Foliar Spray Market Size & Trends

The global foliar spray market was valued at USD 6.91 billion in 2022 and is expected to grow at a CAGR of 5.4% over the forecast period. The demand for foliar sprays in the agricultural market is experiencing robust growth due to their ability to significantly enhance crop yields, improve nutrient efficiency, and provide quick responses to nutrient deficiencies. Foliar sprays provide a highly efficient method of delivering essential nutrients directly to plant leaves. This targeted approach ensures that plants receive nutrients precisely where they are needed, promoting healthy growth, and optimizing nutrient utilization.

In traditional fertilization methods, a significant portion of applied nutrients can be lost to leaching, volatilization, or immobilization in the soil. However, foliar sprays offer a more efficient alternative. By bypassing the soil and directly targeting the leaves, foliar sprays minimize nutrient losses, ensuring a higher percentage of applied nutrients reach their intended destination. This enhanced nutrient efficiency translates into cost savings for farmers, as they can achieve the same or better results with lower overall nutrient inputs.

Furthermore, Nutrient deficiencies can have a detrimental impact on plant growth and productivity. The timely detection and correction of these deficiencies are crucial for farmers to maximize crop quality and yield. Foliar sprays provide a quick response solution to nutrient deficiencies. With their ability to rapidly deliver essential nutrients directly to the foliage, foliar sprays can address deficiencies in real-time, providing an immediate boost to plant health and productivity. This rapid response mechanism allows farmers to respond swiftly to nutrient imbalances and prevent severe yield losses.

Foliar spray technique is a precise agricultural method involving the direct application of liquid nutrient solutions or pesticides onto the leaves of plants. By spraying these solutions onto the foliage, the plant absorbs essential nutrients or pest control substances through its leaf surfaces, providing a rapid and targeted response to specific plant needs. This technique is celebrated for its efficiency in delivering nutrients, mitigating nutrient deficiencies, and managing pests and diseases while reducing the environmental impact associated with soil-based applications. Foliar spray has become an integral component of modern farming practices, enhancing crop health, quality, and overall yield, and is especially compatible with precision agriculture technologies, facilitating its adoption in sustainable and environmentally conscious farming systems.

Type Insights

Based on the type, the market is segmented into nitrogenous, phosphatic, potassic, micronutrients, and others. The nitrogenous segment held the largest market share in 2022. The demand for nitrogenous foliar sprays is on the rise due to their versatility and effectiveness in modern agriculture. Farmers and growers are increasingly turning to these sprays to address specific challenges and optimize their crop management practices. One of the primary drivers behind this growing demand is the need for precise and efficient nutrient delivery. Nitrogen, being a vital element for plant growth, can be rapidly absorbed through the leaves, making foliar sprays an excellent choice for addressing immediate nutrient deficiencies or providing a quick nutrient boost. Moreover, in the era of precision agriculture, foliar sprays offer a targeted approach to nutrient application, ensuring that plants receive the nutrients they need precisely when and where they need them.

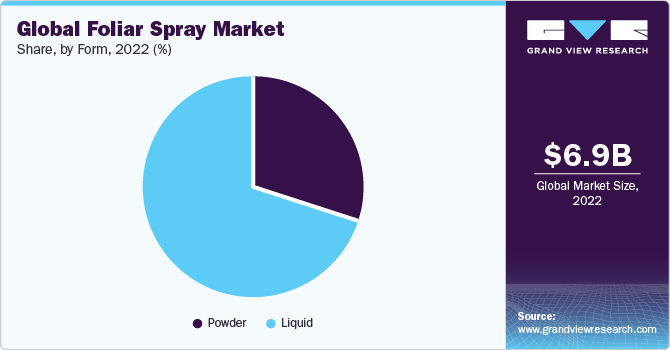

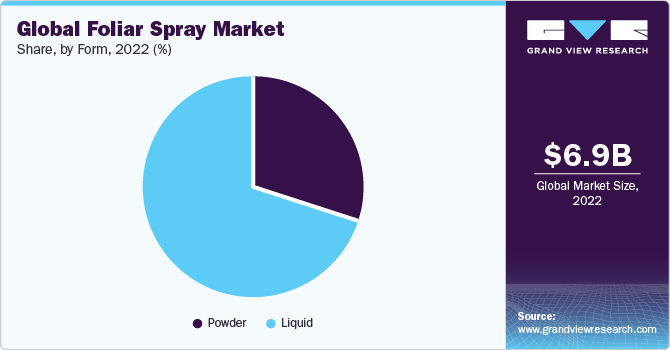

Form Insights

Based on the form, the foliar spray market is segmented into powder and liquid. The liquid segment held the largest market share in 2022. With the ability to customize nutrient mixes to suit specific crop needs and growth stages, liquid foliar sprays have become a vital tool for optimizing crop health, yield, and quality. Their compatibility with other inputs, quick response time, and reduced environmental impact make them an attractive choice for farmers seeking sustainable and efficient crop management solutions in an era of precision agriculture. Moreover, they can be easily mixed with other agricultural inputs, such as pesticides or growth regulators. This allows for the efficient delivery of multiple treatments in a single application, saving time and labor.

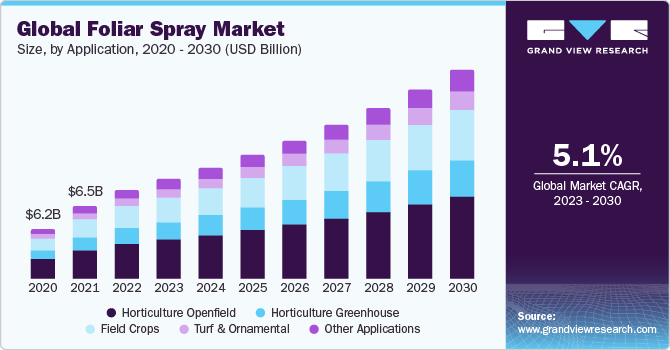

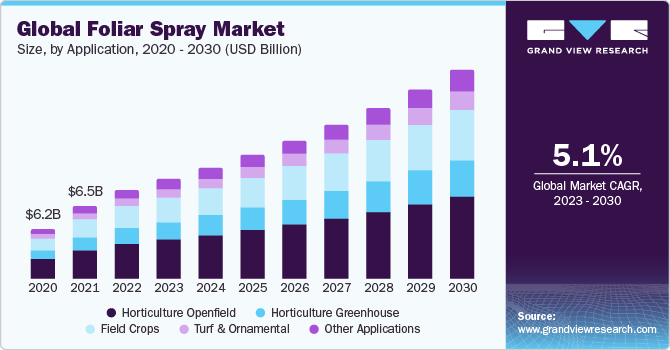

Application Insights

Based on the application, the market is segmented into horticulture openfield, horticulture, greenhouse, field crops, turf & ornamental, and other applications. The horticulture openfield segment held the largest market share in 2022. The openfield horticultural sector includes an extensive range of crops that include vegetables crops, fruit crops, medicinal & aromatic crops, tuber crops, and spices. The foliar spray method allows horticulturists to tailor nutrient applications directly to the unique requirements of various crops, ensuring optimal growth and maximum yield potential. Additionally, foliar sprays offer a rapid response to nutrient deficiencies or stressors, crucial in open-field horticulture where weather conditions and soil variability can pose challenges. Moreover, the technique's ability to enhance crop quality, including factors like color, flavor, and overall appearance, appeals to consumers and can command higher market prices.

Vegetables and fruits have become an essential part of the day-to-day dietary intake of individuals on account of a surge in awareness regarding their nutritive value. According to the Ministry of Statistics & Program Implementation (MOSPI), in 2019-2020, the horticulture market in India (majorly consisting of fruits and vegetables) recorded an output worth USD 48.47 billion. The growth is attributed to the high export potential of vegetables and fruits, which has further contributed to a surge in the efficient production of these crops. The aforementioned factors are anticipated to contribute to the product demand in openfield horticulture in the coming years.

Regional Insights

Asia Pacific dominated the largest market share in 2022. The Asia Pacific region is home to a large and growing population, which necessitates increased agricultural productivity to meet food demand. Foliar sprays are recognized for their ability to enhance crop yields and promote efficient nutrient utilization, making them a valuable tool for addressing this need. Many countries in Asia Pacific have a high proportion of smallholder farmers who often have limited access to advanced agricultural machinery and resources. Foliar sprays provide a cost-effective and accessible way for these farmers to deliver essential nutrients to their crops, improving their livelihoods. Moreover, Asia Pacific is a major contributor to the rising global population. As reported by the United Nations Population Fund, Asia Pacific alone accounted for a share of approximately 60% of the global population (approximately 4.3 billion people) in 2021. Thus, with rising population the demand for food is also anticipated to increase which in turn will drive the demand for foliar sprays so as to improve crop yield.

Key Companies & Market Share Insights

Some of the players operating in the market are ANDAMAN AG, Yara, Aries Agro Limited, Nutrient TECH, K+S Aktiengesellschaft, and Haifa Negev technologies LTD among others. These market players are engaged in adoption of strategic initiatives such as mergers & acquisitions and partnerships to gain the competitive edge. Moreover, numerous specialized service providers offer foliar spray services, focusing exclusively on providing application and advisory services to farmers. These companies often emphasize their expertise, customized solutions, and proximity to local markets, appealing to growers seeking personalized support. In addition, agricultural cooperatives and associations also participate in this market, offering services to their member farmers. These entities may leverage collective purchasing power and knowledge-sharing among their members.

In January 2023, K+S Aktiengesellschaft revealed its plans to purchase 75% of the fertilizer business belonging to Industrial Commodities Holdings (Pty) Ltd (ICH), a prominent South African trading company. The acquisition will result in the establishment of a new entity called Fertiva (Pty) Ltd, which will bolster K+S Aktiengesellschaft's presence and operations in the agricultural sector across South and East Africa. This strategic acquisition signifies the company's commitment to expanding and fortifying its agricultural business in key regions, setting the stage for future growth and success.