- Home

- »

- Automotive & Transportation

- »

-

Fixed-wing Air Ambulance Service Market, Industry Report, 2018-2025GVR Report cover

![Fixed-wing Air Ambulance Service Market Size, Share & Trends Report]()

Fixed-wing Air Ambulance Service Market Size, Share & Trends Analysis Report By Service (Medical Escort Service, Medical Evacuation & Repatriation), By Service Model, By Region, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-586-1

- Number of Report Pages: 134

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2018 - 2025

- Industry: Technology

Report Overview

The global fixed-wing air ambulance service market size was valued at USD 977.6 million in 2017. It is anticipated to rise at a CAGR of 9.4% during the forecast period. These ambulances are used to offer emergency medical transport facilities for enabling patients to travel to-and-from healthcare facilities. The market is anticipated to grow rapidly on account of its surging demand in emerging economies such as China and India. Increasing per capita healthcare expenditure is playing an instrumental role in driving the overall market.

Growing demand for emergency medical transport and emergency medical services (EMS) is encouraging investments in the market. Government initiatives to invest in public healthcare reforms have been a key factor in promoting investments in the emergency medical transport sector, thus fostering the growth of the market.

Advancements in technology are leading to introduction of mobile applications for booking these services, seeking primary care advice, and locating people in need of help. Currently, they are expensive as the market is less regulated. However, various governments are focusing on regulating them for increasing their affordability for the masses.

Market participants are pouring greater funds into effective flight crew training. Adopting state-of-the-art technology is another key factor working in favor of the market. For instance, in May 2018, The British Columbia Ambulance Service invested in enhancing its air ambulance program by using night vision technology to improve its operation in low-light conditions.

The market is witnessing a surge in demand for long-distance patient transport. Fixed-wing air ambulance service is used widely for inter-country patient transport. Incumbents of the market are focusing on providing safe medical transportation facilities to customers. Investing in R & D initiatives, indulging in mergers & acquisitions, and forming partnerships are the key growth strategies being adopted by market players.

Service Insights

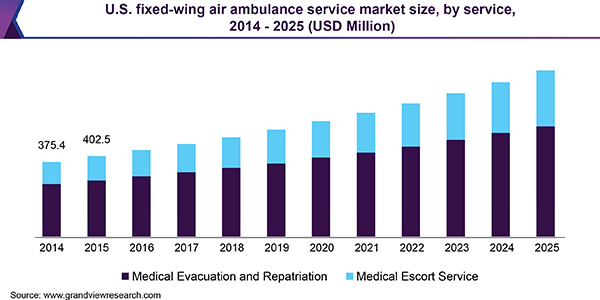

The service segment can be further categorized into medical evacuation & repatriation and medical escort services. Medical evacuation includes facilities pertaining to the transportation of patients who need to be evacuated to the nearest qualified medical facility. Medical repatriation refers to costs and resources associated with providing medical treatment to travelers and transporting the remains of patients from one country to another.

Medical escort services refer to non-emergency facilities provided by medical transport companies with the help of onboard medical escorts. This segment is poised to witness the fastest growth in the market during the forecast period. The growth of the segment can be attributed to growing demand for medical professionals such as nurses, physicians, and paramedics in the emergency medical transport industry.

The demand for medical evacuation and repatriation is likely to witness considerable growth over the coming years owing to need to provide emergency medical aid to patients suffering from life-threatening health conditions, especially when treatment is unavailable at the nearest facility and patient needs to be moved to a sophisticated facility.

Service Model Insights

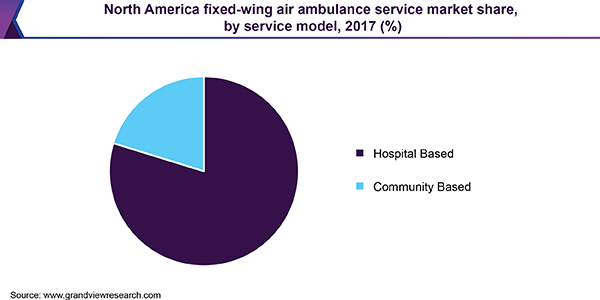

On the basis of service model, the fixed-wing air ambulance service market has been bifurcated into community-based and hospital-based. In the former segment, an independent operator has a base set in the community and offers emergency medical aid to different localities. In the hospital-based segment, a hospital generally offers medical teams and partners with an aircraft provider for aircraft crew, pilots, and mechanics.

The community-based segment is estimated to a higher CAGR in the market during the forecast period. Corporate social responsibility (CSR) activities have become an integral part of differentiation strategies adopted by companies. CSR initiatives are leading to increased donations and funding made by different organizations in the healthcare sector. There has been a significant increase in the number of charity services funded solely by donators. Such initiatives are projected to drive the community-based segment.

Regional Insights

In 2017, North America was the largest revenue contributing region owing to presence of a large number of players followed by Europe. Asia Pacific is an emerging region and is expected to witness significant growth over the coming years. Favorable government initiatives pertaining to EMS are bolstering the growth of the market in APAC.

The market in Latin America is in nascent stage of growth. Healthcare spending in the region slowed in the year 2014. However, governments in the region are focusing on increasing their healthcare spending in order to improve public healthcare systems.

Key Companies & Market Share Insights

The market is characterized by presence of several private and public players. Companies operate independently or in partnership with service and service model providers. The major industry participants include American Medical Response (AMR); Hope Medflight Asia Pte Ltd; Reva, Inc.; and FAI rent-a-jet AG.

The market is fragmented due to presence of a large number of small and big players. Partnerships and mergers & acquisitions are the key strategies adopted by industry players to gain a competitive edge in emerging countries and to enhance their technological capabilities. The market is anticipated to witness increased penetration of third-party service providers in the coming years.

Fixed-wing Air Ambulance Service Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.27 billion

Revenue forecast in 2025

USD 1.99 billion

Growth Rate

CAGR of 9.4% from 2018 to 2025

Base year for estimation

2017

Historical data

2014 - 2016

Forecast period

2018 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2018 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, service model, and region.

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Australia; China; Hong Kong; India; Indonesia; Japan; Malaysia; Philippines; Singapore; Thailand; Brazil; Mexico; Saudi Arabia; South Africa

Key companies profiled

American Medical Response (AMR); Hope Medflight Asia Pte Ltd; Reva, Inc.; and FAI rent-a-jet AG.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2025. For the purpose of this study, Grand View Research has segmented the global fixed-wing air ambulance service market report on the basis of service, service model, and region.

-

Service Outlook (Revenue, USD Million, 2014 - 2025)

-

Medical Evacuation and Repatriation

-

Medical Escort Service

-

-

Service Model Outlook (Revenue, USD Million, 2014 - 2025)

-

Community-Based

-

Hospital-Based

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

-

Asia Pacific

-

Australia

-

China

-

Hong Kong

-

India

-

Indonesia

-

Japan

-

Malaysia

-

Philippines

-

Singapore

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."