- Home

- »

- Healthcare IT

- »

-

Fitness Apps Market Size & Share, Industry Report, 2033GVR Report cover

![Fitness Apps Market Size, Share & Trends Report]()

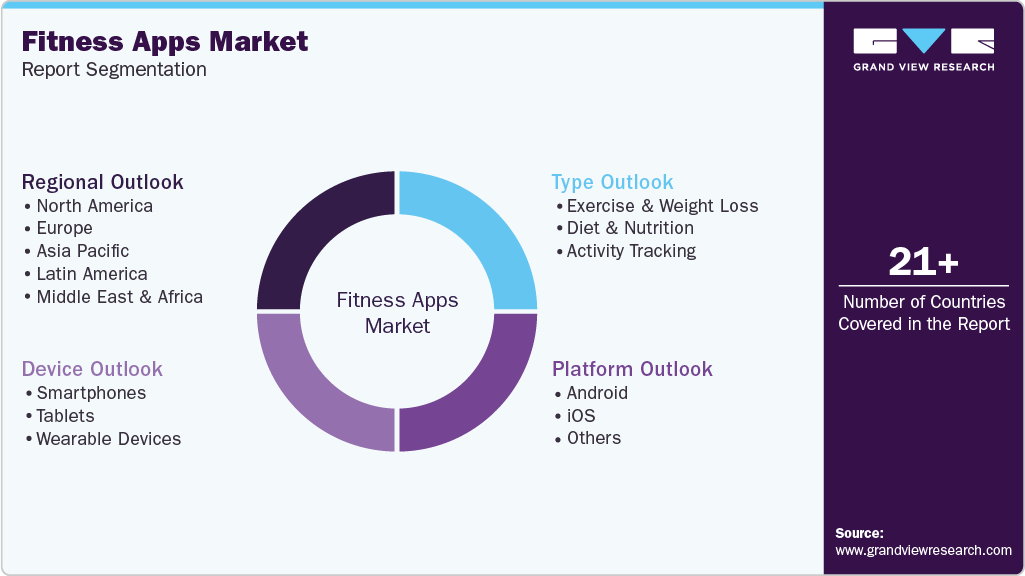

Fitness Apps Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Exercise & Weight Loss, Diet & Nutrition, Activity Tracking), By Platform (Android, iOS), By Device (Smartphones, Tablets, Wearable Devices), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-538-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fitness Apps Market Summary

The global fitness apps market size was estimated at USD 12.12 billion in 2025 and is projected to reach USD 33.58 billion by 2033, growing at a CAGR of 13.40% from 2026 to 2033. This growth is driven by increasing health awareness, technological advancements, the impact of the COVID-19 pandemic, and favorable economic factors, including rising disposable income and lower healthcare costs.

Key Market Trends & Insights

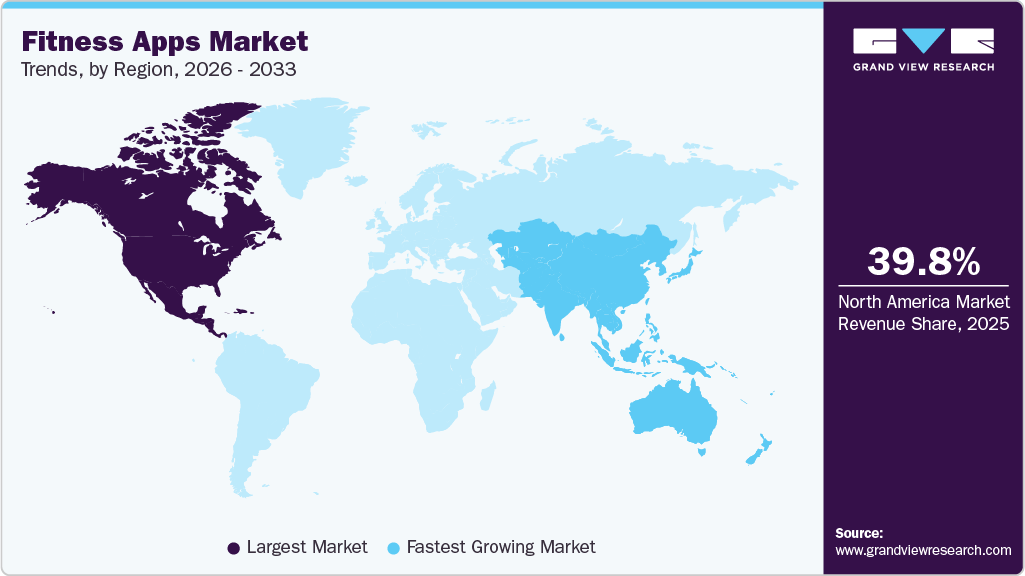

- The North America fitness app market accounted for the largest revenue share of 39.82% in 2025.

- The U.S. fitness app industry held a significant share of North America in 2025.

- By type, the exercise & weight loss segment held the largest revenue share of 53.69% in 2025.

- By platform, the iOS segment held the largest revenue share of 51.99% in 2025.

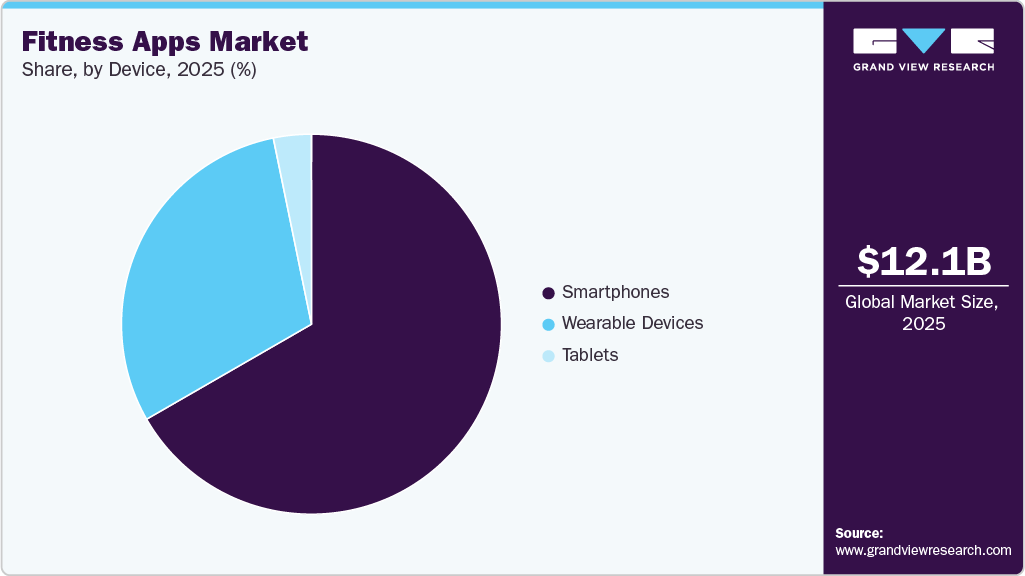

- By device, the smartphones segment held the largest revenue share of 66.70% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 12.12 Billion

- 2033 Projected Market Size: USD 33.58 Billion

- CAGR (2026-2033): 13.40%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

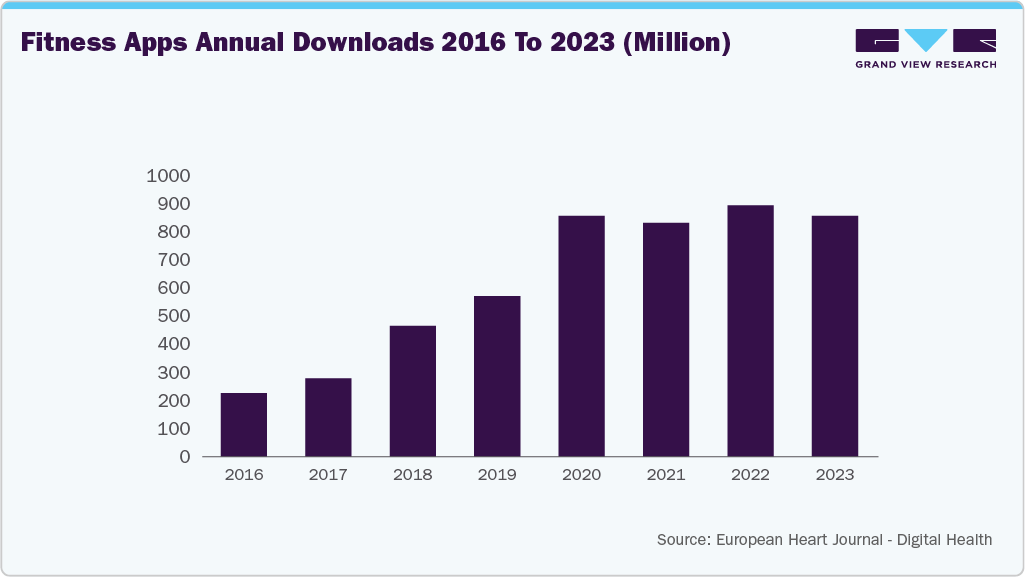

According to a report by Business of Apps, fitness apps were downloaded 858 million times in 2023. The market encompasses a wide range of popular fitness apps that focus on activities such as running, cycling, yoga, and general fitness tracking. The convenience and personalized nature of these apps make them popular among users of all ages.

Smartphones have evolved from communication tools to essential health and fitness tracking devices. Users can monitor physical activity, nutrition, and overall wellness using apps such as Fitbit, MyFitnessPal, Garmin Connect, Fooducate, Noom, and Google Fit. Integration with wearables such as smartwatches provides real-time data on heart rate, calories burned, and sleep patterns.

The rise of digital health solutions, wearable technology, and personalized fitness experiences fuels the growing demand for fitness apps. Leading apps such as MyFitnessPal, with its extensive food database of over 14 million foods to track users' nutrition and exercise routines, and Strava, known for its social features, are at the forefront. Runna, an AI-powered running app, has gained global traction, serving users in over 180 countries and raising USD 9.09 million (Euro 8 million) in venture capital.

AI is revolutionizing the app landscape, with platforms such as Runna and PUSH offering personalized training plans and real-time feedback. As the fitness app market continues to grow, businesses seeking success must prioritize AI-driven personalization, seamless wearable integration, and user-friendly interfaces to align with current trends and user expectations.

The demand for personalized wellness experiences, fueled by advancements in AI and wearable technology, has reshaped how individuals approach fitness. These apps now offer real-time data tracking, making it easier for users to achieve their fitness goals and improve endurance, strength, or overall health. The table below highlights some of the leading fitness apps of 2025, providing key features and relevant statistics for a comprehensive overview of the top platforms in the fitness tech space.

List of Leading Fitness Apps in 2025

App

Key Features

Downloads

Google Rating

Peloton

Live and on-demand classes (cycling, strength, yoga, etc.), community features, multiple devices.

50M+ (on Google Play)

4.6/5

Nike Run Club

Personalized coaching plans, real-time tracking, integrate with various devices.

10M+ (on Google Play)

4.7/5

Nike Training Club

Free workout library, strength, endurance, mobility, structured programs, expert guidance.

10M+ (on Google Play)

4.8/5

Runna

AI-powered running plans, personalized feedback, nutrition tips, adapts to progress.

1M+ (on Google Play)

4.4/5

PUSH

Strength training routines, data-driven performance tracking, personalized feedback.

500K+ (on Google Play)

4.5/5

Garmin Connect+

Personalized fitness suggestions, Garmin Coach for running plans, integration with Garmin devices.

50M+ (on Google Play)

4.3/5

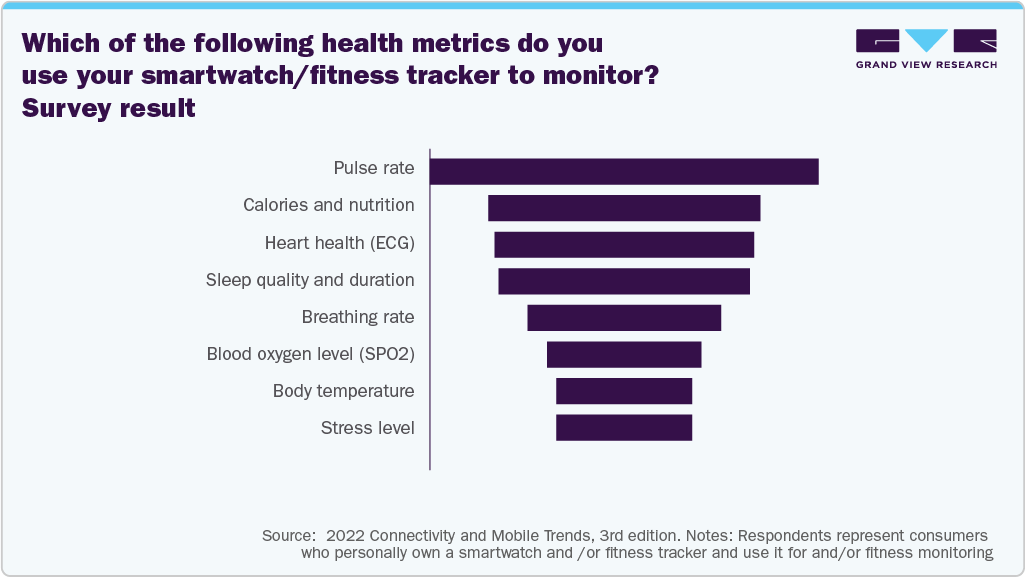

Technological advancements are driving the growth of the fitness app industry. Enhanced smartphone features, such as advanced sensors and GPS, enable precise activity tracking. Integration with wearables, like smartwatches, provides real-time data on heart rate, calories burned, and sleep patterns. According to a 2023 NIH report, nearly one in three Americans uses wearables to monitor their health. The International Data Corporation (IDC) also reported a 2.6% increase in global wearable device shipments in Q3 2023, with a record 148.4 million units shipped. This seamless tech integration boosts the appeal and effectiveness of these apps, driving greater adoption.

A growing global awareness of the importance of maintaining a healthy lifestyle is fueling the fitness app market. As people strive to prevent chronic diseases, manage weight, and enhance overall well-being, these apps offer a convenient platform to set goals, track progress, and stay motivated. In the U.S., obesity rates are rising, with 22 states reporting adult obesity rates above 35% in 2022, according to the CDC. The 2022 WHO report highlights that 16% of adults globally are obese, and by 2030, 1 billion people worldwide are expected to be affected. As health consciousness increases, the accessibility and convenience of fitness apps make them a popular tool for users committed to healthier lifestyles, driving steady market growth.

Furthermore, the demand for personalized solutions is another key factor driving the market growth. These apps often utilize artificial intelligence and machine learning algorithms to provide customized workout plans and nutritional advice tailored to individual user data. This personalization helps users achieve their fitness goals more efficiently and effectively. By catering to specific needs and preferences, these apps enhance user satisfaction and retention, fostering market growth.

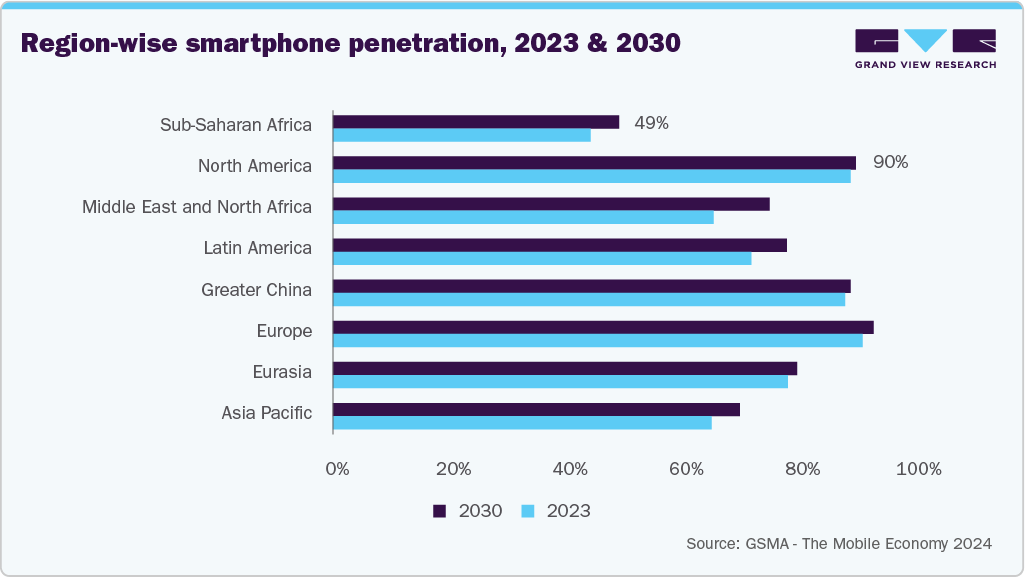

As illustrated in the figure below, in 2023, Europe and North America experienced the highest smartphone penetration rates, at 89% and 91%, respectively.

Notable Investments in the Fitness Apps Industry

Month, Year

Fitness App Developer

Investor

Investment

(in USD)

June 2024

Zing Coach

Zubr Capital and Triple Point Capital

10.0 million

April 2024

ForActive

US ff Venture Capital and Polish Movens Capital

1.6 million

January 2024

Muuvr

Daniela Ryf and Jan van Berkel

1.67 million

January 2024

Harbiz

Octopus Ventures, JME Ventures, Athos Capital, and Enzo Ventures

5.4 million

October 2023

CoPilot

Jackson Square Ventures

6.5 million

Pricing Analysis

App

Standout feature

Pricing

Strava

Live beacon tracking for safety

Free or USD 8/month, USD 60/year

Apple Fitness

Complete analysis will be a part of the final deliverable

Fitbit

PUSH

Runna

Strong

Hevy

Runkeeper

Gymverse

Nike Training Club

Future

Peloton App One

Sweat

Ladder

Alo Moves

FitOn

Apple Fitness Plus

Key Evaluation Metrics for the Fitness Apps Market

The ballpark ranges for Retention Rate, Churn Rate, and Conversion Rate reflect monthly metrics based on standard industry benchmarking for the fitness apps market.

Retention Rate:

-

A monthly retention rate is commonly used in subscription-based services, especially in health and wellness apps, where user engagement tends to fluctuate over longer periods.

-

Daily or weekly retention rates are typically more relevant for social media or gaming apps with shorter user engagement cycles.

Churn Rate:

-

The monthly churn rate is calculated by assessing the percentage of users discontinuing their subscription or engagement within a month.

-

It provides a more stable indicator of user disengagement than daily churn, which can be volatile.

Conversion Rate:

-

The monthly conversion rate reflects how effectively free users upgrade to paid plans over a longer decision-making cycle.

-

Fitness apps often have trial periods or progressive feature unlocks that influence user conversion behavior over weeks, not just days.

User Engagement Metrics for Health & Fitness App Companies

Company

Retention Rate

Churn Rate

Conversion Rate

MyFitnessPal, Inc.

xx% to xx%

xx% to xx%

xx% to xx%

adidas Group

Complete analysis will be a part of the final deliverable

ASICS Corporation

Google (Alphabet Inc.)

Nike, Inc.

Under Armour, Inc.

Azumio, Inc.

Fooducate (Maple Media)

Sweat

Noom, Inc.

Polar Electro

Key Trends in Fitness Apps

The fitness apps industry is poised for substantial evolution as it continues to integrate cutting-edge technologies with evolving consumer expectations. Future advancements will focus on hyper-personalization, immersive user experiences, and integrated health ecosystems. Below are the key trends expected to define the future of fitness apps:

- AI-Powered Smart Coaching

- Immersive Fitness Experiences (AR/VR Integration).

- Predictive Health and Performance Analytics

- Integrated Recovery and Wellness Systems

- Hyper-Connected Fitness Ecosystems

- Social-Driven Fitness Engagement

- Gamification and Real-Time Feedback

- Biometric Wearables and Smart Clothing

- Voice Assistants and Conversational Interfaces

- Sustainable and Eco-Conscious Fitness

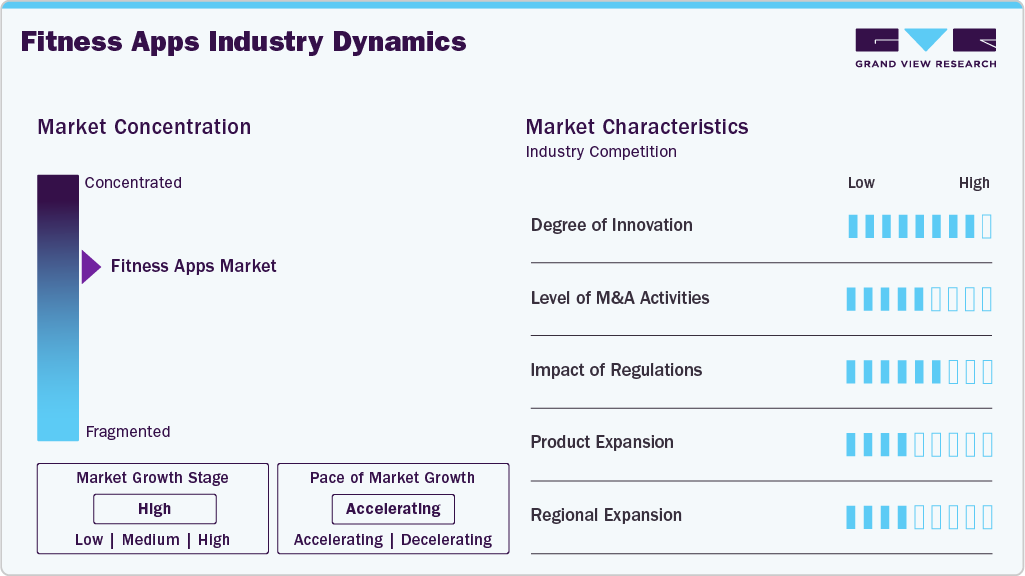

Market Concentration & Characteristics

The fitness apps market is characterized by a high degree of innovation. This is driven by rapid advancements in technology, including AI and machine learning, the integration of wearable devices, and the development of personalized fitness plans. For instance, in October 2023, Polar Electro and Binah.ai entered into a partnership, integrating Binah.ai's software with Polar's Verity Sense sensor for continuous vital and biomarker monitoring. These innovations enhance user experience, provide more accurate data, and offer customized solutions, making fitness apps increasingly effective and appealing to users.

The impact of regulation in the fitness app industry is moderate. While data privacy and health regulations ensure user safety and trust, they also impose compliance costs and development constraints. However, these regulations are crucial for maintaining standards and protecting user data, striking a balance between innovation and necessary oversight to foster a secure and reliable market environment.

The level of mergers and acquisitions in the market is moderate. As the market grows and competition intensifies, companies seek to expand their user base and enhance their technological capabilities. For instance, in July 2021, iFit Health & Fitness, Inc. announced the acquisition of SWEAT, a women's health & fitness platform owned by Kayla Itsines and Tobi Pearce, for USD 400 million. The acquisition aimed to expand the company's footprint in the digital fitness sector and accelerate the delivery of interactive fitness experiences for its customers worldwide.

Companies continually innovate by introducing new features, such as virtual coaching, personalized nutrition plans, and integration with emerging wearable technologies. For instance, in April 2021, Fitbit introduced Luxe, a fitness and wellness tracker designed to help users adopt a more comprehensive approach to their health and well-being. This constant evolution meets the diverse needs of users, keeps them engaged, and attracts new customers, driving significant growth and diversification within the market.

Companies are reaching new audiences by localizing their apps with multilingual support, culturally relevant content, and region-specific features. This tailored approach helps meet the unique needs of users worldwide, driving adoption and growth. As people everywhere become increasingly health-conscious, fitness apps are capitalizing on this trend, making fitness accessible and engaging on a global scale.

Type Insights

In 2025, the exercise & weight loss segment held the largest share of 53.69%, driven by rising obesity rates, health concerns, and growing awareness. The integration of AI and Machine Learning (ML) is expected to further boost market growth. Fitness apps, available on platforms such as iOS and Android, cater to various needs, including lifestyle monitoring, weight management, and exercise tracking. In response to demand, industry players are launching innovative apps. For example, in August 2023, Amo launched HARNA, a fitness app designed to sync workouts with the menstrual cycle, optimizing performance by addressing menstrual discomfort and enhancing fitness experiences for women.

The activity tracking segment is expected to grow at the fastest CAGR, driven by increasing health consciousness. Integrated into wearables such as fitness bands and smartwatches, activity trackers provide data on steps, distance, calories, and sleep patterns, helping users track their fitness progress. Advanced sensors, such as accelerometers and heart rate monitors, ensure accurate data collection, offering reliable insights into exercise intensity and overall health.

Platform Insights

The iOS segment led the fitness app industry, accounting for the largest revenue share of 51.99% in 2025. The high adoption of iOS devices is one of the major factors driving growth and is expected to continue boosting the segment over the forecast period. For instance, as of 2023, there are 153 million iPhone users in the U.S. (Demandsage), and Apple shipped 231.8 million iPhones globally (Backlinko). Fitness apps designed for iOS devices offer a range of features, including fitness coaching, activity tracking, workout streaming, motivational videos, guided meditation, and stretching exercises. Notable iOS popular fitness apps include Centr, 7 Minute Workout, MyFitnessPal, Sworkit, Freeletics, Keelo, JEFIT, Strava, and PEAR.

The Android segment is expected to grow at the fastest CAGR over the forecast period, due to the widespread availability and affordability of Android devices, making fitness apps accessible to a larger audience. As of Q4 2023, Android smartphones accounted for 56% of global smartphone sales (Backlinko). Continuous improvements in the Android OS, including better health & fitness tracking features, API integrations, and machine learning capabilities, are enhancing the functionality and accuracy of fitness apps, driving segment growth.

Device Insights

The smartphones segment led the fitness app market, accounting for the largest share of 66.70% in 2025. The growth is attributed to the increasing global penetration of smartphones. According to the 2024 Kepios report, nearly all the world’s internet users, amounting to 96.3%, utilize a mobile phone to access the internet at least occasionally. Moreover, mobile phones currently account for approximately 57.8% of online time and contribute to around 60% of the world’s web traffic. Hence, the increasing usage of the internet on smartphones is expected to propel segment growth over the forecast period.

The wearable devices segment is expected to grow at the fastest CAGR over the forecast period. The growing health consciousness among consumers and the increasing prevalence of chronic diseases, such as diabetes & cardiovascular diseases, are expected to boost the demand for wearable devices in the market. According to the IDC report, India's wearable market experienced a 34% growth in 2023, with 134.2 million units sold, and smartwatch shipments increased by 74% year-over-year to reach 53.2 million units. Mobile phone integration, wireless connection, and long battery life are among the key features that users seek in a wearable device. Moreover, rapid advancements in the designs of these wearables are propelling their demand in the market.

Regional Insights

The North America fitness apps market accounted for the largest revenue share of 39.82% in 2025. Numerous factors, including the expansion of coverage networks, rapid smartphone adoption, the growing prevalence of chronic diseases, and an aging population, are expected to drive the adoption of fitness apps in North America. The U.S. is the leading market for these applications across the globe. One of the key factors driving market growth is the high adoption of mHealth in North America. The usage of fitness apps increased significantly during the COVID-19 pandemic. 74.0% of U.S. citizens used at least one fitness app during the pandemic, according to a 2020 survey conducted by Freeletics. Moreover, 60.0% of these consumers planned to cancel their gym memberships.

U.S. Fitness Apps Market Trends

TheU.S. fitness apps industryheld a significant share of North America in 2025, due to innovative software development, advanced healthcare management, and numerous key players operating across segments, including mobile & network operations. The U.S. dominated the market in the North America region in 2025. Technological advancements and improved features, such as smartwatches, activity trackers, and personalized fitness goals, including yearly, monthly, and weekly targets, as well as reminders to drink water and daily diet plans, are driving high demand for such applications. According to Fitbit Statistics, more than 73% of health and fitness tracker users in the U.S. used Fitbit in 2023.

Europe Fitness Apps Market Trends

The Europe fitness apps industry is experiencing significant growth. An increase in the number of athletes in Europe, combined with high demand for fitness-related apps such as diet & nutrition apps and workout apps, is expected to propel market growth. Conventionally, these apps were used by athletes or sportspersons. However, in recent years, many individuals have been using fitness apps to maintain a healthy lifestyle and manage weight. An increase in the number of people participating in sports activities is another factor expected to boost demand for these apps. For instance, according to euronews.com, as of March 2023, more than half of Europeans (54%) engaged in physical activity or sports to improve their health.

The UK fitness apps market is expected to grow significantly over the forecast period. The increasing demand for mobile healthcare apps among consumers in the UK is expected to supplement market growth. For instance, according to data published by Business of Apps, 25% of people in the UK used workout/fitness apps, and 15% used nutrition/diet apps in 2023. Furthermore, virtual app vendors focus on developing & launching innovative solutions, as well as extending their geographical reach through key strategies such as partnerships, product launches, collaborations, and approvals. They offer free premium access to users and support in maintaining their health & fitness at home.

Asia Pacific Fitness Apps Market Trends

The Asia Pacific fitness apps industryis expected to register the fastest CAGR over the forecast period.The increasing awareness of health and wellness among the region’s population has driven the demand for fitness solutions, with apps providing a convenient and accessible means to maintain fitness routines. In addition, the widespread adoption of smartphones and improved Internet connectivity has made fitness apps more accessible to a broader audience. According to The Mobile Economy 2023 by GSMA, unique mobile subscriptions in Asia Pacific reached 1.73 billion by the end of 2022, estimated to reach 2.11 billion by 2023. Moreover, the rising incidence of lifestyle-related diseases, such as obesity and diabetes, has prompted individuals to seek proactive health management tools, including fitness apps.

The China fitness apps market is anticipated to register considerable growth during the forecast period. The increasing adoption of digital technologies in China has altered consumer habits, with a notable preference for customized and personalized fitness experiences. Younger consumers, in particular, seek tailored workout routines and dietary plans, often facilitated by AI-driven technologies. For instance, apps such as Keep Fitness, which boasts over 13.54 million monthly active users, exemplify this trend by offering customized routines from a vast exercise database.

Latin America Fitness Apps Market Trends

The Latin Americafitness app industryis anticipated to register considerable growth during the forecast period. Latin America is considered to have a large pool of healthcare human resources and tech entrepreneurs. This is one of the key factors driving the market growth. In addition, increasing expenditure on electronic & mobile devices by buyers is contributing to market growth. Additionally, the number of smartphone users in Brazil reached 155 million in 2023, up from 143.4 million in 2022, thereby further enhancing the access and visibility of fitness apps across the country’s population.

The Brazil fitness apps market is anticipated to register considerable growth during the forecast period. The growing adoption of digital solutions to manage the rising prevalence of chronic diseases is expected to drive market growth in Brazil. For instance, GilcOnLine is an app that allows individuals to manage diabetes by enabling them to view their sugar levels and calculate insulin doses & calorie intakes.

MEA Fitness Apps Market Trends

The fitness apps industry in MEA is anticipated to register considerable growth during the forecast period. Fitness apps are revolutionizing healthcare in the MEA, facilitated by improved internet connectivity and government initiatives. Wearable devices, mHealth apps, and Artificial Intelligence (AI) are key trends transforming healthcare access, costs, & outcomes. Despite challenges in improving infrastructure, affordability, and data privacy, the potential of fitness apps to improve MEA healthcare is substantial.

The Saudi Arabia fitness apps market is anticipated to register considerable growth during the forecast period. The adoption of fitness apps in Saudi Arabia is growing as there is an increase in the penetration of smartphones and improved network coverage. However, initiatives are being taken nationwide to improve access to fitness apps. GymNation’s record of 12,000 signups in Saudi Arabia ahead of new gym openings highlights the country’s increasing embrace of fitness, driving the market growth. As more people join gyms and adopt healthier lifestyles, the demand for fitness apps that offer workout plans, tracking, and nutritional advice rises. These apps complement gym memberships by offering users additional tools to help achieve their fitness goals. The surge in gym signups reflects a broader cultural shift toward fitness, directly boosting the market as people seek digital solutions to enhance their exercise routines.

Key Fitness Apps Company Insights

Key participants in the global fitness apps market focus on devising innovative business growth strategies, including expanding their product portfolios, forming partnerships and collaborations, engaging in mergers and acquisitions, and expanding their business footprints.

Key Fitness Apps Companies:

The following are the leading companies in the fitness apps market. These companies collectively hold the largest market share and dictate industry trends.

- MyFitnessPal, Inc.

- adidas Group

- ASICS Corporation

- Google (Alphabet Inc.)

- Nike, Inc.

- Under Armour, Inc.

- Azumio, Inc.

- Fooducate (acquired by Maple Media LLC)

- Sweat

- Noom, Inc.

- Polar Electro

Recent Developments

-

In June 2024, Talkspace, a prominent online behavioral healthcare provider, partnered with FitOn, the leading fitness app and digital health & wellness platform. This collaboration aims to provide companies with a comprehensive solution that integrates mental health and physical fitness, highlighting the importance of combining these elements in daily life.

-

In March 2024, FIIT, recognized as the top fitness app in the UK, expanded its services by introducing an innovative, integrated hybrid fitness solution, positioning itself as a pioneer in the market. The FIIT Platform aimed to equip members and partners with the necessary technology and resources to embed fitness routines into the daily lives of individuals globally. The company successfully established partnerships across various sectors, further enhancing its ecosystem. This strategic move aimed to penetrate global gyms, fitness centers, the Build-to-Rent (BTR) residential sector, the hospitality industry, corporate wellness programs, and professional fitness training.

-

In March 2024, Polar Electro partnered with Calm, a leading sleep, meditation, and relaxation application with over 150 million downloads. This alliance highlights the crucial role of mental well-being in achieving optimal sports performance and maintaining overall health. It grants Polar users access to Calm’s comprehensive content, encompassing meditation, mindfulness, and sleep resources. In addition, as a benefit of this collaboration, Polar customers are entitled to a complimentary 3-month subscription to Calm, encouraging them to prioritize their mental health and improve their overall wellbeing.

-

In May 2023, Strava, a leader in subscription-based fitness connectivity, announced its collaboration with Nike. This partnership enabled members to monitor and share their activities, motivations, and community interactions across both platforms.

-

In August 2023, Fitbit, Inc. launched an update for its Fitbit app to provide a comprehensive overview of user health and wellness, emphasizing pertinent metrics. It offers a streamlined three-tab interface, allowing users to conveniently monitor their daily objectives & metrics, access motivational insights & guidance, and review personalized achievement & progress summaries.

Fitness Apps Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 13.92 billion

Revenue forecast in 2033

USD 33.58 billion

Growth rate

CAGR of 13.40% from 2026 to 2033

Actual data

2021 - 2024

Forecast data

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, device, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

MyFitnessPal, Inc.; adidas Group; ASICS Corporation; Google (Alphabet Inc.); Nike, Inc.; Under Armour, Inc.; Azumio, Inc.; Fooducate (acquired by Maple Media LLC); Sweat; Noom, Inc.; Polar Electro

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fitness Apps Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global fitness apps market report based on type, platform, device, and region:

-

Type Outlook (Revenue, USD Million; 2021 - 2033)

-

Exercise & Weight Loss

-

Diet & Nutrition

-

Activity Tracking

-

-

Platform Outlook (Revenue, USD Million; 2021 - 2033)

-

Android

-

iOS

-

Others

-

-

Device Outlook (Revenue, USD Million; 2021 - 2033)

-

Smartphones

-

Tablets

-

Wearable Devices

-

-

Regional Outlook (Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fitness apps market size was estimated at USD 12.12 billion in 2025 and is expected to reach USD 13.92 billion in 2026.

b. The global fitness apps market is expected to grow at a compound annual growth rate of 13.40% from 2026 to 2033 to reach USD 33.58 billion by 2033.

b. Exercise & weight loss segment dominated the fitness app market with a share of 53.69% in 2025. This is attributable to the increasing number of people seeking a health-conscious lifestyle.

b. Some key players operating in the fitness app market include MyFitnessPal, Inc., adidas Group, ASICS Corporation, Google (Alphabet Inc.), Nike, Inc., Under Armour, Inc., Azumio, Inc., Fooducate (acquired by Maple Media LLC), Sweat, Noom, Inc., Polar Electro.

b. Key factors that are driving the fitness app market growth include the presence of large pharma organizations, along with key players from multiple industries, and increasing demand for continuous health assessment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.