- Home

- »

- Food Safety & Processing

- »

-

Food Glazing Agents Market Size And Share Report, 2030GVR Report cover

![Food Glazing Agents Market Size, Share & Trends Report]()

Food Glazing Agents Market (2024 - 2030) Size, Share & Trends Analysis By Ingredient (Carnauba Wax, Candelilla Wax), By Function (Coating Agent, Surface Finishing Agent), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-983-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Glazing Agents Market Size & Trends

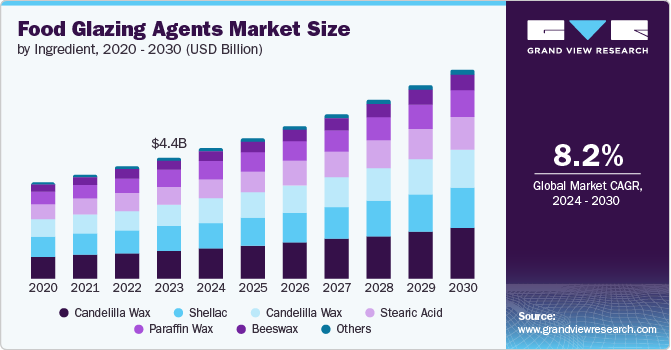

The global food glazing agents market size was valued at USD 4.43 billion in 2023 and is expected to grow at a CAGR of 8.2% from 2024 to 2030. This projected growth can be attributed to the rising popularity of bakery and confectionery products. As consumers increasingly seek visually appealing food products, the demand for food glazing agents is expected to rise. These glazing agents enhance the appearance, texture, and shelf life of baked goods, chocolates, and other sweet treats, giving a glossy finish to such savories.

Another significant market driver is the increased consumption of processed foods. Food glazing agents serve various purposes, such as enhancing flavor, texture, and shelf life. This aligns with the rising consumer demand for convenience-oriented preferences which has led to a surge in processed food consumption, including ready-to-eat meals, snacks, and packaged goods. Processed foods rely on these agents to maintain freshness, safety, taste, appearance, and texture. For instance, emulsifiers play a crucial role by binding water and oil together in emulsions, especially in low-fat processed foods.

Furthermore, the food processing industry’s growth has driven significant market expansion with manufacturers constantly innovating to meet changing consumer preferences and dietary trends. Glazing agents play a key role by enhancing texture, preventing moisture loss, and preserving natural color and flavor, ultimately improving overall product quality.

However, the food glazing market encounters industry challenges due to increased scrutiny of food additives and their potential health effects. As several consumers increasingly seek cleaner labels and natural alternatives, it becomes a potential challenge for manufacturers using synthetic or artificial ingredients in glazing agents.

Ingredients Insights

Carnauba wax secured the dominant market share with 23.7% in 2023 owing to its reliability and eco-friendly attributes. Its stiff, white composition makes it highly durable, with a high melting point and resistance to heat and moisture. This kind of wax is extensively used in candy, baked goods, and chewing gum which gives them a glossy finish, attracting consumers and thereby driving the market growth. Moreover, the trend toward natural, sustainable ingredients has led to an increased demand for organic food glazing agents including carnauba wax. It aligns with this eco-friendly trend without compromising its trend.

Candelilla wax is also projected as the fastest-growing segment over the forecast period owing to its unique nature that drives consumers who are increasingly seeking clean-label products with transparent ingredient lists. Its versatility makes it suitable for various applications including food products and cosmetics. This robust growth was also food manufacturers who prefer candelilla’s unique properties such as coating ability, anti-sticking, binding, and film-forming, which enhance food appearance and quality. In addition, candelilla wax is easily accessible to food companies which allows them to incorporate seamlessly into their product formulations.

Function Insights

In terms of function, coating agents held the dominant market share in 2023 owing to their ability to improve the visual appeal of food products. These agents act as sea sealants, preventing moisture loss and oil retention. They enhance food structure and protect against cracking, discoloration, and spoilage. As shelf life and freshness continues to be a preferred choice for consumers seeking packaged food, manufacturers rely on coating agents to maintain product quality. Additionally, coating agents create a glazy finish, making confectionery, bakery items, and other processed food visually appealing to consumers.

Surface finishing agents have emerged as the fastest-growing segment with a CAGR of 8.4% during the forecast period. This can be credited to customization that has propelled significant demand. The market has witnessed consumers increasingly seek personalized and unique confectionery items for various occasions. Surface finishing agents play a crucial role in achieving the desired appearance, texture, and glossiness of these customized treats. These help in strengthening the structure of food products, especially during manufacturing and processing. By forming a protective film, they prevent cracking, maintain shape, and enhance overall product stability. In addition, these agents contribute to shelf-life extension by protecting against moisture loss, oxidation, and microbial growth.

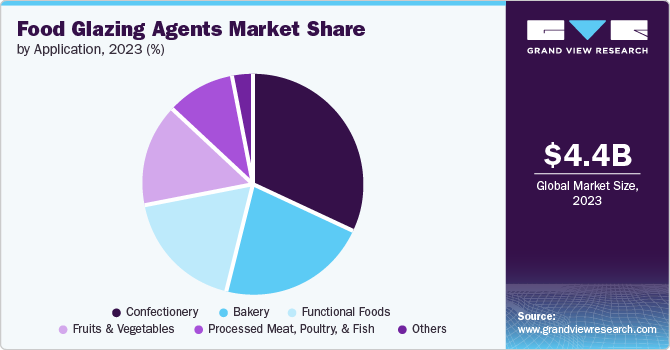

Application Insights

Confectionary products registered the dominant market share with 12.1% in 2023 owing to the increasing consumer demand for confectionery products, including chocolates, candies, and other sweet treats that rely heavily on glazing agents. These agents impart shine, prevent moisture loss, and enhance visual appeal, making confectionery items more enticing to consumers. Moreover, consumers increasingly seek high-quality gourmet and artisanal confectionery, which are further enhanced by the fresh glossy texture that food glazing agents provide.

Bakery is projected to grow significantly over the forecast period owing to the worldwide increasing consumer demand for visually appealing baked goods. The shift in lifestyle, particularly seen in countries such as China, India, and Brazil, has led to an increased consumption of bakery products. Additionally, the market is expected to thrive due to increased demand resulting from the availability of customized products and a wide variety of options. Furthermore, bakeries are constantly innovating to stand out in a competitive market. Food glazing agents allow them to create unique textures, finishes, and visual effects.

Regional Insights

The Europe food glazing agents market held the dominant share with 34.4% of the global market in 2023. The expansion of the food additives industry, coupled with increased consumption of processed foods were the primary drivers of the market. In addition, the region’s affinity for confectionary and bakery items has fueled the demand for glazing agents as they enhance the visual appeal and texture of baked goods, chocolates, and other treats.

North America Food Glazing Agents Market Trends

The North America food glazing agents market accounted for a market share of 23.6% in 2023. This can be attributed to the high demand for ready-to-eat convenience meals that considerably drove the need for food glazing agents in packaged snacks and prepared meals. The region has witnessed increased utilization of natural carnauba wax in candy, baked goods, and chewing gum. Moreover, technological advancements in food glazing agents contribute to efficient production, improved characteristics, and enhanced sales.

U.S. Food Glazing Agents Market Trends

The U.S. food glazing agents market was driven by the rising consumer awareness regarding the advantages of organic food consumption, coupled with the increased popularity of plant-based and naturally derived confectionery and bakery products. Additionally, improved palatability, texture, and flavor contribute to market growth during the forecast period.

Asia Pacific Food Glazing Agents Market Trends

The food glazing agents market in Asia Pacific region held a market share of 28.5% in 2023 owing to the robust growth in bakery and confectionary consumption as consumers seek delectable textures. The rising economic growth in countries including India, Japan, and China has led consumers become more discerning about food texture. Glazing agents improve the appearance, structure, and overall quality of various food items including bakery treats and fresh fruits.

Key Food Glazing Agents Company Insights

The global food glazing agents market is fragmented. Key players adopt prominent strategies such as launching new products, making acquisitions, and expanding their businesses.

-

Capol GmbH is a prominent player in the food glazing agents market. It manufactures a variety of polishing, anti-sticking, glazing, and sealing agents. Capol is also involved in manufacturing coated acids and machine-realizing agents.

-

Mantrose-Haeuser Co., Inc., based in the U.S., focuses on manufacturing coating that is utilized for foods & beverages, food glazing, and baking purposes. The company is primarily specialized in manufacturing green products.

Key Food Glazing Agents Companies:

The following are the leading companies in the food glazing agents market. These companies collectively hold the largest market share and dictate industry trends.

- Mantrose-Haeuser Co., Inc.

- Capol GmbH

- Strahl & Pitsch, Inc.

- British Wax Refining Company Limited

- Kerry Group

- Masterol Foods Pty Ltd

- ADM Corn Processing

- DuPont de Nemours, Inc.

- Wuhu Deli Foods Co., Ltd.

- Ningbo J&S Botanics Inc.

- Arla Foods Ingredients Group P/S

- Macphie of Glenbervie Ltd.

- Mantrose UK Ltd.

- Poth Hille & Co Ltd

- Zeelandia International B.V.

Food Glazing Agents Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.78 billion

Revenue forecast in 2030

USD 7.67 billion

Growth rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredients, function, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia

Key companies profiled

Mantrose-Haeuser Co., Inc.; Capol GmbH; Strahl & Pitsch, Inc.; British Wax Refining Company Limited; Kerry Group; Masterol Foods Pty Ltd; ADM Corn Processing; DuPont de Nemours, Inc.; Wuhu Deli Foods Co., Ltd.; Ningbo J&S Botanics Inc.; Arla Foods Ingredients Group P/S; Macphie of Glenbervie Ltd.; Mantrose UK Ltd.; Poth Hille & Co Ltd.; Zeelandia International B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Glazing Agents Market Report Segmentation

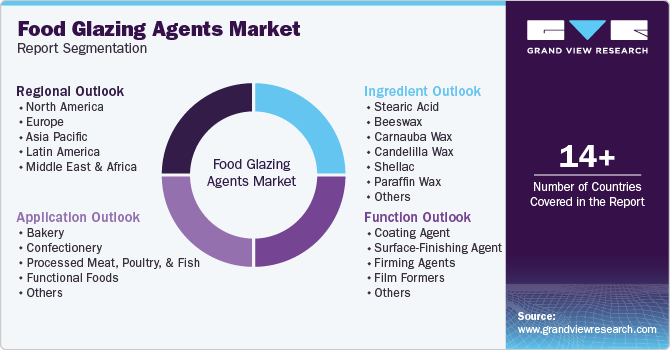

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global food glazing agents market report based on ingredients, function, application, and region.

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Stearic Acid

-

Beeswax

-

Carnauba Wax

-

Candelilla Wax

-

Shellac

-

Paraffin Wax

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery

-

Confectionery

-

Processed Meat, Poultry, & Fish

-

Functional Foods

-

Others

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Coating Agent

-

Surface-Finishing Agent

-

Firming Agents

-

Film Formers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.