- Home

- »

- Homecare & Decor

- »

-

France Kitchenware Market Size, Industry Report, 2033GVR Report cover

![France Kitchenware Market Size, Share & Trends Report]()

France Kitchenware Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cookware, Bakeware, Tableware), By Application (Residential, Commercial), By Distribution Channel (Supermarkets & Hypermarkets, Online Retail), And Segment Forecasts

- Report ID: GVR-4-68040-685-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

France Kitchenware Market Size & Trends

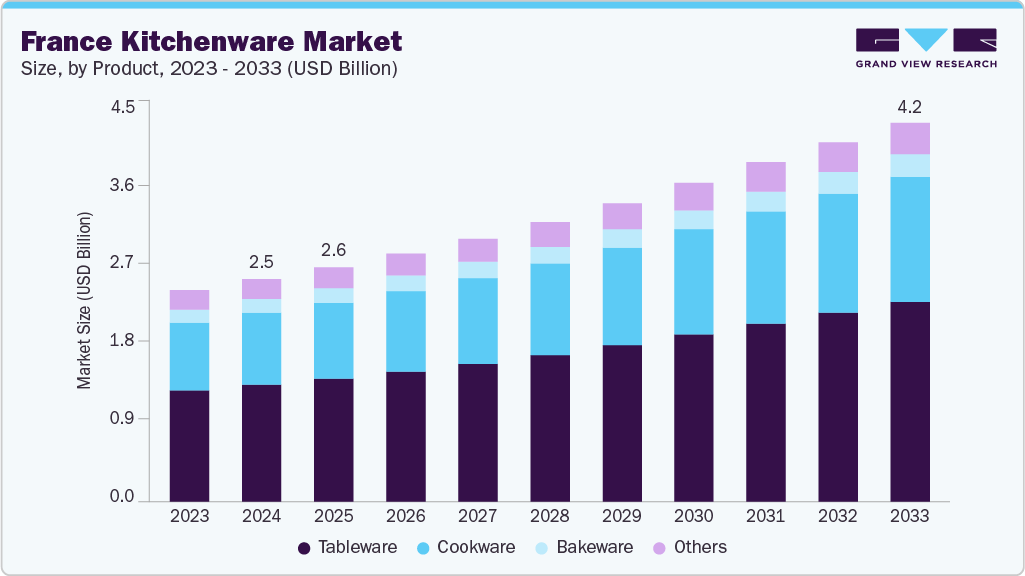

The France kitchenware market size was estimated at USD 2,469.6 million in 2024 and is projected to reach USD 4,208.1 million by 2033, growing at a CAGR of 6.2% from 2025 to 2033. Cooking at home is increasingly seen as a form of self-care and creative expression in France, driving strong interest across demographics, from health-conscious millennials to eco-aware families and older adults who appreciate culinary traditions and quality craftsmanship. This evolution is accelerating growth in the French kitchenware market, where sustainable innovation, aesthetic appeal, and modern functionality are reshaping consumer demand.

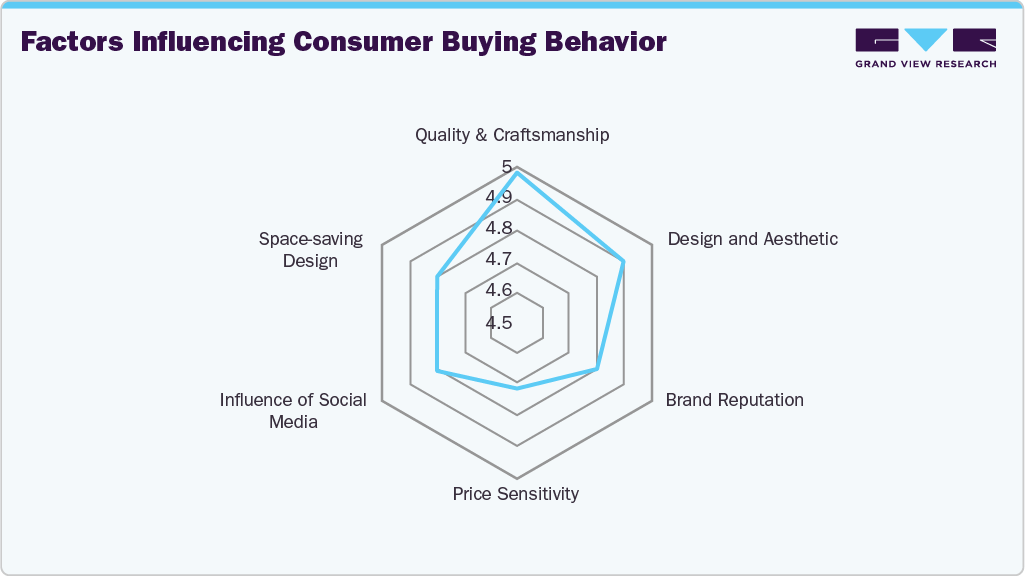

French consumers value gastronomy, technique, and the joy of preparing meals from scratch. This cultural backdrop fuels demand for both classic kitchen staples and modern cooking innovations. Additionally, the rising influence of food-related media, cooking shows, social media influencers, and culinary competitions has sparked heightened consumer interest in high-performance kitchen tools that enable them to recreate chef-level dishes at home.

Home cooking remains a cherished aspect of daily life, valued for both practicality and as a way to nurture health, creativity, and conviviality. Consumers in France are increasingly seeking high-quality kitchenware and gravitating toward trusted brands like De Buyer, Cristel, Le Creuset, and Tefal, which are known for producing durable, induction-compatible, and aesthetically pleasing products. Urban consumers, in particular, show strong interest in multifunctional tools, modular storage solutions, and compact appliances tailored to smaller living spaces. Health-focused trends such as steaming, slow cooking, and sous-vide are fueling demand for specialized appliances like steam ovens, precision cookers, and high-performance blenders, supporting diverse and gourmet culinary experiences at home.

Manufacturers in France are innovating actively to capture shifting consumer preferences. Recent product developments include kitchenware designed for precise temperature control, smart connectivity, and intuitive cooking guidance. Sustainability is also at the forefront, with brands launching ranges featuring recycled stainless steel, ceramic, or PFAS-free non-stick coatings, and handles made from natural fibers or bio-based materials. French companies are emphasizing local production and traceable sourcing, responding to consumers’ preference for “Made in France” products and support for regional craftsmanship. Space-saving designs, such as nesting pots, foldable strainers, and stackable cookware, are gaining popularity, particularly in urban areas where maximizing kitchen space is essential.

Distribution channels for kitchenware in France reflect consumers’ appreciation for both tactile shopping experiences and the convenience of digital commerce. Large home goods retailers like Boulanger, Darty, and Conforama remain key players, offering broad assortments in physical stores where shoppers can evaluate quality, weight, and design. Specialty stores such as La Bovida and E. Dehillerin in Paris cater to professional chefs and passionate home cooks seeking high-end or professional-grade tools. Meanwhile, e-commerce continues to expand rapidly, with major platforms like Amazon.fr, Cdiscount, and specialized online shops such as Mathon.fr or Cuisine Addict offering a wide selection, competitive pricing, and home delivery. Consumers increasingly research and compare products online, blending in-store visits with digital purchases to find the best combination of quality and value.

Consumer Insights

In France, kitchenware plays a central role not only in meal preparation but also in expressing personal taste, celebrating culinary tradition, and supporting mindful living. Far from being purely utilitarian, cookware and tools are chosen for how they align with lifestyle, values, and aesthetics. For instance, in August 2023, Le Creuset introduced its new “Nectar” color range, a luminous golden hue inspired by honey and warm amber tones, transforming cookware into a true style statement. As dining out becomes more selective and health consciousness rises, more French households are investing in high-quality kitchenware that enhances the home cooking experience, elevates everyday meals, and supports eco-conscious choices.

The French consumer places a premium on both performance and presentation. Whether preparing a classic coq au vin or experimenting with plant-based cuisine, buyers seek cookware that delivers precise results while complementing the elegance of the table. Traditional materials like copper and cast iron continue to hold prestige for their craftsmanship and heat control. At the same time, innovations like ceramic-coated pans and multifunctional appliances attract those seeking healthier cooking with minimal effort. For instance, in 2023, Tefal launched its Ingenio Eco Respect range, crafted from 100% recycled aluminium and designed to reduce energy consumption by up to 95%, underlining how sustainability and advanced performance are converging in French kitchens. Products that transition effortlessly from stovetop to table, such as Cristel’s detachable-handle cookware, are especially valued, blending convenience with the visual appeal expected in French dining culture.

Urban dwellers in cities such as Paris, Lyon, and Marseille often prioritize compact, multifunctional items that suit smaller kitchens while delivering exceptional performance. Sleek, minimalist designs, quick cooking capabilities, and energy efficiency are high on their list, reflecting busy lifestyles and contemporary aesthetics. In contrast, suburban and rural consumers tend to favor larger cookware sets, robust appliances, and iconic designs, valuing products that can support family meals, gatherings with friends, and elaborate culinary projects. Sustainability is a major influence, with French buyers increasingly choosing brands that prioritize recycled materials, low-impact manufacturing, and long product lifespans.

Consumers actively search for kitchenware crafted from sustainable materials like recycled metals, responsibly harvested wood, or innovative composites that minimize environmental impact. Plastic-free packaging, durable construction, and long warranties appeal strongly, aligning with the French emphasis on quality and longevity over disposable consumption. Rising energy costs have also sharpened interest in appliances that offer eco-modes, low power usage, and repair-friendly designs, as consumers become more vigilant about utility bills and environmental footprints. French kitchenware brands and retailers emphasize local manufacturing, traceable supply chains, and eco-labels such as the Origine France Garantie certification, reassuring shoppers that their culinary choices reflect not only personal values but also broader commitments to environmental stewardship and cultural heritage.

Product Insights

The demand for tableware accounted for a revenue share of 52.51% in the France kitchenware industry in 2024. Consumers in France show strong interest in stylish, high-quality dining pieces that enhance both everyday meals and social occasions. A growing culture of home entertaining and the influence of social media have increased attention on attractive table settings. The market offers diverse designs and premium materials, encouraging frequent purchases and upgrades.

The demand for cookware is projected to grow at a CAGR of 6.5% over the forecast period of 2025-2033, driven by a strong cultural connection to home cooking and changing consumer expectations. Consumers are spending more time preparing meals at home, valuing healthier eating, cost savings, and the enjoyment of cooking as a creative hobby. Rising interest in diverse cuisines has sparked demand for specialized cookware suited to various techniques and recipes. Consumers are also looking for products that are durable, energy-efficient, and made from eco-friendly materials. Attractive designs and modern features add further appeal, making cookware an increasingly important purchase for French households.

Application Insights

Kitchenware used for residential application accounted for a revenue share of 69.28% in 2024 in the France kitchenware industry. Consumers often invest in high-quality cookware to prepare classic dishes and regional specialties that require precise tools and durable materials. The popularity of open kitchens and beautifully set dining tables has boosted demand for kitchenware that is both functional and visually appealing, blending seamlessly with modern French interiors. Additionally, inflation in restaurant prices has encouraged more families to dine at home, further supporting sales of quality kitchen products. These cultural and economic factors combined to keep residential spending dominant in the France kitchenware industry.

The kitchenware used for commercial applications is projected to grow at a CAGR of 6.7% over the forecast period. Many restaurants, hotels, and catering businesses are updating their kitchens to improve efficiency, comply with health regulations, and offer diverse menus that require specialized equipment. The trend of open kitchens, where cooking is part of the dining experience, has also encouraged investments in high-quality, visually appealing kitchen tools. Additionally, rising tourism and the growth of new dining formats, such as casual dining chains and gourmet food markets, are increasing the demand for durable and professional-grade kitchenware in commercial settings across France.

Distribution Channel Insights

The sales of kitchenware through supermarkets & hypermarkets accounted for a revenue share of 40.13% in 2024. Consumers often prefer buying kitchenware from these stores because they trust the established retail chains and appreciate being able to inspect products in person before purchasing. Many hypermarkets in France, such as E.Leclerc, Carrefour, and Intermarché, have expanded their non-food sections, offering stylish kitchenware collections at competitive prices. These retailers frequently launch limited-time kitchenware lines tied to popular chefs or cooking shows, which attract shoppers looking for affordable yet trendy options. Their strong presence in both urban and rural areas ensures widespread access, helping supermarkets and hypermarkets maintain a significant role in kitchenware sales.

The sale of kitchenware through online retail is projected to grow at a CAGR of 7.1% from 2025 to 2033. Shoppers increasingly rely on e-commerce platforms for convenience, broader product selection, and access to user reviews that guide purchasing decisions. French online retailers and marketplaces such as Amazon.fr, Cdiscount, and La Redoute have strengthened their kitchenware offerings, often featuring exclusive collections, discounts, and faster delivery options. The rise of influencer-led marketing and cooking content on social media has also boosted online demand, with consumers more likely to discover and buy kitchen tools featured in digital content. As consumers continue to prioritize flexibility and choice, online sales are expected to expand steadily in the coming years.

Key France Kitchenware Company Insights

The France kitchenware industry reflects a vibrant mix of renowned heritage brands and newer entrants, all adapting to shifting consumer preferences around culinary traditions, design, and environmental responsibility. Leading companies focus on crafting products with premium materials, innovative functions, and elegant aesthetics, appealing to consumers who value both practical use and the art of creating beautiful dining experiences. These brands strengthen their reach through collaborations with supermarkets, department stores, specialized kitchen boutiques, and increasingly through online channels, making kitchenware accessible across diverse shopping habits.

As French consumers place growing importance on sustainability and versatile cooking tools, manufacturers are launching ranges that feature eco-friendly materials, multifunctional designs, and modern technological enhancements. Flexible production methods and strategic alliances help key players cater to various budgets, enabling them to thrive in France’s dynamic market, where cooking is deeply tied to cultural identity, social connection, and everyday pleasure.

Key France Kitchenware Companies:

- Groupe SEB S.A.

- Le Creuset

- DE BUYER INDUSTRIES

- Cristel USA

- Mauviel1830

- Zwilling J.A. Henckels AG

- Rösle GmbH & Co. KG

- Fissler

- BergHOFF

- Villeroy & Boch AG

Recent Developments

-

In April 2025, Le Creuset celebrated its 100th anniversary with a special release called “Flamme Dorée,” a metallic gold version of its original Flame color introduced in 1925. This limited-edition collection features a shimmering finish and a gold-colored knob, adding a luxurious touch to the brand’s iconic enameled cast-iron pieces. The range includes various cookware like Dutch ovens, braisers, and saucepans, designed to work on all types of cooktops and in the oven. Prices start around USD 310, and the collection will only be available for a short period, appealing to both collectors and cooking enthusiasts.

-

In August 2024, Le Creuset introduced a new color called “Pesch,” inspired by a soft peach shade. The collection will include a round cast-iron pot, a cast-iron rice cooker, and a stoneware mug, all designed with a gentle color gradient and elegant gold knobs. The pieces are intended to bring a fresh and warm look to kitchens and dining tables, reminiscent of the delicate tones of a peach. The products will be available both in physical stores across South Korea and online, with some items offered exclusively through Le Creuset’s official website. The brand aims to appeal to customers looking for both beauty and functionality in their cookware.

France Kitchenware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2604.0 million

Revenue forecast in 2033

USD 4,208.1 million

Growth rate

CAGR of 6.2% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel

Country scope

France

Key companies profiled

Groupe SEB S.A.; Le Creuset; DE BUYER INDUSTRIES; Cristel USA; Mauviel1830; Zwilling J.A. Henckels AG; Rösle GmbH & Co. KG; Fissler; BergHOFF; Villeroy & Boch AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

France Kitchenware Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the France kitchenware market report based on product, application and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cookware

-

Pots & Pan

-

Pressure Cooker

-

Microwave Cookware

-

-

Bakeware

-

Tins & Trays

-

Cups

-

Molds

-

Pans & Dishes

-

Rolling Pin

-

Others

-

-

Tableware

-

Dinnerware

-

Flatware

-

Stemware

-

-

Others

-

Cooking Racks

-

Cooking Tools

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online Retail

-

Others

-

Frequently Asked Questions About This Report

b. The France kitchenware market was estimated at USD 2.47 billion in 2024 and is expected to reach USD 2.60 billion in 2025.

b. The France kitchenware market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach USD 4.20 billion by 2033.

b. Tableware accounted for a revenue share of 52.50% in the France kitchenware industry in 2024, reflecting strong demand for elegant and practical dining solutions. This growth is supported by lifestyle shifts toward home entertaining and interest in refined table settings.

b. Some of the key players in the France kitchenware market include Groupe SEB S.A., Le Creuset, DE BUYER INDUSTRIES, Cristel USA, Mauviel1830, Zwilling J.A. Henckels AG, Rösle GmbH & Co. KG, Fissler, BergHOFF, Villeroy & Boch AG

b. Key factors driving the growth of the France kitchenware market are strong cultural emphasis on cooking and dining, which boosts demand for quality tools and elegant designs. Growing preference for sustainable and multifunctional kitchen products also supports market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.