- Home

- »

- Sensors & Controls

- »

-

Flame Detector Market Size & Share Analysis Report, 2030GVR Report cover

![Flame Detector Market Size, Share & Trends Report]()

Flame Detector Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Fixed, Portable), By Technology (UV, IR, MSIR), By End-use (Oil & Gas, General Industry), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-124-6

- Number of Report Pages: 116

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

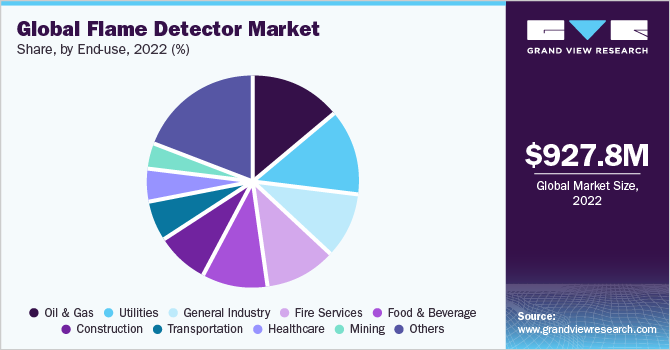

The global flame detector market size was estimated at USD 927.8 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. A flame detector uses sensors to detect and respond to the presence of a flame. These detectors are used to identify smoke and smokeless liquid that can initiate open fire. The rising adoption of flame detectors in industries, such as oil & gas, manufacturing, processing, transportation, and mining, owing to the growing emphasis on workplace safety and stringent government regulations related to fire safety is driving the market growth. Inaddition, the rising integration of the Internet of Things (IoT), big data, and advancements in flame-sensing technology are some of the major trends in the market.

The increasing demand for smart or intelligent fixed and portable flame detectors to deliver fast response times & high accuracy and the ability to detect flames in less time is propelling the growth of the market. For instance, in July 2021, the Korea Research Institute of Standards and Science (KRISS) and HansunST, a KRISS-affiliated company, unveiled an intelligent fire detection system capable of detecting a fire within 10 seconds of its start. The system distinguishes between actual fires and fires used by humans. This intelligent detector has a remarkable ability to accurately sense even a small flame as tiny as 3 centimeters in size in the latent phase, promptly activating an alarm or sending an alert message via a smartphone application. Flame detectors can also detect fire according to the air movement and air temperature.

The flame detectors use Infrared (IR) or Ultraviolet (UV) technology to detect flames in less than a second. The flame detector responds to the detection of a flame according to its installation. For instance, these detectors can deactivate the fuel line, sound an alarm, or activate a fire suppression system. Thus, these features and benefits of flame detectors will help boost the market growth. Increasing demand for advanced technology-based flame detectors is further boosting the market’s growth. Two common and most popular optical flame detectors are a multi-spectrum infrared (MSIR) flame detector and a combination ultraviolet/infrared (UV/IR) flame detector. Unlike simple IR or UV detectors, MSIR and UV/IR flame detectors are sensitive to over one band on the energy spectrum and thus are less prone to produce a false alarm.

Both technologies perform effectively in indoor as well as outdoor environments and deliver a reasonably fast response time. Factors, such as high installation and maintenance costs, are some drawbacks of flame detection technologies that are expected to restrain the growth of the market. For instance, IR flame detectors are susceptible to producing false alarms under certain conditions of motion, heat, and gas emissions. The UV flame detectors are not ideal for environments that are dusty or contain airborne oil droplets. In addition, UV/IR flame detectors have certain limitations. They are not suitable for detecting fires that do not involve carbon combustion, and they only identify fires that emit both UV and IR radiation simultaneously rather than independently.

COVID-19 Insights

The global economy and the flame detector sector growth have been adversely impacted by the COVID-19 pandemic. The pandemic has caused significant economic downturns and disruptions in the supply chain across many countries. To prevent the spread of the virus, governments worldwide implemented complete lockdowns, resulting in industry shutdowns and subsequent disruptions in the supply chain. The lockdowns also caused a shortage of labor and materials worldwide, leading to delays in the manufacturing and distribution of flame detectors. However, the increasing adoption of advanced technologies in industrial settings and increasing investment in the development of industrial and commercial sectors post-COVID-19 is expected to drive the market’s growth.

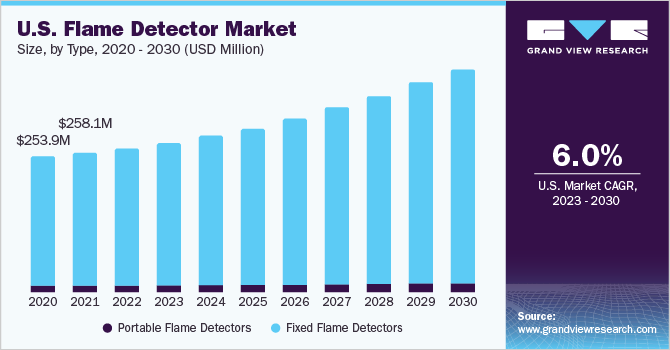

Type Insights

The fixed flame detector segment led the market and accounted for more than 94.0% share of the global revenue in 2022. A fixed flame detector is a stationary device designed to detect the presence of fires or flames in a specific area. These detectors are commonly used in chemical plants, gas turbines, aircraft hangers, and hydrogen storage and test facilities where constant fire monitoring is essential for safety and security. In addition, they also provide detection for several applications in the petrochemical and oil & gas industries, including production and drilling platforms, refineries, LNG/LPG processing and storage facilities, and many others.

The portable flame detector segment is anticipated to grow at a significant CAGR during the forecast period. A portable flame detector is a handheld device used to detect the presence of fires or flames. This detector allows the detection of UV flame in the field. The demand for portable flame detector devices is expected to increase in fire service applications. Moreover, the growing demand for portable devices from firefighters, emergency responders, and safety personnel to quickly detect flames or potential fire sources in different environments is driving the segment’s growth.

Technology Insights

The ultraviolet/infrared (UV/IR) flame detectors segment dominated the market and accounted for more than 41.0% share of the global revenue in 2022. A UV/IR flame detector consists of a UV and IR sensor. The UV sensors are responsible for detecting UV radiation radiating from flames, while the IR sensors monitor the infrared emissions. The adoption of UV/IR flame detectors is increasing in several industries as they provide a rapid response time and increased false alarm immunity against radiation sources for reliable protection.

The MSIRflame detectors segment is expected to grow at a significant CAGR over the forecast period. MSIR flame detectors employ multiple infrared wavelengths to differentiate flame-related radiation from other non-flame sources.They have the widest & longest detection distances, improved false alarm immunity, and are suitable for both indoor and outdoor applications. This technology is ideal for detecting fires from flammable substances, such as n-heptane, alcohol, jet fuels, hydrocarbons, and gasoline.

End-use Insights

The oil & gas segment accounted for over 14.0% share of the global revenue in 2022 and is expected to grow at the highest CAGR over the forecast period. Across various settings, ranging from gas stations to oil rigs, the oil & gas sector faces numerous fire hazards. Storage tanks containing flammable materials are vulnerable to vapor leakage, which could potentially lead to fire ignition. Loading and unloading these flammable substances is highly dangerous. Thus, increasing demand for advanced flame detection systems in the oil & gas industry to detect leaks to enable rapid response and reduce the risk of fire incidents is driving the segment’s growth. Furthermore, the rising product adoption in floating roof tanks, fixed roof tanks, oil & gas rigs, gas stations, pumping stations, and LNG & LPG facilities is boosting the segment growth.

The general industry segment is expected to grow at a significant CAGR over the forecast period. The general industry segment is further divided into automotive, electrical & electronics, textile, pulp & paper, metal manufacturing, chemical, and others. In these industries, there are numerous situations where risks of fire ignition are high. For instance, in the automobile manufacturing process, a variety of flammable gases are present. Furthermore, engine test benches can reach extremely high temperatures. Also, hydrogen-powered vehicles have the risk of fire ignition both during parking and refueling. Thus, increasing the installation of suitable flame detection systems in the automotive industry as a preventive measure against fires and the resulting damages is boosting the segment’s growth.

Regional Insights

North American dominated the market and accounted for more than a 35.0% share of the global revenue in 2022. The region is expected to grow at a significant CAGR during the forecast period. The presence of leading manufacturers, such as Honeywell International Inc., MSA Safety Inc., Teledyne Gas & Flame Detection, Emerson Electric Co., and Johnson Controls, is a major factor behind the growth of the regional market. In addition, growing technology advancements, rapid economic growth, and a growing market for industries, such as oil & gas, automotive, construction, and fire services, are further propelling the market’s growth.

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The growing demand for flame detectors in the region, due to infrastructure expansion, rapid industrialization, and increasing awareness about worker & fire safety measures across various industries is driving the market’s growth. Furthermore, stringent safety regulations by the government and a focus on preventing fire accidents and reducing risks are fueling the adoption of advanced flame detection systems in the region. In addition, the presence of local and global product manufacturers, suppliers, and distributors in the region supports the market growth.

Key Companies & Market Share Insights

The market players are continuously working towardnew product development and up-gradation of their existing product portfolio. For instance, in June 2023, Teledyne Gas and Flame Detection introduced the Spyglass SG50-F line of flame detectors to enhance the protection of individuals and valuable assets, simplifying safety measures. Spyglass SG50-F flame detectors work by analyzing the radiation absorption resulting from gases in the atmosphere and relating it to background atmospheric absorption. These detectors feature UV-IR and triple infrared (IR3) options for a range of applications. The IR3 version is specifically developed to detect hydrocarbons for applications, such as oil & gas platforms, refineries, petrochemical plants, floating production storage & offloading systems, marine facilities, turbine enclosures, and compressor stations.

In addition, in August 2022, Honeywell International Inc. announced the release of the Morley MAx fire detection and alarm system to improve the safety of buildings and residents. The system is equipped with an innovative 7-inch touchscreen panel, delivering an ergonomic and highly intuitive user interface. The Morley MAx is designed for operation in various industries, such as healthcare, education, residential, commercial, and hospitality. Some of the prominent players in the global flame detector market include:

-

Honeywell International Inc.

-

Drägerwerk AG & Co. KGaA

-

Siemens

-

REZONTECH CO., LTD.

-

Teledyne Gas and Flame Detection

-

MSA Safety Incorporated

-

Det-Tronics

-

Johnson Controls

-

Emerson Electric Co.

-

Spectrex

Flame Detector Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 976.3 million

Revenue forecast in 2030

USD 1,602.5 million

Growth rate

CAGR of 7.3% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; France; Germany; China; Japan; South Korea; Australia; New Zealand; Indonesia; Thailand; Malaysia; Singapore; Taiwan; Hong Kong; Philippines; Vietnam; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

Honeywell International Inc.; Drägerwerk AG & Co. KGaA; Siemens, Rezontech Co., Ltd.; Teledyne Gas & Flame Detection; MSA Safety Inc.; Det-Tronics; Johnson Controls; Emerson Electric Co.; Spectrex

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

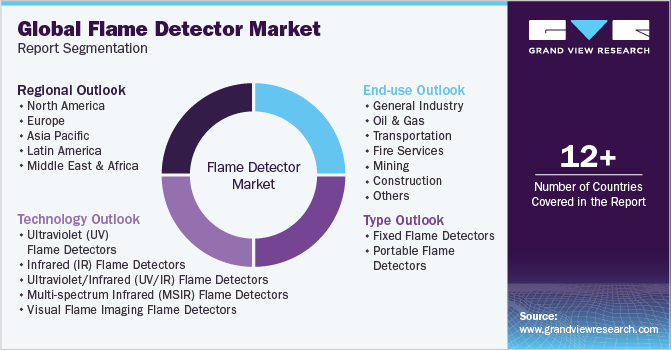

Global Flame Detector Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global flame detector market report based on type, technology, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Fixed Flame Detectors

-

Portable Flame Detectors

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Ultraviolet (UV) Flame Detectors

-

Infrared (IR) Flame Detectors

-

Ultraviolet/Infrared (UV/IR) Flame Detectors

-

Multi-spectrum Infrared (MSIR) Flame Detectors

-

Visual Flame Imaging Flame Detectors

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

General Industry

-

Automotive

-

Electrical & Electronics

-

Textile

-

Pulp & Paper

-

Metal Manufacturing

-

Chemicals

-

Others (Retail, Corporate, Others)

-

-

Oil & Gas

-

Upstream

-

Downstream

-

-

Transportation

-

Railway

-

Maritime

-

Aviation

-

-

Fire Services

-

Firefighters

-

Ambulance

-

Police

-

Defense

-

-

Mining

-

Construction

-

Utilities

-

Government

-

Healthcare

-

Food & Beverage

-

Others (HVACR Industry, MRO (Maintenance, Repairing, & Operations))

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

New Zealand

-

Indonesia

-

Thailand

-

Malaysia

-

Singapore

-

Taiwan

-

Hong Kong

-

Philippines

-

Vietnam

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flame detector market size was estimated at USD 927.8 million in 2022 and is expected to reach USD 976.3 million in 2023.

b. The global flame detector market is expected to grow at a compound annual growth rate of 7.3% from 2023 to 2030 to reach USD 1,602.5 million by 2030.

b. The fixed flame detector segment dominated the component segment in 2022. The growing adoption of fixed flame detectors in chemical plants, gas turbines, aircraft hangers, and hydrogen storage and test facilities drives the segment’s growth.

b. Some key players operating in the flame detector market include Honeywell International Inc., Drägerwerk AG & Co. KGaA, Siemens, REZONTECH CO., LTD., Teledyne Gas and Flame Detection, MSA Safety Incorporated, Det-Tronics, Johnson Controls, Emerson Electric Co., and Spectrex.

b. The key drivers attributed to the market expansion include the rising adoption of flame detectors in industries such as oil and gas, manufacturing, processing, transportation, and mining.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.