- Home

- »

- Plastics, Polymers & Resins

- »

-

Flexible Polyurethane Foam Market Size, Share Report, 2030GVR Report cover

![Flexible Polyurethane Foam Market Size, Share & Trends Report]()

Flexible Polyurethane Foam Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Automotive, Aviation, Mass Transit), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-481-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flexible PU Foam Market Size & Trends

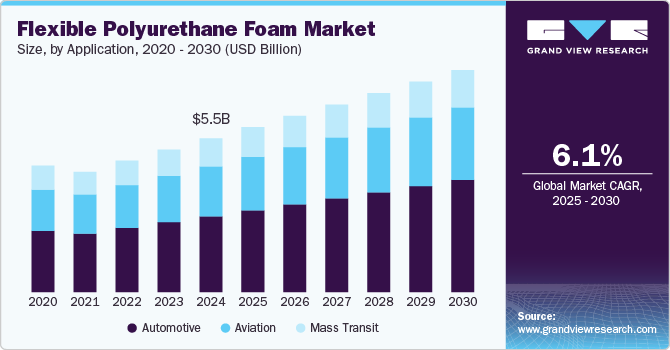

The global flexible polyurethane foam market size was estimated at USD 5.91 billion in 2024 and is expected to grow at a CAGR of 6.14% from 2025 to 2030. The growth of the market can be attributed to the increasing emphasis of different industries on energy efficiency, which has fueled the demand for polyurethane foams for usage, such as insulating and cushioning materials in diverse applications.

Flexible polyurethane (PU) foam plays a significant role in meeting the demand for lightweight composites from the automotive industry. This foam offers an excellent combination of lightweight, strength, and versatility, thereby making it an ideal choice for various automotive applications. By incorporating flexible PU foam in automotive components, manufacturers can reduce the weight of their vehicles that leads to improved fuel efficiency and reduced emissions.

Drivers, Opportunities & Restraints

The increasing demand for lightweight and high-performance composites from the automotive industry directly impacts the growth of the flexible polyurethane (PU) foam market across the world. As the automotive industry strives for fuel efficiency, emission reduction, and enhanced vehicle performance, there is a growing requirement for lightweight materials that can replace traditional heavy components without compromising the safety or functionalities of vehicles.

The adoption of lightweight materials present a significant opportunity for the Flexible Polyurethane (PU) Foam Market. The demand for lightweight and high-performance composites in the automotive industry has spurred innovations in flexible PU foam. Manufacturers continuously invest in research and development activities to enhance the properties of their flexible PU foam, including its strength-to-weight ratio, fire resistance, and thermal insulation. These continuous innovations enable flexible PU foam to meet the evolving requirements of the automotive industry while providing exceptional performance and comfort.

Despite its potential, the volatility in raw material prices, particularly petroleum-based resins, remains a significant restraint for the market. The price trend of Flexible Polyurethane Foam (FPF) has been largely driven by fluctuations in raw material costs, particularly polyols and isocyanates (MDI and TDI). These chemicals, derived from crude oil, have seen price volatility due to the global instability in oil markets. Geopolitical tensions and production cuts by oil-producing nations have led to higher raw material costs, directly impacting the price of FPF. Additionally, the cost of additives and blowing agents, essential in foam production, has also risen, contributing to the overall increase in FPF prices.

Application Insights

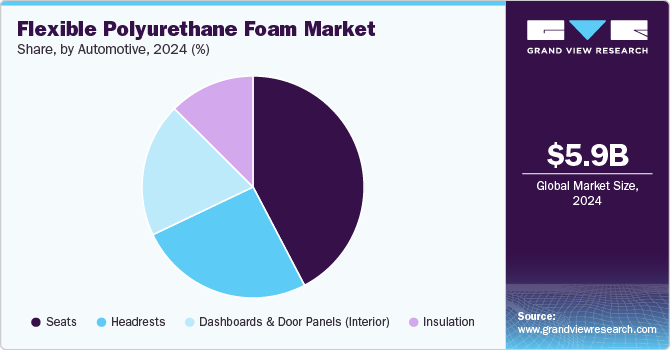

Based on application, the market has been segmented into automotive, aviation, and mass transit. The automotive segment accounted for the largest revenue share of 49.3% in 2024, owing to rising demand for lightweight nature of flexible PU foam. The global automotive industry is under increasing pressure to reduce vehicle weight to improve fuel efficiency and decrease carbon emissions. Automakers achieve significant weight savings by incorporating flexible PU foam in interior and structural components without compromising quality or durability.

Flexible PU foam is widely used in automotive seats as it provides superior comfort and support to passengers and absorbs vibration. The lightweight of this foam also helps reduce the overall weight of vehicles, thereby contributing to their fuel economy. Additionally, flexible PU foam is utilized in interior trim applications of vehicles, including headliners, door panels, and instrument panels, due to its lightness and ability to conform to complex shapes.

The aviation segment is expected to grow at a significant CAGR during the forecast period. The rapid expansion of air travel, especially in emerging markets, significantly contributes to the growing demand for flexible PU foam. Moreover, another significant factor contributing to this demand is the push toward enhancing long-term cost efficiency in airline operations. High durability and resistance to wear & tear make PU foam a preferred material for crew and cockpit seating, reducing the frequency of seat replacements and maintenance.

Regional Insights

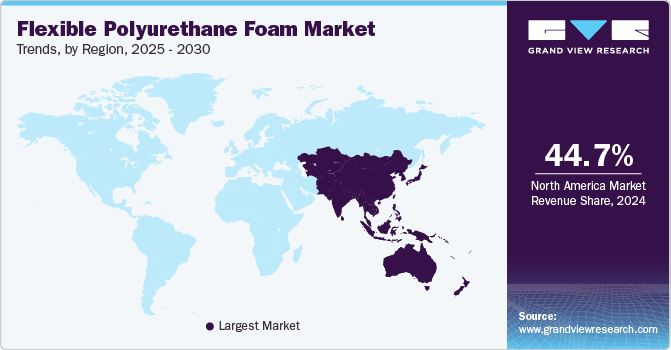

North America holds a significant position in the global flexible polyurethane (PU) foam market. The demand for flexible PU foam in North America has witnessed steady growth over the years, primarily due to growth in various industries such as construction, automotive, furniture, and bedding.

U.S. Flexible Polyurethane Foam Market Trends

The U.S. plays a significant role in the global flexible polyurethane (PU) foam market, exhibiting its strong presence and influence. With a robust manufacturing sector and a technologically advanced market, the U.S. has emerged as one of the leading consumers and producers of flexible PU foam products worldwide. The country's construction, automotive, and furniture industries have been major drivers of flexible PU foam demand, fueling its widespread adoption across various applications.

Asia Pacific Flexible Polyurethane Foam Market Trends

Asia Pacific dominated the global flexible PU Foam market and accounted for largest revenue share of 44.70% in 2024. Asia Pacific boasts a thriving and rapidly expanding polyurethane (PU) foam market, reflecting the region's robust economic growth and industrial development. Several key factors contribute to the market's growth and potential. The construction industry in countries like China, India, and Southeast Asian nations is witnessing significant growth, driving the demand for flexible PU foam in insulation applications.

China's flexible polyurethane foam market is a dynamic and thriving industry that plays a pivotal role in the country's economic growth. The construction sector in China is experiencing significant expansion, driving the demand for PU foam in insulation applications.

Europe Flexible Polyurethane Foam Market Trends

Europe's focus on research and development has fostered technological advancements and innovation in the flexible PU foam market. Collaborations between industry players, research institutes, and academia have resulted in the development of new formulations and improved manufacturing processes, enhancing the performance and environmental profile of flexible PU foam.

Key Flexible Polyurethane Foam Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include BASF SE, Recticel, Eurofoam S.r.l., NMC SA, and Innocor (Huebach Corporation). The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Flexible Polyurethane Foam Companies:

The following are the leading companies in the flexible polyurethane foam market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Recticel

- Eurofoam S.r.l.

- NMC SA

- Innocor (Huebach Corporation)

- Alanto Ltd.

- Vita (Holdings) Limited

- Foamtec International Co., Ltd.

Recent Developments

-

In January 2023, Sheela Group, the parent company of Joyce, acquired Interplasp, a prominent Spanish company renowned for its expertise in flexible polyurethane foam manufacturing. This strategic move solidifies Sheela Group's position as a key player in the European market and emphasizes its commitment to expanding its offerings and capabilities. By incorporating Interplasp into its portfolio, Sheela Group gains access to top-notch technology, resources, and an extensive customer base. This acquisition strengthens the company's ability to deliver high-quality flexible polyurethane foam solutions and reinforces its reputation as an industry leader.

-

In February 2022, BASF announced a partnership with NeveonSA to develop a closed-loop recycling process for mattresses. This collaboration focuses on recycling used PU foam mattresses to create new, high-quality mattresses. BASF has developed a wet chemical recycling method that successfully recovers polyols, the primary component of flexible foam. NEVEON announced the launch of a mattress take-back initiative in Berlin to facilitate the collection and recycling process. The partnership aims to scale up the recycling process in the coming years to support the circular economy in the mattress industry.

Flexible Polyurethane Foam Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.34 billion

Revenue forecast in 2030

USD 8.54 billion

Growth rate

CAGR of 6.14% from 2025 to 2030

Actual data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion/Million, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

BASF SE; Recticel; Eurofoam S.r.l.; NMC SA; Innocor (Huebach Corporation); Alanto Ltd.; Vita (Holdings) Limited; Foamtec International Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flexible Polyurethane Foam Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flexible polyurethane foam market report on the basis of application and region:

-

Application Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Automotive

-

Seats

-

Headrests

-

Dashboards & Door Panels (Interior)

-

Insulation

-

-

Aviation

-

Crew & Cockpit Seating

-

Passenger Seats

-

Crew Rest Mattress

-

Insulation

-

-

Mass Transit

-

-

Regional Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global flexible polyurethane foam market size was estimated at USD 5.91 billion in 2024 and is expected to reach USD 6.34 billion in 2025.

b. The global flexible polyurethane foam market is expected to grow at a compound annual growth rate of 6.14% from 2025 to 2030 to reach USD 8.54 billion by 2030.

b. The automotive segment accounted for the largest revenue share of 49.3% in 2024, owing to rising demand for lightweight nature of flexible PU foam. The global automotive industry is under increasing pressure to reduce vehicle weight to improve fuel efficiency and decrease carbon emissions.

b. Some key players operating in the flexible polyurethane foam market include BASF SE; Recticel; Eurofoam S.r.l.; NMC SA; Innocor (Huebach Corporation); Alanto Ltd.; Vita (Holdings) Limited, and others.

b. The growth of the market can be attributed to the increasing emphasis of different industries on energy efficiency, which has fueled the demand for PU foams for usage as insulating and cushioning materials in diverse applications.et growth include the rising demand for better adhesion in the composites & plastics sector. Additionally, automakers are increasingly attempting to improve road safety and fuel economy by creating ‘green tires’ using adhesion promoters such as silanes in tread compounds.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.