- Home

- »

- Plastics, Polymers & Resins

- »

-

Flexitank Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Flexitank Market Size, Share & Trends Report]()

Flexitank Market (2025 - 2030) Size, Share & Trends Analysis Report By Layer Type (Single Layer, Multi-layer), By Application (Foodstuffs, Chemicals, Oils, Industrial Products, Pharmaceutical Goods), By Region, And Segment Forecasts

- Report ID: 978-1-68038-745-2

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Flexitank Market Summary

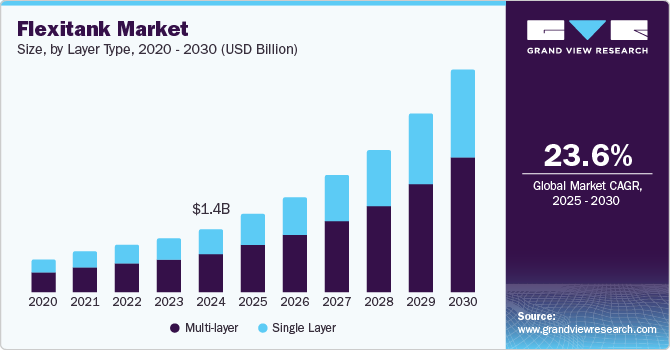

The global flexitank market size was estimated at USD 1,357.3 million in 2024 and is projected to reach USD 4,748.1 million by 2030, growing at a CAGR of 23.6% from 2025 to 2030. The market is experiencing substantial growth driven by the increasing volume of commodity trade globally.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, multi trip accounted for a revenue of USD 917.4 million in 2024.

- Multi Trip is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,357.3 million

- 2030 Projected Market Size: USD 4,748.1 million

- CAGR (2025-2030): 23.6%

- Asia Pacific: Largest market in 2024

As international trade expands, the demand for efficient transportation solutions for bulk liquids is rising, making flexitank a preferred choice.

These innovative containers offer several advantages over traditional shipping methods, including cost-effectiveness, reduced logistical complexities, and enhanced loading efficiency. Flexitank allows the transport of liquids in standard shipping containers, maximizing cargo space and minimizing freight costs. This flexibility is particularly appealing for industries such as food and beverage, chemicals, and agriculture, where bulk liquid transport is essential.

The rise of emerging markets has further fueled market growth, particularly in Asia and Africa. Countries like China and India have significantly ramped up their import volumes of liquid commodities. For instance, China's imports of edible oils grew from 8.5 million metric tons in 2013 to nearly 12 million metric tons in 2023, while India's imports of liquid chemicals increased from around 10 million metric tons to approximately 14 million metric tons in the same period. Such growth in demand reflects the broader trends in commodity trade, where businesses are increasingly seeking reliable and flexible solutions to meet their shipping needs. The e-commerce boom and changing consumer preferences also underscore the importance of versatile packaging solutions, making flexitank an attractive option for exporters aiming to optimize their logistics.

The rising global commodity prices have made efficient transportation methods increasingly critical. As prices for key commodities, such as crude oil and agricultural products, continue to rise, maximizing profit margins through efficient shipping is vital for exporters. The ability to transport larger volumes at lower costs not only benefits exporters but also ensures competitive pricing for consumers. The global market for flexitank is expected to continue expanding as companies recognize the benefits of this innovative shipping method in light of these dynamics.

Layer Type Insights

Based on layer type, the multi-layer segment led the market with the largest revenue share of 54.82% in 2024. Single-layer flexitank are primarily manufactured from materials such as polyethylene (PE), which is known for its lightweight and flexible characteristics. Typically featuring a thickness of around 1mm, these single-layer flexitanks provide a reliable option for the transportation of various industrial products, including chemicals, liquid fertilizers, and certain food products. Their straightforward design allows for efficient filling and discharge processes, making them a popular choice among manufacturers and distributors looking to streamline their logistics operations. Single-layer flexitanks are particularly valued for their cost-effectiveness and ease of handling, which can significantly reduce overall transportation costs while maintaining product integrity during transit.

The single-layer segment is expected to grow at a significant CAGR of 21.0% over the forecast period. The market is experiencing significant growth, and this increase can be attributed to the enhanced protective qualities offered by multi-layer flexitank, which is designed to safeguard sensitive liquid cargo from contamination and external factors. Comprising multiple layers of materials such as polyethylene (PE), ethylene vinyl alcohol (EVOH), and aluminum, these flexitanks provide superior barrier properties, making them particularly suitable for transporting high-value products like pharmaceuticals, chemicals, and specialty liquids. The multi-layer construction not only extends the shelf life of the products but also ensures compliance with strict industry standards, thereby boosting their adoption among manufacturers and logistics providers.

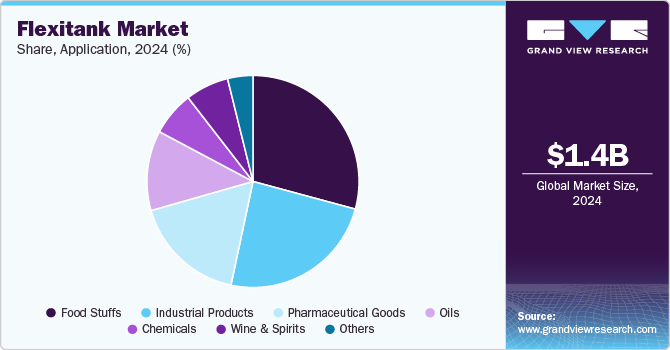

Application Insights

Based on application, the food stuffs segment led the market with the largest revenue share of 29.20% in 2024. Foodstuffs are among the most significant segments in the global market, given its growth over the years. The anticipated growth of the segment can be attributed to the rising consumption of grocery products coupled with the burgeoning growth of retail chains, especially hypermarkets & supermarket chains, in emerging economies. The segment includes a wide range of products, including fruit juices, concentrates, vegetable oils, palm oils, fish oils, edible oils, sorbitol, fructose, coconut oils, egg liquid, malt extract, corn oil, sauces, purees, and bakery & confectionery products, among others.

The chemical segment is expected to grow at a significant CAGR of 24.4% over the forecast period. Flexitank has transformed the transport of non-hazardous chemicals in the chemical industry, offering a highly efficient, low-cost, and durable alternative to conventional packaging options like corrugated containers. Many companies are now opting for flexitank due to its lightweight and sturdy structure, which significantly reduces shipping costs while providing reliable protection during transit. Unlike traditional packaging, these flexitanks are often crafted from recycled polypropylene, ethylene vinyl acetate (EVA), and polyethylene, thereby minimizing the reliance on 100% virgin polymers. This shift supports both cost reduction and sustainability initiatives, allowing chemical manufacturers to meet growing environmental standards.

Region Insights

The flexitank market in North America is anticipated to grow at the fastest CAGR during the forecast period. The demand for single-layer flexitank in North America is largely driven by the rising consumption of various food products, including fresh produce, cheese, and wine, among others. In the coming years, many e-commerce companies are expected to enter the North America market. This development is anticipated to benefit the market growth of single-layer flexitank over the forecast period.

U.S. Flexitank Market Trends

The flexitank market in the U.S. accounted for the largest market share in North America in 2024, owing to the presence of large food & beverage and pharmaceutical industries coupled with strong per capita income. The presence of major flexitank manufacturers, such as Environmental Packaging Technologies, Inc. and Techno Group USA, in the US, are supporting the market growth. The demand is also gaining growth owing to the rising preference for flexitank by the shipping companies for the transportation of liquid orders. For instance, according to a US-based company that offers shipping services to manufacturers and receivers, InterlogUSA, tank containers were the primary means for transporting liquid cargo across the country, but that was the case before the invention of the flexitank.

Asia Pacific Flexitank Market Trends

Asia Pacific dominated the flexitank market with the largest revenue share of 46.93% in 2024. This high growth is attributable to the presence of the two largest agricultural-producing and consuming countries, namely China and India, in the region. Furthermore, several key companies in Europe and North America have been outsourcing production activities to India and China owing to the lower production costs in these countries. Therefore, the potential growth of food and pharmaceutical industries is anticipated to increase the demand for flexitank within the region over the forecast period.

The flexitank market in China is anticipated to grow at a substantial CAGR during the forecast period. The substantial revenue share is bolstered by major players such as Qingdao BLT Packing Industrial Co., Ltd., Full-Pak, and Qingdao LAF Packaging Co., Ltd. The country’s extensive network of ports and favorable shipping facilities enhance its market value. In addition, the escalating global demand for chemicals, foodstuffs, and industrial products significantly contributes to the increasing need for flexitank. Notably, the chemicals segment is expected to dominate the market and experience the fastest growth from 2025 to 2030, driven by a rising need for transporting food-grade liquids and non-hazardous chemicals at low temperatures. The advantages of flexitank, including their compatibility with ocean, rail, and truck transportation, as well as their environmentally friendly and recyclable nature-are set to further propel market growth during the forecast period.

Europe Flexitank Market Trends

The flexitank market in Europe is characterized by the significant presence of the world’s largest pharmaceutical companies, including Bayer AG, F. Hoffmann-La Roche Ltd., Novartis AG, Sanofi, and GlaxoSmithKline, among others. These companies mainly manufacture various temperature-sensitive pharmaceuticals in Europe and export them to the rest of the world. Germany, Switzerland, Belgium, France, and the Netherlands were amongst the top 10 pharmaceutical products exporting countries in the world in 2023. Therefore, large pharmaceutical production in the region makes it a lucrative market for single layer flexitank.

The Germany flexitank market is boosted by the presence of major players such as Büscherhoff Packaging Solutions GmbH and Trans Ocean Bulk Logistics Ltd., contributing to the market's growth and stability. Germany shows a strong preference for single-layer flexitank, which are expected to retain their dominance throughout the forecast period due to their efficiency and convenience. The high focus on recyclable material in order to meet the sustainable goals of the country is another major trend in the Germany market

Key Flexitank Company Insights

The market operates in a highly competitive environment characterized by the presence of several major players who compete primarily on product quality, innovation, and compliance with stringent industry standards. The competition focuses on developing advanced materials with superior cleanliness levels, electrostatic discharge (ESD) properties, and particle control capabilities. Market players are increasingly investing in R&D to develop sustainable and recyclable materials in response to environmental concerns while also expanding their geographic presence through strategic partnerships and acquisitions.

Key Flexitank Companies:

The following are the leading companies in the flexitank market. These companies collectively hold the largest market share and dictate industry trends.

- Qingdao BLT Packing Industrial Co., Ltd. (BLT)

- Nelson Global

- Braid Logistics

- Bulk Liquid Solutions

- Büscherhoff Packaging Solutions GmbH

- Environmental Packaging Technologies Inc.

- Full-Pak Bulk Containers

- K Tank Supply Ltd

- Mak & Williams Flexitank Supply

- MYFLEXITANK

- KriCon Group

- Qingdao LAF Technology Co., Ltd.

- SIA FLEXITANKS

- Shanghai Yunjet Plastic Packaging Co., Ltd.

- TRUST Flexitanks

- Techno Group USA

- Hillebrand Gori Group GmbH

- Neoflex

- FLUIDTAINER FLEXITANK SDN BHD

- Qingdao Hengxin Plastic Co. Ltd

- Philton Polythene Converters Ltd

- Anthente International

- LSM S.A. - FLEXPACK

- United Accredited Co.

- Transocean Forwarding & Commerce

- Rishi FIBC Solutions Pvt Ltd

- Hinrich Industries

- ONE Flexitank

- Infinity Bulk Logistics Sdn Bhd

- Tancomed S.A.

- Transolve Global

Recent Developments

- In November 2023, ASF, Inc., a logistics service provider, announced the expansion of its flexitank portfolio, providing highly efficient and environmentally friendly forms of shipping for non-hazardous bulk liquid cargo.

Flexitank Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,646.6 million

Revenue forecast in 2030

USD 4,748.1 million

Growth rate

CAGR of 23.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in units, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Layer type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S. ;Canada; Mexico; Germany; UK; France; Italy; Spain; Belgium; Netherlands; China; India; Japan; Australia; Singapore; Malaysia; Brazil; Argentina; Saudi Arabia; United Arab Emirates (UAE); South Africa

Key companies profiled

Qingdao BLT Packing Industrial Co., Ltd. (BLT); Nelson Global; Braid Logistics; Bulk Liquid Solutions; Büscherhoff Packaging Solutions GmbH; Environmental Packaging Technologies Inc.; Full-Pak Bulk Containers; K Tank Supply Ltd; Mak & Williams Flexitank Supply; MYFLEXITANK; KriCon Group; Qingdao LAF Technology Co., Ltd.; SIA FLEXITANKS; Shanghai Yunjet Plastic Packaging Co., Ltd.; TRUST Flexitanks; Techno Group USA; Hillebrand Gori Group GmbH; Neoflex; FLUIDTAINER FLEXITANK SDN BHD; Qingdao Hengxin Plastic Co. Ltd; Philton Polythene Converters Ltd; Anthente International; LSM S.A. - FLEXPACK; United Accredited Co.; Transocean Forwarding & Commerce; Rishi FIBC Solutions Pvt Ltd; Hinrich Industries; ONE Flexitank; Infinity Bulk Logistics Sdn Bhd; Tancomed S.A.; Transolve Global;

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flexitank Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flexitank market report based on layer type, application and region:

-

Layer Type Outlook (Volume, Units; Revenue, USD Thousand, 2018 - 2030)

-

Single Layer

-

Multi-layer

-

-

Application Outlook (Volume, Units; Revenue, USD Thousand, 2018 - 2030)

-

Foodstuffs

-

Wine & Spirits

-

Chemicals

-

Oils

-

Industrial Products

-

Pharmaceutical Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Belgium

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Singapore

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flexitank market was estimated at USD 1,357.3 million in the year 2024 and is expected to reach USD 1,646.6 million in 2025.

b. The global flexitank market is expected to grow at a compound annual growth rate of 23.6% from 2025 to 2030 to reach USD 4,748.1 million by 2030.

b. Based on layer type, the multi-layer segment led the market with the largest revenue share of 54.82% in 2024

b. Qingdao BLT Packing Industrial Co., Ltd. (BLT); Braid Logistics UK Ltd.; Bulk Liquid Solutions Pvt. Ltd.; Büscherhoff Packaging Solutions GmbH; Environmental Packaging Technologies, Inc.; Full- Pak; K Tank Supply Ltd.; MY Flexitank; Kricon Group BV; Qingdao LAF Packaging Co., Ltd.; SIA FLEXITANKS; Yunjet Plastics Packaging; Trans Ocean Bulk Logistics Ltd.

b. The key factors that are driving the flexitank market include increasing trade across the countries and the competitive benefits of flexitanks over its traditional substitutes such as ISO containers, drums, barrels, and IBC’s.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.