- Home

- »

- Advanced Interior Materials

- »

-

Floor Grinding Machine Market Size, Industry Report, 2030GVR Report cover

![Floor Grinding Machine Market Size, Share & Trends Report]()

Floor Grinding Machine Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Walk-behind Floor Grinders, Ride-on Floor Grinders), By Operation Mode, By End-use (Marble & Granite, Concrete), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-329-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Floor Grinding Machine Market Size & Trends

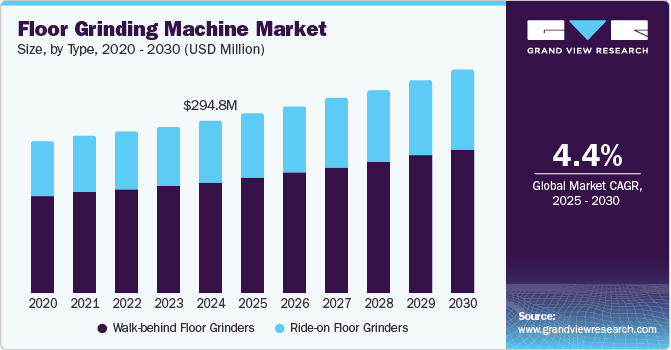

The global floor grinding machine market size was valued at USD 294.8 million in 2024 and is expected to grow at a CAGR of 4.4% from 2025 to 2030.The expanding construction industry, driven by urbanization and infrastructure development, is fueling the demand for high-quality finishes in both interiors and exteriors. Floor grinding machines have become essential for achieving smooth, polished, and refined flooring solutions, with a growing emphasis on aesthetically pleasing surfaces.

The need for durability, low-maintenance, and visually appealing floors in residential, commercial, and industrial spaces is impelling the adoption of advanced grinding technologies. This trend is expected to accelerate the growth of the floor grinding machine industry, as construction projects require precise and efficient floor surface preparation.

Ongoing advancements in floor grinding machine technology, such as enhanced precision, efficiency, and user-friendly features, are expected to propel the market size. These innovations enable faster, more effective floor preparation and polishing, catering to the surging demand for high-quality finishes in construction projects. The increased awareness regarding the importance of dust suppression systems in compliance with safety regulations is influencing product innovation and adoption. In addition, investments in infrastructure development, particularly in emerging economies, are driving the need for durable and aesthetic flooring solutions across commercial, residential, and industrial sectors. The combined focus on technology and infrastructure expansion is set to accelerate the adoption of floor grinding machines in the coming years.

Major projects focused on cleaning and refurbishing structures, such as bridges, roads, and other vital infrastructure, are expected to significantly contribute to the growth of the floor grinding machines industry. Furthermore, the presence of contract firms that offer sandblasting services for home use, including road cleaning, terrace maintenance, and the removal of deposits from fireplaces, is driving market growth.

Type Insights

The walk-behind floor grinders segment held the largest revenue share of 64.3% in 2024, fueled by their versatility, ease of use, and affordability. These machines are ideal for smaller spaces and residential or light commercial projects, offering precision and control during floor preparation. Their compact size allows for better maneuverability, making them highly efficient for intricate grinding tasks. Moreover, walk-behind grinders are more cost-effective than larger, ride-on models, contributing to their widespread adoption in various sectors, thus securing the largest market share.

The ride-on floor grinders segment is anticipated to emerge as the fastest growing segment over the forecast period, attributed to the global expansion of the construction industry and the rising demand for faster, more efficient floor grinding solutions. These machines provide greater productivity, enabling operators to cover large areas in less time while maintaining high precision. Their advanced and automated features also reduce manual labor and improve consistency in floor finishing. With increasing project complexities and a need for high-performance equipment, ride-on floor grinders are preferred.

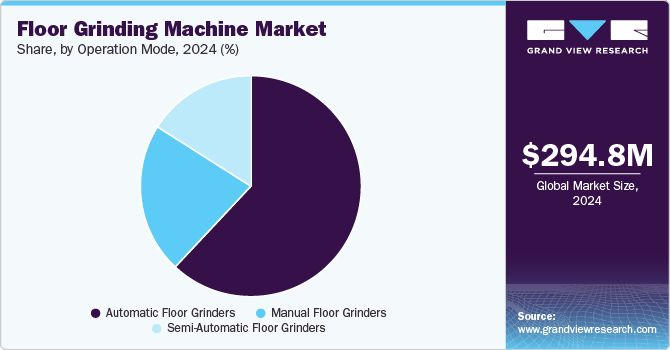

Operation Mode Insights

The automatic floor grinders segment held the largest revenue share in 2024, driven by their efficiency, precision, and ease of use. These machines offer enhanced productivity by reducing manual labor and ensuring consistent, high-quality results across large surfaces. Their automation features, such as adjustable speed and automated functions, make them ideal for both large-scale commercial and industrial applications. The increasing demand for time-saving, cost-effective solutions in construction and renovation projects has driven the widespread adoption of automatic floor grinders, strengthening their dominant position in the floor grinding machine industry.

The semi-automatic floor grinders segment is anticipated to witness the fastest CAGR from 2025 to 2030. The demand for semi-automatic floor grinders is surging owing to their enhanced efficiency and productivity in floor preparation and better finishing compared to manual grinders. Furthermore, the semi-automatic floor grinders require less manual effort, reducing fatigue and allowing workers to accomplish more in less time. They also offer better control and precision over the grinding process, significantly improving the work quality. Improved precision is essential in environments such as pharmaceutical plants, electronics manufacturing facilities, and high-end residential or commercial spaces, where the floor finish plays a crucial role.

End-use Insights

The marble & granite segment accounted for the largest share in 2024, propelled by the growing demand for these premium, durable materials in residential and commercial construction projects. The elegant appearance and long-lasting qualities of marble and granite make them highly preferred options for flooring, countertops, and other surfaces. Floor grinding machines are essential for imparting a smooth, polished finish to these surfaces. The increasing use of marble and granite in modern architectural designs has driven the demand for specialized grinding solutions, cementing the dominance of this segment.

The concrete segment is expected to grow at a significant CAGR over the forecast period, owing to the increasing demand for high-quality, durable, and aesthetically appealing concrete floors. Growing construction and renovation activities, especially in commercial and industrial sectors, are driving the need for advanced grinding machines that ensure smooth, leveled, and polished concrete surfaces. In addition, innovations in concrete grinding technology, such as dust-free operations and faster grinding capabilities, make concrete surfaces more efficient and cost-effective, further accelerating segment expansion.

Application Insights

The non-residential segment held the largest share in 2024, attributed to the high demand for durable and aesthetically appealing floors in commercial, industrial, and institutional spaces. Large-scale construction projects, including offices, shopping malls, factories, and warehouses, require efficient and precise floor-finishing solutions. Floor grinding machines are crucial for achieving smooth, polished, and long-lasting surfaces in these high-traffic areas. The increasing focus on maintaining the quality and appearance of non-residential spaces, combined with the need for fast and efficient flooring solutions, has enhanced the prominence of this segment.

The residential segment is expected to experience the fastest CAGR over the forecast period with the rising trend of home renovations and flooring upgrades. Homeowners are increasingly seeking polished, smooth, and durable floor finishes, driving the demand for advanced grinding machines. The growing popularity of concrete, terrazzo, and natural stone floors in residential spaces is further fueling this demand. Technological advancements in floor grinding machines, offering efficient, dust-free, and user-friendly operations, are further boosting their adoption in residential settings, positioning this segment for significant expansion.

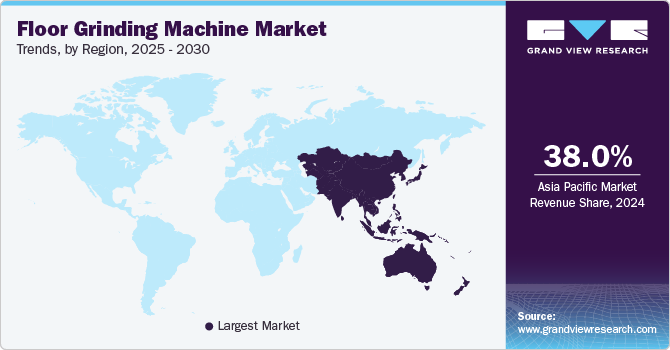

Regional Insights

The North America floor grinding machine market is projected to witness significant growth from 2025 to 2030. The surge in new construction and renovation projects across North America is significantly driving the demand for floor grinding machines, essential for preparing high-quality and durable flooring surfaces. The growing emphasis on sustainable and green building practices further accelerates market growth as builders seek eco-friendly solutions. Floor grinding machines that minimize dust, reduce energy consumption, and provide efficient results are becoming increasingly popular. This demand for both modern construction and environmentally responsible solutions is impelling the expansion of the floor grinding machine industry in North America.

U.S. Floor Grinding Machine Market Trends

The U.S. floor grinding machine market dominated the regional market with the largest share in 2024. The growing preference for durable flooring materials in residential, commercial, and industrial spaces is driving the demand for advanced floor grinding machines in the U.S. Consumers, and businesses are seeking long-lasting, high-quality flooring solutions that require precise surface preparation, boosting the need for efficient grinding equipment. The adoption of more automated and technologically advanced machines further supports this trend, offering fast and accurate results. These innovations enhance productivity and improve cost-efficiency, leading to an increased market size for floor grinding machines in the U.S.

Europe Floor Grinding Machine Market Trends

Europe floor grinding machine market is projected to grow at a significant CAGR from 2025 to 2030. The growing demand for industrial applications across various sectors is significantly driving the market expansion. Industries such as construction, manufacturing, and maintenance require efficient floor preparation and finishing, which increases the need for advanced grinding machinery. Furthermore, the rising popularity of floor grinding machine rentals offers cost-effective solutions for temporary projects, fueling the market growth. Businesses are increasingly opting for rental options to reduce capital expenditure, leading to a surge in demand for floor grinding machines across Europe and contributing to market expansion.

Asia Pacific Floor Grinding Machine Market Trends

Asia Pacific floor grinding machine market dominated the global market with the largest revenue share of 38.0% in 2024, fueled by the increasing focus on infrastructure development and growing inclination toward aesthetic flooring options. Rapid urbanization, rising construction activities, and the demand for high-quality, visually appealing floors in residential, commercial, and industrial projects are fueling this growth. The adoption of polished concrete, marble, and terrazzo surfaces is gaining popularity, requiring efficient grinding solutions for a smooth finish. The growing emphasis on functional and aesthetic flooring in diverse sectors is contributing to the expanding floor grinding machine industry across the region.

India Floor Grinding Machine Market Trends

India floor grinding machine market is projected to have the fastest CAGR in APAC region over the forecast period. The adoption of diamond tooling in floor grinding machines substantially enhances the efficiency and precision of floor polishing and grinding processes, driving market growth in the country. Diamond tools offer superior durability, resulting in longer machine life and reduced maintenance costs, making them highly preferred in both commercial and residential applications. Moreover, the growing emphasis on eco-friendly construction practices, such as the use of low-emission and energy-efficient equipment, is further propelling demand for advanced floor grinding machines. These trends are expected to continue favoring the growth of the floor grinding machine industry in India.

Key Floor Grinding Machine Company Insights

Some major players in the floor grinding machine industry includeAchilli S.r.l.; Bartell Global; Fujian Xingyi Polishing Machine Co., Ltd (Fujian Xingyi Intelligent Equipment Co., Ltd.); Husqvarna Group; Klindex s.r.l.; LINAX Co., Ltd.; National Flooring Equipment; Roll GmbH; Scanmaskin Sverige AB; and Tyrolit - Schleifmittelwerke Swarovski AG & Co K.G.These market players focus on continuous product development, pursue strategic mergers and acquisitions, expand service offerings, and enhance customer support to maintain a competitive edge and meet evolving industry demands.

-

Klindex s.r.l. offers high-quality equipment and solutions for floor grinding, polishing, and maintenance. It provides machines, tools, and accessories for marble, granite, concrete, and other surfaces, catering to both professionals and DIY enthusiasts.

-

Roll GmbH provides innovative solutions in industrial automation, specializing in automation systems, control technology, and robotics. It offers tailored solutions for various sectors, including manufacturing, logistics, and process industries, enhancing efficiency and productivity.

Key Floor Grinding Machine Companies:

The following are the leading companies in the floor grinding machine market. These companies collectively hold the largest market share and dictate industry trends.

- Achilli S.r.l.

- Bartell Global

- Fujian Xingyi Polishing Machine Co., Ltd (Fujian Xingyi Intelligent Equipment Co., Ltd.)

- Husqvarna Group

- Klindex s.r.l.

- LINAX Co., Ltd.

- National Flooring Equipment

- Roll GmbH

- Scanmaskin Sverige AB

- Tyrolit - Schleifmittelwerke Swarovski AG & Co K.G.

Recent Developments

-

In September 2024, Husqvarna Construction introduced a new series of large planetary floor grinders specifically engineered to boost productivity and streamline customer operations. These machines provide enhanced efficiency, making tasks easier and ensuring a smoother, more effective workday.

-

In March 2024, Norton Clipper launched its innovative floor solutions range, featuring powerful and versatile machines, tools, and vacuums. This new product range offers exceptional precision and performance for various floor treatments, including grinding, wood sanding, and cleaning.

Floor Grinding Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 306.7 million

Revenue forecast in 2030

USD 380.4 million

Growth Rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, operation mode, end-use, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Achilli S.r.l.; Bartell Global; Fujian Xingyi Polishing Machine Co., Ltd (Fujian Xingyi Intelligent Equipment Co., Ltd.); Husqvarna Group; Klindex s.r.l.; LINAX Co., Ltd.; National Flooring Equipment; Roll GmbH; Scanmaskin Sverige AB; and Tyrolit- Schleifmittelwerke Swarovski AG & Co K.G.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Floor Grinding Machine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global floor grinding machine market report based on type, operation mode, end-use, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Walk-behind Floor Grinders

-

Ride-on Floor Grinders

-

-

Operation Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual Floor Grinders

-

Semi-Automatic Floor Grinders

-

Automatic Floor Grinders

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Marble & Granite

-

Concrete

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.