- Home

- »

- Healthcare IT

- »

-

Fitness Tracker Market Size & Share, Industry Report, 2030GVR Report cover

![Fitness Tracker Market Size, Share & Trends Report]()

Fitness Tracker Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Smart Watches, Smart Bands, Smart Clothing), By Application, By Wearing Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-291-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fitness Tracker Market Summary

The global fitness tracker market size was estimated at USD 60.9 billion in 2024 and is projected to reach USD 162.8 billion by 2030, growing at a CAGR of 18.0% from 2025 to 2030. The increasing prevalence of chronic diseases such as obesity, diabetes, and heart disease is one of the major drivers of market growth.

Key Market Trends & Insights

- North America dominated the fitness tracker market with the largest revenue share of 41.7% in 2024.

- Asia Pacific, on the other hand, is anticipated to have the highest rate of growth in the regional market from 2025 to 2030.

- Based on wearing type, the hand wear segment led the market with the largest revenue share of 72.3% in 2024.

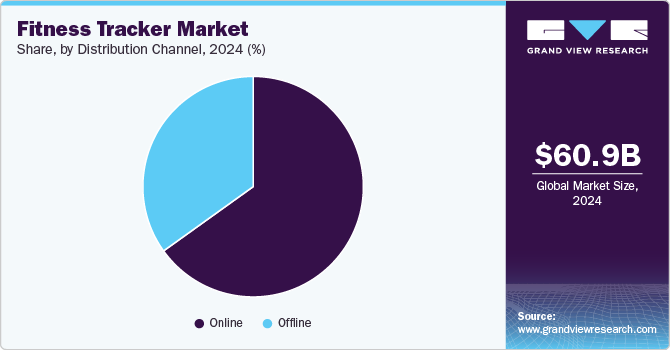

- Based on distribution channel, the online segment led the market with the largest revenue share of 65.1% in 2024.

- Based on application, the running tracking segment led the market with the largest revenue share of 22.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 60.9 Billion

- 2030 Projected Market Size: USD 162.8 Billion

- CAGR (2025-2030): 18.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, in February 2024, according to the World Health Organization (WHO), approximately more than 1 billion people in the globe are obese, which includes 340 million adolescents, 650 million adults, and 39 million children. With the rise of sedentary lifestyles, the incidence of lifestyle-related diseases such as hypertension and diabetes is anticipated to increase, emphasizing the importance of continuous monitoring of physiological parameters. Portable medical devices facilitate healthcare data integration, offering physician’s real-time access and minimizing errors. The growing mortality rates associated with non-communicable diseases further emphasize the need for tailored monitoring and care, leading to a higher demand for fitness trackers. For instance, according to Diabetes UK (The British Diabetic Association), over 5.6 million individuals in the UK are living with diabetes.

Fitness trackers help individuals track their daily physical activity, which helps maintain a healthy lifestyle and reduce the risk of chronic diseases. The growing trend of integrating fitness trackers with smartphones and smartwatches is one of the major trends in the global market. The increasing popularity of fitness apps and the integration of fitness trackers with these apps is driving the market.

Modern consumer preferences are shifting towards more tech-driven and personalized fitness experiences. Consumers seek workout options that align with their busy lifestyles and are performed anywhere, including at home, in parks, or while traveling. For instance, in February 2024, Samsung launched Galaxy Fit 3, a health and fitness tracker, in the Philippines market. Its features offer sleep monitoring, blood oxygen level monitoring, and sleep pattern tracking. It supports over 100 workout modes, including running, rowing machine, elliptical, and pool swim.

The expanding e-commerce sector further stimulates the market, creates a robust distributor network, and facilitates retail partnerships among industry players. The growing trend of using fitness trackers as a part of corporate wellness programs is expected to create opportunities for the global market. For instance, in November 2022, GluCare.Health, a digital therapeutics company, collaborated with Fitbit to integrate advanced health data sets from Fitbit wearables into the company's clinical framework.

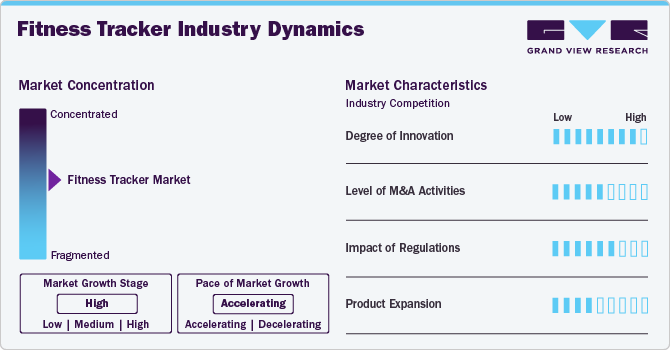

Market Concentration & Characteristics

The fitness tracker industry is characterized by a high degree of innovation owing to dynamic market trends, growing R&D activities, and technological advancements. For instance, in January 2023, Leiden University collaborated with Garmin Ltd. and initiated a 5-year research project to predict depression using the Garmin vívosmart four fitness trackers.

The fitness tracker industry is characterized by a medium level of merger and acquisition (M&A) activity, facilitating access to complementary technologies and expertise to capture a larger market share. For instance, in 2021, Google completed its acquisition of Fitbit, Inc. for USD 2.1 billion. The acquisition has helped Google expand its presence in the wearable devices market.

The fitness tracker industry is navigating a landscape of stringent regulations and standards to ensure these innovative devices' safety, efficacy, and compliance. The U.S. FDA regulatory body directs the difference between a medical device and a smart wearable, including fitness trackers. The FDA has created two categories of intended uses to determine the nature of smart wearables. Moreover, the Health Insurance Portability and Accountability Act (HIPAA) restricts the disclosure of protected health information (PHI).

Several market players are expanding their business by launching new solutions in the market to expand their product portfolio. For instance, in October 2023, Xiaomi introduced the Xiaomi Smart Band 9 Pro, which includes more than 150 sports modes and an integrated GPS for tracking running.

Type Insights

Based on type, the smart watches segment led the market with the largest revenue share of 48.5% in 2024. Modern smartwatches have advanced sensors, including gyroscopes, accelerometers, GPS, electrocardiogram (ECG) capabilities, and heart rate monitors. These technologies precisely track various fitness parameters such as calories burned, heart rate, distance traveled, and sleep quality. Improvements in display quality, battery life, and connectivity options, such as Wi-Fi and Bluetooth, enhance the user experience, making smartwatches more attractive and reliable to consumers. For instance, in July 2024, Samsung Electronics H.K. Company introduced the Galaxy Watch Ultra and Watch7, integrating various innovative AI features to deliver higher functionality and performance for everyday wellness and health management.

The smart bands segment is anticipated to witness at the fastest CAGR over the forecast period. These devices are dedicated to fitness and health tracking. While they lack smartwatches' advanced functionalities and app ecosystems, fitness bands provide precise and reliable fitness data at a more affordable price. They usually have longer battery life, which is less disruptive for users who prefer infrequent charging. In addition, their lightweight and flexible design makes them ideal for continuous use during physical activities. Such factors boost the segment growth.

Application Insights

Based on application, the running tracking segment led the market with the largest revenue share of 22.8% in 2024. Growing adoption and consumer preferences have led to the availability of most of these applications in most fitness trackers available. Fitness trackers record the intake of food and water. While running, these trackers use Bluetooth to alert users to notifications. For instance, the Samsung Galaxy Watch Active2 Under Armour Edition is designed for individuals who want to enhance their running fitness. It offers distinct features that create a connected running experience.

The glucose monitoring segment is anticipated to witness at the fastest CAGR over the forecast period. Market growth is driven by rising awareness of preventive measures for diabetes and the introduction of new products. Diabetes, a widespread and growing global concern, is characterized by the pancreas' inability to produce insulin, leading to elevated blood glucose levels efficiently. For instance, according to the International Diabetes Federation, projections indicate an anticipated rise to 783 million (1 in 8 adults) by 2045.

Wearing Type Insights

Based on wearing type, the hand wear segment led the market with the largest revenue share of 72.3% in 2024. Hand-wear fitness trackers integrate seamlessly with smartphones, allowing users to access real-time data and receive messages, notifications, and calls directly on their wrists. This integration improves user convenience and makes the fitness tracker a part of the broader digital ecosystem, contributing to its market growth. For instance, in April 2023, Xiaomi launched the Mi Band 8 fitness tracker, which monitors heart rate, sleeping pattern, stress, and blood oxygen.

The leg wear segment is anticipated to witness at the fastest CAGR over the forecast period. The rising need for assessing and monitoring health parameters is anticipated to drive the adoption of fitness products integrated with technology, including smart shoes, to promote market growth. For instance, in January 2023, Ajantashoes.com, a shoes & footwear collection, launched a smart shoe that features step tracking, fall Detection, workout tracking, quick call dial, and access to music apps and websites.

Distribution Channel Insights

Based on distribution channel, the online segment led the market with the largest revenue share of 65.1% in 2024 and is anticipated to witness at the fastest CAGR over the forecast period. The rising adoption and penetration of smartphones and internet utilization, along with the increasing accessibility and popularity of e-commerce platforms owing to their high convenience and quick service, is anticipated to boost segment growth over the forecast years. For instance, according to Backlinko, approximately as of March 2024, 4.88 billion people own smartphones.

The offline segment is anticipated to witness at a significant CAGR over the forecast period, owing to the fact that offline stores allow users to examine and analyze the product before buying it. Furthermore, offline stores are beneficial in providing immediate assistance from skilled personnel with product knowledge, which helps drive product sales with the help of this distribution channel. Offline channels offer unique opportunities for brands to engage with consumers through product samples, live demonstrations, and special promotions.

Regional Insights

North America dominated the fitness tracker market with the largest revenue share of 41.7% in 2024. Moreover, rising health issues related to sedentary lifestyles, the advent of innovative products by key market players, and the growing penetration of smartphones and the internet in North America are anticipated to drive market growth. For instance, according to the Centers for Disease Control and Prevention, in 23 states of the U.S., more than one in three adults (35%) has obesity.

U.S. Fitness Tracker Market Trends

The fitness tracker market in the U.S. accounted for the largest market share in North America in 2024. Various factors, such as growth in coverage networks, rapid usage of smartphones, rise in prevalence of chronic diseases such as diabetes, and increase in the geriatric population, drive the adoption of fitness trackers in the U.S. For instance, according to SingleCare Administrators, 34.2 million adults have diabetes in the U.S., 10.5% of the population.

Europe Fitness Tracker Market Trends

The fitness tracker market in Europe is anticipated to register at a considerable CAGR during the forecast period. The rising prevalence of chronic diseases, such as heart disease, diabetes, and obesity, is one of the primary drivers of the market growth in this region. For instance, according to WHO, cardiovascular diseases (CVDs) are the leading cause of disability and premature mortality in the European Region, accounting for more than 42.5% of all fatalities annually.

The Germany fitness tracker market is anticipated to register at a considerable CAGR during the forecast period. Factors such as rising demand for smartwatches among athletes and fitness enthusiasts and growing adoption of advanced activity monitors to track general health fuel the fitness tracker industry in the country.

The fitness tracker market in UK is anticipated to register at a considerable CAGR during the forecast period. Factors such as growing awareness regarding health and the rising prevalence of obesity in the country fuel the market growth. For instance,

according to the UK Government, approximately 63.8% of adults in England 18 years and above were living with obesity.

Asia Pacific Fitness Tracker Market Trends

The fitness tracker market in Asia Pacific is anticipated to register at the fastest CAGR over the forecast period. Factors such as rising healthcare expenditure, increasing incidence of obesity, and a growing number of athletes motivate governments and private organizations to develop new models for fitness regimes to propel market growth. Furthermore, the high adoption of fitness trackers in the working-class population due to steady economic expansion, technological advancements, and population growth drives the market growth.

The Japan fitness tracker market is anticipated to register at a considerable CAGR during the forecast period.The key drivers, such as changes in the standard of living, an increase in the number of fitness enthusiasts, and a rise in fitness awareness among the population, boost market growth. For instance, in May 2024, Huawei, a Chinese company , introduced a wearables lineup, including smartwatches with upgraded health and fitness features.

Latin America Fitness Tracker Market Trends

The fitness tracker market in Latin America is anticipated to witness at a steady CAGR during the forecast period. Strategic partnerships between app developers & fitness equipment manufacturers and favorable government initiatives promoting physical activity have bolstered the market’s expansion in Latin America.

The Brazil fitness tracker market is anticipated to register at a considerable CAGR during the forecast period. Favorable government initiatives and rising funding fuel the country's market growth. This funding encourages entrepreneurs and developers to create user-friendly, localized fitness trackers that cater to diverse demographics and health needs.

Middle East & Africa Fitness Tracker Market Trends

The fitness tracker market in the Middle East and Africa is expected to grow at a lucrative CAGR during the forecast period. As consumers become more health-conscious, the demand for devices monitoring vital signs and tracking fitness levels has surged. Wearable devices, such as smartwatches, smartbands, and advanced health monitoring gadgets, provide users with real-time health data, empowering them to make informed decisions about their health and wellness. Thus, such benefits offered by fitness trackers fuel the market growth.

The UAE fitness tracker market is anticipated to register at a considerable CAGR during the forecast period. Rising product launches and awareness among people regarding fitness drive the country's market growth. For instance, in December 2023, Endefo, a Dubai-based electronic company, launched smartwatches for India's market, including Enfit NEO PRO and Enfit NEO with advanced health monitoring capabilities.

Key Fitness Tracker Company Insights

Key participants in the fitness tracker industry are focusing on developing innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Fitness Tracker Companies:

The following are the leading companies in the fitness tracker market. These companies collectively hold the largest market share and dictate industry trends.

- Apple, Inc.

- Google (Fitbit, Inc.)

- Garmin Ltd.

- HYPE

- SAMSUNG

- Fossil Group

- Huawei Technologies Co., Ltd.

Recent Developments

-

In September 2024, Masimo, a medical innovator, partnered with Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, to develop a next-generation smartwatch for OEMs building Wear OS by Google smartwatches.

-

In July 2024, KORE, a Georgia-based IoT company, collaborated with mCare Digital, a software company, and launched mCareWatch 241, a smartwatch for virtual patient monitoring. It enables wearers to obtain emergency assistance, GPS tracking, call capabilities, a heart rate monitor, reminders, fall detection, speed dialing, a geo-fence alarm, a pedometer, and non-movement detection.

Fitness Tracker Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 71.2 billion

Revenue forecast in 2030

USD 162.8 billion

Growth rate

CAGR of 18.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, wearing type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Apple, Inc.; Google (Fitbit, Inc.); Garmin Ltd.; HYPE; SAMSUNG; Fossil Group; Huawei Technologies Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fitness Tracker Market Report Segmentation:

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global fitness tracker market report based on the type, application, wearing type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Watches

-

Smart Bands

-

Smart Clothing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Heart Rate Tracking

-

Sleep Monitoring

-

Glucose Monitoring

-

Sports

-

Running Tracking

-

Cycling Tracking

-

Others

-

-

Wearing Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hand Wear

-

Leg Wear

-

Head Wear

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fitness tracker market size was estimated at USD 60.9 billion in 2024 and is expected to reach USD 71.2 billion in 2025.

b. The global fitness tracker market is expected to grow at a compound annual growth rate of 18.0% from 2025 to 2030 to reach USD 162.8 billion by 2030.

b. The smartwatch segment dominated the fitness tracker market in 2024 accounting for the largest revenue share of over 48.5% owing to the high demand for smartwatches.

b. Some of the key players in the fitness tracker market are Apple, Inc., Google (Fitbit, Inc.), Garmin Ltd., HYPE, SAMSUNG, Fossil Group, Huawei Technologies Co., Ltd.

b. The increasing prevalence of chronic diseases such as obesity, diabetes, and heart disease are one of the major drivers of the fitness tracker market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.