- Home

- »

- Medical Devices

- »

-

Florida Dialysis Centers Market Size & Share Report, 2030GVR Report cover

![Florida Dialysis Centers Market Size, Share & Trends Report]()

Florida Dialysis Centers Market (2023 - 2030) Size, Share & Trends Analysis Report By Modality (In-Center, In-Home, SNF-based), By Dialysis Type (Hemodialysis, Peritoneal Dialysis), By Facility Type, And Segment Forecasts

- Report ID: GVR-4-68040-071-7

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Florida Dialysis Centers Market Trends

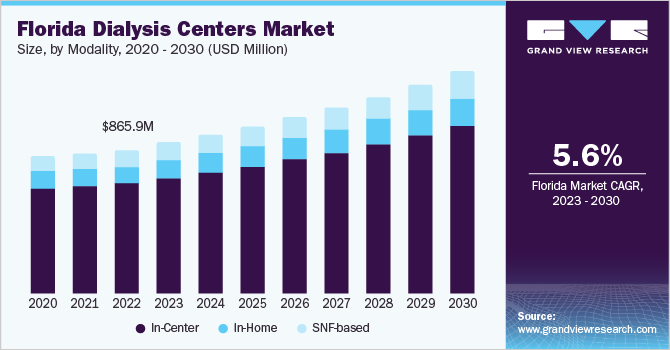

The Florida dialysis centers market size was valued at USD 865.9 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.61% from 2023 to 2030. Technological advancements, a high prevalence of kidney diseases, the lack of kidney donors, and favorable reimbursement scenarios are major factors driving the market’s growth. According to the American Kidney Fund, in April 2021, around 48,215 individuals in the state were suffering from ESRD. Of these, 34,847 residents depend on dialysis to stay alive; the remaining 13,368 have undergone kidney transplants.

Moreover, the number of individuals with CKD is rising in the U.S. as well as in Florida. This is due to the increase in the geriatric population and rising incidence of conditions that are risk factors for kidney disease, such as hypertension & diabetes. Diabetes, high blood pressure, and obesity are the major reasons for kidney disease in Florida. High blood pressure is the leading cause of kidney failure in Florida and is responsible for more than 33% of new cases. Thus, increasing cases of kidney diseases are projected to propel the demand for dialysis during the forecast period.

The COVID-19 pandemic negatively impacted the market. Several cases of COVID-19 were causing complications such as kidney conditions, leading to shorter patient treatment times as well as a decline in staff & supply shortages that were impeding access to life-sustaining treatments. The impact of COVID-19 on people with kidney disorders led to the first drop in the number of patients on dialysis in the U.S. in the 50-year history of the Medicare ESRD Program. In addition, supply and staff shortages resulted in dialysis center closures and backlogs in moving patients among hospitals, skilled nursing facilities, and dialysis centers.

Patient treatment practices changed as a result of the pandemic, and new safety precautions have been implemented to reduce the risk of COVID-19 transmission. To reduce the risk of infection, the industry has increased the use of telemedicine for patient consultations and changed staffing & scheduling procedures. These changes have raised prices and reduced the availability of qualified staff.

Furthermore, the potential applications of telehealth services are expected to boost market growth. Telehealth helps healthcare professionals monitor patients at home. This can involve vital signs, test results, and other health indicators to make sure patients are receiving the proper care. Moreover, for patients who have trouble traveling to a center, telehealth can enhance access to services.

Modality Insights

Based on modality, the market is segmented into in-center, in-home, and SNF-based. In-center held a majority of the market share of 76.69% in the modality segment in 2022. The consistent growth in the prevalence of End-stage Renal Disease (ESRD) and CKD has offered an opportunity for major players to expand their services, and several leading indicators of kidney disorders, such as diabetes, suggest a continuation of this trend.

Furthermore, the introduction of new dialysis facilities in Florida is expected to fuel market growth. For instance, in March 2023, Oak Street Health entered into a new joint venture with Interwell Health, a kidney care management company, to expand its reach into the dialysis care industry. The new venture will operate as OakWell and will deliver primary care to patients with ESRD.

Advancements in Skilled Nursing Facilities (SNFs) are expected to drive segment growth. Residents in nursing homes and SNFs can obtain onsite dialysis rather than going to a center for care. The stress of traveling for treatment can be reduced with onsite treatment at an SNF, and there is a chance of improved care coordination between the SNF, nephrologist, and the company's care staff at the patient’s residence.

On the other hand, the in-home segment is projected to register the fastest CAGR over the forecast period, owing to its potential to increase patient-centeredness when caring for ESRD patients while preserving clinical efficacy & possibly providing significant cost savings. This cost reduction, which has enabled new competition and helped to generate unique technologies, and created new opportunities for industry participants, is the primary force behind the evolution of the home dialysis market.

Dialysis Type Insights

Based on dialysis type, the Florida dialysis centers market is segmented into hemodialysis and peritoneal dialysis. Hemodialysis held a majority of the market share of 89.78% in 2022. The most common form of treatment for renal failure is hemodialysis. The demand for hemodialysis is being driven by the clinical advantages of this technique, including the shorter process time and growing adoption of Arteriovenous (AV) fistula.

In addition, leading companies are focusing on developing novel equipment and services along with expanding alliances & collaborations with market participants, which is anticipated to propel market growth in Florida. Hemodialysis machines for home and hospital use are currently available in the market. For instance, in August 2022 , Dialyze Direct entered into a partnership with Infinite Care to offer on-site hemodialysis at facilities in Florida and New York. This initiative was expected to strengthen the company’s position as a notable home hemodialysis supplier to skilled nursing facilities in the region.

Peritoneal dialysis (PD) is projected to register the fastest CAGR over the forecast period, owing to various advantages of peritoneal dialysis in kidney failure and Chronic Kidney Disease (CKD). PD is simple to use at home and can be monitored 24/7. These benefits have increased its popularity among renal patients and will continue to support the home care segment growth during the forecast period.

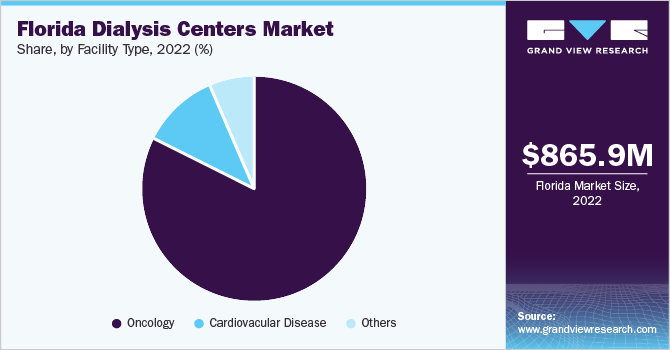

Facility Type Insights

Based on facility type, the market is segmented into dialysis chains, independent facilities, and hospital-based. The dialysis chains segment held a majority share of the market at 82.60% in the facility type segment in 2022 and is also expected to register the fastest CAGR over the forecast period. This can be attributed to an increased number of outpatient facilities, with free-standing units expanding more quickly than hospital-based facilities.

The development of multiunit chains is even more striking. A single company owns a number of facilities under the organizational structure known as chain membership. DaVita and Fresenius, two major publicly-traded companies, control more than 60% of the dialysis facilities.

Independent centers offer training and after-care for eligible patients receiving hemodialysis at home. Independent centers offer several advantages, such as cost-effectiveness and flexibility. These centers are small-scale facilities that can give patients more personalized care. They can quickly make changes to adapt to new treatments & technology, and they can customize their services to suit the specific needs of patients.

Key Companies & Market Share Insights

The market is highly fragmented, with the presence of many national and regional players. New product launches and partnerships are some of the major strategies undertaken by key market players to grow their market share. For instance, in February 2022, Fresenius Medical Care announced agreements with more than 1,000 nephrology providers in the U.S. as a part of the new Kidney Care Choices (KCC) models. Some prominent players in the Florida dialysis market include:

-

South Florida Dialysis Center

-

Fresenius Medical Care

-

Central Florida Kidney Centers, INC.

-

Mayo Clinic Dialysis Center

-

UF Health Dialysis Center

-

U.S. Renal Care, Inc.

-

Florida Kidney Physicians (American Renal Association Boca)

-

DaVita, Inc.

-

Crown Dialysis Center of Palm Beach

-

Universal Kidney Centers

-

Innovative Renal Care

-

ARC Dialysis

Florida Dialysis Centers Market Report Scope

Report Attribute

Details

The market size value in 2022

USD 865.9 million

The revenue forecast in 2030

USD 1.3 billion

Growth rate

CAGR of 5.61% from 2023 to 2030

The base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, dialysis type, facility type

Key companies profiled

South Florida Dialysis Center; Fresenius Medical Care; Central Florida Kidney Centers, INC.; Mayo Clinic Dialysis Center; UF Health Dialysis Center; U.S. Renal Care, Inc.; Florida Kidney Physicians (American Renal Association Boca); DaVita, Inc.; Crown Dialysis Center of Palm Beach; Universal Kidney Centers; Innovative Renal Care; ARC Dialysis

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Florida Dialysis Centers Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Florida dialysis centers market report based on modality, dialysis type, and facility type:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

In-Center

-

In-Home

-

SNF-based

-

-

Dialysis Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemodialysis

-

Peritoneal Dialysis

-

-

Facility Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dialysis Chains

-

Independent Facilities

-

Hospital-based

-

Frequently Asked Questions About This Report

b. The Florida dialysis centers market was estimated at USD 865.9 million in 2022 and is expected to decline to around USD 909.3 million in 2023.

b. The Florida dialysis centers market is expected to grow at a compound annual growth rate of 5.61% from 2023 to 2030 and is expected to reach USD 1.3 billion by 2030.

b. The in-center segment dominated the Florida dialysis centers market by modality, with a share of around 76.7% in 2022. This is attributable to the increasing prevalence of ESRD in geriatric population in the state.

b. Some of the key players operating in the Florida dialysis centers market include South Florida Dialysis Center; Fresenius Medical Care; Central Florida Kidney Centers, INC.; Mayo Clinic Dialysis Center; UF Health Dialysis Center; U.S. Renal Care, Inc.; Florida Kidney Physicians (American Renal Association Boca); DaVita, Inc.; Crown Dialysis Center of Palm Beach; Universal Kidney Centers; Innovative Renal Care; ARC Dialysis

b. The key factors driving the Florida dialysis center market growth include technological advancements in dialysis services, high prevalence of kidney diseases, lack of kidney donors, and favorable reimbursement scenarios.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.