- Home

- »

- Automotive & Transportation

- »

-

Food Traceability Market Size, Share & Growth Report, 2030GVR Report cover

![Food Traceability Market Size, Share & Trends Report]()

Food Traceability Market Size, Share & Trends Analysis Report by Technology Type (RFID, Barcodes, Infrared, Biometrics, GPS), By Software, By End User, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-162-7

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Food Traceability Market Size & Trends

The global food traceability market size is expected to reach USD 15.66 billion in 2022, growing at a compound annual growth rate (CAGR) of 8.8% from 2023 to 2030. Stringent regulations and standards set by government bodies and international organizations regarding food safety and traceability are key drivers for the adoption of traceability solutions. Compliance with these regulations is essential for producers to ensure the safety of their products and maintain consumer trust. Increasing consumer awareness and a growing demand for transparency in food sourcing are significant drivers for the adoption of traceability systems. Consumers want to know the origin of the products they consume, and companies are responding by implementing traceability solutions to provide detailed information about the journey of products from farm to table.

The global market refers to the industry that focuses on implementing systems and technologies to track and trace the movement of food products throughout the supply chain. This market has gained significant attention and importance in recent years due to various factors, including concerns about food safety, regulatory requirements, and the need for transparency in the supply chain.

The industry has witnessed a notable strategic initiative from major participants, such as partnerships, product launches, mergers, acquisitions, geographical expansion, and an increasing trend towards automated and intelligent decision-making. For instance, in March 2021, Honeywell International Inc. has successfully secured a controlling stake in Fiplex Communications Inc., a company headquartered in Miami with expertise in the development of in-building communication systems. This deliberate acquisition strategically aims to augment Honeywell's portfolio of in-building connectivity and communication solutions. The products offered by Fiplex are poised to play a pivotal role as a foundational element for Honeywell's wireless technologies, thereby catalyzing innovation within the organization.

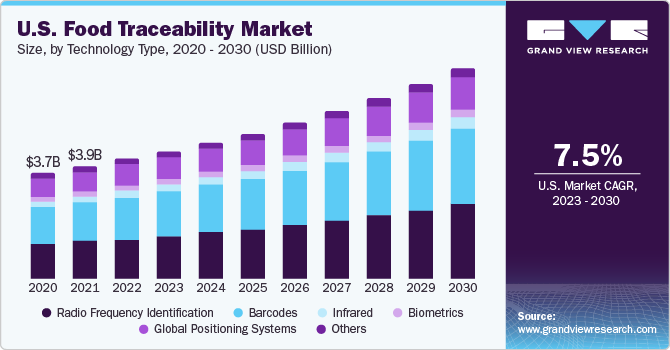

The U.S. Market pertains to the industry within the U.S. that focuses on implementing systems and technologies to trace and track the movement of food products throughout the supply chain. This market has garnered significant attention due to concerns about food safety, regulatory requirements, and the growing emphasis on transparency in the food supply chain. The market is strongly influenced by U.S. regulatory frameworks aimed at ensuring the safety and traceability of products. Compliance with regulations, such as the Food Safety Modernization Act (FSMA), drives the adoption of traceability solutions.

COVID-19 Impact on the Food Traceability Market

The pandemic triggered disruptions in global supply chains, affecting the production, processing, and distribution of food products. These disruptions highlighted the need for robust traceability systems to identify and address issues promptly. The pandemic led to changes in regulatory priorities and requirements to address emerging challenges. Companies in the industry faced the dual challenge and opportunity of adapting to these changes while ensuring compliance through effective traceability measures. The need for remote monitoring, data analytics, and efficient communication in a socially distanced environment accelerated the digital transformation of the sector. This has led to the adoption of more advanced and integrated traceability technologies.

The COVID-19 pandemic has reshaped the landscape of the market by highlighting the critical role of traceability in ensuring food safety and resilience in supply chains and meeting the evolving expectations of consumers and regulatory bodies. The challenges posed by the pandemic have prompted industry stakeholders to embrace innovative solutions and accelerate the adoption of advanced traceability technologies.

Technology Type Insights

In terms of technology type, the market is classified into radio frequency identification (RFID), barcodes, infrared, biometrics, global positioning systems (GPS), and others. The barcodes segment dominated the market, with a market share of over 34.0% in 2022. It is expected to grow at a CAGR of 9.2% throughout the forecast period. The segment’s growth can be attributed to the cost-effectiveness of the barcode technology to implement compared to some other traceability technologies. The simplicity of barcodes makes them accessible to a wide range of businesses, including small and medium-sized enterprises in the food industry. While other technologies, such as RFID and blockchain, also play important roles in food traceability, the widespread acceptance, simplicity, and cost-effectiveness of barcodes make them a dominant and preferred choice for many businesses operating in the dynamic and complex food supply chain.

The RFID segment is anticipated to grow at a considerable CAGR of 9.8% throughout the forecast period. The growth is driven by its ability to deliver advanced functionalities, improve operational efficiency, and meet the evolving demands of the industry for more sophisticated traceability solutions. The unique features and capabilities of RFID position it as a technology with substantial growth potential in the dynamic landscape of the market. RFID enables real-time monitoring of food products at each stage of the supply chain. This capability allows for instant updates on the location, condition, and status of products, facilitating quick decision-making and response to any issues that may arise.

Software Insights

In terms of software, the market is classified into enterprise resources planning (ERP), friction welding, laboratory information systems, warehouse software, supply chain management (SCM), and others. Supply chain management (SCM) dominated the market, with a market share of over 35.0% in 2022. It is expected to grow at a CAGR of 8.1% throughout the forecast period. The dominance of supply chain management (SCM) software in the market is driven by its ability to provide end-to-end visibility, integrate seamlessly with traceability solutions, ensure regulatory compliance, and optimize various aspects of supply chain operations.

The comprehensive features of SCM software position it as a central and crucial element in achieving effective and reliable traceability within the dynamic and complex food supply chain. SCM software contributes to overall operational efficiency by streamlining supply chain processes, reducing delays, and optimizing resource utilization. This efficiency extends to traceability efforts, where a well-orchestrated supply chain enhances the accuracy and reliability of traceability data.

Enterprise resource planning (ERP) is expected to grow at the highest CAGR of 10.0% throughout the forecast period. ERP systems offer comprehensive end-to-end integration across various business functions within an organization. This includes modules for inventory management, production planning, distribution, and quality control. The ability to seamlessly integrate traceability processes with these core functions makes ERP a powerful solution for managing the entire food supply chain.

The ability to provide end-to-end integration, ensure regulatory compliance, offer real-time visibility, and support efficient recall management. The comprehensive features and functionalities of ERP systems make them a central component in the pursuit of effective and reliable traceability within the complex and dynamic food supply chain and are the factors responsible for the growth of the ERP software across the market.

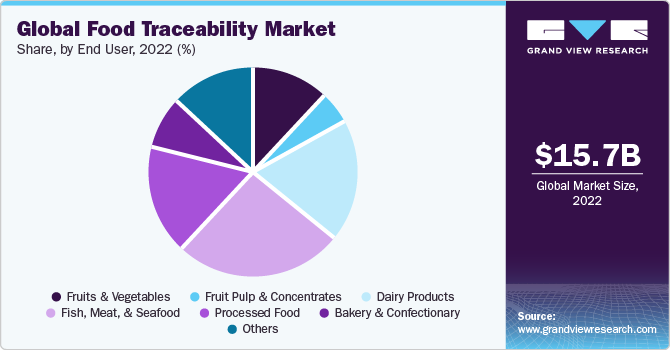

End User Insights

In terms of end user, the market is classified into fish, meat, and seafood, fruit pulp & concentrates, fruits & vegetables, dairy products, processed food, bakery & confectionary, others. The fish, meat, and seafood segment has dominated the market, gaining a market share of more than 25.0% in 2022, and is expected to witness a CAGR of 7.5% during the forecast period. The dominance of fish, meat, and seafood in the market is driven by a combination of regulatory pressures, consumer demands, complex supply chains, and the need to address specific challenges related to safety, quality, and integrity in these perishable food industries. The adoption of traceability solutions in these sectors is essential for meeting regulatory requirements, ensuring consumer confidence, and managing the complexities inherent in the production and distribution of fish, meat, and seafood products.

The processed food segment is anticipated to grow at a considerable CAGR of 10.5% throughout the forecast period. A combination of consumer trends, regulatory requirements, supply chain complexities, and the need for quality and safety assurance in an evolving and dynamic industry landscape drives the growth of the segment. The adoption of advanced traceability solutions is poised to play a pivotal role in meeting these challenges and supporting the continued growth of the processed food sector.

Regional Insights

North America dominated the market in 2022, with a share of over 31.0%. It is expected to grow at a CAGR of 7.2% throughout the forecast period. North America's dominance in the food traceability market is a result of a combination of regulatory initiatives, consumer demands, technological infrastructure, collaborative industry efforts, and a strong focus on food safety and quality. The region's proactive approach to adopting and advancing traceability solutions positions it as a leader in ensuring transparency and accountability throughout the food supply chain. North American businesses have been at the forefront of adopting technological innovations in traceability. The region's companies often leverage emerging technologies to enhance the efficiency, accuracy, and overall effectiveness of their traceability systems.

Asia Pacific is expected to grow at a considerable CAGR of 11.1%. The highest growth of the region is influenced by a combination of regulatory trends, industry dynamics, technological advancements, consumer expectations, and the region's growing role in the global food supply chain. The proactive adoption of traceability solutions is anticipated to be a pivotal factor in addressing the evolving challenges and ensuring the safety and transparency of the food ecosystem in Asia Pacific. For instance, in December 2020, Walmart China introduced a blockchain traceability platform as part of its product traceability strategy. Through scanning the QR code, consumers gain access to comprehensive details about the product, including location changes, transportation processes, shipping times, test reports, and other relevant information at every stage of the supply chain. This initiative significantly enhances consumer confidence and trust in the transparency of the product's journey from origin to destination.

Key Companies & Market Share Insights

The market can be moderately consolidated. Key players in the market are adopting strategies such as product launches to gain a competitive edge. For instance, in May 2022, OPTEL Group, a global frontrunner in supply chain traceability solutions across various industries, unveiled Optchain, a collection of modular intelligent supply chain (ISC) solutions designed for the food and beverage sector. Optchain is purposefully crafted to meet the imminent food traceability requirements of all participants in the supply chain, ensuring compliance with the Food and Drug Administration's crucial update to the Food Safety Modernization Act (FSMA) - specifically Section 204.

Key Food Traceability Companies:

- C.H. Robinson

- Cognex

- Honeywell International Inc

- SGS SA

- Zebra Technologies

- Carlisle

- Merit-Trax

- FoodLogiQ

- Safe Traces

- Food Forensics

- Bext360

- rfxcel

- Covectra

- Bar Code Integrators

Food Traceability Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.89 billion

Revenue forecast in 2030

USD 30.52 billion

Growth Rate

CAGR of 8.8% from 2023 to 2030

Historic year

2017 - 2021

Base year for estimation

2022

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology type, software, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); U.A.E.; South Africa

Key companies profiled

Honeywell International Inc; C.H. Robinson; FoodLogiQ; Safe Traces; OPTEL Group; Cognex; Zebra Technologies; Bar Code Integrators; SGS SA; Carlisle; Merit-Trax; Food Forensics; Bext360; rfxcel; Covectra

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

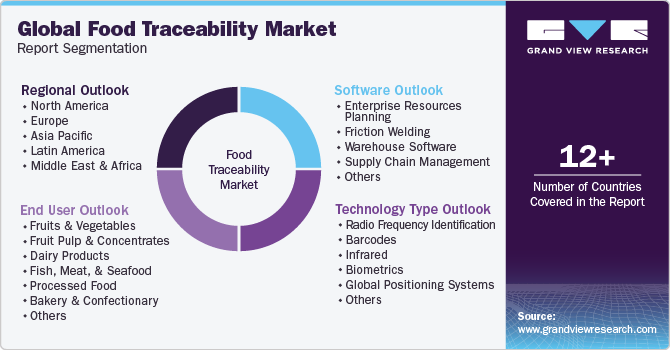

Global Food Traceability Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segments and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global food traceability market based on technology type, software, end user, and region.

-

Technology Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Radio Frequency Identification

-

Barcodes

-

Infrared

-

Biometrics

-

Global Positioning Systems

-

Others

-

-

Software Outlook (Revenue, USD Million, 2017 - 2030)

-

Enterprise Resources Planning (ERP)

-

Friction Welding

-

Laboratory Information Systems

-

Warehouse Software

-

Supply Chain Management (SCM)

-

Others

-

-

End User Outlook (Revenue, USD Million, 2017 - 2030)

-

Fruits & Vegetables

-

Fruit Pulp & Concentrates

-

Dairy Products

-

Fish, Meat, and Seafood

-

Processed Food

-

Bakery & Confectionary

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

U.A.E.

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global food traceability market size was estimated at USD 15.66 billion in 2022 and is expected to reach USD 16.89 billion in 2023.

b. The global food traceability market is expected to grow at a compound annual growth rate of 8.8% from 2023 to 2030 and reach USD 30.52 billion by 2030.

b. North America dominated the food traceability market with a share of over 31.0% in 2022. North America's dominance in the food traceability market is a result of a combination of regulatory initiatives, consumer demands, technological infrastructure, collaborative industry efforts, and a strong focus on food safety and quality.

b. Some key players operating in the food traceability market include Bio-Rad Laboratories, Honeywell International Inc, C.H. Robinson, FoodLogiQ, Safe Traces, OPTEL Group, Cognex, Zebra Technologies, Bar Code Integrators, SGS SA, Carlisle, Merit-Trax, Food Forensics, Bext360, rfxcel, and Covectra, among others.

b. Stringent regulations and standards set by government bodies and international organizations regarding food safety and traceability are key drivers for the adoption of traceability solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."