- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Fish Protein Hydrolysate Market Share Report, 2020-2027GVR Report cover

![Fish Protein Hydrolysate Market Size, Share & Trends Report]()

Fish Protein Hydrolysate Market (2020 - 2027) Size, Share & Trends Analysis Report By Technology (Autolytic, Acid Hydrolysis), By Form (Powder, Liquid), By Source (Sardines, Anchovies), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-968-5

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fish Protein Hydrolysate Market Summary

The global fish protein hydrolysate market size was valued at USD 243.7 million in 2019 and is projected to reach USD 361.5 million by 2027, growing at a compound annual growth rate (CAGR) of 5.1% from 2020 to 2027. Ascending product demand in the pharmaceutical industry owing to their fast absorption functionality, thereby promoting lean muscle mass, as well as their ability to reduce the effects of hypertension in consumers is expected to drive the market growth over the upcoming years.

Key Market Trends & Insights

- North America dominated the market and accounted for over 40.0% share of the global revenue in 2019.

- By technology, acid hydrolysis segmentled the market and accounted for more than 46.0% share of the global revenue in 2019.

- By source, anchovy segment led the market and accounted for more than 32.0% share of the global volume in 2019.

- By application, animal feed & pet food segment led the market and accounted for more than 46.0% share of the global revenue in 2019.

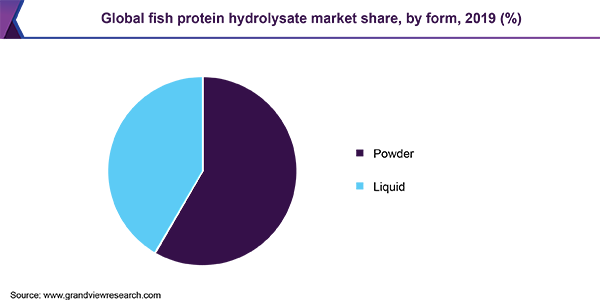

- By form, Powder-based products led the market and accounted for more than 57.0% share of the global volume in 2019.

Market Size & Forecast

- 2019 Market Size: USD 243.7 Million

- 2027 Projected Market Size: USD 361.5 Million

- CAGR (2020-2027): 5.1%

- North America: Largest market in 2019

- Asia Pacific: Fastest growing market

Fish protein refers to ingredients that are extracted from ground whole fish. Fish Protein Hydrolysate (FPH) find application in several end-use industries including animal feed, pet food, cosmetics, and food & beverages, among others. The growing consumption of fish protein in various food & beverage applications, such as infant formulations, sports nutrition, and protein supplements, is projected to drive the overall market over the next few years.

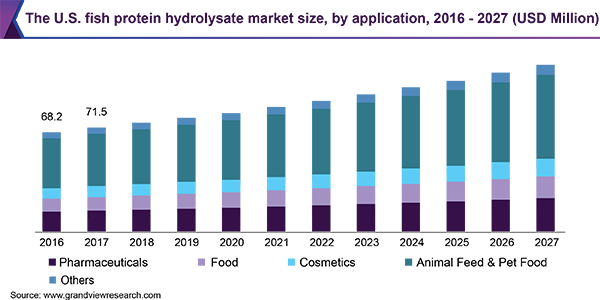

The market in the U.S. is projected to exhibit high growth due to high product demand on account of rising awareness about weight management and muscle building, disease prevention, and physical, as well as mental, health. In addition, the growing food & beverage industry and increasing middle-class population coupled with high-income levels are expected to drive the product demand over the forecast period.

In the food & beverage application, the product is proven to have a positive impact on gastrointestinal issues associated with Irritable Bowel Syndrome (IBS) and Crohn's disease. In infant formula application, fish proteins are utilized to produce alternative hypoallergenic protein foods for infants suffering from celiac disease, gluten intolerance, and milk allergy.

The most commonly used types of fish are anchovies, herrings, and sardines, among others. These are a source of a variety of components, including peptides with antioxidative, antimicrobial, antihyperglycemic, and antihypertensive properties. Moreover, research suggests that fish side streams consist of valuable bioactive ingredients, such as proteins, fish oils & fatty acids, enzymes, glucosaminoglycans, and chitin & chitosan. The demand for FPH is anticipated to witness high growth in animal feed applications over the next few years.

Rising utilization of the product in the aquaculture feed industry is one of the main factors contributing to the growth of the aforesaid segment. This can be attributed to the fact that currently, fish farming caters to over 50% of the world's fish food supply, which is likely to grow further in the coming years. This in turn is projected to make fish protein hydrolysate a key segment in supplying highâ€quality amino acid and overall nutritive value to the aquaculture sector.

However, an insufficient supply of raw materials, such as Tuna sourced from the Pacific Ocean and Japan Sea, or Atlantic Salmon obtained from the Scandinavian countries, including Denmark, Norway, and Sweden, is projected to restrict the market growth. Moreover, aquatic products are extremely perishable, which are stored, processed, and sold quickly. Herein, unforeseeable obstructions in the transport routes prevent the smooth movement of fresh food supply chains, thereby, resulting in food loss and hampering market demand.

Technology Insights

Acid hydrolysis technology led the market and accounted for more than 46.0% share of the global revenue in 2019. This technology is more widespread as opposed to autolytic and enzymatic hydrolysis. The acid hydrolysis is held at high pressure and temperature solution, 220-310 mPa, and 121-138 °C respectively, in the presence of hydrochloric and sulfuric acid for several hours to achieve a certain degree of hydrolysis (DH). The mixture so obtained is neutralized to pH 6.0-7.0 and is then delivered for further dehydration.

Growing demand for the product as a binder, gelling agent, and an emulsifier in various food & beverage applications, such as nutritional supplements and functional foods, is projected to augment the segment growth. Rising utilization of seafood protease and trypsin, from Atlantic salmon and pyloric ceca from distinguished fishes, as nutritional additive and cryoprotectant in aquafeed and liquid fertilizers is likely to further augment the segment growth over the upcoming years.

However, the process of acid hydrolyzation entails several drawbacks, such as destruction of an essential amino acid called tryptophan and/or the presence of high sodium chloride (NaCl) content in the final product, making it inappropriate for use in biochemical and food applications.

The enzymatic hydrolysis process is carried out in a mild to slightly elevated temperature solution, typically 35-65 °C, in the presence of various enzymes, such as pepsins, papain, alcalase, bromelain neutrase, and flavourzyme, to name a few. On account of its ability to maintain neutral taste, to retain essential fish nutrients, and to shorten the reaction time, the demand for FPH by enzymatic hydrolysis is projected to witness steady growth over the next few years.

Source Insights

Anchovy source segment led the market and accounted for more than 32.0% share of the global volume in 2019. On account of the growing demand for high-quality agricultural fertilizers and increasing consumption of organic solutions due to changing consumer perception about chemical-induced fertilizers in the aforesaid field, the demand for anchovy-derived protein hydrolysate is anticipated to witness steady growth over the next few years.

Furthermore, anchovy-based protein hydrolysate is being rapidly utilized in producing high-performance and economical fertilizers owing to the product’s ability to enhance soil quality, which, in turn, is projected to propel the overall market demand. Stringent regulations pertaining to the use of chemically-enhanced fertilizers and growing R&D initiatives by companies, such as Dramm Corporation and U.S. Ag Florida, Inc. towards manufacturing good-quality organic fertilizer solutions, is likely to further propel the product demand.

In terms of volume, demand for sardine-based protein hydrolysate is anticipated to grow at the fastest CAGR of 5.1% over the projected period. Sardines are rich in long-branched amino acids and omega 3, which are suitable for animal feed formulations. In aquaculture feed application, the product is highly compatible with salt and/or seawater aquatic life and are easily digestible in nature, which is anticipated to drive the product demand in the next few years.

In addition, growing demand for high-quality and natural aquafeed products, which not only enhance flesh-to-bone consistency in freshwater aquaculture but also decreases the outbreak of several viral infections, such as fin rot and dropsy, is projected to augment the demand for sardine-based protein hydrolysate in the global market. In agriculture application, sardine-based protein hydrolysate is known to promote crop yield and growth as well as reduce plant infection, which, in turn, is likely to spur the market demand for the product in the said application segment.

Application Insights

Animal feed & pet food application segment led the market and accounted for more than 46.0% share of the global revenue in 2019. The product aids in the reduction of the outbreak of infectious diseases as well as promotes the metabolic system of animals against bacteria, fungi, viruses, and parasites. This factor along with the product’s ability to improve the health and metabolism of livestock is among the key factors augmenting the demand for FPH in the segment.

In the animal feed sector, regular consumption of FPH by broiler chickens aids in muscle development. Enzymes present in fish proteins help in the gut morphology of broilers by facilitating the digestion of fibrous food, including grains and soybean meal. In addition, on account of bioaccumulation, the growing consumption of natural growth promoters, as opposed to antibiotic promoters in poultry animals, is projected to further drive the product demand over the next few years.

In the pharmaceutical sector, FPH offers several health benefits, including regulation of blood pressure and exhibits anti-aging properties for skin, which enable it as a safe ingredient for human consumption. The product’s quick-absorbing characteristics together with a high concentration of branched amino acids make it suitable for use as cosmetic ingredients and in nutritional & pharmaceutical supplements.

Moreover, in response to the aforementioned factors, industry manufacturers are rapidly incorporating FPH in their pharmaceutical preparations to offer natural and low side-effect products to the consumers. Herein, FPH is used in producing supplements for the elderly population, as the product does not trigger blood insulin and cholesterol and levels and is easily digestible. This factor, in turn, is estimated to spur the product demand over the forecast period.

Form Insights

Powder-based products led the market and accounted for more than 57.0% share of the global volume in 2019. The growing demand for powdered FPH in manufacturing pharmaceutical-grade products, including protein powder and other supplements, which aid in blood and muscle recovery after accidents, is likely to augment the segment growth in the next few years.

Furthermore, rising consumption of natural ingredients, which have low toxicity and are economical in nature, in cosmetics and agricultural applications is projected to spur the demand for powder-based FPH. Moreover, powdered products have distinguished attributes, such as longer shelf-life, easier transportation, and storage, thereby exhibiting decreased chances of spoilage. In terms of revenue, the liquid FPH segment is anticipated to register the maximum CAGR of 5.5% over the projected period.

Liquid products contain approximately 90 percent of moisture and have high water solubility and a favorable amino acid profile, which makes them excellent for use in manufacturing pharmaceutical and nutraceutical formulations. Furthermore, liquid FPH has a satiating effect, which aids in maintaining cholesterol levels and in the reduction of the risk of malignant and benign tumors in humans. This is also expected to augment the demand for these products.

Regional Insights

North America dominated the market and accounted for over 40.0% share of the global revenue in 2019. Promising trends and growing consumption of collagen-enriched and anti-aging products in the region are anticipated to spur the product demand in the cosmetics industry over the forecast period. FPH is used to manufacture anti-aging creams, serums, and face masks, on account of its rich protein concentration and amino acid content.

Rising awareness about skincare in the region is projected to drive the FPH demand in the cosmetics as well as the healthcare sector over the upcoming years. Presence of well-established cosmetics products manufacturers in the region, such as Elemis Ltd., Dr. Dennis Gross Skincare LLC, and ReeceThomas LLC, which focus on expanding their product portfolio and consumer reach by launching protein- and marine collagen-rich cosmetics solutions will drive the market further.

The market in Asia Pacific is anticipated to register the fastest CAGR over the upcoming years. In the regional food sector, fish protein is primarily used for nutritional & dietary supplements. However, the regional market is yet to achieve its full potential in the beverages application. Products targeting mental well-being and overall health have motivated the industry to undertake new food-related research & development initiatives.

Regardless of the uncertainties pertaining to existing regulations, FPH is defining the context of a rapidly evolving market in main countries, such as China, India, Japan, and Australia. The industry is also expected to grow on account of the rising self-care movement, changes in the food regulations, and continuous scientific evidence highlighting the critical link between diet and health.

Key Companies & Market Share Insights

Industry players market is sourcing good-quality raw material and is focusing on developing new hydrolyzed protein extraction processes and innovating indigenous technology to broaden the customer base and gain brand recognition. The growing consumption of natural ingredients is prompting industry players to adopt pure FPH solutions, which is likely to spur market growth. In March 2020, Bio-marine Ingredients Ireland Ltd. together with Irish Research Council’s Enterprise Partnership conducted a 12-week feeding trial, to investigate the effects of low fishmeal diets/high plant-protein, with and without FPH supplementation on gut health and growth performance in Atlantic salmon grown in freshwater. Awaiting the results of this recent study, the company hopes to open new avenues for sustainable aquaculture feed market. Some of the prominent players in the fish protein hydrolysate market include:

-

Sopropeche

-

Diana Group

-

Copalis Sea Solutions

-

Scanbio

-

Bio-marine Ingredients Ireland Ltd.

-

United Fisheries

-

Shenzhen Taier

-

New Alliance Dye Chem Pvt. Ltd.

-

Neptune's Harvest

-

Alaska Protein Recovery, LLC

-

Great Pacific BioProducts Ltd.

-

BrownsFish Genesis

-

Dramm Corp.

-

U.S. Ag Florida, Inc.

-

Sampi

-

Marutham Bio Ages Innovations (p) Ltd.

-

Hofseth BioCare

-

Janatha Fish Meal & Oil Products

Fish Protein Hydrolysate Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 254.7 million

Market volume in 2020

50,278.3 tons

Revenue forecast in 2027

USD 361.5 million

Volume forecast in 2027

69,148.9 tons

Growth Rate

CAGR of 5.1% (Revenue-based)

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in tons, revenue in USD thousand and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, form, source, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

The U.S.; Canada; Mexico; Germany; The U.K.; Spain; Italy; France; China; India; Japan; Australia; Brazil; Chile; Peru; UAE

Key companies profiled

Sopropeche; Diana Group; Copalis Sea Solutions; Scanbio; Bio-marine Ingredients Ireland Ltd.; United Fisheries; Shenzhen Taier; New Alliance Dye Chem Pvt. Ltd.; Neptune's Harvest; Alaska Protein Recovery, LLC; Great Pacific BioProducts Ltd.; BrownsFish Genesis; Dramm Corporation; U.S. Ag Florida, Inc.; Sampi; Marutham Bio Ages Innovations (p) Limited; Hofseth BioCare; Janatha Fish Meal & Oil Products

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global fish protein hydrolysate market report on the basis of technology, form, source, application, and region:

-

Technology Outlook (Volume, Tons, Revenue, USD Thousand, 2016 - 2027)

-

Acid Hydrolysis

-

Autolytic Hydrolysis

-

Enzymatic Hydrolysis

-

-

Form Outlook (Volume, Tons, Revenue, USD Thousand, 2016 - 2027)

-

Liquid

-

Powder

-

-

Source Outlook (Volume, Tons, Revenue, USD Thousand, 2016 - 2027)

-

Anchovy

-

Herrings

-

Menhaden

-

Sardine

-

Shads

-

Others

-

-

Application Outlook (Volume, Tons, Revenue, USD Thousand, 2016 - 2027)

-

Food

-

Pharmaceuticals

-

Animal Feed & Pet Food

-

Cosmetics

-

Others

-

-

Regional Outlook (Volume, Tons, Revenue, USD Thousand, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Chile

-

Peru

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global fish protein hydrolysate market size was estimated at USD 243.7 million in 2019 and is expected to reach USD 254.7 million in 2020.

b. The fish protein hydrolysate market is expected to grow at a compound annual growth rate of 5.1% from 2020 to 2027 to reach USD 361.5 million by 2027.

b. Powder segment dominated the fish protein hydrolysate market with a share of 58.3% in 2019. The growing demand for the product in manufacturing pharmaceutical-grade products, including protein powder and other supplements, which aid in blood and muscle recovery after accidents, is likely to augment the overall market growth in the next few years.

b. Some of the key players operating in the fish protein hydrolysate market include SOPROPECHE; Diana Group; COPALIS SEA SOLUTIONS; Scanbio; Bio-marine Ingredients Ireland Ltd.; United Fisheries; Shenzhen Taier; New Alliance Dye Chem Pvt. Ltd.; Neptune's Harvest; Alaska Protein Recovery, LLC; Great Pacific BioProducts Ltd.; BrownsFish Genesis; Dramm Corporation; U.S. Ag Florida, Inc.; SAMPI; Marutham Bio Ages Innovations (p) Limited; Hofseth BioCare; and Janatha Fish Meal & Oil Products.

b. The key factors that are driving the fish protein hydrolysate market include the growing consumption of chemical-free and nutrient-rich food products among consumers across the globe. On account of the presence of vitamin A & D and minerals, the product is utilized as an ingredient in various food applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.