- Home

- »

- Food Additives & Nutricosmetics

- »

-

Food Antioxidants Market Size, Share & Growth Report, 2030GVR Report cover

![Food Antioxidants Market Size, Share & Trends Report]()

Food Antioxidants Market Size, Share & Trends Analysis Report By Type (Natural, Synthetic), By Form (Dry, Liquid), By Application (Meat & Poultry, Bakery & Confectionery, Fats & Oil, Fish), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-010-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Specialty & Chemicals

Report Overview

The global food antioxidants market size was valued at USD 502.2 million in 2021 and is expected to witness a compound annual growth rate (CAGR) of 6.1% from 2022 to 2030. The growing application of food antioxidants in a wide variety of prepared meals and packaged food has been the key driver for the growth of the market. The rising requirement for the long shelf life of packaged food is expected to be the major contributor to the escalating demand for food antioxidants during the forecast period.

Rising food consumption on the account of growing population has propelled the demand for a wide variety of prepared food globally. Such food comprises meat, poultry, bakery, sweets, confectionery, oil, fish, and many more. These food products are already prepared and kept at the store for a few days prior to selling to customers. Thus, a little portion of food antioxidants is mixed in the formulation of food to provide it with a long shelf life without losing its healthy properties. The rapid increase in the consumption of packaged food across the globe is anticipated to be the key factor for the rising demand for food antioxidants over the foreseeable future.

Increasing disposable income coupled with rapid growth in urbanization has been fostering the demand for prepared food globally. The time crunch to prepare their own food for working professionals has compelled them to rely on prepared food products which are easy to consume and contain healthy properties. The shift in consumers’ lifestyles is leading to a change in their preferences for food products. Consumers are highly aware of the variety of food products available in the market and the ingredients used in them as preservatives and nutrients. This factor is likely to contribute to the growth of the food antioxidants market globally over the projected years.

The government of different countries has imposed strict regulations pertaining to the consumption of food antioxidants as an additive in food products. The regulatory bodies have set some strict limitations on the use of antioxidants in food products. Especially, there are several stringent policies introduced by the government in the addition of synthetic antioxidants due to the involvement of chemicals in its formulation. They have defined a certain content level for antioxidants and other related additives and have also made it mandatory for manufacturers to clearly mention all ingredients that go into the production of prepared food products.

The outbreak of COVID-19 directly affected the meat & poultry market due to massive supply shortages of such food products on the account of the shutdown of many food facilities. In addition, consumers tended to avoid meat and livestock food products during the pandemic due to the risk of viruses being transmitted through the meat. However, the rising panic situation on the account of the shutdown of a maximum number of local food stores elevated the consumption of packaged food that could be stored for a longer period. Increasing dependencies on prepared food propelled the consumption of antioxidants in food products during the pandemic.

Type Insights

The synthetic type segment dominated the market at a revenue share of over 55% in 2021. The growth is attributable to the rising consumption of butylated hydroxyanisole (BHA), butylated hydroxytoluene (BHT), Tert-butylhydroquinone (TBHQ), and Propyl Gallate (PG) in the production of a wide range of food products. Synthetic antioxidant is a mixture of numerous chemicals and involves a typical industrial process for their formulation. Thus, the government of many countries has imposed some strict regulations on its consumption as an additive. Synthetic antioxidants are widely utilized to increase the shelf life and provide a better texture, color, and fragrance to food products.

Natural antioxidants belong to natural sources such as plants, animals, fruits, herbs, and spices and do not involve a typical chemical operation. Natural antioxidants comprise carotenoids, rosemary extracts, vitamin C, vitamin E, ascorbic acid, alpha-tocopherol, and others. Rising inclination towards maintaining a healthy lifestyle has bolstered the consumption of naturally extracted antioxidants. Growing awareness of health and the side effects of chemicals is expected to fuel the demand for natural antioxidants over the projected years.

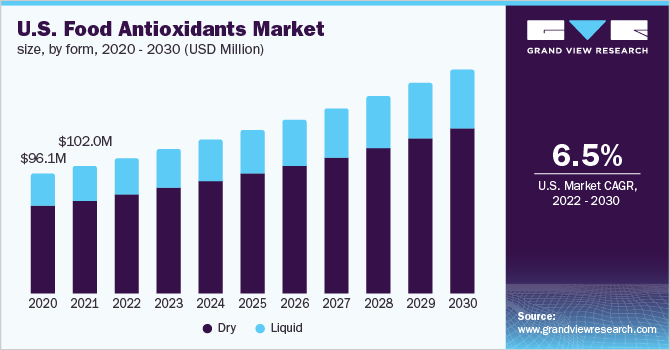

Form Insights

The dry form segment dominated the market with a revenue share of over 72% in 2021. The high share is attributable to the increasing consumption of powder based antioxidants in food products. Technical grade powders are highly consumable for numerous food products. The powder reduces the effects of free radicals and can significantly decrease the damage caused by them. Majority of food antioxidants are in dry form including powder, tablets, flakes, and granular. Dry antioxidants are widely preferred by consumers owing to the ease of their transport, storage, and usage. Growing prepared food market is expected to drive the demand for dry antioxidants globally over the forthcoming years.

Liquid antioxidants are also used in a wide range of food products, such as fats and oil, mayonnaise, and more. However, liquid antioxidants are complicated to transport, store, and usage. In addition, liquid antioxidants are not easily mixed with all types of food products, and thus, the market is expected to witness a limited demand for liquid antioxidants over the future years.

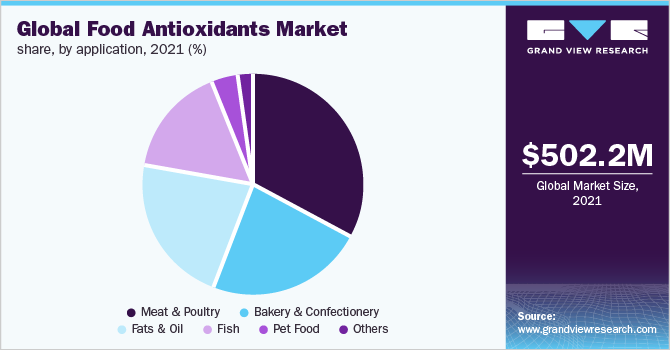

Application Insights

Meat & Poultry application dominated the market with a revenue share of over 32% in 2021. The growth is driven by the rising consumption of meat and its related food products across the globe. Meat & poultry are considered rich sources of protein that is required by humans to have a balanced diet. The consumption of meat & poultry products provides an adequate amount of protein to human bodies. The meat segment typically involves red meat including the meat of pork, lamb, and beef. The rising popularity of poultry meat on the account of its low price is expected to be the key driver for the growth of the poultry market. Meat & poultry products are also sold in the packaged form which is stored for a long time and consumed according to the need. Food antioxidants preserve the meat from bacteria and fungi and provide a longer shelf life to the meat & poultry products. Growing meat & poultry consumption on the account of its health benefits is anticipated to drive demand for food antioxidants in the coming years.

Bakery and confectionery products are highly consumed by all age groups of people. Bakery products involve food products such as bread, toast, cookies, biscuits, and more. These food products are an essential part of people’s daily diet. Bakery & confectionery market is witnessing rapid innovation on the account of evolving habits and preferences of customers. In addition, the trend of gifting chocolates, sweets, and other confectionery products, especially at festivals is also a contributing factor to the growth of bakery & confectionery market. Increasing consumption of bakery and confectionery products is expected to stimulate the demand for food antioxidants over the forecast period.

Fats and oil are majorly consumable food products and are expected to record stable growth over the projected years. Fats & oil are sourced from plants such as palm, soybean, olive oil, sunflower, and rapeseed. Fatty acids and vegetable oil is consumed in a wide application of food products, and thus required to be preserved. Food antioxidants provide longer shelf life to fats & oil products and keep it safe from degrading. Growing utilization of fats and oil in food products is likely to escalate the demand for food antioxidants over the future years.

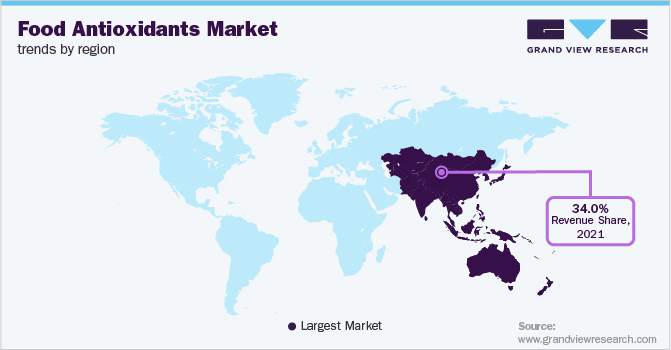

Regional Insights

Asia Pacific dominated the market with a revenue share of over 34% in 2021. The high share is attributable to the rising population in the countries like China, India, and Japan. According to the Food and Agriculture Organization (FAO), China was the largest food producer with an output value of USD 1.56 trillion. The major factor driving the food market in China is the growing population of the country. India is the second most populous country in Asia, which also contributes to the increasing consumption of food. Asia Pacific is one of the majorly impacted regions by the strike of COVID-19. The health crisis has spread awareness for consuming healthy food products across the region. Rising population coupled with the growing consumption of food is expected to augment the demand for food antioxidants over the projected years.

North America captures the second largest revenue share with a share of over 30% in 2021.The high share is attributable to the lifestyles of consumers in countries like the U.S. and Canada. Majority of people are working professionals in North America and thus, rely heavily on prepared food. In addition, the dire COVID-19 situation in the U.S. has compelled its population to have a healthy diet to immunize their body to fight against the virus. Food antioxidants preserve the food for a long time and prevent the formation of free radicals in human body. This factor is likely to fuel the demand for food antioxidants in North America over the next few years.

Europe holds a lucrative opportunity for the growth of food antioxidants market owing to the rising awareness of the health benefits of antioxidants. Rapid economic development and rising disposable income in Europe have propelled the consumption of prepared food across the region. Rising reliance on prepared food is anticipated to elevate the demand for food antioxidants across Europe in the near future.

Key Companies & Market Share Insights

Key players in the market are dedicated to new product design coupled with the rapid investment and mergers & acquisitions. Increasing innovation by the key players in the market is creating a competitive environment for the new entrants in the market. Some prominent players in the global food antioxidants market include:

-

BASF SE

-

Archer Daniels Midland Company (ADM)

-

DuPont

-

Kalsec Inc.

-

Kemin Industries

-

Camlin Fine Sciences

-

3A Antioixidants

-

Eastman Chemical Company

-

Frutarom Ltd

-

Barentz Group

-

Vitablend Nederland BV

-

Crystal Quinone Pvt Ltd

-

Sasol Limited

-

Naturex

Recent Development

-

In August 2022, Kalsec® partnered with Infinome™ Biosciences to provide naturally sourced and innovative ingredientswith superior quality.

-

In August 2022, Kemin launched ENTEROSURE™, a resilient intestinal health solution. The solution helps to enhance the control of enteric bacterial pathogens to reduce the use of antibiotics.

-

In December 2021, Barentz acquired Gangwal in India to become a major international distributor of specialty drugs and nutraceutical ingredients.

-

In April 2021, Eastman acquired 3F Feed & Food to strengthen its product portfolio and provide customized solutions to challenges faced by its customers.

Food Antioxidants Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 531.69 million

Revenue forecast in 2030

USD 852.62 million

Growth Rate

CAGR of 6.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in Tons, Revenue in USD Million, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, China, India, Japan, South Korea, Indonesia, Singapore, Malaysia, Vietnam, Brazil, Argentina, Colombia, Saudi Arabia, UAE, South Africa, Nigeria

Key companies profiled

BASF SE, Archer Daniels Midland Company (ADM), DuPont, Kalsec Inc., Kemin Industries, Camlin Fine Sciences, 3A Antioixidants, Eastman Chemical Company, Frutarom Ltd, Barentz Group, Vitablend Nederland BV, Crystal Quinone Pvt Ltd, Sasol Limited, Naturex

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

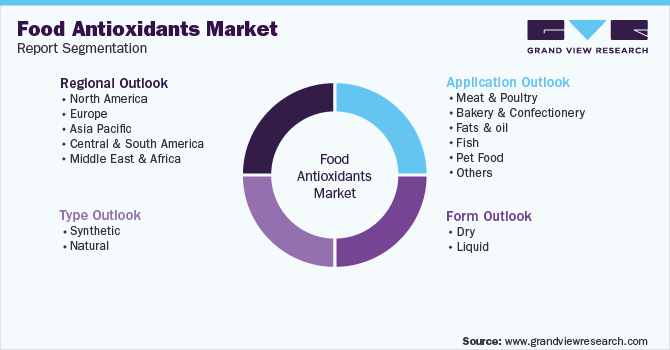

Global Food Antioxidants Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global food antioxidants market report on the basis of type, form, application, and region:

-

Type Outlook (Volume, Tons, Revenue, USD Million; 2018 - 2030)

-

Synthetic

-

Natural

-

-

Form Outlook (Volume, Tons, Revenue, USD Million; 2018 - 2030)

-

Dry

-

Liquid

-

-

Application Outlook (Volume, Tons, Revenue, USD Million; 2018 - 2030)

-

Meat & Poultry

-

Bakery & Confectionery

-

Fats & oil

-

Fish

-

Pet Food

-

Others

-

-

Regional Outlook (Volume, Tons, Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Singapore

-

Malaysia

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global food antioxidant market size was estimated at USD 502.2 million in 2021 and is expected to reach USD 531.69 million in 2022.

b. The global food antioxidant market is expected to grow at a compound annual growth rate of 6.1% from 2022 to 2030 to reach USD 852.62 million by 2030.

b. The meat & poultry segment emerged as the largest application segment in 2021 and accounted for a revenue share of around 32.7%.

b. key players operating in the food antioxidant market are BASF SE, Archer Daniels Midland Company (ADM), DuPont, Kalsec Inc., Kemin Industries, Camlin Fine Sciences, 3A Antioixidants, Eastman Chemical Company, Frutarom Ltd, Barentz Group, Vitablend Nederland BV, Crystal Quinone Pvt Ltd, Sasol Limited, Naturex

b. The growing application of food antioxidant in a wide variety of prepared meals and packaged food has been the key driver for the growth of the market. Rising requirement of long shelf life of packaged food is expected to be the major contributor for the escalating demand of food antioxidant during the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."