Finance Cloud Market Size, Share & Trends Report]()

Finance Cloud Market Size, Share & Trends Analysis Report By Solution, By Service, By Deployment, By Enterprise, By Application, By End-use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-971-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

Report Overview

The global finance cloud market size was valued at USD 19.96 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 20.3% from 2022 to 2030. Factors such as rapid digitalization, corporate agility, on-demand innovation, and a secure environment for sensitive data are driving the demand for finance cloud among banks and financial institutions. The COVID-19 pandemic positively affected the market for finance cloud. The economy stagnated owing to an increase in COVID-19 cases around the world. However, the financial services, banking, and insurance sectors were operating despite the pandemic. Financial institutions had to abruptly adopt remote working during the pandemic, leading to an investment in a cloud-based infrastructure. In July 2020, Deutsche Bank and Google Cloud entered into a 10-year strategic cloud partnership. The partnership is expected to increase resilience, accelerate the development of new capabilities, and reduce expenditure.

The finance cloud helps insurance companies, banks, and other financial institutions to track assets, expenses, and wealth management. In recent years, there has been a considerable change in customer expectations and interactions, with a greater emphasis on personalization and promptness. To meet these client expectations, banks, financial institutions, and insurance companies are incorporating innovative technologies, such as the finance cloud.

The market for finance cloud computing services has great potential to grow in emerging economies and regions such as India, China, Brazil, and Africa. For instance, the monitoring and analytics software company ITRS Group Ltd. estimated that by 2022, 86% of the Asia Pacific financial services sector would have adopted the public cloud. Organizations can considerably reduce the cost of buying, maintaining, and upgrading IT systems and equipment by using cloud-based tools.

However, the finance cloud industry growth is constrained by issues associated with data security, protection, and high investment & maintenance costs. The security of cloud storage is frequently threatened by data loss. As opposed to being stolen and shared, information can be fully affected resulting from a computer virus, hacking, or a malfunctioning system.

Service Insights

The managed services segment held the largest revenue share of 64.8% in 2021 and is projected to advance at a CAGR of 19.9% during the forecast period. Managed services enable organizations to outsource all or a portion of their IT operations and infrastructure so they may concentrate on their primary corporate objectives.

Based on service, the market is bifurcated into professional services and managed services. The professional services segment is expected to witness the highest CAGR of 24.8% during the forecast period. Organizations willing to upgrade their infrastructure are using the expertise of professional cloud service providers specializing in the deployment of cloud-based structures for secure and smooth cloud adoption.

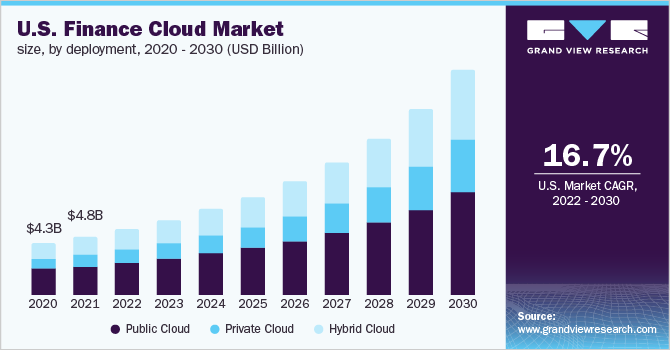

Deployment Insights

The public cloud segment generated the largest market revenue of 9.73 billion in 2021. The public cloud reduces expenditure because businesses only pay for the resources they use, cutting down on wasteful expenditure on idle resources. Businesses also have the freedom to simply scale up or down according to demand for the cloud. Based on deployment, the market is segmented into public cloud, private cloud, and hybrid cloud.

The private cloud segment is expected to expand at the highest CAGR of 23.0% during the forecast period. The private cloud provides users with tools and services for managing cloud applications, including data storage, monitoring, and security, with minimal expenditure. Using the private cloud makes it possible for organizations to avail many benefits of cloud computing without sacrificing control security and customization. Advantages of private cloud include freedom to customize software and hardware, fully enforced regulatory standards and compliance, and greater access and security control.

Enterprise Insights

The large organization segment dominated the market and accounted for 68.2% of the global revenue share in 2021. The growth of this segment can be attributed to the rising demand for digitalization, better customer support, and enhanced security for sensitive data. Based on the enterprise, the market is bifurcated into large organizations and small & medium organizations.

The small & medium enterprise segment is likely to advance at the highest CAGR of 24.0% through 2030. The growth of this segment can be attributed to factors such as stringent regulatory compliance, reduced IT infrastructure costs, and fraud detection & prevention features.

Application Insights

The wealth management segment generated the largest revenue for the market of USD 5.62 billion in 2021 and is projected to expand at a CAGR of 18.5% during the forecast period. Factors such as increasing demand for cloud technology from wealth and investment organizations to manage a growing demanding client base, regulatory requirements, and shifting generational wealth, are driving the market growth of this segment.

Based on application, the finance cloud market is further divided into revenue management, wealth management, account management, customer relationship management, asset management, and others. The asset management segment is expected to register the highest CAGR of 23.4%. Organizations can obtain a range of benefits by using a cloud-based asset management software solution, including effective operations, financial accountability, more accurate tracking, and simple reporting.

End-Use Insights

The banking & financial services segment dominated the market and accounted for 68.9% of the global revenue share in 2021. The growth of this segment can be ascribed to factors such as reduced customer acquisition costs, rising security concerns, and the need for disaster recovery. Banks and financial institutions are collaborating with finance cloud providers for cloud adoption.

For instance, in August 2020, Microsoft Corp. and Standard Chartered entered into a partnership to accelerate the latter’s digital transformation with the cloud-first strategy. Among other industry pioneers, JP Morgan is switching its retail operations to Thought Machine’s cloud-based core banking system.

Based on end-use, the market for finance cloud is bifurcated into banking & financial services, and insurance. The insurance segment is expected to register the highest CAGR of 23.6% during the projection years. The growth can be attributed to the effect of the COVID-19 pandemic as there has been a considerable surge in demand for financial cloud services from the insurance sector, as organizations are strengthening their digital experiences and operational processes.

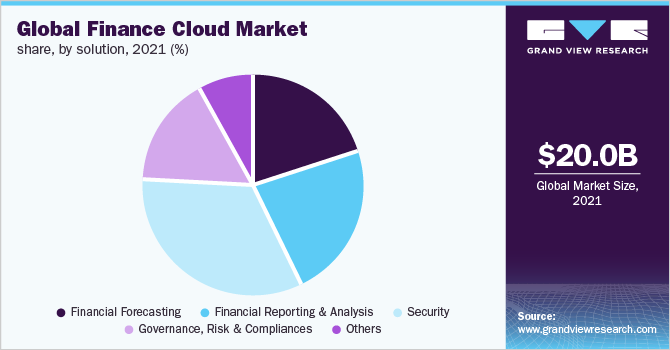

Solution Insights

Security was the dominant solution segment with a revenue of 4.58 billion in 2021. Cybersecurity is a key concern in the financial services industry. Cloud service providers offer a wide range of security services, such as managed firewalls and key management systems (KMS) to help in encryption, DDoS protection, etc. According to Forbes Media LLC., the banking sector reported 30% more ransomware assaults in the first half of 2021 than in 2020.

Based on solution, the market for finance cloud is further divided into financial forecasting; financial reporting & analysis; security; governance, risk & compliances; and others. The governance, risk & compliances segment is likely to register the highest CAGR of 21.8% during the forecast timeline. The use and proliferation of devices, such as tablets, within businesses and beyond the extended workplace, is a major factor driving the adoption of governance, risk & compliance (GRC) apps and solutions via Software as a service (SaaS).

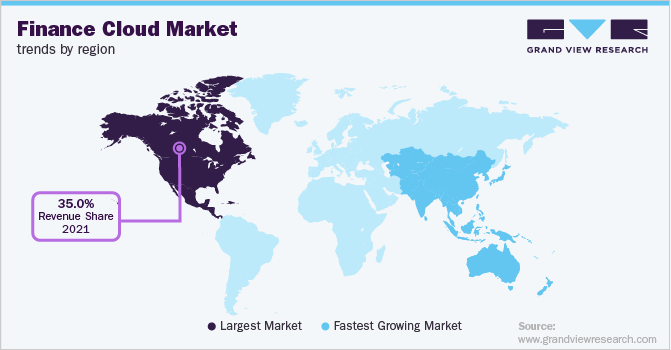

Regional Insights

North America dominated the market in 2021, with a revenue share of 35.0% in 2021, and is projected to expand at a CAGR of 18.9% through 2030. In the North American region, isolated infrastructure has been moved to the cloud as a result of a robust economy and higher internet penetration rates. Additionally, improved agility and security, lower capital expenditure (CapEx), and reduced IT administration complexity are some of the key drivers of the expansion of the North American finance cloud industry.

Asia Pacific is expected to be the fastest-growing region, expanding at a CAGR of over 21.6% during the forecast period. Factors such as the increase in cloud application deployment to address the rising demand for customer management, growing client needs, and increased digitalization in the region are attributed to the market growth. For instance, the Indian government is aiming to digitize payment systems and broaden financial inclusion, through fintech projects including Aadhaar, Jan Dhan Yojana, and the Unified Payments Interface (UPI).

Key Companies & Market Share Insights

The competitive landscape of the market for finance cloud is fragmented, featuring several global as well as regional players. Key participants are entering into strategic collaborations, partnerships, and mergers & acquisitions to expand their business footprint and survive the highly competitive environment. Moreover, cloud providers are investing considerably in research & development activities to incorporate new technologies in their offerings and develop advanced products to gain a competitive advantage over other market players.

For instance, in November 2021, Amazon Web Services, Inc., announced a multi-year partnership with Nasdaq, Inc. to build a next-generation cloud-based infrastructure for capital markets around the globe. Other market infrastructure operators and market players may also use this technology to relocate their trading platforms to the cloud. This collaboration with Nasdaq aims to build a market infrastructure that is truly cloud-based, more durable, scalable, and open to all markets. Some prominent players in the global finance cloud market are:

-

Acumatica, Inc.

-

Amazon Web Services, Inc.

-

ARYAKA NETWORKS, INC.

-

Cisco Systems, Inc.

-

Google (Alphabet Inc.)

-

IBM

-

Microsoft

-

Oracle

-

Sage Group plc

-

SAP

-

Unit4

-

Wipro

Finance Cloud Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 23.23 billion

Revenue forecast in 2030

USD 101.71 billion

Growth rate

CAGR of 20.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, service, deployment, enterprise, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; China; India; Japan; Brazil; Mexico

Key companies profiled

Acumatica, Inc.; Amazon Web Services, Inc.; ARYAKA NETWORKS, INC.; Cisco Systems, Inc.; Google (Alphabet Inc.); IBM; Microsoft; Oracle; Sage Group plc; SAP; Unit4; Wipro

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Finance Cloud Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global finance cloud market report based on solution, service, deployment, enterprise, application, end-use, and region:

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Financial Forecasting

-

Financial Reporting & Analysis

-

Security

-

Governance, Risk & Compliances

-

Others

-

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Professional Services

-

Managed Services

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Enterprise Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Revenue Management

-

Wealth Management

-

Account Management

-

Customer Relationship Management

-

Asset Management

-

Others

-

-

End-Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Banking & Financial Services

-

Insurance

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global finance cloud market size was estimated at USD 20.0 billion in 2021 and is expected to reach USD 23.23 billion in 2022.

b. The global finance cloud market is expected to grow at a compound annual growth rate of 20.3% from 2022 to 2030 to reach USD 101.71 billion by 2030.

b. North America dominated the finance cloud market with a share of 35.0% in 2021. This is attributable to the presence and concentration of prominent players such as Acumatica, Inc., Amazon Web Services, Inc., ARYAKA NETWORKS, INC., Cisco Systems, Inc., Google, and others.

b. Some key players operating in the finance cloud market include Acumatica, Inc., Amazon Web Services, Inc., ARYAKA NETWORKS, INC., Cisco Systems, Inc., Google LLC, IBM Corporation, Microsoft, Oracle, Sage Group plc, SAP SE, Unit4, and Wipro.

b. Key factors driving the market growth include the rapid adoption of cloud in small & medium enterprises across the globe and an increase in the need for transparency & operational efficiency in the business processes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."