- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyurethane Foam Market Size, Industry Report, 2033GVR Report cover

![Polyurethane Foam Market Size, Share & Trends Report]()

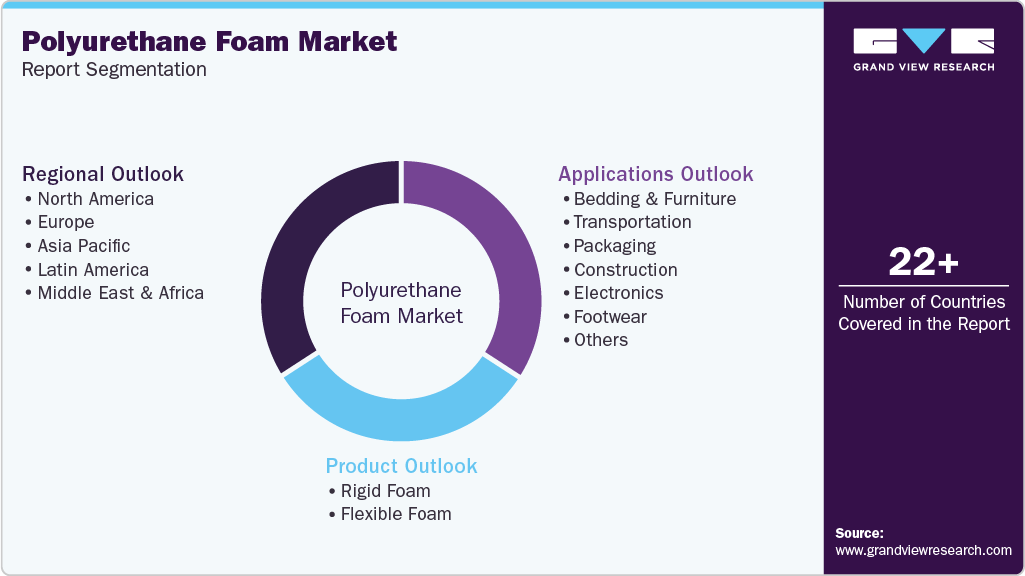

Polyurethane Foam Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Rigid Foam, Flexible Foam), By Application (Bedding & Furniture, Transportation, Packaging, Construction, Electronics, Footwear), By Region, And Segment Forecasts

- Report ID: 978-1-68038-807-7

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyurethane Foam Market Summary

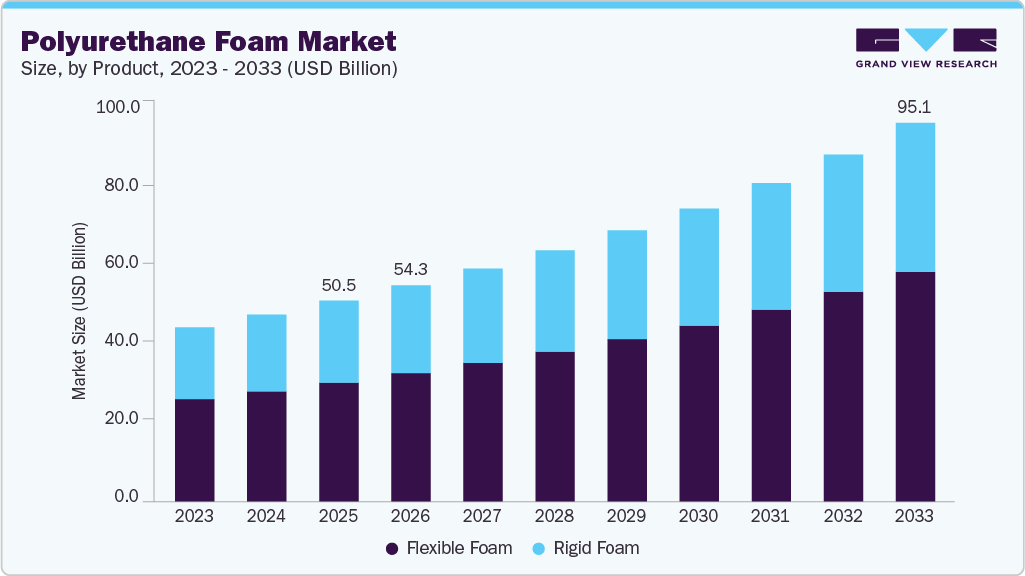

The global polyurethane foam market size was estimated at USD 50.47 billion in 2025 and is projected to reach USD 95.15 billion by 2033, growing at a CAGR of 8.3% from 2026 to 2033. The growth in appliances and cold chain infrastructure is anticipated to drive the market.

Key Market Trends & Insights

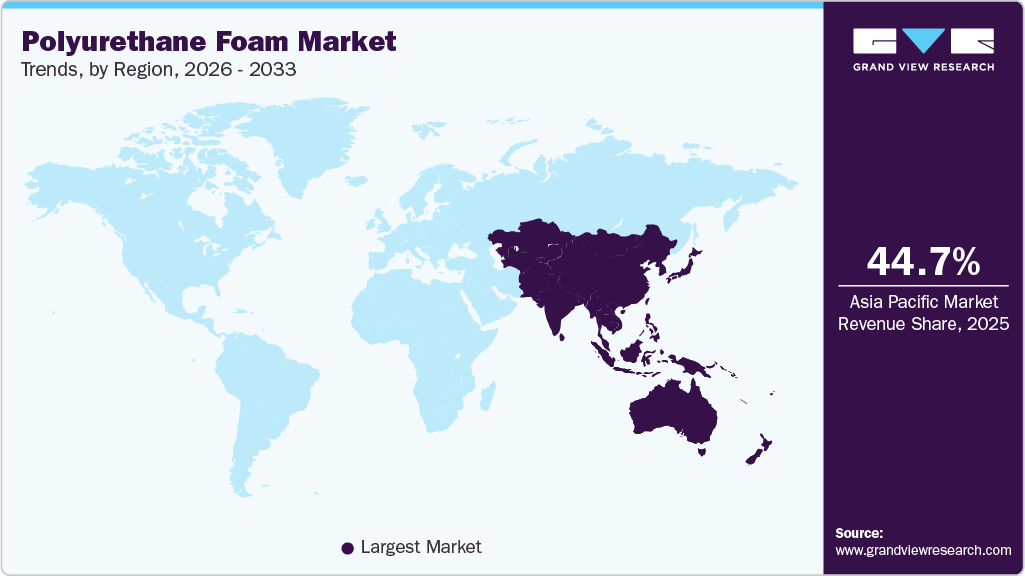

- Asia Pacific dominated the global polyurethane foam industry with the largest revenue share of 44.70% in 2025.

- The polyurethane foam industry in India is expected to grow at a substantial CAGR of 10.1% from 2026 to 2033.

- By product, the flexible foam segment is expected to grow at a considerable CAGR of 8.7% from 2026 to 2033 in terms of revenue.

- By applications, the electronics segment is expected to grow at a considerable CAGR of 9.0% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 50.47 Billion

- 2033 Projected Market Size: USD 95.15 billion

- CAGR (2026-2033): 8.3%

- Asia Pacific: Largest market in 2025

Polyurethane foam is widely used in refrigerators, freezers, and insulated transport due to its high insulation efficiency. Rising demand for food preservation, pharmaceutical logistics, and temperature-controlled storage is steadily increasing foam consumption across both developed and emerging markets.

The polyurethane foam industry is shifting toward sustainability and performance-driven innovation. Manufacturers are increasingly adopting bio-based polyols and low-global-warming potential blowing agents to meet tightening environmental standards and customer preferences for greener materials. This trend extends to smart and high-performance foam variants with embedded sensors and enhanced thermal management properties. Asia Pacific continues to lead growth due to rapid urbanization, rising construction activity, and expansion in the automotive and furniture sectors.

Drivers, Opportunities & Restraints

Growth in building and construction demand is a primary driver of the polyurethane foam market. Rigid PU foams are widely specified for thermal insulation in walls, roofs, and refrigeration panels due to superior energy performance. Rising enforcement of energy-efficiency codes globally is increasing the uptake of high-performance insulation solutions. Simultaneously, automotive manufacturers are expanding the use of flexible PU foams for lightweighting and occupant comfort, reinforcing demand across key end-use industries.

The rise of bio-based polyols offers a significant growth opportunity as sustainability priorities intensify among regulators and buyers. Bio-based feedstocks can reduce the carbon footprint of polyurethane products while aligning with circular economy goals. Adoption of these raw materials opens premium market segments and can improve brand positioning for manufacturers focused on environmentally conscious buyers. Expansion into bio-foam formulations also supports compliance with stricter VOC and emissions regulations.

Raw material price volatility remains a key restraint for the industry. Dependence on petroleum-derived chemicals such as polyols and isocyanates exposes producers to crude oil price fluctuations, which disrupt cost structures and compress margins. Supply chain interruptions can further exacerbate price instability and operational planning. These dynamics hinder long-term investment decisions and challenge competitive pricing, particularly for smaller manufacturers with limited hedging capacity.

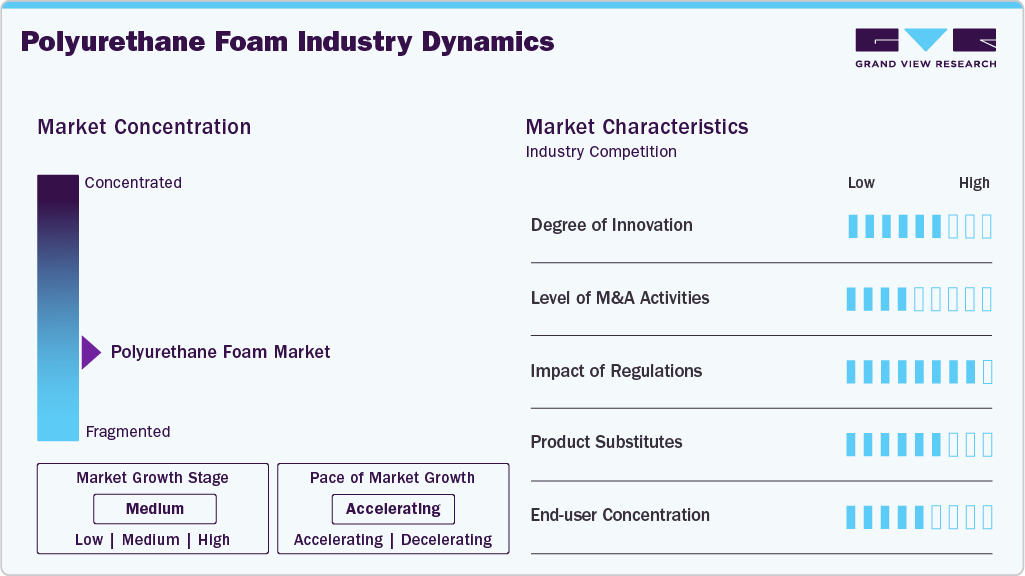

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The industry exhibits fragmentation, with key players dominating the industry landscape. Major companies such as Huntsman Corporation, The Dow Chemical Company, BASF SE, Sekisui Chemical Co., Ltd., Trelleborg AG, Future Foam, Inc., Elliott Co. of Indianapolis, Inc., Recticel S.A., Foamcraft, Inc., UFP Technologies, Inc., Rogers Corporation, Wanhua Chemical Group Co., Ltd., Saint-Gobain S.A., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet the evolving demands of the industry.

Innovation in the polyurethane foam sector is concentrated on sustainable feedstocks, formulation engineering, and process upgrades. The adoption of bio-based polyols and recycled feedstocks is accelerating as firms seek to lower their life-cycle carbon intensity and comply with customer ESG mandates. Regulators and buyers are forcing a rapid switch to low global warming potential blowing agents, driving changes in chemistry and equipment. Simultaneously, advances in material science, such as the use of nanoscale fillers and engineered additives, are improving thermal, fire, and acoustic performance while enabling thinner cross sections and new application windows.

Polyurethane foam faces multiple commercially proven substitutes across end uses. For insulation, PIR, XPS, and EPS panels, as well as mineral wool, compete on cost, fire performance, and moisture resistance. In bedding and furniture, natural latex and hybrid coil-latex constructions excel in terms of durability and eco-credentials. Electronics potting and thermal management often utilize silicones and epoxies when high-temperature stability or permanent rigidity is required. Each substitute presents tradeoffs in R-value, cost, recyclability, and certification that shape buyer choice regionally.

Product Insights

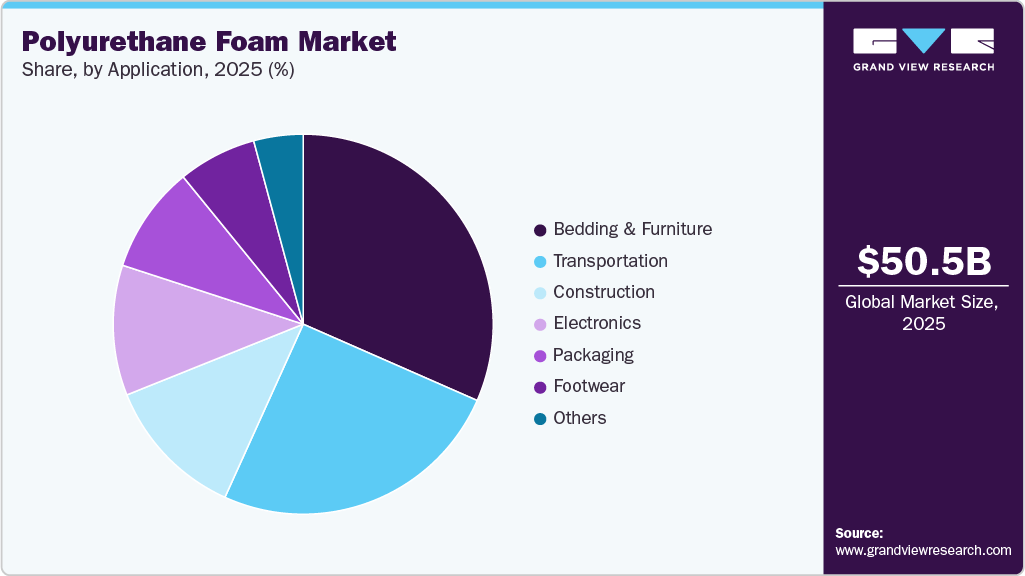

Flexible foam dominated the market across all product segments in terms of revenue, accounting for a 59.12% market share in 2025, and is forecasted to grow at an 8.7% CAGR from 2026 to 2033. Automotive lightweighting continues to underpin the growth of flexible foam. OEMs are specifying high-resilience, engineered viscoelastic foams to reduce component mass while maintaining crash performance and occupant comfort. The transition to electric vehicles increases demand for seat solutions that combine comfort with thermal and vibration management. Tier suppliers are responding with tailored formulations and recycled polyol blends to meet sustainability targets and cost pressures. This structural change in vehicle design expands volume and value per vehicle for flexible foam producers.

The rigid foam segment is anticipated to grow at a substantial CAGR of 7.8% through the forecast period. Rigid polyurethane foam demand is being driven by tighter building energy codes and aggressive retrofit programs in Europe and North America. The material’s low thermal conductivity enables the creation of thinner, higher-performing insulation panels that reduce operational energy use and lifecycle costs. Growth in cold chain logistics and commercial refrigeration generates consistent institutional demand for foam, which requires its structural and insulating properties. Suppliers are also shifting to low global warming potential blowing agents to meet regulations and customer procurement criteria.

Applications Insights

Bedding & furniture dominated the market across the applications segmentation in terms of revenue, accounting for a market share of 31.58% in 2025, and is forecasted to grow at an 8.4% CAGR from 2026 to 2033. E-commerce penetration and direct-to-consumer mattress sales are reshaping demand for foam in the bedding and furniture industries. Consumers favor zoned support and pressure-relief foams that deliver sleep quality and durability claims, which are easily demonstrated in online trials and return data. Retail consolidation and private label growth push manufacturers toward scalable, configurable slabstock processes and greener formulations. Regulatory focus on flame retardants and VOC emissions is also shifting buyer preferences toward certified, low-emission foam grades, creating premium differentiation opportunities for compliant suppliers.

The electronics segment is expected to expand at a substantial CAGR of 9.0% through the forecast period. Electronics applications are driving demand for specialized polyurethane foam used in potting, encapsulation, and thermal management. Network densification for 5G and higher power density in EV inverters increases demand for materials that combine thermal conductivity with dielectric insulation. Manufacturers require low-outgassing, low-moisture foams to protect sensitive components in compact assemblies. Rising electronics miniaturization and stricter EMI and thermal reliability expectations create higher value opportunities for formulated potting compounds and absorber foams.

Regional Insights

The Asia Pacific polyurethane foam industry held the largest share, accounting for 44.70% in 2025, and is expected to grow at the fastest CAGR of 9.1% over the forecast period. Rapid urbanization and infrastructure investment are the primary drivers of growth for polyurethane foam in the Asia Pacific. Large-scale residential and commercial construction in China, India, and Southeast Asia is driving an increase in demand for rigid foam insulation to meet energy efficiency targets. The growth in automotive production in the region also increases demand for flexible foam in seating and interiors. Expanding local polyols and blowing agent capacity is reducing lead times and supporting cost-competitive manufacturing.

China Polyurethane Foam Market Trends

China’s driver mix combines sustained construction activity with rapid electrification of transport. State and local infrastructure projects continue to absorb large volumes of rigid foam for insulation. Concurrent growth in EV production increases demand for specialized flexible foams for seating and thermal management components. Domestic polyol and blowing agent capacity expansion is lowering import dependence and enabling faster product rollout, particularly for cost-sensitive commercial and appliance segments.

North America Polyurethane Foam Market Trends

The polyurethane foam industry in North America is growing as building retrofit programs and stricter energy codes are accelerating the uptake of high-performance rigid polyurethane insulation. Commercial refrigeration and cold chain expansion, driven by food e-commerce and pharmaceuticals, support continuous demand for spray and slabstock foams. The shift to low global warming potential blowing agents is prompting capital investment by converters. These dynamics are strengthening supplier ties with construction and refrigeration OEMs and creating steadier, higher-value revenue streams.

The polyurethane foam industry in the U.S. is being driven by federal and state energy efficiency initiatives that prioritize the use of better insulating materials. Incentives for building upgrades and increased HVAC efficiency are boosting the specification of rigid polyurethane systems. The rise of lightweighting in the automotive industry and the increasing demand for electric vehicles are driving demand for engineered flexible foams in seating and battery system components. Supply chain localization and investments in bio-based polyol projects are improving margins and supporting longer-term capacity expansion.

Europe Polyurethane Foam Market Trends

The polyurethane foam industry in Europe is driven by regulatory pressure and sustainability mandates. Tougher environmental standards favor low global warming potential blowing agents and recycled or bio-based polyols. The European Union's renovation agenda and green building programs are promoting higher-specification insulation in commercial and residential projects. Manufacturers are investing in formulation changes and certification to meet VOC and fire safety requirements, which is raising product differentiation and premiumization in the regional market.

Key Polyurethane Foam Company Insights

The polyurethane foam industry is highly competitive, with several key players dominating the landscape. Major companies include Huntsman Corporation, The Dow Chemical Company, BASF SE, Sekisui Chemical Co., Ltd., Trelleborg AG, Future Foam, Inc., Elliott Co. of Indianapolis, Inc., Recticel S.A., Foamcraft, Inc., UFP Technologies, Inc., Rogers Corporation, Wanhua Chemical Group Co., Ltd., and Saint-Gobain S.A. The polyurethane foam industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Polyurethane Foam Companies:

The following are the leading companies in the polyurethane foam market. These companies collectively hold the largest market share and dictate industry trends.

- Huntsman Corporation

- The Dow Chemical Company

- BASF SE

- Sekisui Chemical Co., Ltd.

- Trelleborg AG

- Future Foam, Inc

- Elliott Co. of Indianapolis, Inc.

- Recticel S.A.

- Foamcraft, Inc.

- UFP Technologies, Inc.

- Rogers Corporation

- Wanhua Chemical Group Co., Ltd.

- Saint-Gobain S.A.

Recent Developments

-

In October 2025, BASF confirmed progress on a major MDI capacity expansion in the U.S., a project that will raise North American MDI output toward 600,000 tonnes per year and ease feedstock constraints for foam producers. The investment supports long-term supply security for PU foam value chains.

-

In April 2025, LANXESS completed the sale of its Urethane Systems business to Japan’s UBE Corporation, transferring five production sites, application labs, and about 400 employees. The deal strengthens UBE’s global PU footprint and consolidates technical capabilities for system formulations.

-

In November 2024, Carpenter Co. acquired mattress brand Casper Sleep, positioning the vertically integrated polyurethane foam maker to capture downstream mattress value and accelerate direct-to-consumer product strategies. The deal aligns supply integration with branded distribution and margin expansion goals.

Polyurethane Foam Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 54.31 billion

Revenue forecast in 2033

USD 95.15 billion

Growth rate

CAGR of 8.3% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; Netherlands; Poland; China; India; Japan; South Korea; Australia; Thailand; Indonesia; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

Huntsman Corporation; The Dow Chemical Company; BASF SE; Sekisui Chemical Co., Ltd.; Trelleborg AG; Future Foam, Inc.; Elliott Co. of Indianapolis, Inc.; Recticel S.A.; Foamcraft, Inc.; UFP Technologies, Inc.; Rogers Corporation; Wanhua Chemical Group Co., Ltd.; Saint-Gobain S.A.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyurethane Foam Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global polyurethane foam market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Rigid Foam

-

Flexible Foam

-

-

Applications Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Bedding & Furniture

-

Mattress

-

Chairs

-

Upholstery Components

-

-

Transportation

-

Automotive

-

Railway

-

Aerospace

-

Marine

-

-

Packaging

-

Construction

-

Electronics

-

Footwear

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

Netherlands

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global polyurethane foam market size was estimated at USD 50.47 billion in 2025 and is expected to reach USD 54.31 billion in 2026.

b. The global polyurethane foam market is expected to grow at a compound annual growth rate of 8.3% from 2026 to 2033 to reach USD 95.15 billion by 2033.

b. Bedding & furniture dominated the market across the applications segmentation in terms of revenue, accounting for a market share of 31.58% in 2025, and is forecasted to grow at an 8.4% CAGR from 2026 to 2033.

b. Some key players operating in the polyurethane foam market include Huntsman Corporation, The Dow Chemical Company, BASF SE, Sekisui Chemical Co., Ltd., Trelleborg AG, Future Foam, Inc., Elliott Co. of Indianapolis, Inc., Recticel S.A., Foamcraft, Inc., UFP Technologies, Inc., Rogers Corporation, Wanhua Chemical Group Co., Ltd., and Saint-Gobain S.A.

b. The growth in appliances and cold chain infrastructure is anticipated to drive the market. Polyurethane foam is widely used in refrigerators, freezers, and insulated transport due to its high insulation efficiency. Rising demand for food preservation, pharmaceutical logistics, and temperature-controlled storage is steadily increasing foam consumption across both developed and emerging markets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.