- Home

- »

- Medical Devices

- »

-

Foley Catheter Market Size & Share, Industry Report, 2030GVR Report cover

![Foley Catheter Market Size, Share & Trends Report]()

Foley Catheter Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (2-way Foley Catheters, 3-way Foley Catheters, 4-way Foley Catheters), By Material (Silicone, Latex), By Indication (Urinary Incontinence, BPH), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-009-3

- Number of Report Pages: 122

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Foley Catheter Market Summary

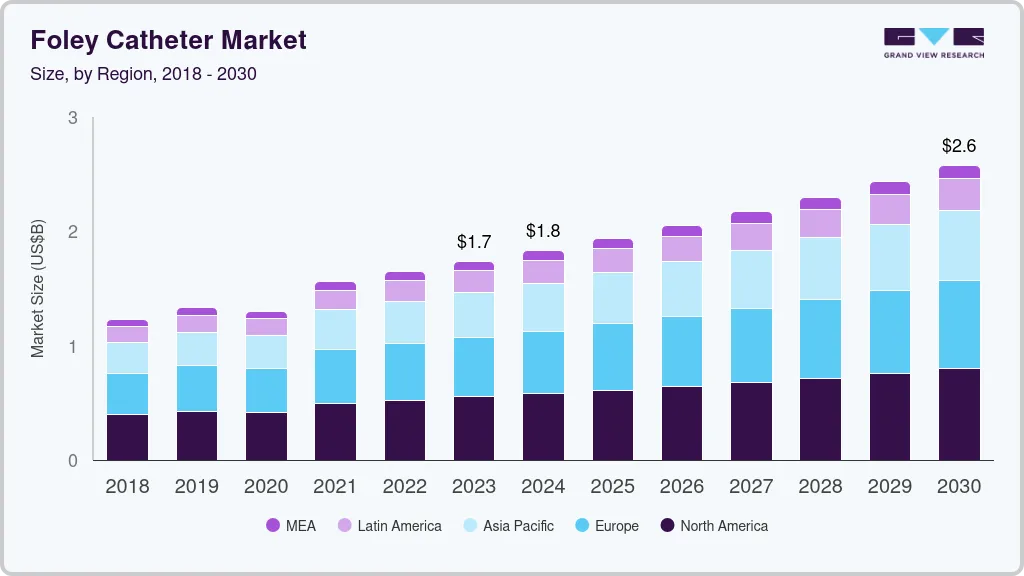

The global foley catheter market size was estimated at USD 1,835.7 million in 2024 and is projected to reach USD 2,579.7 million by 2030, growing at a CAGR of 5.9% from 2025 to 2030. This is due to the increasing prevalence of urological disorders such as urinary tract infections (UTIs) and kidney and ureteral stones, the rising preference for minimally invasive surgeries, and the rising geriatric population in the Asia Pacific region, especially in countries such as Japan, India, and China.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, 2-way foley catheters accounted for a revenue of USD 992.5 million in 2024.

- 3-way Foley Catheters is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,835.7 Million

- 2030 Projected Market Size: USD 2,579.7 Million

- CAGR (2025-2030): 5.9%

- North America: Largest market in 2024

For instance, the data published by the United Nations sexual and reproductive health agency in December 2023 indicates that India's current elderly population, which stands at 153 million (aged 60 and above), is projected to rise to 347 million by 2050.

The increasing prevalence of kidney stone disease, cystitis, benign prostatic hyperplasia, and other urinary tract disorders are expected to drive the foley catheters industry during the forecast period. According to the data published by the National Kidney Foundation in November 2023, 19.1% of males and 9.4% of females report ever having a kidney stone by age 70. Furthermore, the data published by the American Kidney Fund in May 2024 reported that kidney stones are a typical kidney problem. Over 1 in 10 males and almost 1 in 14 females in the U.S. will have kidney stones at least once in their lives.

Over the past decade, the demand for Minimally Invasive Surgeries (MIS) has risen significantly. Several factors contribute to this trend, including higher patient satisfaction due to smaller incision wounds, shorter hospital stays, and reduced economic costs. In addition, MIS typically results in fewer postsurgical complications. Foley catheters are commonly used in these procedures. As a result, the increasing demand for minimally invasive surgeries is expected to drive market growth during the forecast period.

Along with the above factors, the global foley catheter industry continues to consolidate due to the increased research collaboration and distribution agreements between diverse manufacturers. For instance, in December 2023, Bactiguard Holding AB collaborated with Becton Dickinson & Company (BD) and granted an exclusive license to BD for distributing Bactiguard-coated Foley catheters in several countries such as the U.S., Ireland, UK, Japan, Canada, and Australia among others except for China. Such distribution agreements among industry players are anticipated to drive market growth in the coming years.

Technological advancements, coupled with product launches to streamline the procedures and make them safer & more cost-effective, are among the key factors contributing to market growth. Moreover, industry players are launching accessories for foley catheters. For instance, in December 2022, CATHETRIX., a urinary (Foley) smart catheter fixation device manufacturer, launched a catheter stabilizer to prevent accidental Foley catheter extractions and urinary tract infections (UTIs). Thus, due to such product launches, the foley catheters industry is expected to grow rapidly in the coming years.

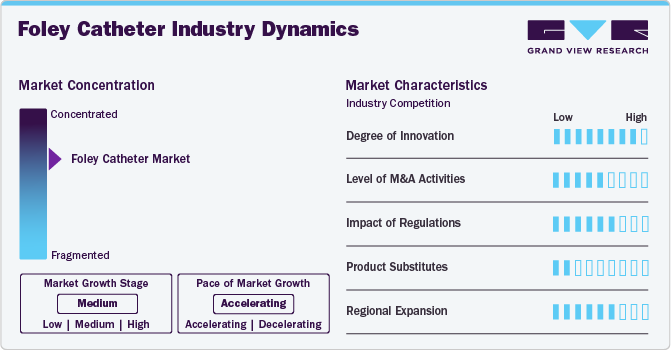

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The foley catheter market is characterized by growth owing to technological advancements, the rising prevalence of urological disorders, and the increasing prevalence of older people.

Foley catheter has advanced in many ways, including materials and coatings. These advancements have made catheters more user-friendly, hygienic, and effective at reducing the risk of infection. For instance, a study published by ScienceDirect in September 2024 suggested some potential improvements in the design of Foley catheters to reduce the associated risk for UTI. Thus, such studies for innovating designs of foley catheters are anticipated to drive foley catheter industry growth.

Regulatory bodies such as Health Canada, the Food and Drug Administration (FDA), and the European Union set standards for the quality and safety of medical devices, including Foley catheters. These devices are classified into various categories based on their associated risk levels, which influence the level of regulatory scrutiny they receive. For instance, the FDA classifies Foley catheters as Class II devices and regulates them under 21 CFR 876.5130 with the product code EZL.

Many industry players are acquiring smaller catheter manufacturers to gain a competitive edge in the rapidly expanding Foley catheter market. For example, in January 2022, HR Pharmaceuticals, Inc. acquired Medical Technologies of Georgia (MTG), a catheter manufacturer, to broaden its range of urology products. These acquisitions are expected to drive industry growth in the coming years.

Companies in the Foley catheter industry strategically focus on regional expansion to strengthen their market presence. For instance, in September 2021, Integer Holdings Corporation announced the construction of an innovation and manufacturing facility in Galway, Ireland. This expansion aims to address the growing demand for regional research, development, and manufacturing capabilities and enhance capacity for catheters and delivery systems.

Product Insights

The 2-way foley catheters segment captured the largest market share, with around 51.38% in 2024. The 2-way foley catheter is the most common type of indwelling catheter, and it has two channels: one for passing urine and the other for inflating and deflating balloons. There are two connectors on 2-way foley catheters; one is used to drain urine from the bladder and the other to inflate the balloon. A pediatric version of the 2-way catheter is also available; it functions in the same way but has smaller dimensions to fit a child's smaller frame. This catheter is developed using latex and silicone to ensure flexibility and reliability. The increasing prevalence of urological disorders among children is anticipated to boost the segment growth in the coming years.

The 3-way foley catheters segment is expected to grow at the highest CAGR during the forecast period. The third channel on some three-way catheters allows for continuous bladder irrigation. When a prostate or bladder is bleeding, and the bladder needs intermittent or continuous irrigation to clear debris or blood clots, this urinary catheter is frequently used. These products are used for short- and long-term urine drainage. The rising burden of urological issues such as bladder bleeding and urine drainage is anticipated to drive segment growth over the forecast period.

Material Insights

The silicone foley catheters segment captured the largest market share in 2024. These catheters have a lubricious covering that is permanently infused with silver ions. Ionic bonding keeps the silver in the hydrophilic coating, and it also has a unique surface modification technology that uses covalent bonding to keep it attached to the silicone surface. The silicone coating on the foley catheter provides a zone of resistance to bacteria around the catheter surface and inhibits microbial colonization on the device's surface, reducing the risk of catheter-related urinary tract infections, which is expected to fuel the segment's growth. The main advantage of a silicone foley catheter is that it is effective for persons with sensitive skin and non-allergenic. While allergies to silicone can exist, they are much less common than allergies to latex. For those who experience pain during clean self-catheterization or intermittent, silicone may also be softer and so preferable. Due to its extreme smoothness and flexibility, silicone makes insertion simple and less painful for the urethra. They have less encrustation and are more tissue-friendly than latex. Furthermore, larger lumens are typically present in silicone catheters to enhance drainage.

The latex foley catheters segment is expected to grow at the highest CAGR of 6.49% during the forecast period. While latex catheters are made entirely of latex, they are otherwise identical to other catheters in design. Like silicone, latex is soft and flexible but also thermos-sensitive. This indicates that latex is more flexible because it can adjust to the temperature of its surroundings. Both Foley and intermittent catheters can be made of latex. People prefer using latex over other materials because of its thermos-sensitive characteristics. They are also flexible, which may help many people experience less discomfort during insertion..

Indication Insights

The urinary incontinence segment dominated the market with around 32.21% of the revenue share. Urinary incontinence is a condition resulting in involuntary loss of control of the bladder. It has a significant impact on long-term care facilities and is one of the main reasons for the admission of elderly people to institutionalized care. The increasing prevalence of urinary incontinence is anticipated to propel the segment growth over the forecast period. According to a study published by the National Library of Medicine in August 2024, approximately 13 million people in the U.S. are directly impacted by urinary incontinence.

The spinal cord injury segment is expected to grow at the highest CAGR during the forecast period. Spinal cord injury can affect the control of a patient over their bladder. This is a result of injury to nerves controlling the passage of signals from the bladder to the brain. Thus, nerves fail to relay the message for emptying of the bladder, which results in bladder dysfunction. Spinal shocks are another reason for incontinence and cause temporary loss of spinal cord reflexes. During spinal shocks, patients are catheterized because their bladder fails to drain urine. Thus, the rising prevalence of spinal cord injury is anticipated to propel the segment growth in the coming years. According to the data published by the WHO in April 2024, over 15 million people are living with spinal cord injury (SCI) across the globe.

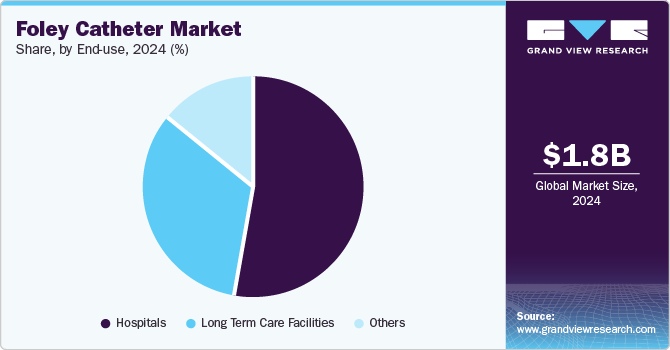

End Use Insights

In 2024, the hospital segment led the market with a share of 52.83%. This growth primarily arises from the rising number of patients experiencing various urological diseases, which has led to an increase in surgical treatments. Hospitals tend to attract significantly more patients for urological procedures and other therapies compared to other healthcare settings. This is mainly due to their ability to effectively manage any emergencies that may arise during surgical procedures and their wide range of available treatment options. Therefore, the hospital segment is expected to grow, driven by these factors.

Long term care facilities segment is anticipated to grow at the highest CAGR during the forecast period. The lucrative expansion of this market is due to an increase in the adoption of minimally invasive surgeries, a high desire for outpatient surgeries, and the cost-effectiveness of long-term care facilities -based urology procedures. Lower postsurgical complications in minimally invasive urology surgery, on the other hand, are predicted to boost demand for long-term care facilities. Compared to hospitals, they provide patients various benefits, including same-day release and faster procedure times. As a result of the factors discussed above, the long-term care facilities segment is anticipated to rise rapidly over the forecast period.

Regional Insights

North America foley catheter market held the largest revenue share, more than 31.62%, in 2024. The increasing incidence of chronic kidney diseases (CKD) and the rising aging population in developed economies are driving the demand for foley catheters for urological procedures. According to the data published by Universities Canada in September 2023, approximately 20% of the Canadian population is over 65 years old.

U.S. Foley Catheters Market Trends

The U.S. foley catheters market is expected to dominate the North American market over the forecast period due to the increasing launches of products and the presence of key players. Some players operating in the U.S. market include Medtronic, Cardinal Health, Teleflex Incorporated, and Coloplast Corporation, among others.

Europe Foley Catheters Market Trends

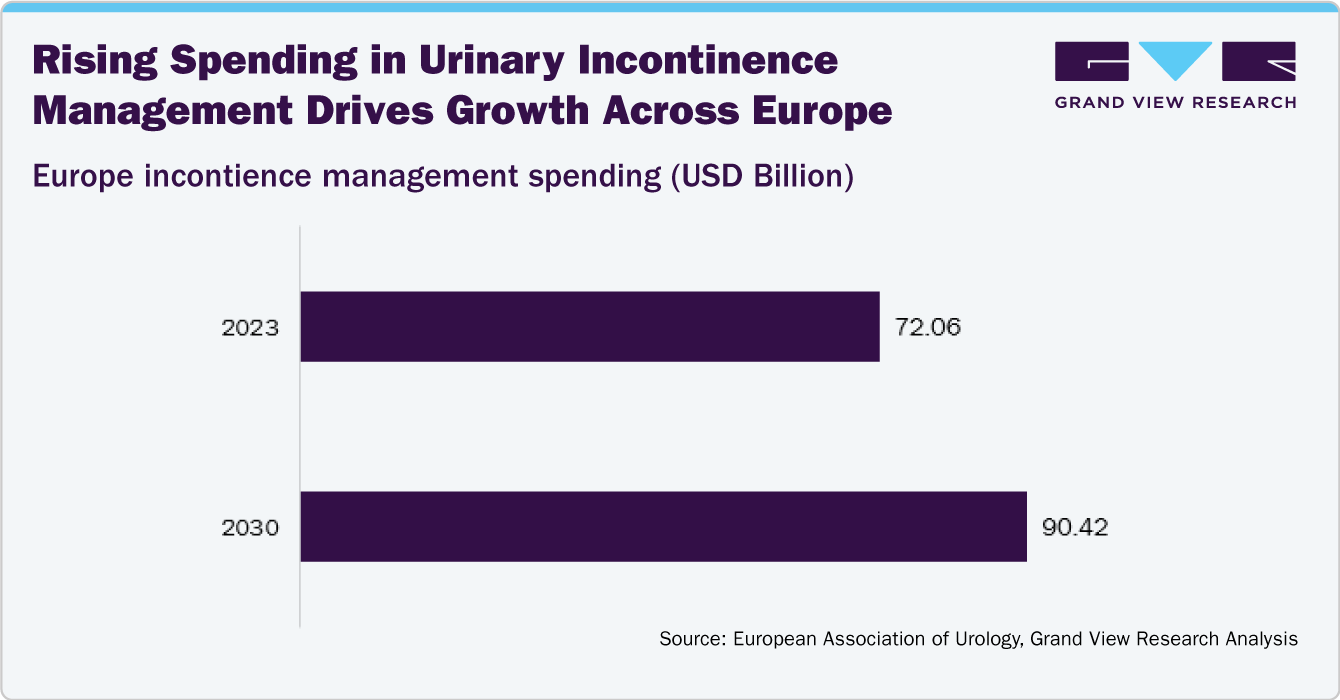

The foley catheters market in Europe is driven by several key factors. The increasing prevalence of urological disorders, including urinary retention and bladder dysfunction, is leading to a higher demand for catheterization procedures. In addition, the aging population in European countries is contributing to a rise in healthcare needs, as older adults are more likely to require catheterization.

The UK foley catheters market is anticipated to experience substantial growth in the coming years. This growth can be attributed to several factors, including an aging population and rising prevalence of urological diseases. Rising research activities in the UK are anticipated to support the market growth. For instance, in February 2023, researchers at the University of Nottingham discovered a new coating designed to prevent bacterial infections commonly caused by biofilms on catheters. This innovation highlights the ongoing efforts to enhance catheter safety and effectiveness, further propelling market growth.

France foley catheters market is projected to grow during the forecast period. France's aging population contributes to a higher incidence of conditions that require catheter use, thereby boosting market demand. Advances in catheter technology, including developing antimicrobial and silicone-coated options, enhance patient safety and comfort, further propelling market growth.

The foley catheters market in Germany is experiencing steady growth driven by several factors, including government initiatives to enhance healthcare infrastructure and increased investments in medical devices. These efforts are expected to support the ongoing expansion of the market.

Asia Pacific Foley Catheters Market Trends

The Asia Pacific foley catheters market is poised for growth due to several key factors. The rising demand for Foley catheter products in emerging markets like India and China significantly contributes to market expansion. In addition, increasing healthcare expenditures across the region enhances access to medical devices and improves healthcare infrastructure. The large patient populations in countries such as India, China, and Japan further drive demand for effective urological solutions.

The foley catheters market in China is driven by the rising prevalence of urological disorders and an aging population. Increased healthcare investments and advancements in catheter technology, such as antimicrobial features, enhance patient safety. Growing awareness of urological health further fuels the country's demand for effective catheterization solutions.

The foley catheters market in Japan is projected to experience significant growth during the forecast period, primarily driven by the country's rapidly aging population, which is more susceptible to urological disorders. Conditions like urinary incontinence are becoming increasingly common among the Japanese population. A study published by Sage Journals in October 2023 reported that approximately 25.5% of Japanese women aged 20-65 experience urinary incontinence, with prevalence increasing with age. This large patient pool is expected to propel market growth significantly in the coming years.

Middle East And Africa Foley Catheters Market Trends

The foley catheters market in the Middle East and Africa is driven by the rising prevalence of urological disorders, increasing healthcare investments, and improvements in medical infrastructure. Growing awareness of catheterization needs among healthcare providers further supports regional market expansion.

The foley catheter market in Saudi Arabia is driven by the increasing prevalence of urological disorders, a growing aging population, and significant healthcare investments. In addition, government initiatives to enhance medical infrastructure further support market growth in the country.

The foley catheters market in Kuwait is expected to grow over the forecast period due to rising healthcare expenditures and an increasing aging population. In addition, the growing prevalence of urological disorders is anticipated to support the market growth.

The growing prevalence and incidence of urological disorders, particularly urinary incontinence, are expected to drive demand for Foley catheters. According to data published by the European Association of Urology in November 2023, approximately 55-60 million Europeans experience continence health issues. Urinary incontinence imposes a significant economic burden, which could increase by 25% by 2030 if no measures are implemented to support continence health. Therefore, the rising prevalence of urological diseases and the corresponding healthcare expenditures are anticipated to enhance growth in the foley catheter market in the coming years.

Key Foley Catheter Company Insights

Sterimed Group, HEMC (Hospital Equipment Manufacturing Company), ANGIPLAST PRIVATE LIMITED, Advin Health Care, AdvaCare Pharma, Teleflex Incorporated, Bactiguard AB, Cardinal Health, Medtronic, B. Braun SE, Ribbel International Limited, and Coloplast Corp are some of the major players in the foley catheters industry. Companies are expanding their portfolios of foley catheters to gain a competitive advantage in the coming years. Moreover, industry players focus on obtaining approvals for advanced foley catheters to meet the growing demand in the coming years.

Key Foley Catheters Companies:

The following are the leading companies in the foley catheters market. These companies collectively hold the largest market share and dictate industry trends.

- Sterimed Group.

- ANGIPLAST PRIVATE LIMITED

- HEMC (Hospital Equipment Manufacturing Company)

- Cardinal Health

- Advin Health Care

- AdvaCare Pharma

- Teleflex Incorporated

- Bactiguard AB

- Medtronic

- B. Braun SE

- Ribbel International Limited

- Coloplast Corp

Recent Developments

-

In January 2025, UNOQUIP GmbH introduced its latest Open Tip Silicone Foley Catheters to its portfolio. These new models are engineered to improve urinary drainage and facilitate catheter insertion in difficult situations. Featuring a smooth, atraumatic open tip designed for guidewire catheterization and exchange, the new models also include an additional drainage eyelet to enhance urine flow and reduce the risk of blockages.

-

In December 2024, the Egress Foley catheter, developed by Dr. Bruce Gardner, a radiologist at Sanford Health in Bismarck and produced by InnoCare Urologics, has received 510(k) approval from the U.S. FDA. This approval falls under a newly established FDA product category code identifying Foley catheters with safety features. This milestone represents the company’s first FDA clearance for its platform technology and marks the first device ever cleared under this new code.

Foley Catheters Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.94 billion

Revenue forecast in 2030

USD 2.58 billion

Growth Rate

CAGR of 5.86% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, indication, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada, Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea;Brazil; Colombia; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Sterimed Group; HEMC (Hospital Equipment Manufacturing Company); ANGIPLAST PRIVATE LIMITED; Advin Health Care; AdvaCare Pharma; Teleflex Incorporated; Bactiguard AB; Cardinal Health; Medtronic; B. Braun SE; Ribbel International Limited; Coloplast Corp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Foley Catheters Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global foley catheters market report based on product, material, indication, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

2-way Foley Catheters

-

3-way Foley Catheters

-

4-way Foley Catheters

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Silicone Foley Catheters

-

Latex Foley Catheters

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Urinary Incontinence

-

Enlarged Prostate Gland/BPH

-

Spinal Cord Injury

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Long Term Care Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LATAM

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global foley catheter market size was estimated at USD 1.84 billion in 2024 and is expected to reach USD 1.94 billion in 2025.

b. The global foley catheters market is expected to grow at a compound annual growth rate of 5.86% from 2025 to 2030 to reach USD 2.58 billion by 2030.

b. North America dominated the foley catheter market in 2024 and is expected to witness a growth rate of 5.50% over the forecast period. This is due to the high prevalence of urological disorders such as prostate cancer and bladder cancer, along with technological advancements.

b. Prominent key players operating in the foley catheter market include Sterimed Group, HEMC (Hospital Equipment Manufacturing Company), ANGIPLAST PRIVATE LIMITED, Advin Health Care, AdvaCare Pharma, Teleflex Incorporated, Bactiguard AB, Cardinal Health, Medtronic, B. Braun SE, Ribbel International Limited, and Coloplast Corp.

b. Key factors that are driving the foley catheters market growth include a surge in the number of surgical procedures for urological diseases and increasing demand for minimally invasive surgeries. In addition, the rising geriatric population, and increasing various initiatives by major key market players such as acquisitions, mergers, and product launches are anticipated to boost the market are further fuelling the growth of the foley catheters market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.