- Home

- »

- Advanced Interior Materials

- »

-

Aramid Fiber Market Size & Share, Industry Report, 2033GVR Report cover

![Aramid Fiber Market Size, Share & Trends Report]()

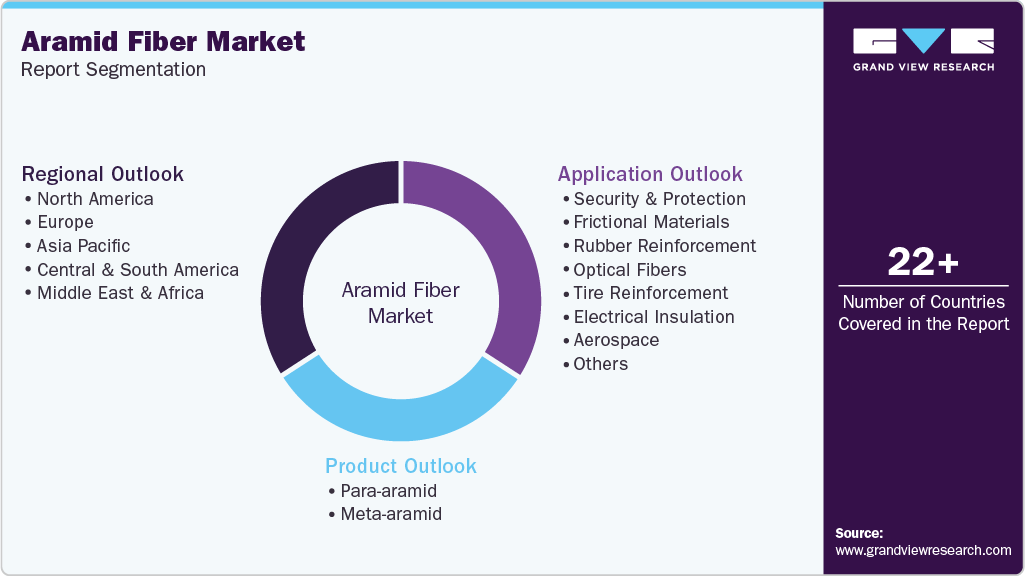

Aramid Fiber Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Para-aramid, Meta-aramid), By Application (Frictional Materials, Optical Fibers, Electrical Insulation, Security & Protection), By Region, And Segment Forecasts

- Report ID: 978-1-68038-883-1

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aramid Fiber Market Summary

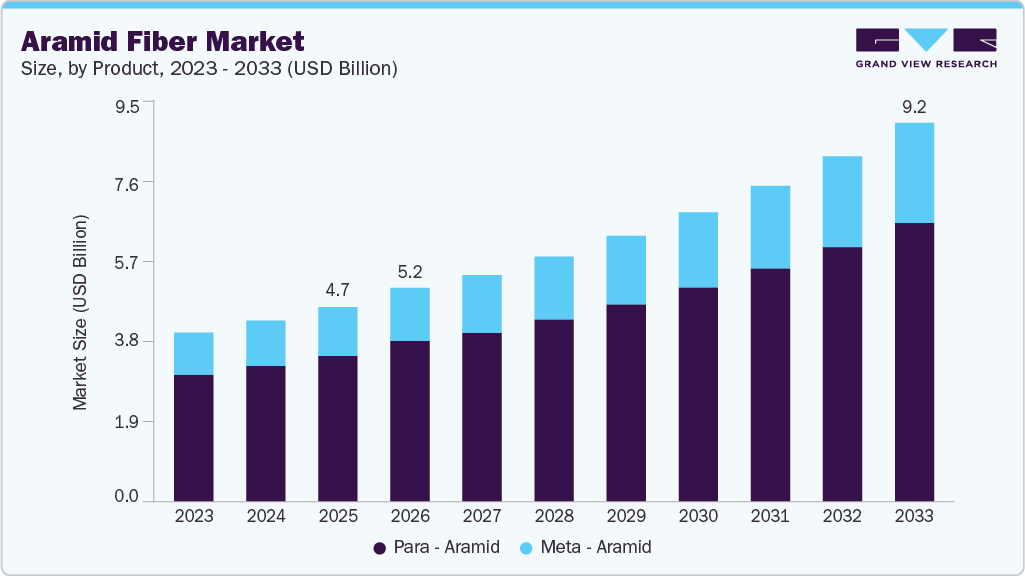

The global aramid fiber market size was estimated at USD 4.71 billion in 2025 and is projected to reach USD 9.18 billion by 2033, growing at a CAGR of 8.5% from 2026 to 2033. Demand for aramid fiber is increasing steadily due to its exceptional mechanical strength, thermal stability, and resistance to abrasion and chemicals, making it suitable for high-performance applications.

Key Market Trends & Insights

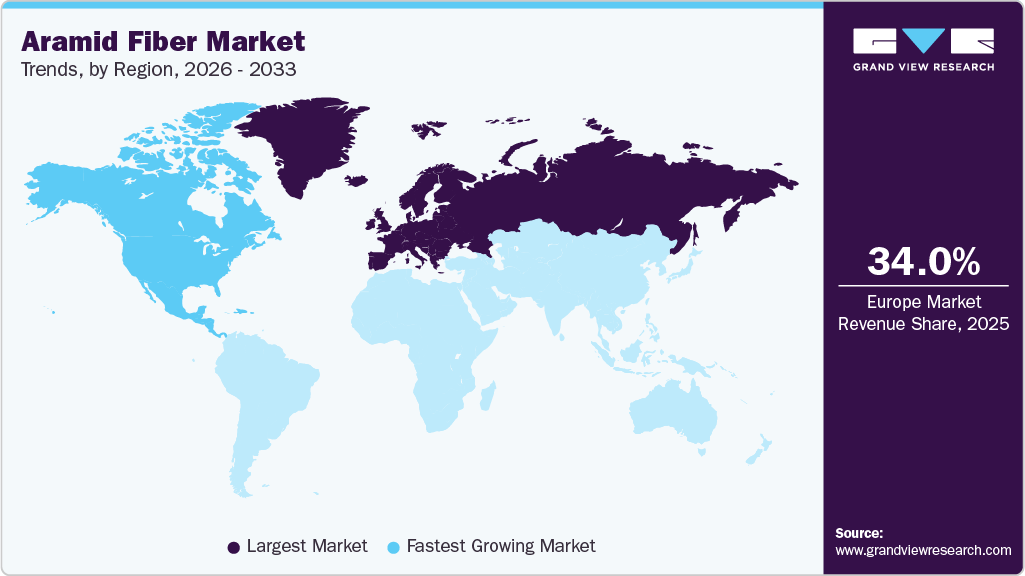

- Europe dominated the aramid fiber market with the largest revenue share of 34.0% in 2025.

- The aramid fiber market in Germany plays a crucial role in the European market due to its strong automotive and industrial manufacturing base.

- By product, the para-aramid segment held the highest revenue market share of 74.9% in 2025.

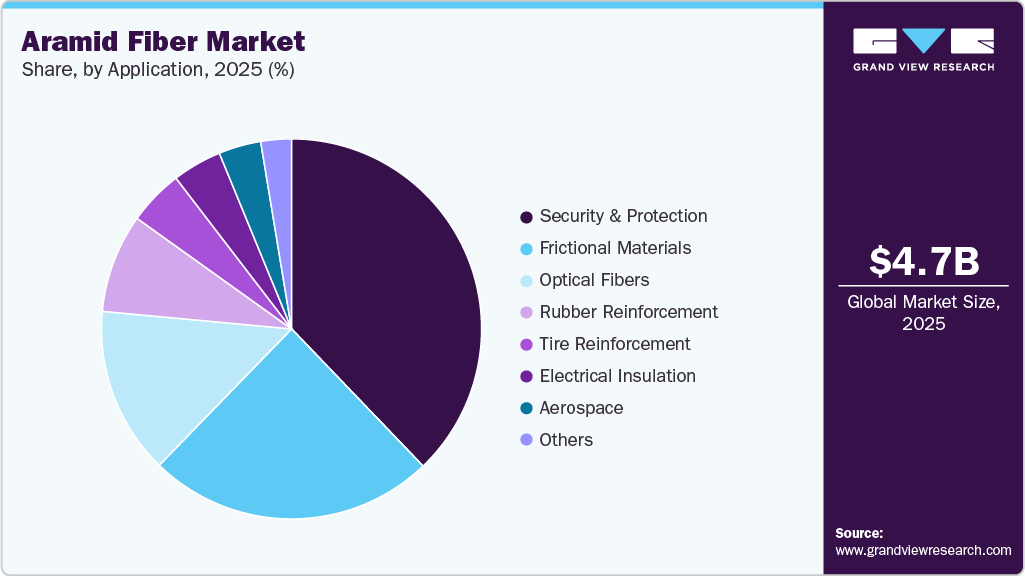

- By application, the security & protection segment held the highest revenue market share of 37.8% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4.71 Billion

- 2033 Projected Market Size: USD 9.18 Billion

- CAGR (2026-2033): 8.5%

- Europe: Largest market in 2025

- North America: Fastest growing market

Industries such as defense, aerospace, automotive, and industrial safety increasingly prefer aramid fibers over conventional materials to achieve lightweighting without compromising durability.Rising geopolitical tensions and the modernization of military forces have accelerated the use of para-aramid fibers in ballistic protection, body armor, and armored vehicles. In the aerospace sector, aramid fibers are widely used in aircraft components, honeycomb structures, and interior panels due to their fatigue resistance and impact absorption properties. Growth in electric vehicles has further increased adoption, as aramid fibers help improve battery safety, braking performance, and structural reinforcement. Expansion of telecommunications and fiber-optic networks has also contributed to demand, where aramid fibers are used as strength members in cables.

Key demand drivers include increasing defense spending and procurement of advanced personal protection and armored systems across developed and emerging economies. Stringent workplace safety regulations are boosting demand for flame-resistant clothing and protective equipment, particularly in oil & gas, chemical processing, and manufacturing industries. Automotive manufacturers are adopting aramid fibers to meet fuel efficiency targets and emission regulations through lightweight materials. The rapid expansion of renewable energy infrastructure, especially wind energy, has increased the use of aramid fibers in reinforcement applications. Growth in telecommunications infrastructure and 5G deployment further drives demand for durable and temperature-resistant materials.

Governments across major economies are promoting the use of advanced materials through defense modernization programs and aerospace manufacturing incentives. Increased funding for military personnel protection and next-generation defense equipment directly supports the use of aramid fibers. Occupational safety regulations mandate the use of flame-resistant and high-performance protective clothing in hazardous work environments, boosting meta-aramid demand. Infrastructure development programs indirectly support aramid fiber usage through growth in telecommunications, transportation, and energy sectors.

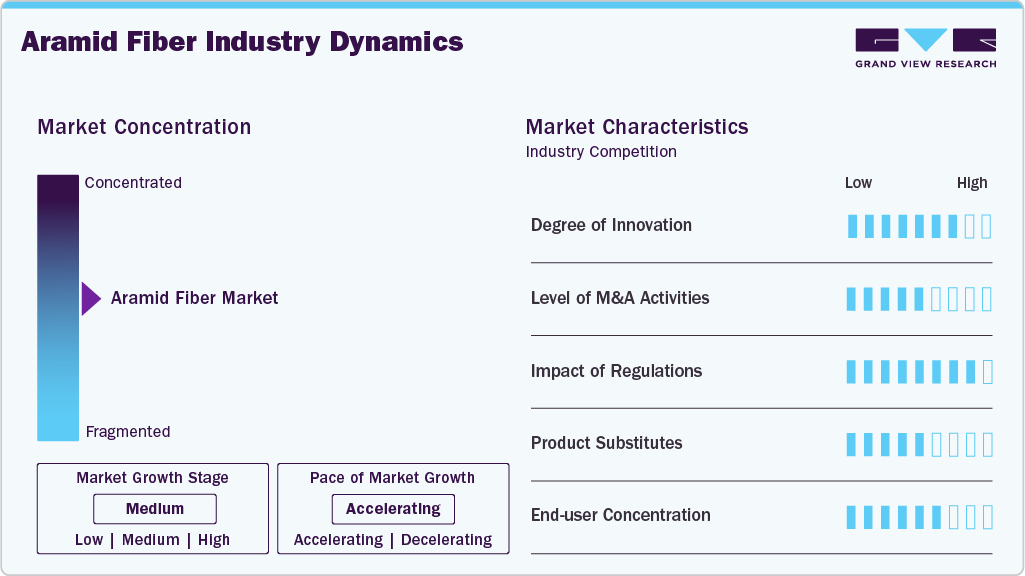

Market Concentration & Characteristics

The aramid fiber industry is moderately consolidated, dominated by a small number of global manufacturers with strong technological capabilities and established supply chains. Leading players benefit from proprietary production processes, long-term defense contracts, and strong relationships with aerospace and automotive OEMs. High capital investment requirements and complex manufacturing processes act as significant entry barriers for new players. However, regional manufacturers in the Asia Pacific are gradually increasing capacity to meet domestic demand. Strategic partnerships and long-term supply agreements are common competitive strategies.

The threat of substitutes in the aramid fiber industry is moderate, primarily from carbon fiber, glass fiber, and ultra-high-molecular-weight polyethylene fibers. Carbon fiber offers higher stiffness but lacks the impact resistance and flexibility of aramid fibers in many safety applications. Glass fiber is cheaper but does not match aramid’s strength-to-weight ratio or thermal resistance. UHMWPE competes strongly in ballistic protection but performs poorly at high temperatures. Aramid fibers continue to hold a strong position where heat resistance, toughness, and durability are critical. As a result, substitution is application-specific rather than widespread.

Product Insights

The para-aramid segment held the highest revenue market share of 74.9% in 2025, due to its superior tensile strength, impact resistance, and lightweight characteristics. Para-aramid fibers are widely used in ballistic protection, aerospace components, tire reinforcement, and high-performance composites, making them critical across defense and industrial applications. Strong demand from military modernization programs and increasing adoption in automotive lightweighting have supported sustained revenue leadership. Their ability to replace metal components while maintaining high durability further strengthens their market position. Para-aramid fibers continue to dominate applications where performance, safety, and longevity are critical requirements.

The meta-aramid segment is expected to grow at a significant CAGR of 9.5% over the forecast period, due to rising demand for flame-resistant and heat-resistant materials across industrial and occupational safety applications. Meta-aramid fibers are extensively used in protective clothing for firefighters, electrical workers, and industrial personnel operating in high-temperature or hazardous environments. Increasing enforcement of workplace safety regulations and stricter compliance standards are driving adoption globally. Growth in oil & gas, chemical processing, and energy industries further supports demand. The expanding use of meta-aramid in filtration and insulation applications also contributes to its strong growth outlook.

Application Insights

The security & protection segment held the highest revenue market share of 37.8% in 2025, owing to widespread use of aramid fibers in ballistic armor, helmets, protective vests, and armored vehicles. Para-aramid fibers dominate this segment because of their high energy absorption and resistance to impact and penetration. Rising defense spending, internal security requirements, and law enforcement modernization have reinforced demand. Increasing geopolitical tensions and focus on personnel safety continue to drive sustained consumption. Security applications remain a core revenue-generating segment for aramid fiber manufacturers.

The electrical insulation segment is expected to grow at a significant CAGR of 9.0% over the forecast period, due to increasing demand for heat-resistant and non-conductive materials in electrical and electronic applications. Meta-aramid fibers are widely used in electrical insulation papers, motor slot liners, and transformer components due to their thermal stability and dielectric properties. Expansion of power generation, renewable energy installations, and electric vehicle production is supporting demand. Upgrades to aging electrical infrastructure further contribute to growth. The segment is expected to benefit from long-term investments in energy efficiency and electrification initiatives.

Regional Insights

Europe dominated the global aramid fiber market and accounted for the largest revenue share of 34.0% in 2025, supported by automotive lightweighting initiatives and strict environmental regulations. Strong demand from industrial safety and firefighting applications continues to drive consumption. Aerospace manufacturing across key European economies supports high-performance fiber usage. Focusing on sustainability is pushing innovation in fiber recycling and manufacturing efficiency. Defense and security modernization programs contribute steadily to market demand. Regulatory compliance drives consistent adoption across industries. Europe remains a mature but innovation-driven market.

Germany Aramid Fiber Market Trends

The aramid fiber market in Germany plays a crucial role in the European market due to its strong automotive and industrial manufacturing base. Emphasis on lightweight vehicles and advanced safety components supports fiber demand. Industrial safety standards are among the strictest globally, boosting protective clothing usage. Research and development activities contribute to innovation in composite materials. Aerospace and defense applications provide additional market support. Domestic manufacturers focus on high-quality, specialized applications. Germany continues to be a key contributor to regional growth.

Asia Pacific Aramid Fiber Market Trends

The aramid fiber market in the Asia Pacific is growing due to rapid industrialization, expanding automotive production, and growing defense procurement. Strong growth in telecommunications infrastructure and renewable energy projects further supports regional demand. Countries in the region are investing heavily in domestic manufacturing capabilities for advanced materials. Increasing safety regulations across industries are driving demand for protective clothing and insulation materials. The presence of cost-competitive manufacturing and expanding end-use industries provides long-term growth potential. Asia Pacific continues to be both a major production and consumption hub. The region is expected to maintain market leadership during the forecast period.

China aramid fiber market represents a key growth market supported by defense modernization and expanding aerospace manufacturing. Government initiatives to localize high-performance fiber production have encouraged capacity expansions. Rapid growth in electric vehicles and renewable energy installations has increased material demand. The country’s strong focus on infrastructure and telecom development further supports aramid fiber consumption. Domestic manufacturers are improving product quality to compete with global leaders. Industrial safety regulations are also tightening, boosting meta-aramid usage. Overall, China remains a strategic market for both production and consumption.

North America Aramid Fiber Market Trends

The aramid fiber market in North America is driven primarily by defense spending and aerospace manufacturing activities. Strong adoption of advanced materials in automotive lightweighting initiatives supports demand. The region has a well-established safety equipment industry that relies heavily on aramid fibers. Technological innovation and R&D investment remain high among manufacturers. Replacement demand from aging defense and aerospace fleets further sustains consumption. Regulatory emphasis on worker safety enhances market stability. North America remains a high-value market with consistent demand.

The U.S. aramid fiber market is driven by significant military procurement and homeland security requirements. Widespread use of aramid fibers in ballistic armor and protective apparel remains a major growth factor. Aerospace manufacturing and defense aviation programs also contribute substantially. Automotive manufacturers increasingly use aramid fibers to improve safety and performance. Strong focus on innovation and product development enhances competitive positioning. Strict workplace safety regulations support stable demand. The U.S. remains one of the most technologically advanced markets.

Central & South America Aramid Fiber Market Trends

The aramid fiber market in CSA is emerging for aramid fibers, supported by growing industrialization and infrastructure development. The increasing demand for protective equipment in the mining, oil & gas, and manufacturing sectors supports growth. The expansion of automotive production in select countries contributes to rising consumption. Defense and security investments remain moderate but are gradually increasing. Telecom infrastructure development adds incremental demand. Limited domestic production leads to reliance on imports. The market shows steady but comparatively slower growth.

Middle East & Africa Aramid Fiber Market Trends

The aramid fiber market in the MEA is driven mainly by defense, oil & gas, and industrial safety applications. High demand for flame-resistant clothing in hazardous work environments supports the use of meta-aramid. Infrastructure development and energy projects create additional opportunities for applications. Defense modernization programs contribute to para-aramid demand. The region relies heavily on imports due to limited manufacturing capacity. Safety regulations are gradually strengthening across industries. Overall, the market shows stable long-term growth potential.

Key Aramid Fiber Company Insights

Some of the key players operating in the market include China National Bluestar (Group) Co., Ltd., Hyosung Corp.

-

China National Bluestar Co., Ltd. is a major Chinese chemical manufacturing company with strong capabilities in advanced materials, including aramid fibers. The company benefits from government backing and an extensive domestic production network, enabling it to serve defense, industrial, and automotive applications. Bluestar focuses on reducing China’s reliance on imported high-performance fibers through capacity expansion and technology development.

-

Hyosung Corporation is a South Korea-based global industrial conglomerate with a strong presence in advanced industrial materials, including aramid fibers. The company is known for its high-strength para-aramid products used in tire reinforcement, industrial safety, and aerospace applications. Hyosung emphasizes continuous R&D and capacity expansion to strengthen its position in global high-performance fiber markets.

DuPont and Kolon Industries, Inc. are some of the emerging market participants.

-

DuPont is a global science and engineering company and a pioneer in the market, best known for its Kevlar and Nomex product lines. The company holds a strong position in defense, aerospace, automotive, and industrial safety applications due to its advanced material technology and long-standing customer relationships. DuPont continues to invest in innovation and application development to maintain market leadership.

-

Kolon Industries, Inc. is a South Korea-based manufacturer specializing in industrial materials, including aramid fibers under its Heracron brand. The company serves automotive, defense, electrical insulation, and reinforcement applications. Kolon focuses on expanding global reach through technology upgrades, capacity expansion, and strategic partnerships to strengthen its competitiveness in the market.

Key Aramid Fiber Companies:

The following are the leading companies in the aramid fiber market. These companies collectively hold the largest market share and dictate industry trends.

- Teijin Ltd.

- Yantai Tayho Advanced Materials Co.

- DuPont

- Hyosung Corp.

- Toray Chemicals South Korea, Inc.

- Kermel S.A

- Kolon Industries, Inc.

- Huvis Corp.

- China National Bluestar (Group) Co., Ltd.

Recent Developments

-

In January 2024, DuPont and Point Blank Enterprises announced an exclusive agreement to provide body armor made with Kevlar EXO aramid fiber to state and local law enforcement agencies across North America.

-

In April 2025, Teijin Limited began implementing Digital Product Passport (DPP) technology for its aramid and carbon fibers to enhance supply chain transparency and support sustainability claims.

-

In April 2023, DuPont launched Kevlar EXO, its most significant aramid fiber innovation in over 50 years-a new technology platform designed for high-performance and protective applications in extreme conditions.

Aramid Fiber Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5.18 billion

Revenue forecast in 2033

USD 9.18 billion

Growth rate

CAGR of 8.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Volume in tons, revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Russia; China; Japan; India; South Korea; Brazil

Key companies profiled

Teijin Ltd.; Yantai Tayho Advanced Materials Co.; DuPont; Hyosung Corp.; Toray Chemicals South Korea, Inc.; Kermel S.A.; Kolon Industries, Inc.; Huvis Corp.; China National Bluestar (Group) Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aramid Fiber Market Report Segmentation

This report forecasts revenue growth at the regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global aramid fiber market based on product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Para-aramid

-

Meta-aramid)

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Security & Protection

-

Frictional Materials

-

Rubber Reinforcement

-

Optical Fibers

-

Tire Reinforcement

-

Electrical Insulation

-

Aerospace

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the aramid fiber market include Teijin Ltd., Yantai Tayho Advanced Materials Co, E. I. du Pont de Nemours and Company (DowDuPont), Hyosung Corp., Toray Chemicals South Korea, Inc., Kermel S.A, Kolon Industries, Inc., Huvis Corp., China National Bluestar (Group) Co., Ltd., SRO Aramid (Jiangzu) Co., Ltd.

b. Key factors driving the aramid fiber market include rising defense and security demand, increasing focus on lightweight and high-performance materials in automotive and aerospace industries, stringent workplace safety regulations, and expanding electrical, telecommunications, and energy infrastructure.

b. The global aramid fiber market size was estimated at USD 4.71 billion in 2025 and is expected to reach USD 5.18 billion in 2026.

b. The global aramid fiber market is expected to grow at a compound annual growth rate of 8.5% from 2026 to 2033 to reach USD 9.18 billion by 2033.

b. The para-aramid segment held the highest revenue market share of 74.9% in 2025, due to its superior tensile strength, impact resistance, and lightweight characteristics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.