- Home

- »

- Next Generation Technologies

- »

-

Flow Meter Market Size And Share, Industry Report, 2030GVR Report cover

![Flow Meter Market Size, Share & Trends Report]()

Flow Meter Market (2025 - 2030) Size, Share & Trends Analysis Report By Power Type (Electric, Solar, Battery Powered), By Product (Differential Pressure, Positive Displacement), By Application, By Pipe Size, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-150-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Flow Meter Market Summary

The global flow meter market size was estimated at USD 10.64 billion in 2024 and is projected to reach USD 15.17 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. The growth is driven by the increasing demand for precise measurement and monitoring across various industries, including oil and gas, water and wastewater, chemicals, and power generation.

Key Market Trends & Insights

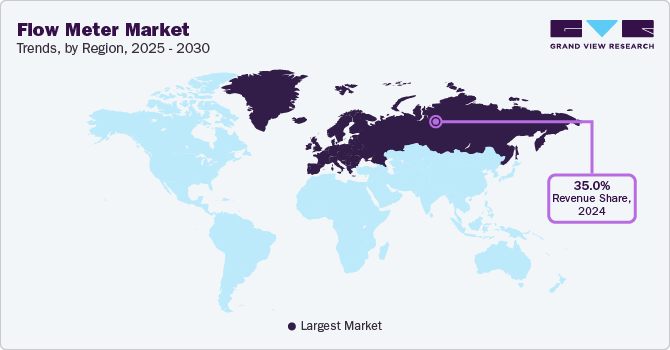

- Europe accounted for the largest market share of more than 35% in 2024.

- The UK flow meter market is being influenced by the drive towards conserving water, decarbonizing, and enhanced regulatory compliance.

- By product, the magnetic segment dominated the flow meter industry in 2024 with a revenue share of 27.2% and is expected to grow at a significant rate over the forecast period.

- By application, the power generation segment dominated the market in 2024.

- By power type, the battery powered segment is projected to grow rapidly during the forecast period of 2025-2030.

Market Size & Forecast

- 2024 Market Size: USD 10.64 Billion

- 2030 Projected Market Size: USD 15.17 Billion

- CAGR (2025-2030): 6.0%

- Europe: Largest Market in 2024

As industries focus more on energy efficiency, sustainability, and process optimization, the need for innovative flow metering solutions is also growing. Regulatory requirements for accurate reporting and environmental compliance further propel this market. The rising adoption of IoT-enabled smart flow meters, real-time analytics, and wireless communication is supporting demand across multiple sectors by enabling businesses to optimize processes and reduce costs. One prominent trend in the flow meter market is the increasing use of digital and smart flow metering technologies. These systems, which offer remote monitoring, wireless communication, and integrated diagnostics, provide real-time insights that enhance operational efficiency and decrease downtime. As industries transition towards Industry 4.0, there is a growing need for flow meters that can integrate into broader digital systems. This trend is particularly evident in utilities, manufacturing, and chemicals, where automated analysis and data collection have become essential for optimizing efficiency and ensuring compliance with environmental regulations.

Another rising trend is the growing adoption of non-invasive flow meters, especially in sectors where hygiene and safety are critical, such as food and beverages and pharmaceuticals. Technologies such as ultrasonic, electromagnetic, and Coriolis flow meters are increasingly replacing traditional mechanical meters due to their superior accuracy, reliability, and low maintenance requirements. These advanced meters also enhance safety by minimizing the risks associated with mechanical components in high-pressure environments. The growing emphasis on environmental sustainability is driving demand for these next-generation meters, as they improve resource management and enable more accurate control over fluid and gas flow. Leading companies in the flow meter industry are focusing on innovation and strategic partnerships to remain competitive.

Key players such as ABB, Emerson Electric, Siemens, and Endress+Hauser are at the forefront of developing smart and digital flow metering solutions. These companies are investing in research and development to create flow meters with additional features, including remote diagnostic capabilities, predictive maintenance, and real-time data monitoring. Furthermore, mergers and acquisitions are common in this sector, as companies aim to expand their portfolios and enter new geographic markets to capitalize on emerging opportunities.

Product Insights

The magnetic segment dominated the flow meter industry in 2024 with a revenue share of 27.2% and is expected to grow at a significant rate over the forecast period. Magnetic flow meters are widely used in industries such as water and wastewater treatment, food and beverage processing, and chemicals due to their high reliability and accuracy in measuring the flow of conductive liquids. Since these meters have no moving parts, they experience less wear and tear, resulting in lower maintenance requirements. Their robust design, resistance to pressure drops, and non-intrusive nature make them ideal for applications where hygiene, durability, and efficiency are critical. Additionally, increasing investments in water infrastructure and stringent environmental regulations are expected to drive global demand for magnetic flow meters. As industries seek scalable and long-term metering solutions, the magnetic flow meter segment is projected to experience steady growth throughout the forecast period.

On the other hand, the coriolis segment is expected to grow at a faster CAGR during the forecast period. The segment growth is driven by the rising demand for high-accuracy measurement devices in mission-critical applications. Coriolis mass flow meters provide direct mass flow measurements, which are especially important in industries such as pharmaceuticals, specialty chemicals, and oil and gas, where precise fluid measurement is vital for quality and safety. These meters perform well with a wide range of fluid types, including viscous substances, slurries, and multi-phase flows, without being influenced by pressure, temperature, or fluid composition. Their ability to measure both mass flow and fluid density in a single instrument offers significant process optimization benefits. Furthermore, integration with digital communication protocols and process automation platforms is enhancing their appeal in modern industrial settings. As industries increasingly emphasize process accuracy, safety, and regulatory compliance, Coriolis flow meters are expected to see strong demand and widespread adoption in both developed and emerging markets.

Application Insights

The power generation segment dominated the market in 2024, owing to the increasing need for effective monitoring and control of fluid systems in thermal, nuclear, and renewable power plants. Accurate flow measurements are essential for optimizing fuel consumption, enhancing system efficiency, and ensuring environmental compliance in power generation operations. Flow meters are used to measure the flow of water, steam, and fuel, which is critical for the performance and safe operation of turbines, boilers, and coolers. Investment in modernizing power infrastructure, especially in countries transitioning to renewable energy sources, has stimulated growth in this segment. Additionally, combined heat and power (CHP) systems and the push for energy efficiency in traditional power plants have further increased demand for flow meters. As a result, the power generation segment is expected to maintain its dominant position in the global market in the coming years.

The oil & gas segment is projected to grow rapidly from 2025 to 2030. This expansion is fueled by continuous innovation in upstream, midstream, and downstream operations, as well as the increasing sophistication of oil extraction and processing methods. Flow meters play a vital role in measuring and controlling the movement of crude oil, refined products, natural gas, and various chemicals through pipelines and refineries. In upstream operations, precise flow measurement is essential for well testing and production monitoring, while in downstream operations, it is crucial for refining and distribution. Factors such as increased offshore oil field development, rising investments in LNG infrastructure, and a heightened focus on operational efficiency and safety are driving the demand for advanced flow metering solutions. Furthermore, with fluctuating oil prices, organizations are prioritizing the reduction of losses and the streamlining of processes, making high-precision and real-time measurement instruments, such as ultrasonic and Coriolis flow meters, increasingly attractive. Consequently, the oil and gas segment is one of the fastest-growing application segments in the flow meter industry.

Power Type Insights

The battery powered segment is projected to grow rapidly during the forecast period of 2025-2030, driven by the increasing demand for small, portable, and wireless flow metering solutions. Battery-powered flow meters offer greater flexibility and easier installation compared to traditional wired flow meters, especially in hard-to-reach or remote areas where wired infrastructure is either unavailable or too costly. These instruments are particularly beneficial in industries such as water and wastewater, oil and gas, and agriculture, where temporary flow measurement or non-intrusive installation is required. Advances in low power consumption technology and longer-lasting batteries are enabling extended operation periods, reducing maintenance needs and service interruptions.

The solar segment is anticipated to grow significantly during the forecast period, fueled by the growing trend towards sustainable energy solutions and carbon footprint reduction across industries. Solar-powered flow meters provide an off-grid solution ideal for field applications such as irrigation systems, environmental monitoring, and oil and gas operations in remote locations. The need to reduce dependence on conventional power sources, along with advancements in miniaturized solar panel technologies, is enhancing the feasibility and attractiveness of these systems for continuous flow monitoring. Furthermore, government initiatives promoting the use of renewable energy in infrastructure and utilities are supporting the adoption of solar-powered devices in both public and private sector projects. These systems typically come with onboard data loggers and wireless transmitters, enabling cost-effective remote monitoring without incurring additional energy expenses. As industries strive to meet global sustainability goals and decrease energy reliance, solar-powered flow meters are expected to experience steady and significant growth in use.

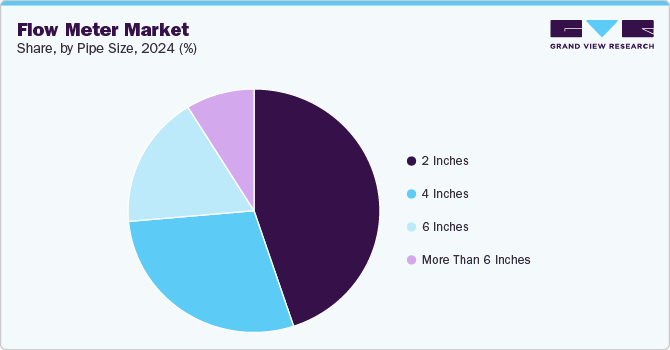

Pipe Size Insights

The 4 inches segment accounted for a significant market share in 2024. This segment is widely used in industrial processes such as oil and gas, water treatment, power generation, and chemical processing, where accurate flow monitoring is needed for medium and large-scale fluid transport systems. The 4-inch diameter provides an optimal balance, allowing it to handle large volumes of flow while still being flexible enough for installation in various operational environments. These meters can be used in both insertion and inline configurations, accommodating various technologies including electromagnetic, ultrasonic, and vortex flow meters. The durability and versatility of 4-inch flow meters make them a popular choice for medium-capacity pipeline facilities that require precise, real-time flow information to meet operational efficiency and regulatory standards. Continued industrial growth and updates to utility infrastructure worldwide are expected to maintain this segment's dominance in the market.

On the other hand, the 2 inches segment is anticipated to experience the fastest growth between 2025 and 2030. This trend is driven by increasing demand from applications in the food and beverage industry, pharmaceuticals, HVAC systems, and precision irrigation, where smaller pipeline networks and lower flow rates are common. Compact 2-inch flow meters offer easy installation, cost-effectiveness, and accurate flow measurement in space-restricted applications. Additionally, the rising use of decentralized water systems and modular industrial configurations is fueling the demand for small-diameter flow meters that can be easily integrated into compact process flows. Technological advancements that enhance sensitivity and provide digital connectivity in compact meters are also contributing to their accelerated adoption. As industries move toward greater automation and real-time monitoring, the 2-inch pipe size segment is likely to see significant growth, particularly in developing markets and small-scale process applications.

Regional Insights

Europe accounted for the largest market share of more than 35% in 2024. The Europe flow meter industry is gradually on the rise owing to energy-saving regulations, digitalization of industries, and rehabilitation of old utility infrastructure. Increasing demand is reported in water and wastewater treatment, chemical manufacturing, and energy. Smart flow meter adoption with incorporated diagnostics, remote monitoring, and real-time calculation is on the rise, particularly in Northern Europe and Western Europe. Electromagnetic and ultrasonic flow meters are experiencing increased popularity because of their non-intrusive nature and low maintenance. Sustainability drives within the EU region also underpin market expansion, with industries demanding accurate measuring equipment to track water usage and minimize energy use.

U.K. Flow Meter Market Trends

The UK flow meter market is being influenced by the drive towards conserving water, decarbonizing, and enhanced regulatory compliance. Utilities are retrofitting their networks with smart flow measurement systems to address Ofwat's leakage reduction goals and enhance metering accuracy for both residential and industrial uses. Moreover, the food and pharmaceutical industries are also spending on hygienic and non-invasive flow meters in order to preserve quality control and adhere to safety standards. With an eye to digital infrastructure and post-Brexit investment incentives, UK-based manufacturing industries are adopting cutting-edge flow metering technologies to enhance productivity and process automation.

The flow meter market in Germany is heavily driven by its high-tech manufacturing base and excellent industrial automation focus. Germany's chemical, automotive, and water treatment industries fuel consistent demand for high-precision flow meters. German industries prefer Coriolis and electromagnetic flow meters due to their reliability and precision in sophisticated and high-capacity environments. The continuous energy transition has also driven installations of flow meters in renewable power and district heating systems. In addition, Germany's stringent environmental laws mandate industries to measure and report fluid consumption and emissions with accuracy, which further drives the use of advanced metering technologies across industrial sites.

North America Flow Meter Market Trends

The North America flow meter industry continues to experience steady demand, largely driven by advancements in the oil and gas, chemical processing, and water management industries. There is an increasing emphasis on energy efficiency, industrial automation, and adherence to environmental regulations, which encourages industries to adopt more precise and intelligent flow measurement technologies. Technological advancements such as wireless connectivity, IoT-enabled devices, and real-time data analytics are influencing purchasing decisions among utilities and manufacturing operations. Furthermore, regulatory standards set by organizations such as the EPA and ANSI are prompting the modernization of water, gas, and steam metering systems. Both replacement demand and new installations are contributing to the market's resilience.

The United States flow meter industry is strengthened by a well-developed industrial base, stringent environmental monitoring standards, and aging infrastructure that necessitates replacement. The demand for digital and smart flow meters is rising among municipal water utilities and industrial plants, especially those seeking enhanced operational insights and energy efficiency. The shale gas boom and ongoing investments in LNG export terminals are also fueling the demand for high-accuracy and robust flow meters. Additionally, sectors such as food and beverage, pharmaceuticals, and HVAC are increasingly adopting non-intrusive flow technologies to meet safety and compliance requirements.

Asia Pacific Flow Meter Market Trends

The Asia Pacific flow meter industry is expanding rapidly due to the growth of various industries, urbanization, and an increasing demand for efficient water and energy management. Countries in the region are investing in smart infrastructure, including water distribution and wastewater treatment, where accurate flow measurement is crucial. Ultrasonic and electromagnetic flow meters are becoming more popular due to their reliability in large utility applications. Regional manufacturing hubs, particularly in Southeast Asia, are adopting advanced flow meters to optimize processes. Government initiatives focused on clean energy and sustainability are driving market growth, especially in industries such as oil and gas, chemicals, and power generation.

The China flow meter market is being fueled by heightened industrialization and stringent pollution control policies. Government regulations aimed at pollution control and resource efficiency are pushing industries toward smart and automated metering systems. China's significant investments in water infrastructure and the oil and gas sector have made it one of the largest purchasers of flow meters in the region. Local manufacturers are expanding their product lines to include digital and wireless-enabled flow meters to meet the rising demand for Industry 4.0 solutions. Additionally, China's strong focus on renewable energy and hydrogen initiatives is creating new opportunities for flow measurement applications.

The flow meter market in India is also experiencing considerable growth, driven by the expansion of urban infrastructure, an emphasis on water management, and government initiatives such as Smart Cities and AMRUT. The country's reliance on agriculture and thermal power further increases the demand for flow meters in irrigation systems and power plants. Water shortages are prompting utilities and municipalities to implement flow measurement systems to detect leaks and monitor distribution. In industries such as food processing, chemicals, and pharmaceuticals, non-contact and hygienic flow meters are being utilized to ensure compliance with regulations and quality standards. Increased investment in these areas supports the overall market growth.

Key Flow Meter Company Insights

Some of the key players in the flow meter market include ABB Ltd., Emerson Electric Corporation, Siemens, and Endress+Hauser AG.

-

ABB Ltd. offers a broad portfolio of flow metering solutions across electromagnetic, Coriolis, vortex, and thermal mass measurement technologies. Its star products such as the ProcessMaster and AquaMaster series are installed in applications varying from industrial process control to urban water management. ABB places its focus on connectivity, with digital communication protocols and cloud-enabled devices that support real-time monitoring and diagnostics. The company keeps building solutions for predictive maintenance and smart asset management across industrial sectors.

-

Emerson Electric Corporation offers an extensive lineup of flow measurement devices under its Rosemount and Micro Motion brands. The company focuses on high-performance applications in oil and gas, petrochemicals, food and beverage, and life sciences. Rosemount 3051S pressure and flow transmitters and Micro Motion Coriolis meters are widely used for their accuracy and integrated diagnostics. Emerson has also been expanding its wireless capabilities and integration of analytics so users can control process variability and improve throughput more effectively.

-

Siemens offers a broad range of flow meters through its SITRANS F product line, comprising Coriolis, ultrasonic, and electromagnetic technologies. Siemens brings these products together with its overall automation system to enable digital twin modeling, remote calibration, and data-driven decision-making in plant applications. Applications extend from municipal water distribution systems to high-precision industrial batch processes.

-

Endress+Hauser AG produces flow meters utilizing several principles such as electromagnetic, Coriolis, ultrasonic, and vortex technologies. Its Proline product line is well embraced in the water treatment, chemicals, food and beverage, and pharmaceuticals industries. Endress+Hauser incorporates cutting-edge self-verification and IIoT functionality into its products, allowing operators to monitor device health and performance continuously without interrupting the process.

General Electric, Hitachi High-Tech, and Honeywell International Inc. are some of the emerging market participants in the market.

-

General Electric, under its Panametrics brand, offers ultrasonic flow meters that find wide application in oil and gas, power generation, and industrial process industries. The brand has both clamp-on and inline models suitable for harsh operating conditions such as high-pressure and high-temperature environments. Panametrics also offers portable and fixed systems with real-time data analytics capabilities, applicable to liquid and gas flow measurement.

-

Hitachi High-Tech Corporation produces a specialty line of flow sensors and instruments focused on laboratory, industrial fluid management, and analytical systems. Its products mainly consist of thermal mass and electromagnetic meters for precise measurement in fluid analysis, process design, and laboratory automation installations in Asia-Pacific and other territories.

-

Honeywell International Inc. provides a range of flow measurement solutions from its Process Solutions business segment. Honeywell products are utilized in refining, chemical, and power applications. Its flow meters are frequently integrated into broader automation and safety platforms to provide centralized control and monitoring of key fluid transport applications. Honeywell also aims to improve compatibility with plant digitalization efforts.

Key Flow Meter Companies:

The following are the leading companies in the flow meter market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Emerson Electric Corporation

- em-tec GmbH

- Endress+Hausar AG

- General Electric

- Hitachi High-Tech Corporation

- Honeywell International Inc.

- HÖNTZSCH GMBH & CO. KG

- Krohne Messtechnik Gmbh

- Siemens

- Yokogawa Electric Corporation

Recent Developments

-

In March 2024, Yokogawa Electric Corporation announced the acquisition of Adept Fluidyne Pvt. Ltd., one of India's largest domestic manufacturers of magnetic flowmeters. This acquisition provides Yokogawa with a manufacturing base in India for its range of high-performance magnetic flowmeters and grants access to Adept's product lineup, thereby enhancing timely delivery to the growing Indian market.

-

In April 2024, SONOTEC GmbH unveiled the SONOFLOW CO.55 SD V3.0 at the INTERPHEX exhibition in New York. This stainless steel, non-contact clamp-on flow meter features an integrated touch display. Designed to meet Good Manufacturing Practice (GMP) requirements, it offers real-time flow data, flow direction, and status information directly on the sensor's display. The touch interface allows process engineers to check and reset flow and volume data, as well as perform incremental flow adjustments without the need for additional hardware, enhancing efficiency in bioprocess technology.

-

In August 2024, ABB launched its next-generation electromagnetic flowmeters, the ProcessMaster and AquaMaster. These flowmeters are designed to enhance accuracy, connectivity, and flexibility in industrial and utility applications. They feature a modular design, allowing for easy customization and upgrades, and come equipped with IoT connectivity for real-time data analytics and process control. The unified technology platform ensures compatibility with previous-generation devices, reducing the total cost of ownership and extending the product lifecycle.

Flow Meter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.31 billion

Revenue forecast in 2030

USD 15.17 billion

Growth rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Power type, product, application, pipe size, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

ABB Ltd.; Emerson Electric Corporation; em-tec GmbH; Endress+Hausar AG; General Electric; Hitachi High-Tech Corporation; Honeywell International Inc.; HÖNTZSCH GMBH & CO. KG; Krohne Messtechnik Gmbh; Siemens; Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flow Meter Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flow meter market report based on product, application, pipe size, pipe size, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Differential Pressure (DP)

-

Positive Displacement (PD)

-

Magnetic

-

Wired Magnetic Flowmeter

-

Wireless Magnetic Flowmeter

-

-

Ultrasonic

-

Coriolis

-

Turbine

-

Vortex

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Water & Wastewater

-

Oil & Gas

-

Chemicals

-

Power Generation

-

Pulp & Paper

-

Food & Beverage

-

Others

-

-

Pipe Size Outlook (Revenue, USD Million, 2018 - 2030)

-

2 inches

-

4 inches

-

6 inches

-

More than 6 inches

-

-

Power Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric

-

Solar

-

Battery Powered

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flow meter market size was estimated at USD 10.64 billion in 2024 and is expected to reach USD 11.32 billion in 2025.

b. The global flow meter market is expected to grow at a compound annual growth rate of 6% from 2021 to 2028 to reach USD 15.17 billion by 2030.

b. Europe dominated the flow meter market with a share of 35.06% in 2024. This is attributable to the presence of a large number of manufacturers and providers of flow rate measurement products and solutions in the region such as Endress+Hausar AG, Krohne Messtechnik GmbH, and ABB Ltd.

b. Some key players operating in the flow meter market include ABB Ltd, Emerson Electric Corporation, General Electric, Krohne Messtechnik GmbH, HÖNTZSCH GMBH & CO. KG, and Siemens.

b. Key factors that are driving the flow meter market growth include increasing demand for flow rate measurement in oil and gas management applications and the growing popularity of intelligent flow meters.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.