- Home

- »

- Advanced Interior Materials

- »

-

Food Service Equipment Size, Share & Growth Report, 2030GVR Report cover

![Food Service Equipment Market Size, Share & Trends Report]()

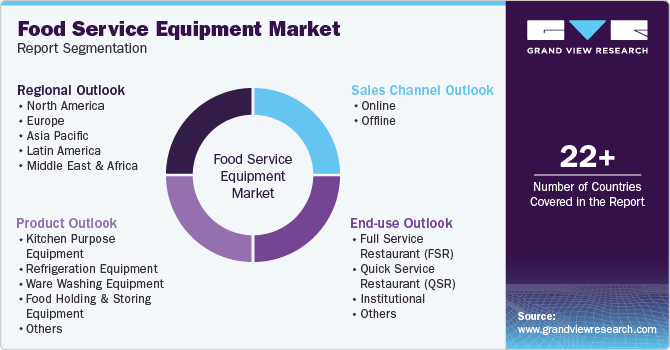

Food Service Equipment Market Size, Share & Trends Analysis Report By Product (Kitchen Purpose Equipment), By End-use (Full Service Restaurant), By Sales Channel (Online, Offline), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-841-1

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Food Service Equipment Market Trends

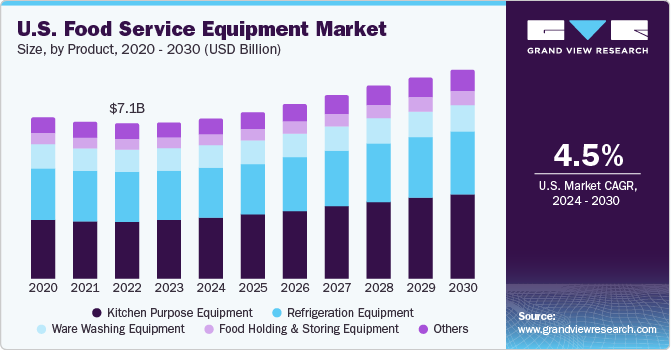

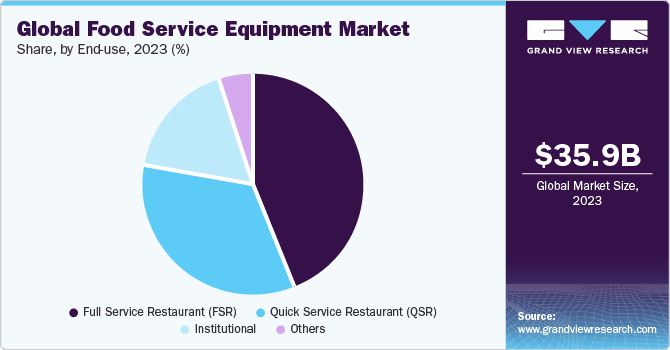

The global food service equipment market size was valued at USD 35.97 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2030. Changing food consumption patterns, increased demand for takeaways and the expanding hospitality sector are some of the key factors driving the market. Furthermore, factors such as increasing digitalization, the need for sustainable & eco-friendly equipment, and stringent consumer safety norms are expected to create promising growth opportunities for the market in the near future. The market has rapidly evolved following the changing needs of clients for outfitting their kitchen spaces. Changing social customs coupled with technological progressions, have created a dynamic marketplace for the equipment used in the end-use sector.

The market has rapidly evolved following the changing needs of clients for outfitting their kitchen spaces. Changing social customs coupled with technological progressions, have created a dynamic marketplace for the equipment used in the end-use sector. From the discovery of equipment for preparing and storing food, such as cooking stoves, ranges, and electrical refrigerators, to the availability of custom foodservice appliances to cook different cuisines, the range of technologically-advanced and innovative products has entered the market over the years and is expected to favor the market growth in the longer run. Furthermore, rapid technological advancements achieved with the help of continual Research & Development (R&D) activities have helped appliance manufacturers to offer technology-driven efficiencies to their clients.

The market demand has significantly increased in response to the emergence of several casual restaurant chains in North America and Europe. Companies are mandated to sell certified and tested commercial kitchen appliances according to the safety rules laid by several regulatory bodies worldwide. These safety standards aim to create a guarded environment for both the restaurant operators and consumers. National Sanitation Foundation (NSF), an American product testing, inspection, and certification non-profit organization, has developed equipment safety standards to ensure food safety requirements and sanitation protocols are maintained by the end-use sector. With food safety being the utmost priority, standards have been set for the material used, design, and equipment architecture.

The growing awareness about energy consumption and eco-friendly initiatives facilitates consumers to adopt energy-efficient appliances, thereby creating opportunities for this market. Energy consumption norms across the globe emphasize reducing the Green House Gas (GHG) emissions to mitigate the rising impact of climate change. End customers are increasingly preferring appliances holding the ENERGY STAR symbol, a mark of energy efficiency of the equipment, which helps restaurants, institutional kitchens, and cafes save energy while also reducing maintenance and utility costs. As reported in 2018 by the Energy Star program of the U.S, Environmental Protection Agency (EPA), food service equipment with the ENERGY STAR symbol helps the end-use operators to save USD 5,300 or around 340 MMBTU per year.

The rising innovation is leading to the Industry 4.0 revolution in the industrial and commercial sectors. The advancements in semiconductors and microelectronics have driven the development of high-quality and high-precision equipment for various applications in the food industry. Connected devices, real-time alerts, workflow processing, temperature monitoring, remote control, etc., are some of the advanced features being researched and introduced in the food service equipment. Key manufacturers of the food service equipment are launching such innovated equipment, targeting the high-end commercial kitchens, cafes, and restaurants.

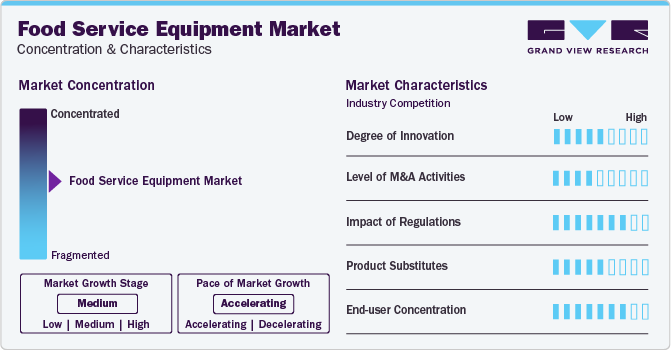

Market Concentration & Characteristics

Market is characterized by the medium growth, and pace of the market growth is accelerating. The food service equipment industry is characterized by a high degree of competition, with a large global and local player. Major players in the market often have a global presence and strong distribution networks in various countries across the world. Companies in this sector usually offer a diverse range of food service equipment, catering to various end-users differing in size and other specifications.

Due to the critical nature of applications, because it involves the preparation of food and beverage products, the impact of the regulation is high in this industry. Moreover, the developing economies are focusing on strengthening the domestic regulatory framework which regulates the type of technology and material used for the manufacturing of the equipment. The ban of certain materials used for sealing is also seen impacting the market across the world.

The degree of innovation in the food service equipment is medium to high. The increasing number of food service establishments, such as café, hotels, commercial kitchens, restaurants, etc., are leading to increasing demand for new food service equipment. Many end-users are actively looking for innovation and added key features in the food service equipment, which is likely to boost the degree of innovation in the global market for food service equipment.

Product Insights

The kitchen purpose equipment segment accounts for the largest revenue share of over 35% of the overall market in 2023 and is estimated to witness the fastest growth from 2024 to 2030. The procurement of appropriate kitchen appliances is a must while establishing a new business or refurbishing an existing place to ensure smooth operations. The growth of the kitchen purpose equipment segment is highly subject to the use of innovative products in commercial kitchens, depending on the space and budget of the kitchen. The increasing demand for meal preparation appliances in the open food service kitchens has encouraged manufacturers to increase their focus on elements, including the latest technology solutions and appliance exterior designs. The trend of embedding sensors in kitchen purpose equipment, such as fryers, ovens, and cooktops, has led to real-time monitoring of meal preparations.

Furthermore, restaurants are shifting to smaller kitchens owing to the increasing rent of commercial spaces. This is compelling the food service equipment manufacturers to upgrade their product designs and make them compact, multipurpose, and faster in functionality. The refrigeration equipment segment constituted a significant market share in 2023. The rising popularity of take-away and ready-to-eat items has compelled restaurant chains to equip themselves with modern refrigerators. This has necessitated manufacturers to incorporate bidirectional Internet of Things (IoT) connectivity in commercial refrigerators to remotely monitor food inventory and temperature.

End-use Insights

The full service restaurant (FSR) segment accounted for the dominant revenue share of over 43.8% of the market in 2023. The high market share of FSRs can be attributed to the advent of digital dining trends, which has compelled food service operators to deploy modern equipment to speed up the preparation process and reduce delivery uptime. The subsequent shift in the dine-out culture for formal events as well as informal gatherings during travel & tourism activities has increased the footfall in full-service restaurants over the past few years. As a result, the FSR segment is likely to retain its dominance over the forecast period.

The quick service restaurants (QSRs) segment is expected to register the fastest growth over the forecast period. This can be attributed to the rising working population and globalization of prominent restaurant chains by establishing franchisee joints. QSRs emphasize menu innovation, convenience, and competitive pricing. Furthermore, the continual product innovations in the food service equipment industry have been acknowledged as an added stimulus enabling time-constrained consumers to have quicker access to good-quality cooked items.

Sales Channel Insights

The offline segment of the sales channel of the global market for food service equipment dominated the industry in 2023 on a revenue basis. This is attributed to the strong market capture by the brick and mortar retailers across the global food service equipment industry. The offline segment includes brick & mortar, specialty food retailers, shopping malls and, shopping centers, etc. The offline segment is anticipated to dominate the global market over the forecast period, owing to the higher demand by the customers due to factors including in-detail assistance, better analysis of the product characteristics, and visual inspection.

The online segment is expected to witness the highest growth over the forecast period in the global market. The increasing introduction of the online retailing option by the major key players to the customers is likely to contribute to the segment growth. Moreover, the existing online retailing giants are increasingly collaborating with major food service equipment brands in order to reach wider customer base. Additionally, online retail sites allow customers to compare prices and specifications for different brands at the same time, which is likely to positively impact customer shopping behavior. Such factors are anticipated to drive the growth of the online segment over the forecast period.

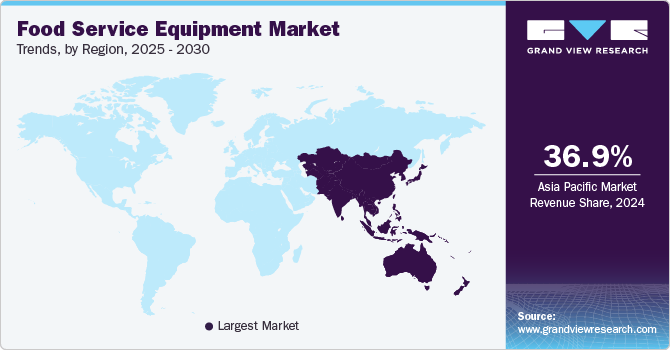

Regional Insights

The Asia Pacific market accounted for the highest revenue share of close to 36% in 2023 and is expected to retain its dominance in the market over the forecast period. Rapidly westernizing dining customs and expansion of the tourism sector, particularly in Singapore, Malaysia, Indonesia, and Australia, are driving the demand for food service equipment in the region. Furthermore, restaurants are incorporating multiple cuisines into their menus owing to an increasing number of customers experimenting with new foods and developing a taste for different cuisines. Additionally, the rising consumption of processed foods is expected to create a soaring demand for these appliances in the Asia Pacific region.

The U.S. has emerged as the dominant market in the food service equipment industry, owing chiefly to the presence of well-established brands such as McDonald's, Burger King Corporation, KFC Corporation, and Starbucks Coffee Company, among others. Moreover, government initiatives influencing the tourism sector and immigration in the country are projected to uplift the restaurant industry in the near future, which could work well for these appliances' deployment rates in the region. The Central & South America market is anticipated to foresee significant growth owing to the rising demand for off-premise or home delivery services.

India food service equipment market

Food processing and food service industry in India is blooming owing to the increasing urbanization and rising population across the country. The number of metro cities and urban areas are rapidly growing. Moreover, the improvement in the standard of living, increasing demand for outside food products, and rising establishments of café, restaurants, and commercial kitchens are expected to provide a boost to the food service market growth over the forecast period.

China food service equipment market

The market for food service equipment in China is expected to enjoy lucrative growth over the forecast period. The increasing disposable income, rising popularity of the western fast foods, and development in the food service franchises in China are likely to have positive impact on the growth of the food service equipment market over the forecast period.

Key Companies & Market Share Insights

The rising deployment of sustainable technology equipment has compelled key players to focus on business strategies such as collaborations, mergers, and acquisitions beneficial for their businesses. Key manufacturers are collaborating with solution providers to build customer-centric equipment addressing food wastage by grocery stores, hypermarkets, and supermarkets.

Moreover, the food service equipment market is also characterized by technological advancements that incorporate automation, digital features, advanced user interface, device linking capabilities, and IoT specifications. In May 2022, Welbilt, Inc. launched the Largest Smart Restaurant Ecosystem. This is likely to empower the offering for the connected restaurant equipment,KitchenConnect. Additionally, strategies such as new product launch targeted marketing are being adopted to gain a competitive edge in the market.

Key Food Service Equipment Companies:

- AB Electrolux

- Ali Group S.r.l. a Socio Unico

- Dover Corporation

- Duke Manufacturing

- Haier Group

- SMEG S.p.A.

- The Middleby Corporation

Recent Developments

-

In July 2023, Hoshizaki America announced the expansion of its sales team in the country with three new manufacturers’ representative groups to represent their refrigeration lines. Gabriel Group, Preferred Source, and Elevate Foodservice Group would act as agents in the Midwest, the Northern Texas, and the Northeast territories respectively

-

In February 2023, The Middleby Corporation announced the acquisition of Marco Beverage Systems, a Dublin, Ireland-based designer and manufacturer of energy-efficient beverage dispensing solutions. The acquisition would help expand Middleby’s offerings in cold brew dispense and coffee brewers, along with various types of hot, cold, and sparkling water dispensers

-

In February 2023, Vollrath Company announced the revamping of its countertop equipment line, aimed at improving the performance, functionality, and ease of use for customers. New features or updates have been added to hot food merchandizers; fryers; gas equipment such as charbroilers, hot plates, and griddles; and half-size long warmers. Additionally, the company has also updated the visual design of their models

-

In January 2023, Rancilio Group announced that the Rancilio Specialty RS1 had obtained the Premium Certification from the Italian Espresso Institute (IEI), making it one of the first espresso machines to attain this certification. The RS1 features a multi-boiler system and Advanced Temperature Profiling technology and was tested on the constancy of the extraction temperature, pre-infusion, and steam production

Food Service Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 37.75 billion

Revenue forecast in 2030

USD 56.90 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, sales channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, France, Italy, Spain, UK, China, India, Japan, South Korea, Australia, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

AB Electrolux, Ali Group S.r.L., a Socio Unico, Dover Corporation, Blue Star Limited, Duke Manufacturing, Fujimak Corporation, Haier Group, Hoshizaki Corporation, Illinois Tool Works Inc., Rancilio Group, Smeg S.p.A, The Middleby Corporation, The Vollrath Company, Llc, Traulsen

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Service Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global food service equipment market report on the basis of product, end-use, sales channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Kitchen Purpose Equipment

-

Cooking Equipment

-

Grills

-

Fryers

-

Ovens

-

Toasters

-

Others

-

-

Food & Beverage Preparation Equipment

-

Slicers & Peelers

-

Mixers & Grinders

-

Blenders

-

Juicers

-

Ice Crushers

-

Others

-

-

-

Refrigeration Equipment

-

Ware Washing Equipment

-

Food Holding & Storing Equipment

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Full Service Restaurant (FSR)

-

Quick Service Restaurant (QSR)

-

Institutional

-

Others

-

-

Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global food service equipment market size was estimated at USD 34.88 billion in 2022 and is expected to be USD 35.97 billion in 2023.

b. The food service equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 56.90 billion by 2030.

b. Asia Pacific dominated the food service equipment market with a revenue share of 35.87% in 2022 on the account of the rapidly westernizing dining customs and expansion of the tourism sector, particularly in Singapore, Malaysia, Indonesia, and Australia, are driving the demand for food service equipment in the region.

b. Some of the key players operating in the food service equipment market include: AB Electrolux; Ali Group S.r.l. a Socio Unico; Dover Corporation; Duke Manufacturing; Haier Group; SMEG S.p.A.; The Middleby Corporation.

b. Key factors that are driving the food service equipment market growth include changing food consumption patterns, increased demand for takeaways and the expanding hospitality sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."