- Home

- »

- Specialty Polymers

- »

-

Flame Resistant Fabrics Market Size & Share Report, 2030GVR Report cover

![Flame Resistant Fabrics Market Size, Share & Trends Report]()

Flame Resistant Fabrics Market (2024 - 2030) Size, Share & Trends Analysis Report By Fiber Type (Aramid, Modacrylic), By End-use (Military, Firefighting), By Material Type (Treated, Inherent), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-260-3

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flame Resistant Fabric Market Summary

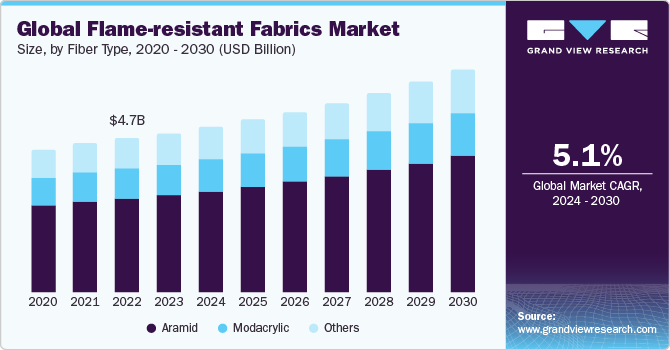

The global flame resistant fabrics market size was estimated at USD 4.91 billion in 2023 and is projected to reach USD 6.89 billion by 2030, growing at a CAGR of 5.1% from 2024 to 2030. The growing concerns related to employee safety among various end use industries, coupled with stringent regulations regarding work safety by governments in developed countries, such as the U.S., Canada, the UK, France, Italy, and Germany, are expected to drive market growth over the forecast period.

Key Market Trends & Insights

- Asia Pacific flame-resistant fabrics market accounted for a revenue share of 34.1% in 2023.

- By fibre type, the aramid fibers segment accounted for the highest share of over 60.8% of the global revenue in 2023.

- By end use, the industrial safety segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.91 Billion

- 2030 Projected Market Size: USD 6.89 Billion

- CAGR (2024-2030): 5.1%

- Asia Pacific: Largest market in 2023

The flame-resistant fabric is commonly used in military uniforms, combat equipment, tents, sleeping bags, and other equipment used to protect individuals from fire risks during combat operations, training, and emergencies.

The rising geopolitical tensions in North Korea and the Middle East are expected to drive demand for flame-resistant fabrics over the forecast period. Prominent players in the industry are adopting various strategies, such as operational capacity expansions, joint ventures, partnerships, new product developments, mergers & acquisitions, and research and development, to gain a competitive advantage. These players have undertaken industry expansion initiatives to increase their operational capacity.

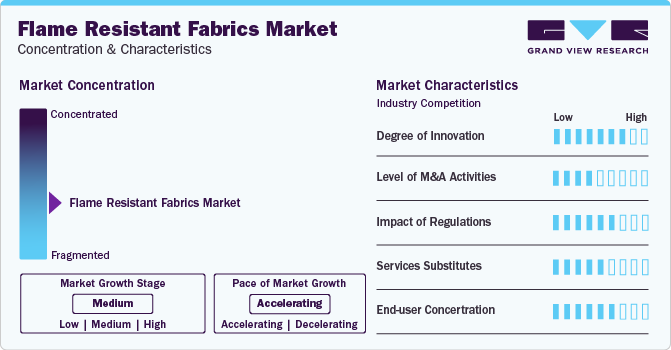

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of its growth is accelerating. The global market is fragmented owing to the presence of several suppliers and manufacturers that are based in China, the U.S., the UK, Canada, and South Korea, as well as in other emerging economies such as India. These countries have been major contributors to the overall market growth owing to the increasing R&D activities related to these fabrics undertaken by multinational corporations, research institutes, and manufacturers based in these countries.

Flame resistant fabrics are a crucial part of any industrial safety, firefighting, and military; thus, regulations, guidelines, and standards are in place to eliminate death, injury, property, and economic loss due to fire, electrical, and related hazards. Furthermore, countries, such as the UK, the U.S., and Japan require that all clothing for women and children, as well as clothing for the elderly and disabled, must state that it "passed flame resistance tests".

The threat of substitutes is expected to remain medium. The presence of internal substitutes including polyester, nylon, modacrylic, and aramid to fire-resistant protective clothing poses a higher threat of substitution. However, high investments and complex manufacturing processes are expected to lower the threat.

Fiber Type Insights

The aramid fibers segment accounted for the highest share of over 60.8% of the global revenue in 2023 and is expected to witness significant growth over the forecast period. This growth is attributed to the superior strength and heat-resistant properties offered by aramid fibers. These fibers offer comfort and flexibility and, thus, find application in various end-use industries, such as mining, oil & gas, and chemical manufacturing, for the protection of workers.

The modacrylic fibers segment is anticipated to grow at a significant rate over the forecast period. Modacrylic fibers are inherently flame-resistant and can be easily blended with lyocell, aramid, or polyamide-imide fibers. Moreover, these fibers are highly durable and not prone to wrinkling. In addition, these fibers exhibit high chemical and solvent resistance. Hence, they are used in lightweight home furnishing goods applications.

End-use Insights

The industrial safety segment dominated the market in 2023 and is expected to grow at the fastest rate from 2024 to 2030. The use of flame-resistant clothing serves as a protective measure against fire hazards and helps minimize the risk of fatal injuries. The adoption of fire safety measures in the manufacturing industry across sectors, such as oil & gas, automotive, and utility, coupled with mandatory regulations about workplace safety has remained an important factor in driving the product demand in the industrial sector.

Military personnel are often exposed to the rise of thermal explosions from explosive devices, such as artillery and grenades. These fibers protect military personnel from the risk of fatal fire injuries caused by intense heat being generated during the explosions. To meet the strict standards set by the federal government, military personnel need to have access to a range of high-quality, flame-resistant clothing options. As military expenditure increases for research, development, and equipment acquisition, the demand for these fabrics is expected to rise in the future.

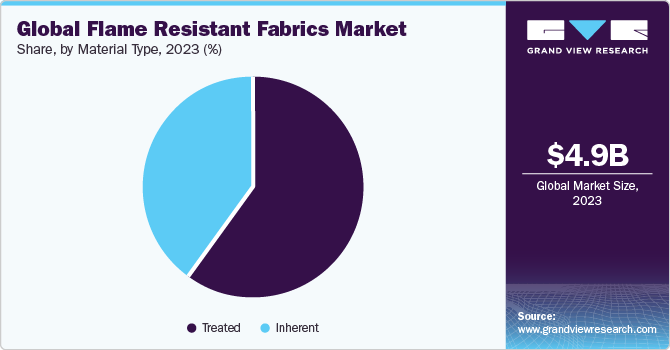

Material Type Insights

The treated material type segment dominated the market in 2023 and is expected to witness significant growth over the forecast period. Treated flame-retardant fabric is a type of fabric that has been chemically treated to increase its flame resistance. These fabrics are applied with a flame-retardant chemical during the fiber-forming process to make them flame-resistant. These fabrics are specifically designed to prevent or slow down the spread of flames, reducing the risk of fire accidents and offering additional protection to end-users. Hence, with the growth in the oil & gas and petroleum industries, the demand for fame-resistant fabrics made of treated material is anticipated to remain high.

The inherent material type segment is anticipated to grow at a significant rate from 2024 to 2030. Inherent flame-resistant fabrics possess the ability to resist flames due to their chemical composition. Aramid fibers and modacrylic fibers are prime examples of such fabrics, as their structure is naturally non-combustible, making them highly resistant to heat as compared to treated fibers. Inherent flame-resistant fibers provide long-lasting protection, as flame-resistant properties are inherent in the fabric and cannot be washed out or degraded over time. These factors are anticipated to fuel the demand for inherent flame resistance fabrics.

Regional Insights

The flame-resistant fabrics market in North America is expected to witness rapid growth in the future. The chemical and oil & gas industries in North America have witnessed growth due to increasing demand for chemicals in end-use industries, such as plastics, petroleum products, cosmetics, and food processing. In oil & gas and chemical processing facilities, the chance of fire occurrence is high due to the presence of flammable chemicals and gases. Hence, field workers are required to have equipment made of flame-resistant fabrics, thereby increasing the product demand.

U.S. Flame Resistant Fabric Market Trends

The U.S. flame-resistant fabrics market accounted for the largest share of 79.6% in North America in 2023. Being one of the most technologically advanced militaries across the globe, the U.S. has been continuously spending to acquire new equipment to give adequate protection to its military personnel. Hence, with such high defense spending, the demand for equipment made of flame-resistant fabric is anticipated to grow in the U.S.

The flame-resistant fabric market in Canada is expected to grow at a CAGR of 4.8% from 2024 to 2030. Canada is expected to witness a strong surge in demand for multi-family housing compared to single-family housing. With an expansion of the residential construction sector, the demand for utility sector services, such as natural gas supply and electricity supply, is rising, which is anticipated to create the need for flame resistant protection for enhancing worker safety, thereby fueling the market growth.

Asia Pacific Flame Resistant Fabric Market Trends

The Asia Pacific flame-resistant fabrics marketaccounted for a revenue share of 34.1% in 2023 owing to factors, such as low production costs and availability of cheap labor that attract multinational companies to set up their production facilities in developing countries, including China and India. However, these economies have experienced a significant increase in injuries and fatalities across industries due to a lack of superior-quality protective gear. This further leads to high compensation costs for employers in the long term. These trends are anticipated to accelerate the expansion of the flame-resistant fabrics sector in the region.

The flame-resistant fabrics market in India is expected to grow at a CAGR of 5.1% from 2024 to 2030. Favorable government initiatives, such as "Make in India", to promote domestic production have encouraged investments in the chemical, mining, and pharmaceutical industries. Stringent product testing methods and compliance with government standards in these industries are expected to drive the demand for fire resistant protective wear industry.

Europe Flame Resistant Fabric Market Trends

The Europe flame-resistant fabrics market is anticipated to grow at a significant rate from 2024 to 2030. Flame-resistant fabric is used to manufacture the equipment used to protect military personnel from explosions and critical fire burns. Hence, the ongoing Russia-Ukraine war has been propelling the defense sector to purchase new equipment, thereby boosting the product demand in Europe.

The flame-resistant fabrics market in Germany accounted for the highest revenue share of 24.4% in Europe in 2023. The surged economic restructuring by government sanctions is expected to contribute to the growth of the oil & gas, chemicals, and utility industries in Germany. This is anticipated to fuel the demand for protective wear for workers in various industries owing to rising concerns related to their safety.

The UK flame-resistant fabric market is anticipated to grow at a CAGR of 4.8% from 2024 to 2030. Businesses based in the UK emphasize the presence of domestic supply chains of raw materials that have increased the number of manufacturers across the country, following Brexit. A favorable legal and regulatory environment, coupled with the formulation of a coherent industrial strategy in the UK, is expected to drive growth of the industrial sector. This is anticipated to contribute to the demand for flame-resistant protective wear in new industrial setups, thereby leading to market growth.

Central & South America Flame Resistant Fabric Market Trends

The Central & South America flame-resistant fabrics market is expected to witness significant growth over the coming years owing to the flourishing oil & gas, utility, and metallurgy industries in the region. This surge is likely to create demand for protective wear and parallelly increase the product demand.

The flame-resistant fabrics market in Brazil is expected to grow at a CAGR of 4.2% from 2024 to 2030. Frequent occurrence of fire breakouts due to the drier climate and changes in land use boost the growth of firefighting industries and further increase the requirement for flame-resistant fabrics used in protective wear.

Middle East & Africa Flame Resistant Fabric Market Trends

The Middle East & Africa flame-resistant fabrics market is anticipated to grow at a significant rate over the forecast period. The region has witnessed an expansion in the oil & and gas sector, due to the presence of a high amount of crude oil & and liquefied natural gas (LNG) resources and the use of advanced technologies to improve production & and refining capability. Oil & gas refineries entail the risk of flash fires, hence there is a need to protect oil rig workers against fatal burn injuries. Hence, the demand for flame-resistant fabric is growing, due to the expansion of the oil & gas industry in the region.

The flame-resistant fabric market in Saudi Arabia accounted for the highest revenue share of 28.4% in Middle East & Africa in 2023. Saudi Arabia invested heavily in infrastructure projects, such as King Salman Energy Park, NEOM, and others. Wall coverings made with flame-resistant fabrics help improve fire safety by preventing flames from spreading in case of a fire accident. Hence, the demand for flame-resistant fabric is anticipated to grow over the forecast period, due to the growth of the construction industry.

Key Flame Resistant Fabrics Company Insights

Some of the key players operating in the industry include DuPont, TenCate Protective Fabrics, Nam Liong Global Corporation, and Klopman International.

-

DuPont is a U.S.-based chemical manufacturer and supplier. The company's product line includes adhesives, advanced printing solutions, construction materials, consumer products, electronics & industrial, fabrics, fibers & nonwovens, healthcare solutions, industrial films, packaging materials & solutions, personal protective equipment, solar/photovoltaic solutions, and water solutions

-

TenCate Protective Fabrics manufactures inherently fire-resistant textiles for the military, firefighters, heavy industries, energy, and oil & gas industries. Furthermore, the company operates three offices across North America, Europe, and Asia Pacific

LEVITEX, U-Long High-Tech Textile Co., Ltd., and Baltex are some of the emerging participants in flame resistant fabrics industry.

-

Baltex designs, manufactures and supplies a diverse range of high-performance technical textiles that are tailored to meet the requirements of various demanding applications. It delivers advanced materials to the aerospace, military, medical, composites, and automotive industries. The product range of the company includes spacer fabrics, net & mesh fabrics, eco fabrics, elastic fabrics, solid knitted fabrics, aramid fabrics, etc.

-

LEVITEX provides an extensive product range, which encompasses flame-retardant fabrics, workwear fabrics, camouflage fabrics, and multi-functional fabrics for use in firefighting, metal smelting, oil extraction, and chemical protection applications

Key Flame Resistant Fabrics Companies:

The following are the leading companies in the flame-resistant fabrics market. These companies collectively hold the largest market share and dictate industry trends.

- Nam Liong Global Corporation

- LEVITEX

- U-Long High-Tech Textile Co., Ltd.

- XM Textiles, Henan Zhuoer Protective Technology Co., Ltd.

- Baltex

- SIKOR-TEX

- SINTEX, Inc.

- Klopman International, Xinxiang Yulong Textile Co., Ltd.

- Indorama Ventures Fibers Germany

- Milliken & Company

- DuPont

- TenCate Protective Fabrics

Recent Developments

-

In January 2024, Henan Zhuoer Protective Technology Co., Ltd. launched premium-quality flame-resistant fabric (260gsm FR cotton flame-resistant uniforms) that is composed of 98% cotton and 2% antistatic materials. It is designed to offer wearers superior protection against fire risks. This fabric is a perfect, reliable, and durable fit for professionals operating in hazardous work conditions present in the oil & gas and construction industries

-

In June 2023, Nam Liong Global Corp. signed a memorandum of cooperation with the Tainan City Fire Bureau to protect Greater Tainan from fire hazards. This collaboration has been undertaken to improve and enhance the effectiveness of fire rescue and firefighting operations with the help of an innovative R&D team of the Taiwan City Fire Bureau. This collaboration is expected to help the company improve its flame-resistant fabric offerings by undertaking R&D activities related to them

Flame Resistant Fabrics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.11 billion

Revenue forecast in 2030

USD 6.89 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fiber type, end-use, material type, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; Japan; India; Australia; Brazil; Saudi Arabia; UAE

Key companies profiled

Nam Liong Global Corp.; LEVITEX; U-Long High-Tech Textile Co., Ltd.; XM Textiles; Henan Zhuoer Protective Technology Co., Ltd.; Baltex; SIKOR-TEX; SINTEX, Inc.; Klopman International; Xinxiang Yulong Textile Co., Ltd.; Indorama Ventures Fibers Germany; Milliken & Company; DuPont; TenCate Protective Fabrics

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

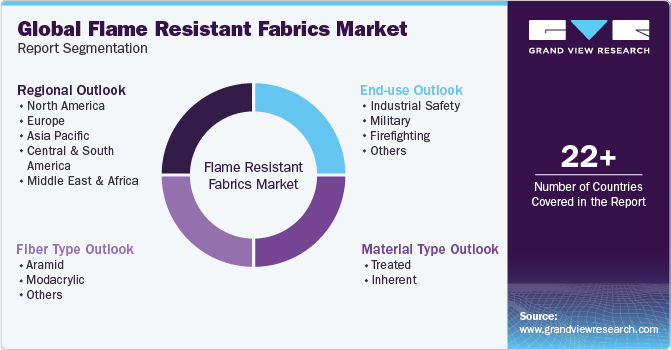

Global Flame Resistant Fabrics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flame resistant fabrics market report based on fiber type, end-use, material type, and region:

-

Fiber Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Aramid

-

Modacrylic

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Industrial Safety

-

Oil & Gas

-

Utility

-

Manufacturing

-

-

Military

-

Firefighting

-

Others

-

-

Material Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Treated

-

Inherent

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global flame resistant fabrics market size was estimated at USD 4.91 billion in 2023 and is expected to reach USD 5.11 billion in 2024.

b. The global flame resistant fabrics market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 6.89 billion by 2030.

b. Aramid fiber segment led the market and accounted for over 60.8% share of the revenue in 2023. This growth is attributed to the superior strength and heat-resistant properties offered by aramid fibers. These fibers offer comfort and flexibility, thus finding application in various end-use industries, such as mining, oil & gas, and chemical manufacturing, for the protection of workers.

b. Some of the key players operating in the flame-resistant fabrics market include Nam Liong Global Corporation, LEVITEX, U-Long High-Tech Textile Co., Ltd., XM Textiles, Henan Zhuoer Protective Technology Co., Ltd., Baltex, SIKOR-TEX, SINTEX, Inc., Klopman International, Xinxiang Yulong Textile Co., Ltd., Indorama Ventures Fibers Germany, Milliken & Company, DuPont, and TenCate Protective Fabrics.

b. The key factors that are driving the global flame-resistant fabrics market include the growing concerns related to employee safety among various end-use industries, coupled with stringent regulations regarding work safety by governments in developed countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.