- Home

- »

- Next Generation Technologies

- »

-

Asset Management Market Size, Share, Trends Report, 2030GVR Report cover

![Asset Management Market Size, Share & Trends Report]()

Asset Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Service), By Asset Type, By Function, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-214-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asset Management Market Summary

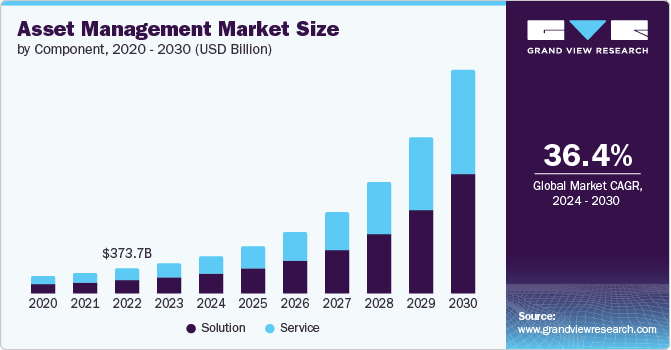

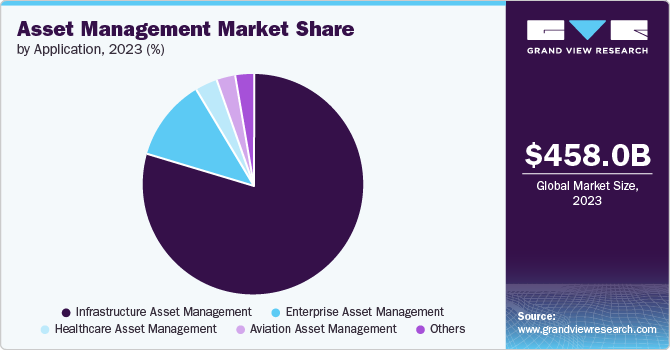

The global asset management market size was estimated at USD 458.02 billion in 2023 and is expected to reach USD 3,677.39 billion by 2030, growing at a CAGR of 36.4% from 2024 to 2030. The market's growth is increasing owing to rapid digital change, technological advances, and the efforts of test asset management in the industry.

Key Market Trends & Insights

- North America dominated the asset management market with a revenue share of 33.04% in 2023.

- The asset management market in the U.S. anticipated to grow at a significant CAGR of 34.6% from 2024 to 2030.

- Based on application, the aviation segment led the market with the largest revenue share of 79.5% in 2023.

- Based on function, the location and movement tracking segment led the market with the largest revenue share of 35.0% in 2023.

- Based on component, the solution segment led the market with the largest revenue share of 54.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 458.02 Billion

- 2030 Projected Market Size: USD 3,677.39 Billion

- CAGR (2024-2030): 36.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The capacity to portray a virtuous cycle of leadership visions, such as a robust talent asset type, employee resilience, operational improvements, stakeholder alignment, and culture strengthening, expand market growth. Organizations have a plethora of chances to strengthen customer-centric relationships due to digitalization. The asset-intensive organization faces increased competition and reliance on the success or failure of the businesses involved in their management abilities. Several companies are now aggressively investing in technological advancements such as artificial intelligence (AI), predictive maintenance, augmented reality (AR), the Internet of Things (IoT), and more. The implementation of contemporary management methods contributes to asset lifespan.

The capabilities of asset management solutions to streamline operations, optimize the utilization of existing resources, and subsequently help enterprises save costs, enhance profits, and improve the return on investment (RoI) are expected to drive the market's growth. Rapid digitization and abundant availability of orthorectified images through satellites have enabled the use of geographical information systems (GIS). GIS enables better planning, designing, developing, and maintaining assets in industries such as the energy and transportation sectors. These solutions and services help organizations in reducing inventory & stock management costs. They also help enterprises utilize their existing assets efficiently by tracking and managing them in real time.

The global industry is seeing new prospects as demand for image-based barcode scanners grows. The increased use of barcode readers, particularly image-based barcode readers, across numerous business verticals such as transportation and logistics, healthcare, consumer products, and others, presents significant opportunities. Image-based barcode scanners are progressively replacing laser scanners. Compared to 2D barcode tags, 1D barcode tags transmit less information (data matrix and QR codes). In terms of cost, long-term durability, and 2D multiple code reading capacity, image-based barcodes are also more efficient.

Asset management solutions also help organizations utilize their assets efficiently by providing vital statistics on the utilization of the assets and making favorable recommendations to optimize the utilization. The assets' life and value can be increased, and the RoI can be improved. Personnel tracking solutions can help organizations ensure workforce safety and enhance workforce efficiency. In the healthcare industry, tracking personnel and equipment can help enhance patient care. Digitization has opened immense opportunities for organizations to enhance their relationship with customers. Asset-intensive organizations have realized that amid the intensifying competition, the success or failure of their business depends on addressing the complexities involved in their management. Hence, several asset-intensive organizations are investing in advanced and innovative solutions to transform and upgrade their operational processes significantly.

The high capital investment associated with implementing management solutions is emerging as one of the major factors restraining the market's growth. Offerings based on a Real-Time Location System (RTLS) can reduce the workforce's costs and boost resource utilization efficiency across various industries and industry verticals. However, these offerings can be highly capital-intensive. Although the prices of some of the components associated with the solutions, such as readers and tags, are plummeting, the overall costs of these systems are expected to remain high, mainly owing to the costs associated with software and servers, and maintenance services.

On-premise solutions typically consume more time, capital, and space. Moreover, skilled professionals are required to maintain and operate on-premises solutions. On the contrary, cloud-based solutions and services eliminate the need to install additional hardware as they can be accessed on all sorts of basic devices, such as smartphones, tablets, laptops, and personal computers. Cloud-based solutions also ensure reliability and easy availability of data as they store it in various data centers across the globe. In addition, cloud-based solutions also make it easier for organizations to secure business intelligence and optimize the use and value of the assets available to them. Hence, cloud-based solutions and services are gaining popularity among enterprises across various geographies. Asset-intensive organizations and businesses are managing to gain access to the latest hardware, software, and service features available in the market by implementing cloud-based solutions.

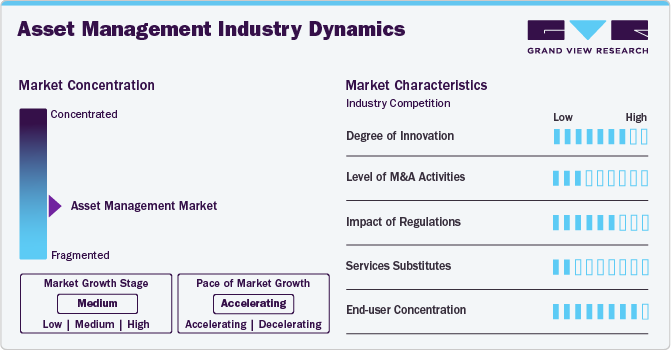

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market is fairly fragmented.The market is also witnessing a growing emphasis on mobility and remote access. As remote work becomes more prevalent across industries, end users, especially global organizations or enterprises with large inventories, are seeking fixed asset management platforms that can offer mobile accessibility and support. This trend reflects the need for employees to access asset data and perform tasks from anywhere, ensuring continuity and efficiency in operations. Suppliers are thus focusing on the development of mobile-friendly interfaces and applications that empower users to manage assets, catering to the evolving needs of modern workplaces.

Integration capabilities have also emerged as a critical factor influencing buyer decisions in the market. Organizations increasingly prioritize solutions that can seamlessly integrate with their existing ERP systems, accounting software, and other relevant applications. Suppliers are responding to this trend by enhancing the interoperability of their platforms, enabling seamless data exchange and improving buyer’s decision-making capabilities.

Several companies are now investing in technological advancements, such as Artificial Intelligence (AI), predictive maintenance, Augmented Reality (AR), the Internet of Things (IoT), and more. The implementation of contemporary management methods contributes to asset lifespan. The capabilities of asset management solutions to streamline operations, optimize the utilization of existing resources, and subsequently help enterprises save costs, enhance profits, & improve the Return on Investment (RoI) are expected to drive the industry growth. Rapid digitization and easy availability of orthorectified images through satellites have enabled the use of Geographical Information Systems (GIS).

Compliance with regulatory requirements and industry standards remains a paramount concern for buyers in the fixed market. Organizations seek solutions to ensure adherence to accounting standards, tax regulations, and reporting requirements, mitigating the risk of non-compliance and associated penalties. Suppliers are, therefore, developing robust compliance features within their platforms, enabling buyers to maintain financial transparency and regulatory compliance easily. For instance, in March 2024, Supernova Technology, a fintech company, introduced the latest edition of Aperture, a comprehensive bank collateral management tool. This updated version is designed to handle various collateral types, such as marketable securities, real estate, accounts receivable, insurance, and fixed assets. The solution primarily focuses on offering transparency and efficiency, empowering users to make well-informed decisions using comprehensive insights and a complete picture of collateral, borrowers, and loans.

Component Insights

Based on component, the solution segment led the market with the largest revenue share of 54.7% in 2023. The solution segment has been further segmented into a real-time location system (RTLS), barcode, mobile computer, labels, a global positioning system (GPS), and others. The barcode section is assisting the solution segment in gaining market share. Due to 2D code-reading capabilities, long-term reliability, and multiple code-reading abilities, image-based barcode scanners are progressively being embraced across many industries and industry verticals, including healthcare, logistics, food & beverage, and consumer products.

The service segment is projected to register at the fastest CAGR of 36.9% over the forecast period. The segment's growth can be attributed mainly to the growing adoption of strategic and operational plans by several global organizations. Strategic management refers to managing investments over time to increase the return on assets (RoA). These services are intended to assist organizations in achieving their objectives by ensuring that all functions work together to attain the same objectives.

Asset Type Insights

Based on asset type, the digital asset segment led the market in 2023 with the largest revenue share of 23.4%. Businesses are rapidly adopting digital solutions and services to lower overall operating expenses and standardize company operations. The continuous digitalization trend is good news for digital solutions and service providers. Over the forecast period, rising volumes and densities of digital assets across companies are expected to boost demand for digital solutions.

The in-transit segment is anticipated to register at the fastest CAGR of 38.4% over the forecast period. The expanding e-commerce activities worldwide are generating demand for in-transit solutions for tracking the items supplied by the seller, which is driving the category's expansion. In-transit management solutions can also assist transportation service companies in tracking and identifying their assets while they are in transit. With the expanding population and continued digitalization, demand for in-transit management solutions is expected to rise.

Function Insights

Based on function, the location and movement tracking segment led the market with the largest revenue share of 35.0% in 2023. Shipping corporations, aviation businesses, 3PLs, and shared mobility providers are all rapidly using location and movement tracking solutions to keep track of their assets in real-time. Disruptive technologies that can give real-time details on asset health and availability for use and maintenance are gaining traction. Simultaneously, combining a geographic information system (GIS) and a global positioning system (GPS) allows for easier access to geographical data from a single perspective. This helps with the administration of working assets in the context of the location and the visualization and search for them on a map.

The repair and maintenance segment is expected to grow at the fastest CAGR of 38.3% over the forecast period. The demand for support & maintenance solutions is anticipated to gain significant traction over the forecast period. Assets, such as equipment, machinery, transportation, and infrastructure, require regular maintenance for their effective functioning and extended life. Once the installation and development or manufacturing are accomplished, the support and maintenance services take over and play a vital role throughout the life cycle of the assets. Support and maintenance services may assist firms in increasing their efficiency and, as a result, their overall revenue generation.

Application Insights

Based on application, the aviation segment led the market with the largest revenue share of 79.5% in 2023. The rise of asset management in aviation segment can be ascribed to commercial airline operators' increased focus on expanding their service offerings in response to rising demand for airborne freight and in-flight passenger transportation. Major corporations involved in commercial airspace aircraft operations are seeking ways to outsource asset management services. Some of the significant aviation management solutions that are being increasingly deployed include predictive and prescriptive maintenance solutions, GR-aware software suites, and tracking solutions.

The infrastructure segment is anticipated to grow at the fastest CAGR of 35.3% over the forecast period, due to the increasing use of IAM services to minimize infrastructure procurement and maintenance costs. The surge in the adoption of AI (Artificial Intelligence) and the Internet of Things (IoT) is predicted to be aided by the development of sophisticated wireless technologies and protocols. Moreover, the vendors operating in the infrastructure management market are adopting a dual-track strategy known as the Design-Build and Build-Operate-Transfer strategy. The strategy envisages the local vendors undertaking the construction work while the large corporations provide operation & maintenance software and services.

Regional Insights

North America dominated the asset management market with a revenue share of 33.04% in 2023. North America has established a substantial lead in infrastructure development and technological adoption. The market growth of the North America would be fueled by a strong presence of significant IT corporations and growing digitization in the United States and Canada. The market is also predicted to rise due to the increasing adoption of connected, smart, and secure technologies for asset-centric applications.

U.S. Asset Management Market Trends

The asset management market in the U.S. anticipated to grow at a significant CAGR of 34.6% from 2024 to 2030. The rise of technology, particularly the integration of Internet of Things (IoT) devices and sensor technologies, has transformed fixed asset management practices. IoT-enabled asset tracking systems provide real-time visibility into asset location, conditions, and performance, enabling proactive maintenance and minimizing downtime.

Europe Asset Management Market Trends

The asset management market in Europe is expected to grow at a significant CAGR of 35.9% from 2024 to 2030. The rising trend of digital transformation initiatives among European enterprises is driving the adoption of integrated asset management platforms. These platforms offer centralized control and visibility over diverse asset portfolios, facilitating better decision-making and resource allocation. Organizations are increasingly recognizing the importance of optimizing asset lifecycle management to enhance productivity, minimize downtime, and support long-term sustainability goals.

The UK asset management market is anticipated to grow at a significant CAGR of 33.6% from 2024 to 2030. The healthcare sector in the UK has been undergoing digital transformation aimed at enhancing patient care, increasing operational efficiency, and improving clinical outcomes. The growing adoption of digital technologies such as Electronic Health Records (EHRs), telemedicine, and wearable health devices presents the need for efficient Asset Managements to effectively track and maintain these digital assets.

The asset management market in Germany is expected to grow at the fastest CAGR of 35.0% from 2024 to 2030.German automotive companies are investing heavily in digital platforms that enable real-time monitoring of assets throughout their lifecycle, from production to distribution and more. These platforms provide actionable insights that drive operational efficiency, reduce downtime, and enhance overall productivity.

The France asset management market is anticipated to grow at a rapid CAGR from 2024 to 2030.One of the major growth drivers of the France market is the ongoing digital transformation of infrastructure, particularly in the energy sector. The country's commitment to modernizing its electrical grid has heightened the focus on leveraging digital technologies to enhance efficiency, reliability, and sustainability of operations in the energy sector.

Asia Pacific Asset Management Market Trends

The asset management market in Asia Pacificis anticipated to grow at a significant CAGR of 37.8% from 2024 to 2030. Asia Pacific is emerging as one of the fastest-growing regional markets and hence offers immense potential for the market's growth. The burgeoning middle class, investors' gradual transfer from deposits to financial assets, higher life expectancies, and longer pension durations have resulted in a need to manage valuable asset data in the BFSI industry, driving up demand for AM solutions. Aside from that, the industry is driven by a shift away from on-premises AM solutions and toward software-as-a-service (SaaS) solutions, particularly among SMEs. Furthermore, the tremendous quantity of content production occurring due to the region's growing internet and smartphone adoption is a positive outlook for the sector.

The China asset management market is expected to grow at the fastest CAGR of 40.9% from 2024 to 2030. China's sustained investment in infrastructure development serves as a fundamental driver for the market growth. The country's infrastructure projects encompass transportation systems, energy networks, telecommunications, and urban development. These large-scale investments create significant demand for asset management solutions to effectively plan, monitor, and maintain the vast array of assets across the nation.

The asset management market in India is anticipated to grow at an substantial CAGR of 38.0% from 2024 to 2030. Growing investments in cloud infrastructure are a key driver for the market growth. As India continues to embrace digital transformation across industries, the adoption of cloud-based asset management solutions is expected to accelerate. Organizations recognize the need to optimize asset utilization, minimize downtime, and mitigate risks to remain competitive in today's dynamic business environment.

The Japan asset management market is expected to grow at a significant CAGR of 34.8% from 2024 to 2030. Japan's infrastructure, particularly in sectors such as transportation, energy, and utilities, is aging and requires notable renewal and modernization. This presents a compelling need for effective asset management solutions to optimize the lifecycle of existing infrastructure, extend its operational lifespan, and ensure safety and reliability.

Middle East & Africa Asset Management Market Trends

The asset management market in Middle East & Africa is anticipated to grow at a significant CAGR of 35.5% from 2024 to 2030. The Middle East and Africa market is driven by the growing use of advanced technologies such as Artificial Intelligence (AI) in asset management practices. As businesses in this region increasingly recognize the importance of efficient asset management, they are turning to advanced technologies to streamline processes, optimize resource allocation, and enhance overall productivity.

The Saudi Arabia asset management market is expected to grow at the fastest CAGR during the forecast period. Smart manufacturing technologies, such as Industrial IoT (IIoT), big data analytics, and automation are transforming fixed asset management in Saudi Arabia. As the country continues to diversify its economy and invest in industrialization, there is a growing emphasis on leveraging advanced technologies to enhance operational efficiency, productivity, and competitiveness across various sectors.

Key Asset Management Company Insights

Some of the key companies operating in the market include International Business Machines Corporation, Hitachi, Ltd., and Honeywell International Inc., among others are some of the leading participants in the market.

-

International Business Machines Corporation holds a notable position due to its strong brand reputation, extensive product portfolio, and global presence. The company's focus on innovation, reliability, and customer-centric approach has enabled it to establish itself as a trusted partner for organizations seeking effective fixed asset management solutions. Through continuous investment in research and development, strategic partnerships, and customer-centric initiatives, IBM continues to strengthen its position in the fixed market, driving innovation and delivering value to its customers worldwide

-

Hitachi, Ltd. leverages its extensive expertise in industrial technology and digital solutions. As a leading provider of innovative asset management solutions, Hitachi has established itself as a trusted partner for organizations seeking to optimize their asset lifecycle management processes. It holds a significant market share owing to comprehensive offerings, innovative technologies, strategic partnerships, and global presence

-

Honeywell's prominence stems from its comprehensive offerings, including hardware, software, and services designed to track, manage, and optimize fixed assets effectively. Honeywell's solutions leverage advanced technologies such as IoT, cloud computing, AI, and data analytics to provide real-time visibility into asset performance, streamline maintenance processes, and enhance operational efficiency

WSP Global Inc., Zebra Technologies Corporation are some of the emerging market participants in the global market.

-

WSP is a global professional services firm providing consulting, engineering, and construction services across a wide range of industries and industry verticals. The company offers a comprehensive suite of services, including engineering, design, planning, consulting, project management, environmental assessment, and construction management. The company's multidisciplinary expertise allows it to undertake projects of varying scales and complexities

-

Zebra Technologies Corporation offers a diverse portfolio of products and services tailored to the unique needs of industries, such as retail, healthcare, transportation & logistics, and manufacturing, among others. The company’s suite of solutions includes retail technology solutions, healthcare technology solutions, transportation & logistic solutions, manufacturing plant floor solutions, and warehouse & distribution solutions

Key Asset Management Companies:

The following are the leading companies in the asset management market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Inc.

- Adobe Systems Inc.

- Brookfield Asset Management Inc.

- Honeywell International Inc.

- IBM Corp.

- Oracle Corp.

- Rockwell Automation, Inc.

- Siemens AG

- WSP Global Inc.

- Zebra Technologies Corp.

- Hitachi, Ltd.

- General Electric Company

- Bentley Systems, Incorporated

- Hexagon AB

- AssetWorks, Inc.

- SAP SE

Recent Developments

-

In April 2024, Rockwell Automation, Inc. announced plans to showcase its collaboration with Ericsson through a demonstration of Plex Asset Performance Management (APM) at the Hannover Messe 2024 trade fair. The system, powered by industrial private 5G connectivity, facilitates real-time decision-making and the management of emerging assets, such as Autonomous Mobile Robots (AMRs). The adoption of private 5G technology enables manufacturers to enhance their flexibility, agility, and sustainability while expanding the scope of devices and intelligence within their networks

-

In November 2023, ABB unveiled ABB Ability SmartMaster, an extensive APM platform tailored for the verification and condition monitoring of instrumentation and field devices across various industries, including wastewater, water, oil & gas, and chemical, among others, in India. SmartMaster systematically collects, analyzes, and validates diagnostic data from instruments remotely without disrupting ongoing measurement activities

-

In December 2023, Siemens AG announced the acquisition of BuntPlanet, a technology company based in Spain. BuntPlanet's software solutions have been deployed globally to assist customers in various domains, including smart metering, asset management, water quality monitoring, and integrating AI and hydraulic models to detect leaks and anomalies in water networks. Since 2019, Siemens AG has been holding a licensing agreement with BuntPlanet to market SIWA LeakPlus, the company’s leakage detection software. The acquisition facilitated the integration of BuntPlanet's entire suite of solutions with Siemens AG’s application portfolio for water utilities, further enhancing the breadth and depth of the company’s offerings available to water customers

Asset Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 571.77 billion

Revenue forecast in 2030

USD 3,677.39 billion

Growth rate

CAGR of 36.4% from 2024 to 2030

Base year for estimation

2023

Historic Year

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Market Size in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue, company share, competitive landscape, growth factors, and trends

Segments covered

Component, asset type, function, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

ABB Inc.; Adobe Systems Inc.; Brookfield Asset Management Inc.; Honeywell International Inc.; IBM Corp.; Oracle Corp.; Rockwell Automation, Inc.; Siemens AG; WSP Global Inc.; Zebra Technologies Corp.; Hitachi, Ltd.; General Electric Company; Bentley Systems; Incorporated; Hexagon AB; AssetWorks, Inc.; SAP SE

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Asset Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global asset management market report based on component, asset type, function, application, and region:

-

Component Outlook (Market Size, USD Billion, 2018 - 2030)

-

Solution

-

Real-Time Location System (RTLS)

-

Barcode

-

Mobile Computer

-

Labels

-

Global Positioning System (GPS)

-

Others

-

-

Service

-

Strategic Asset Management

-

Operational Asset Management

-

Tactical Asset Management

-

-

-

Asset Type Outlook (Market Size, USD Billion, 2018 - 2030)

-

Digital Assets

-

Returnable Transport Assets

-

In-transit Assets

-

Manufacturing Assets

-

Personnel/ Staff

-

-

Function Outlook (Market Size, USD Billion, 2018 - 2030)

-

Location & Movement Tracking

-

Check In/ Check Out

-

Repair and Maintenance

-

Others

-

-

Application Outlook (Market Size, USD Billion, 2018 - 2030)

-

Infrastructure Asset Management

-

Transportation

-

Energy Infrastructure

-

Water & Waste Infrastructure

-

Critical Infrastructure

-

Others

-

-

Enterprise Asset Management

-

Healthcare Asset Management

-

Aviation Asset Management

-

Others

-

-

Region Outlook (Market Size, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global asset management market size was estimated at USD 458.02 billion in 2023 and is expected to reach USD 571.77 billion in 2024.

b. The global asset management market is expected to grow at a compound annual growth rate of 36.4% from 2024 to 2030 to reach USD 3,677.39 billion by 2030.

b. The market's growth is increasing owing to rapid digital change, technological advances, and the efforts of test asset management in the industry. The capacity to portray a virtuous cycle of leadership visions, such as a robust talent Asset Type, employee resilience, operational improvements, stakeholder alignment, and culture strengthening, expands market growth. Due to digitalization, organizations have a plethora of chances to strengthen customer-centric relationships.

b. Some key players operating in the asset management market include ABB Inc., Adobe Systems Inc., Brookfield Asset Management Inc., Honeywell International Inc., IBM Corp., Oracle Corp., Rockwell Automation, Inc., Siemens AG, WSP Global Inc., Zebra Technologies Corp., Hitachi, Ltd., General Electric Company, Bentley Systems, Incorporated, Hexagon AB, AssetWorks, Inc., SAP SE.

b. North America dominated the market in 2023 with a market share of over 33%. It has established a substantial lead in infrastructure development and technological adoption. The growth of the North American market will be fueled by the strong presence of significant IT corporations and growing digitization in the United States and Canada.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.