- Home

- »

- Plastics, Polymers & Resins

- »

-

Silicone Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Silicone Market Size, Share & Trends Report]()

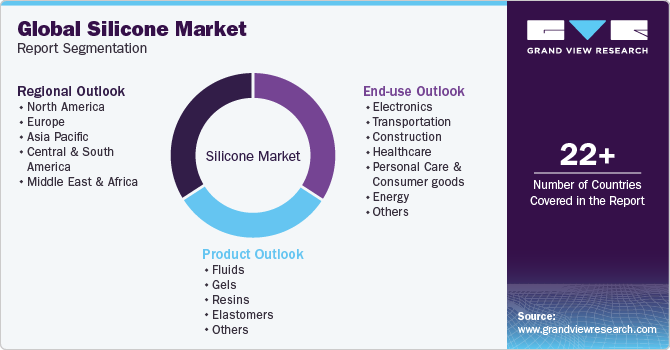

Silicone Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fluids, Gels, Resins, Elastomers), By End-use (Electronics, Transportation, Construction, Healthcare, Industrial Processes, Energy), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-063-7

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Silicone Market Summary

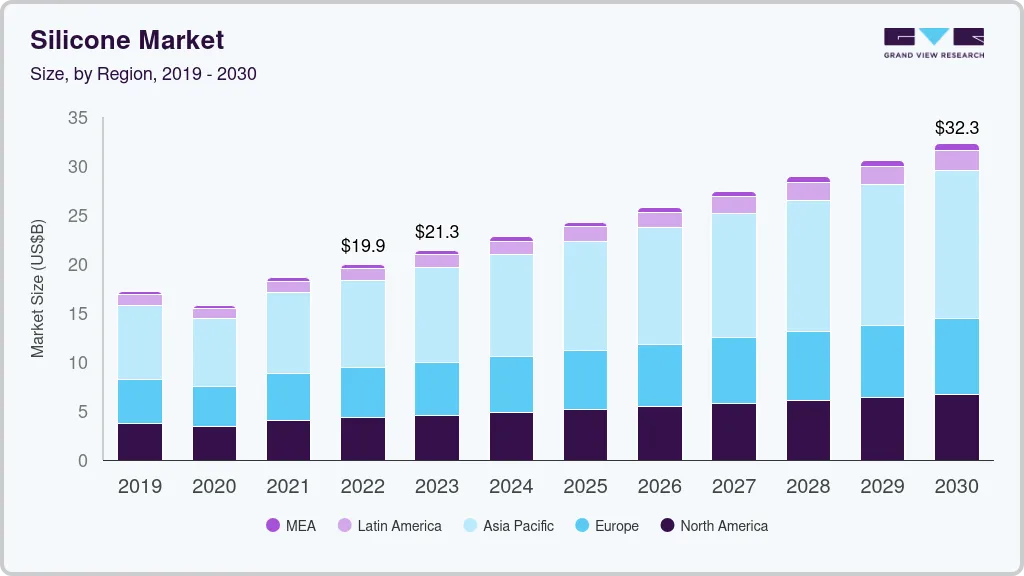

The global silicone market size was estimated at USD 21.33 billion in 2023 and is projected to reach USD 32.26 billion by 2030, growing at a CAGR of 6.0% from 2024 to 2030. Growing demand for silicone in various end-use industries including personal care, consumer goods, industrial processes, and construction is expected to drive market growth.

Key Market Trends & Insights

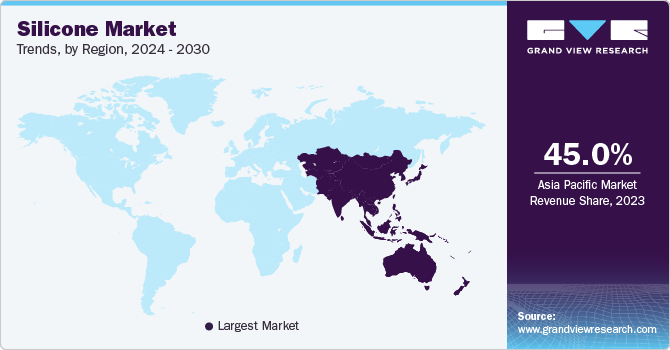

- Asia Pacific dominated the market with a revenue share of more than 45.0% in 2023.

- Based on end-use, the industrial process segment led the market with a revenue share of more than 25.0% in 2023.

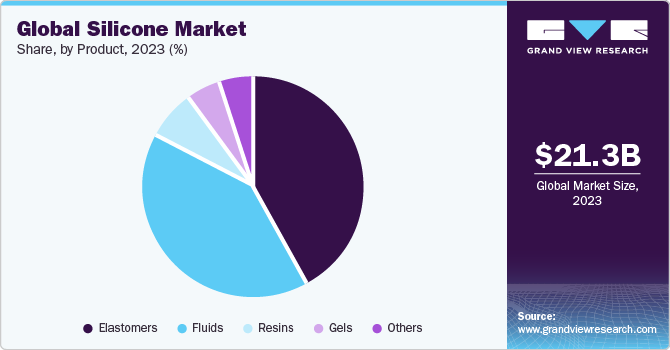

- Based on product, the elastomers segment dominated the market with a revenue share of more than 41.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 21.33 Billion

- 2030 Projected Market Size: USD 32.26 Billion

- CAGR (2024-2030): 6.0%

- Asia Pacific: Largest market in 2023

The U.S. silicone industry is expected to perform moderately owing to limited opportunities by market maturity of both manufacturing industries in general and use of silicones. However, continuous product innovation and ongoing technological developments are expected to promote application of silicone in emerging markets.Emerging applications include electric vehicles (EVs) and health & personal care, which, in turn, are expected to fuel market growth over the forecast period. Moreover, suppliers continue to gain market share through value-added product development and by creating inroads into applications that conventionally use other materials.

Silicone is widely used in the construction industry owing to weather resistant, highly stable, and inert & high-water repellent properties. It is used in conjugation with several materials such as marble, glass, concrete, aluminum, steel, and polymers, which find application in residential and commercial constructions. In addition, they are also used in construction of roads, bridges, pipelines, oil rigs, and industrial units. Rising population, increasing urbanization, and rapid industrial growth have resulted in a growing need for construction and infrastructure development globally.

The silicone industry is expected to grow owing to increasing application scope of silicone in various end-use industries. Across electronics industry, silicone is used in a broad range of electronic applications such as for protecting insulators from salt air damage, moisture-proofing of boards, modification of semiconductor encapsulating materials, and protecting ends of heating element wires in printed circuit boards (PCBs), semiconductors, and electronic control units (ECUs), LED devices, and others.

Market Dynamics

Growing construction industry globally and increasing demand from various end-user industries preponderance for the market. Silicone is widely used across the construction industry owing to weather resistant, highly stable, and inert & high-water repellent properties. It is used in conjugation with several materials such as marble, glass, concrete, aluminum, steel, and polymers, which find application in residential and commercial constructions. In addition, they are also used in the construction of roads, bridges, pipelines, oil rigs, and industrial units. Rising population, increasing urbanization, and rapid industrial growth have resulted in a growing need for construction and infrastructure development globally.

The market is expected to grow owing to the increasing application scope of silicone in various end-use industries. In electronics industry, silicone is used in a broad range of electronic applications such as for protecting insulators from salt air damage, moisture-proofing of boards, modification of semiconductor encapsulating materials, and protecting ends of heating element wires in printed circuit boards (PCBs), semiconductors, and electronic control units (ECUs), LED devices, and others.

End-use Insights

Based on end-use, the industrial process segment led the market with a revenue share of more than 25.0% in 2023. Silicones are extensively used within various industrial processes for a wide range of applications such as antifoaming agents and lubricants in offshore drilling and paper production, industrial coatings, and paint additives. In paints and coatings, silicone is used to boost performance by offering different components with enhanced durability, thermal resistance, and resistance to corrosion & chemicals, thus reducing unplanned maintenance or maintenance costs for industrial infrastructure and machinery.

The construction segment is expected to grow at a CAGR of 5.7% from 2024 to 2030. Silicones in the building & construction industry are widely used owing to their high strength and moisture resistance properties. They can be used in conjugation with numerous materials used for residential and commercial constructions, including concrete, steel, marble, glass, aluminum, and polymers. In addition, they are used in roads, bridges, pipelines, oil rigs, and industrial units. The superior flexibility of silicones helps minimize the damage caused during the occurrence of low to medium-intensity earthquakes, which makes them a viable option over other materials.

In the automotive industry, silicone is used in the form of rubber, grease, coating, and sheets. Silicone rubber is used as a coating for spark plug wires, airbags, and adhesive owing to its resistance to high impact, excellent electrical insulation, weatherability, heat & chemical resistance, and tear strength. In the form of grease, it is widely used as a lubricant for brakes owing to its stability over a wide temperature range.

Silicone in the consumer goods industry is used in a broad range of products from cookware to household goods to sporting goods. Silicone is biocompatible, virtually inert, and chemically resistant, and has excellent electrical & thermal insulation properties, which make it an ideal material for application in products such as bakeware, utensils, wrist & hair bands, and grips in pens, hairbrushes, shower heads, swim goggles, and masks.

Product Insights

Based on product, the elastomers segment dominated the market with a revenue share of more than 41.0% in 2023. Silicone elastomers are vulcanized silicone-based polymers that are made with an amalgamation of cross linkers, reinforcing agents, linear polymers, and a catalyst. Based on processing temperature and type of basic straight-chain molecule, these elastomers have been classified as high-temperature vulcanizing (HTV), liquid silicone rubber (LSR), and room-temperature vulcanization (RTV).

The room temperature vulcanized (RTV) silicone rubber is made up of a two-component system available in the soft to medium hardness range. It can aggressively adhere to and release from most surfaces and can be cured under room temperature without heating. Room-temperature vulcanized silicone rubber possesses excellent thermal resistance and dielectric properties. It is used as sealing and filler between surfaces and gasketing in various applications of electrical vehicles. Apart from electric vehicles, RTV silicone rubbers are extensively used in architectural elements, aerospace, energy, consumer electronics, and electronics industries.

Silicone gel is a clear jelly-like sheet, which is primarily used in the personal care industry to prevent scars of freshly healed wounds and reduce prominent immature scars. In addition, silicone gels are used in potting and encapsulation of electronic equipment including LEDs and solar devices. Silicone gels possess superior water repellency, high dielectric strength, and excellent ability to dampen mechanical vibrations. Growing personal care industry owing to an increasing aging population and growing concern over appearance is expected to fuel demand for silicone gels over the forecast period.

Silicone resins are polymers and carry a relatively low molecular weight with a three-dimensional network structure. They possess excellent thermal stability, heat resistance, weather ability, dielectric properties, and water repellency, which make them suitable as binders in varnishes, paints, and impregnation products. Rising demand for silicone resins from paints and coatings industry to enhance heat resistance in coating and rendering is expected to fuel market demand over the forecast period.

Regional Insights

Asia Pacific dominated the market with a revenue share of more than 45.0% in 2023. Large market share of the region is attributed to the presence of several small-sized, medium, and large market players in the region. Market players shifting production facilities from North America and Europe to Asia Pacific, owing to factors such as cheap labor, easy availability of raw materials, and more market penetration opportunities in industries including construction, electronics, transportation, industrial process, personal care, and consumer products, energy, and healthcare, is anticipated to propel the regional production of silicone over the forecast period.

Europe was the second largest market, and it is expected to grow at a CAGR of 5.1% from 2024 to 2030. Expanding construction sector in various countries including Germany, UK, France, Russia, and Spain is expected to drive product demand over the forecast period. An increase in funding from the EU and supportive measures (such as incentives, subsidies, and tax breaks) undertaken by several governments is expected to boost growth of the construction sector in the region. In addition, growing utilization of silicone in the renewable energy sector for applications in windmills and solar panels and in the healthcare sector for aesthetic implants is expected to boost silicone market growth.

North America is one of the leading markets for silicone additives owing to its high demand in plastics and composites, manufacturing chemicals, paints and coatings, and food and beverages. In addition, the region has high growth potential for medical-grade silicones driven by strong demand from the healthcare industry and presence of several large manufacturers in North America.

Key Companies & Market Share Insights

Global silicone industry is significantly fragmented in nature with the presence of big manufacturing players globally. Market players compete mainly on the basis of technology used for production of silicone and quality of products. Key market players are inclined towards adopting marketing strategies such as mergers & acquisitions, new and innovative products along with production capacity expansions are some of popular strategies adopted by a majority of the market players operating in the global silicone market.

- In September 2023, Wacker Chemie AG, a silicone manufacturer, announced the expansion of their silicone production capacities in China with an investment of USD 160.34 million (EUR 150 million). The facility will be capable of manufacturing silicone fluids, silicone emulsions, and silicone elastomer gels.

Key Silicone Companies:

- Elkay Chemicals Pvt. Ltd.

- Supreme Silicones

- Shin-Etsu Chemical Co., Ltd.

- Silchem Inc.

- Silteq Ltd

- Amul Polymers

- Wacker Chemie AG

- Specialty Silicone Products, Inc.

- Illinois Tool Works Inc.

- Evonik Industries AG

- Hutchinson

- Kemira Oyj

- Dow Inc.

- Nano Tech Chemical Brothers Private Limited

- Elkem ASA

Silicone Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.78 billion

Revenue forecast in 2030

USD 32.26 billion

Growth rate

CAGR of 6.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; Spain; China; India; Japan; Australia; Brazil; Saudi Arabia

Key companies profiled

Elkay Chemicals Pvt. Ltd.; Supreme Silicones; Shin-Etsu Chemical Co., Ltd.; Silchem Inc.; Silteq Ltd; Amul Polymers; Wacker Chemie AG; Specialty Silicone Products, Inc.; Illinois Tool Works Inc.; Evonik Industries AG; Hutchinson; Kemira Oyj; Dow Inc.; Nano Tech Chemical Brothers Private Limited; Elkem ASA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silicone Market Segmentation

This report forecasts revenue & volume growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global silicone market report based on product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fluids

-

Straight Silicone Fluids

-

Modified Silicone Fluids

-

-

Gels

-

Resins

-

Elastomers

-

High-Temperature Vulcanized (HTV)

-

Liquid Silicone Rubber (LSR)

-

Room Temperature Vulcanized (RTV)

-

-

Others

-

Adhesives

-

Emulsions

-

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electronics

-

Transportation

-

Construction

-

Healthcare

-

Personal Care and Consumer goods

-

Energy

-

Industrial Processes

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global silicone market size was estimated at USD 21.33 billion in 2023 and is expected to reach USD 22.78 billion in 2024.

b. The silicone market is expected to grow at a compound annual growth rate of 6.0% from 2024 to 2030 to reach USD 32.26 billion by 2030.

b. The industrial process segment led the global silicone market and accounted for the largest revenue share of more than 25.2% in 2023.

b. The elastomers segment led the global silicone market and accounted for the largest revenue share of more than 41.89% in 2023.

b. Asia Pacific dominated the silicone market with a share of more than 45.18% in 2023. This is attributable to strong demand from the construction, electrical & electronics, personal care & consumer goods, and industrial process end-use segments.

b. Some of the key players operating in the global silicone market include Shin-Etsu Chemical Co., Ltd., Wacker Chemie AG, Evonik Industries AG, Elkay Chemicals Pvt. Ltd., Supreme Silicones, Dow Inc., KCC CORPORATION, Elkem ASA, Silchem Inc., and Specialty Silicone Products, Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.