- Home

- »

- Pharmaceuticals

- »

-

Food Allergy Treatment Market Size, Industry Report, 2030GVR Report cover

![Food Allergy Treatment Market Size, Share & Trends Report]()

Food Allergy Treatment Market (2025 - 2030) Size, Share & Trends Analysis Report By Allergen Type (Dairy Products, Peanuts, Poultry Products), By Drug Type (Immunotherapy, Antihistamines), By Route of Administration, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-290-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Allergy Treatment Market Summary

The global food allergy treatment market size was estimated at USD 6,872.9 million in 2024 and is projected to reach USD 11,332.1 million by 2030, growing at a CAGR of 8.3% from 2025 to 2030. Key factors propelling the market include the rising prevalence of food allergies worldwide and increasing R&D activities for novel drugs.

Key Market Trends & Insights

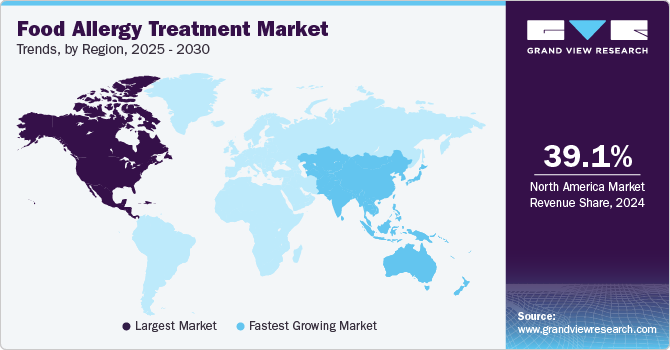

- North America dominated the food allergy treatment market with the largest revenue share of 39.14% in 2024.

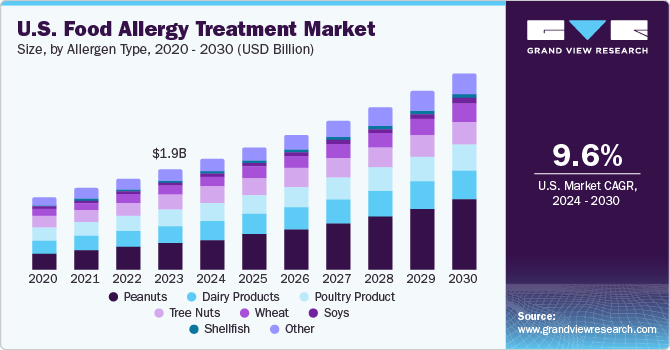

- The food allergy treatment market in the U.S. is projected to grow at a lucrative CAGR over the forecast period.

- Based on drug type, the epinephrine segment led the market with the largest revenue share of 41.0% in 2024.

- Based on route of administration, the parenteral route segment led the market with the largest revenue share of 54.90% in 2024.

- Based on allergen type, the peanuts segment led the market with the largest revenue share of 20.55% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6,872.9 Million

- 2030 Projected Market Size: USD 11,332.1 Million

- CAGR (2025-2030): 8.3%

- North America: Largest market in 2024

Moreover, the adoption of new biological agents to treat food allergies and an increase in clinic visits by patients seeking therapy for food allergies are likely to drive the market over the forecast period.

The increasing prevalence of food allergies, such as dairy and peanuts, is especially common among children in Western nations. Peanut allergy, often persistent throughout life, typically manifests in early childhood and is associated with more severe reactions than other food allergies. Unlike many food allergies that resolve as children age, peanut allergies continue into adulthood for the majority. Traditionally, food allergy management focuses on strict allergen avoidance and emergency action plans, including the availability of adrenaline auto-injectors. However, with the 2018 European Academy of Allergy and Clinical Immunology (EAACI) guidelines recommending Oral Immunotherapy (OIT) as a treatment option for children as young as 4 to 5 years old, there has been a shift toward more proactive management. This change acknowledges the growing prevalence of food allergies, driving the development of innovative treatments that enhance management and potentially reduce the severity of allergic reactions.

Food allergies such as peanut allergy affect about 1% to 2% of the U.S. population, so the need for effective treatments is more crucial than ever. Over the past 10 years, the prevalence of peanut allergy has increased. For instance, as per Food Allergy Treatment Research & Education, in 2022, approximately 32 million Americans have an illness, and 6.1 million of those have a peanut allergy. In addition, peanut allergy ranks among the most prevalent food allergies, impacting a staggering 17 million individuals across Europe.

The increase in funding for allergy treatments is driving advancements in research, development, and accessibility of innovative therapies, addressing the growing demand for more effective treatments & management strategies. Government agencies, private investors, and pharmaceutical companies are investing heavily in research and development for new allergy treatments, recognizing the urgent need for safe and effective therapies. For instance, in November 2023, The Food Allergy Fund accepted the proposal for its USD 500,000 Repurposing Innovators Research Grant, which supports innovative approaches to repurpose FDA-approved drugs for preventing food allergies, treating anaphylaxis, or maintaining tolerance in previously allergic individuals. Thus, this influx of funding is fueling the discovery and development of innovative drugs aimed at desensitizing patients to specific allergens and reducing the severity of allergic reactions.

Technological trends in the global industry focus on innovations in immunotherapy, including Oral Immunotherapy (OIT) and Epicutaneous Immunotherapy (EPIT), for desensitization. Biologic drugs like monoclonal antibodies are being developed to block allergic reactions. Precision medicine, leveraging genomics and biomarkers, allows for personalized treatments. Vaccine-based therapies are being explored to reduce or cure allergies. Advancements in diagnostics include more accurate blood tests, skin prick tests, and wearable devices for monitoring allergic reactions. Mobile apps also improve food tracking and emergency management, while gene-editing technologies like CRISPR offer future solutions.

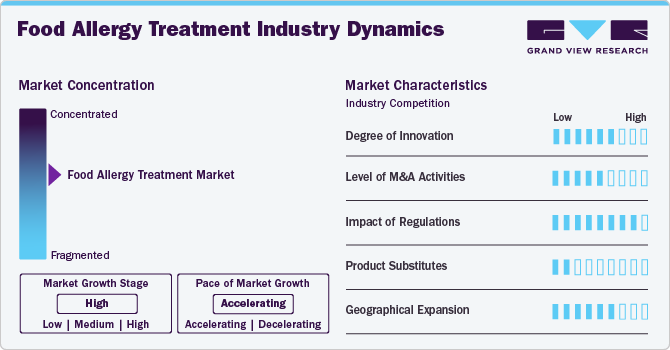

Market Concentration & Characteristics

The food allergy treatment industry is currently in a growth stage, with accelerated expansion driven by innovation and technological advancements. Product approvals and advancements in clinical trials propel this evolution. For instance, in December 2022, Aravax, a clinical-stage biotechnology company, initiated its series B funding round with a substantial USD 20 million investment from prominent Australian life science investors Brandon Capital and Tenmile. This funding will empower Aravax to begin Phase 2 trials of PVX108 and seek additional capital to expedite its development efforts. Having received approval for its Investigational New Drug (IND) application from the U.S. FDA and a Clinical Trial Notification from Australia's Therapeutic Goods Administration (TGA), Aravax is set to progress its Phase 2 clinical trial program across the U.S. and Australia. Further funding will support the expansion of this study and hasten development toward Phase 3. This significant investment demonstrates strong investor confidence in advancing PVX108 into its Phase 2 development stage.

The food allergy treatment industry is also characterized by a moderately high level of merger and acquisition (M&A) and collaboration activity. The leading players, such as Nestlé; Aimmune Therapeutics, Inc. among others, are involved in M&A activities. For instance, in October 2020, Nestle SA completed the acquisition of Aimmune Therapeutics, Inc. This acquisition, conducted by Nestlé Health Science, represents a significant step in its ongoing commitment to delivering innovative, science-backed nutritional solutions that promote healthier lifestyles. The acquisition of Aimmune Therapeutics, notably for its groundbreaking product PALFORZIA, the first FDA-approved treatment for peanut allergies, is seen as a transformative move.

In the food allergy treatment industry, regulatory trends are evolving to ensure greater safety and accessibility for patients. Regulatory agencies like the U.S. FDA are increasingly receptive to reviewing and approving noninjectable treatments, reflecting a shift toward more patient-friendly options. These agencies are also emphasizing rigorous allergen labeling and traceability measures to protect consumers. The introduction of stricter guidelines for allergen labeling and the evaluation of innovative treatment options is fostering a more favorable regulatory environment, promoting improved patient care and quality of life for food allergy sufferers.

The threat of substitutes is generally low, as there are limited direct substitutes for specialized food allergy treatments. While allergen avoidance and emergency response measures can help manage food allergies, these are not substitutes for medical treatments. However, off-label use of products or medications not specifically developed for food allergies can be a potential substitute in some cases, though their efficacy and safety may vary, making them less reliable substitutes.

The food allergy treatment industry is expanding regionally, enhancing the accessibility of therapeutics across diverse healthcare facilities nationwide. This strategy ensures wider availability across geographic areas, extending market presence and enabling patients in different regions to access a variety of treatments.

Allergen Type Insights

Based on allergen type, the peanuts segment led the market with the largest revenue share of 20.55% in 2024 and is expected to grow at the fastest CAGR over the forecast period. Key factors propelling the market include the rising prevalence of peanut allergies worldwide and increasing R&D activities for novel drugs. Moreover, the growing adoption of new biological agents to treat allergies and an increase in clinic visits by patients seeking therapy for this allergy are likely to drive the market over the forecast period.

The tree nuts segment is projected to grow at a significant CAGR over the forecast period. The tree nuts market, particularly as a recognized allergen category, is witnessing considerable growth driven by rising consumer demand, expanding imports, and increasing exports. Tree nuts like almonds, cashews, and walnuts are becoming staples in global markets due to their nutritional benefits and widespread usage in both food products and culinary applications. However, tree nut allergies are also among the most common and severe food allergies, fueling demand for clear labeling and allergen-free alternatives. This dual trend of increased consumption alongside heightened allergen awareness is spurring growth in the tree nuts market.

Drug Type Insights

Based on drug type, the epinephrine segment led the market with the largest revenue share of 41.0% in 2024. Epinephrine is considered to be the medication of choice for the treatment of allergic conditions. The growth of the epinephrine segment is driven by the rising prevalence of food allergies globally, with over 32 million Americans and 10% of the population in some Asia-Pacific countries affected by food allergens such as peanuts, tree nuts, shellfish, and dairy. Moreover, increased awareness of anaphylaxis among patients and caregivers has led to greater adoption of auto-injectors, supported by school programs and public health mandates requiring epinephrine availability in educational and public settings.

The immunotherapy segment is projected to grow at the fastest CAGR over the forecast period, driven by drugs such as Xolair and PALFORZIA. In January 2020, the FDA's approval of PALFORZIA marked a significant milestone in the food allergy treatment industry. PALFORZIA addresses a crucial unmet medical need by providing a treatment option for peanut allergies. Prior to its approval, patients had limited choices beyond strict avoidance, and this approval introduced a potentially life-changing solution. This oral immunotherapy product is specifically indicated for mitigating allergic reactions, including anaphylaxis that might occur from accidental peanut exposure in children aged 4 to 17 years with a confirmed diagnosis of peanut allergy. With ongoing R&D exploring multi-allergen immunotherapy options (e.g., ADP101 by Alladapt), the segment is poised for significant growth, particularly in developed regions with robust healthcare infrastructure.

Route of Administration Insights

Based on route of administration, the parenteral route segment led the market with the largest revenue share of 54.90% in 2024 and is expected to grow at the fastest CAGR of 10.12% over the forecast period. Epinephrine is the primary medication for anaphylaxis treatment, preferably administered via Intramuscular (IM) injection into the lateral thigh. Although Intravenous (IV) administration is an option, it is primarily restricted to inpatient settings as it requires proper monitoring. Although antihistamines, corticosteroids, and bronchodilators can be used as supportive therapies, they do not target the underlying condition directly. IV fluids are crucial to prevent and manage tissue hypoperfusion.

The oral segment is projected to grow at a steady CAGR over the forecast period. The main treatment for oral food allergies is oral immunotherapy (OIT), which involves consuming small amounts of the food allergen gradually. OIT has a number of clear benefits for allergy sufferers. By desensitizing patients to food allergies, it attempts to lessen the intensity of allergic reactions. According to the American Academy of Allergy, Asthma & Immunology, in clinical studies, efficacy is often defined as the onset of a desensitized phase. It has been demonstrated that OIT for peanut, egg, and milk desensitizes between 60 and 80 percent of the patients. Oral drugs are non-invasive, making them more accessible and easier for patients, especially children, compared to injections or other routes.

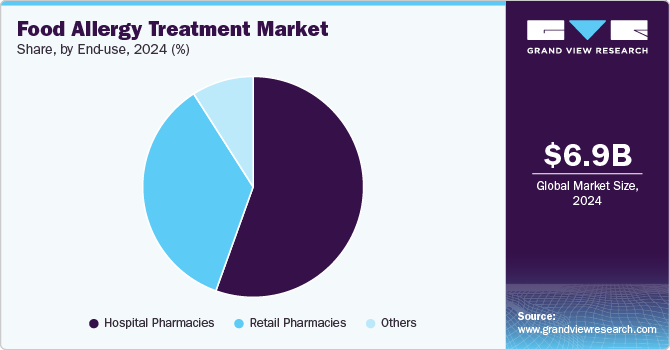

End Use Insights

Based on end use, the hospital pharmacies segment led the market with the largest revenue share of 55.48% in 2024. The rising number of hospital pharmacies plays a key role in driving the market growth. With more hospitals establishing specialized pharmacies, accessibility to treatments like antihistamines, epinephrine auto-injectors, and newer immunotherapy options has increased. For instance, according to the American Hospital Association, in the United States, there are 6,120 hospitals in 2024. The facilities stock allergy treatments such as antihistamines, epinephrine auto-injectors, and corticosteroids, which are critical for managing allergic reactions.

The retail pharmacies are projected to grow at the fastest CAGR over the forecast period. Retail pharmacies play a pivotal role as a distribution channel. With the increasing prevalence of food allergies globally, especially among children and young adults, there is a growing demand for treatments like antihistamines, epinephrine injectors, and dietary supplements that manage allergic reactions and symptoms. Retail pharmacies not only make these treatments more accessible to patients but also serve as critical points for patient education, offering information on allergy management and emergency treatment options.

Regional Insights

North America dominated the food allergy treatment market with the largest revenue share of 39.14% in 2024. The region held a major market share due to an increase in understanding of the high potential associated with allergy drugs. This has driven U.S.-based firms to make considerable investments in the development of these drugs. Moreover, new players are entering the market with their novel products, which is expected to intensify competitive rivalry in the North America market.

U.S. Food Allergy Treatment Market Trends

The food allergy treatment market in the U.S. is projected to grow at a lucrative CAGR over the forecast period, due to the increasing prevalence of food allergy cases, rising awareness about early diagnosis, and availability of a wide range of therapeutics. According to the data published by FARE (Food Allergy Research & Education), in July 2024, over 170 foods can trigger allergies, but nine major allergens-milk, egg, peanut, tree nuts, wheat, soy, fish, shellfish, and sesame, which account for most serious cases in the U.S. Approximately 33 million Americans have food allergies, affecting 11% of adults and nearly 8% of children. Reactions can be life-threatening, with 3.4 million emergency visits annually.

Europe Food Allergy Treatment Market Trends

The food allergy treatment market in Europe is projected to exhibit at a significant CAGR over the forecast period, due to the presence of developed economies, such as Germany, Spain, the UK, France, and Italy. These countries have advanced infrastructure, which is anticipated to significantly boost clinical research prospects in the region. Moreover, the market growth can be attributed to a growing biotechnology industry and rising investments in R&D, which is expected to boost the market.

The UK food allergy treatment market is expected to grow at the fastest CAGR over the forecast period. The availability of novel drugs and formulations and growing clinical trials for children to prevent food allergies further help boost the market growth. For instance, In October 2024, The SEAL (Stopping Eczema and Allergy) clinical trial was launched in the UK. This trial will involve 50 babies aged 0-12 weeks showing signs of eczema or dry skin.

The food allergy treatment market in France is expected to grow at the fastest CAGR over the forecast period. As per the study “Allergy Prevalence in France and Skin Impact - Epidemiological Survey of a Representative Sample of French Adults,” released in July 2021, it is projected that, on average, about 10 million French adults have one or the other kind of allergy. The study included 2,036 adults, out of which 20.2% of French adults reported allergies.

The Germany food allergy treatment marketis expected to grow at a significant CAGR over the forecast period. According to the Bundesinstitut für Risikobewertung (BfR) report published in June 2024, approximately 3 to 6% of the population is affected by food allergies in Germany. The most frequent allergens for children and teenagers include cow's milk, eggs, peanuts, wheat, and tree nuts.

Asia Pacific Food Allergy Treatment Market Trends

The food allergy treatment market in Asia Pacific exhibits some key variations. Some countries, such as Australia, face a relatively high prevalence of peanut allergies, and others, such as China, show lower incidence rates. Understanding these regional disparities is crucial for market stakeholders. It is essential to recognize the diverse trends and adapt strategies accordingly. Moreover, Traditional Chinese Medicine (TCM) is gaining attention due to its potential to address allergies. The long-standing reputation of TCM for effectiveness, cost-efficiency, & safety is attracting interest in China and Western societies. However, there is a need to carefully consider how TCM may impact the broader modern medicine market.

The China food allergy treatment market is expected to grow at a moderate CAGR over the forecast period. Food allergies appear to be a significant concern in Western countries but are notably less prevalent in other parts of the world, particularly in China. For instance, in Beijing, food allergies represent only a small percentage, ranging from 3.4% to 5.0% of all allergies, and these allergies are primarily associated with foods such as fish, shrimp, seaweed, and crab, rather than peanuts.

The Japan food allergy treatment market is expected to grow at the fastest CAGR over the forecast period. According to the Pediatric Allergy and Immunology published by the European Academy of Allergy and Clinical Immunology and John Wiley & Sons Ltd. in July 2024, Food allergy (FA) prevalence in Japan has notably increased over the past decade, leading to an increased public health burden.

Latin America Food Allergy Treatment Market Trends

The food allergy treatment market in Latin America is expected to grow at a moderate CAGR during the forecast period. This market is diverse, with varying prevalence of peanut allergy across different countries in the region. In some countries like Brazil and Mexico, food allergies are more common, while in others, the prevalence is lower. This variance in disease prevalence directly influences the size and dynamics of the treatment industry in each country.

The Brazil food allergy treatment market is expected to grow at the fastest CAGR over the forecast period. In Brazil, allergies to tree nuts, particularly Brazil nuts, are not uncommon, and they can be quite severe. These allergies typically manifest by the age of 2 years, and some individuals may become allergic to more types of tree nuts as they grow older.

Middle East & Africa Food Allergy Treatment Market Trends

The food allergy treatment market in the Middle East and Africa is marked by varying prevalence rates across different countries. Although the prevalence of peanut allergy is relatively low in some areas, there is a growing concern in several countries. The market scenario is diverse, with some countries relying on traditional treatments and others exploring innovative approaches. Key players in this market need to adapt to this regional diversity and cater to the specific needs of each country.

The Saudi Arabia food allergy treatment market may differ from regions with higher prevalence rates. Although the market may not be as extensive, there is still a demand for treatments and solutions that cater to the needs of those affected. Key players in the market should focus on providing accessible & affordable treatments, along with education and support for patients and their families.

Key Food Allergy Treatment Company Insights

Key players in the global industry are engaged in strategic initiatives such as mergers & acquisitions, partnerships, and the development of innovative therapies to enhance their market presence. Leading companies, including Roche, Novartis, and Teva Pharmaceutical, are focused on advancing their product pipelines to address unmet treatment needs. These strategic efforts reflect the industry's commitment to improving patient outcomes and expanding treatment accessibility in the treatment landscape.

Key Food Allergy Treatment Companies:

The following are the leading companies in the food allergy treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Sanofi

- Stallergenes Greer

- DBV Technologies

- Vedanta Biosciences, Inc.

- Alladapt Immunotherapeutics, Inc.

- COUR Pharmaceuticals

- Aravax

- Prota Therapeutics Pty Ltd

- Teva Pharmaceutical Industries Ltd.

- F. Hoffman-La Roche Ltd.

- Novartis AG

Recent Developments

-

In October 2024, DBV Technologies announced positive regulatory updates for its Viaskin Peanut patch in the U.S. and Europe. The FDA has agreed to an Accelerated Approval pathway for the patch in toddlers aged 1-3 years, contingent on a six-month safety study starting in Q2 2025. Meanwhile, the EMA confirmed a pathway for approval in children aged 1-7 years. DBV also reported strong enrollment for the VITESSE Phase 3 study in children aged 4-7, with topline results expected in Q4 2025.

-

In July 2024, Stallergenes Greer announced FDA approval for Palforzia oral immunotherapy to treat peanut allergy in toddlers (ages 1-3). The approval expands upon the 2020 FDA approval for ages 4-17. The decision follows the successful Phase 3 POSEIDON study, which demonstrated Palforzia's efficacy and safety in young children. Stallergenes Greer acquired Palforzia in September 2023 and is transitioning it into their allergen immunotherapy portfolio.

-

In February 2024, the FDA approved Novartis Xolair (omalizumab) as the first treatment for reducing allergic reactions, including anaphylaxis, in people aged 1 and older with IgE-mediated food allergies. This approval is based on positive results from the Phase III OUtMATCH study, offering hope for those managing severe food allergies.

Food Allergy Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.62 billion

Revenue forecast in 2030

USD 11.33 billion

Growth rate

CAGR of 8.27% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug type, allergen type, route of administration, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; Denmark, Sweden, Norway, France; Italy; China; India; Japan, Thailand, South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Sanofi; Stallergenes Greer; DBV Technologies; Vedanta Biosciences, Inc.; Alladapt Immunotherapeutics, Inc.; COUR Pharmaceuticals; Aravax; Prota Therapeutics; F. Hoffman-La Roche Ltd.; Novartis AG; Teva Pharmaceuticals

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Allergy Treatment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global food allergy treatment market report based on the allergens type, drug type, route of administration, end use, and region:

-

Allergen Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy Products

-

Poultry Product

-

Tree Nuts

-

Peanuts

-

Shellfish

-

Wheat

-

Soys

-

Other

-

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Antihistamines

-

Epinephrine

-

Immunotherapy

-

Xolair

-

PALFORZIA

-

Others

-

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Parenteral

-

Other

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global food allergy treatment market size was estimated at USD 6.87 billion in 2024 and is expected to reach USD 7.62 billion in 2025.

b. The global food allergy treatment market is expected to grow at a compound annual growth rate of 8.27% from 2025 to 2030 to reach USD 11.33 billion by 2030.

b. Based on Drug Type, Epinephrine segment held a dominant share in 2024 with a share of 41.0%. Epinephrine is considered to be the medication of choice for treatment of allergic conditions. Owing to its use as the initial treatment of choice for emergency allergic conditions.

b. Some of the key market players are Sanofi; Aimmune Therapeutics (Nestle SA); DBV TechnologiesVedanta Biosciences, Inc.; Alladapt Immunotherapeutics, Inc.; COUR Pharmaceuticals; Aravax; Prota Therapeutics; and Teva Pharmaceuticals.

b. Key factors propelling the market include the rising prevalence of food allergies worldwide and increasing R&D activities for novel drugs. Moreover, the adoption of new biological agents to treat food allergies and an increase in clinic visits by patients seeking therapy for food allergies are likely to drive the market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.