- Home

- »

- Automotive & Transportation

- »

-

Freight Forwarding Market Size, Share, Industry Report, 2030GVR Report cover

![Freight Forwarding Market Size, Share & Trends Report]()

Freight Forwarding Market (2025 - 2030) Size, Share & Trends Analysis By Mode Of Transports (Road, Maritime, Rail, Air), By Customer Type (B2B, B2C), By Service (Transportation & Warehousing, Value Added Services), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-128-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Freight Forwarding Market Summary

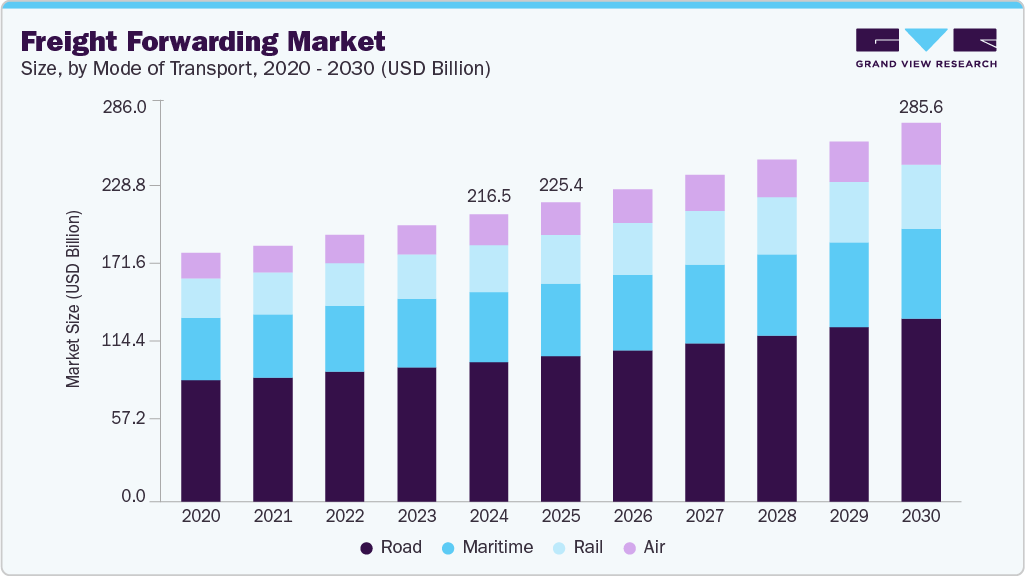

The global freight forwarding market size was estimated at USD 216.47 billion in 2024 and is projected to reach USD 285.60 billion by 2030, growing at a CAGR of 4.9% from 2025 to 2030. Globalization has played a central role in propelling the growth of the market.

Key Market Trends & Insights

- Asia Pacific freight forwarding market led the global market with a revenue share of 31.8% in 2024.

- The rapid expansion of e-commerce in India freight forwarding market.

- By mode of transport, the road segment dominated the overall market with a revenue share of 48.5% in 2024.

- By customer type, the B2B segment dominated with a revenue share of 55.1% in 2024.

- Based on service, the transportation & warehousing segment held a dominant position in 2024 and is anticipated to reach a CAGR of 5.2%.

Market Size & Forecast

- 2024 Market Size: USD 216.47 Billion

- 2030 Projected Market Size: USD 285.60 Billion

- CAGR (2025-2030): 4.9%

- Asia Pacific: Largest market in 2024

As businesses increasingly expand their operations beyond their domestic borders and engage in international trade, the demand for efficient and dependable freight forwarding services has experienced a substantial upswing. This surge in demand is primarily attributed to companies actively sourcing raw materials, components, and finished products from various countries while simultaneously selling their goods to a global customer base. This global expansion and integration of business activities necessitate the specialized knowledge and services freight forwarders offer to manage the intricate logistics inherent in global trade effectively.As businesses venture into the global marketplace, they encounter many logistical challenges and complexities. These complexities stem from varying regulations, customs procedures, transport modes, and geographic distances in international commerce. To navigate these challenges successfully, companies require the expertise and support of freight forwarders who understand the intricacies of international logistics. Freight forwarders serve as intermediaries between businesses and the various entities involved in transporting and delivering goods, including shipping lines, airlines, trucking companies, customs authorities, and more.

The rapid expansion of e-commerce has also profoundly impacted the market's growth. Online retail and digital marketplaces have experienced significant growth as consumers increasingly prefer to shop online, transforming how products are sourced and sold. This shift towards digital commerce often involves international trade, which presents intricate supply chain logistics challenges that are met by freight forwarders. Online retailers and e-commerce platforms rely heavily on freight forwarders to efficiently move goods from manufacturers, often located in different countries, to consumers spread across the globe. This reliance on specialized logistics companies has become a hallmark of the e-commerce supply chain.

Online retail businesses acquire goods from a worldwide network of manufacturers to provide customers with various products. Freight forwarding holds a pivotal position in orchestrating the movement of these goods, guaranteeing their smooth transition from the manufacturer's base to the online retail firm's distribution hubs or storage facilities. This entails managing the intricate aspects of international shipping, customs processes, and legal requirements, which can significantly differ between countries. Additionally, online retail firms often need to disseminate products to customers across the globe, necessitating a sophisticated approach to worldwide supply chain management. Freight forwarders are indispensable collaborators in devising transportation routes, opting for the most suitable modes of transport (whether by air, sea, or land), and overseeing the freight forwarding processes necessary for delivering goods to customers' residences. They possess the necessary expertise to navigate the complexities of international trade and guarantee the timely and efficient movement of merchandise.

Mode Of Transport Insights

The market is classified into road, maritime, rail, and air. The road segment dominated the overall market with a revenue share of 48.5% in 2024 and is expected to witness a CAGR of 4.8% during the forecast period. One of the primary factors contributing to the prevalence of road transportation is its adaptability and accessibility. Road transportation can access a wide range of locations, even reaching remote areas where alternative modes might not be as feasible. This accessibility makes it the preferred choice for conveying goods to diverse destinations, thus serving a broad clientele.

Furthermore, cost-efficiency has played a pivotal role in propelling the expansion of road transport. In numerous instances, road transport is more economically efficient for short to medium-distance shipments than rail or air transport. This cost-related advantage has rendered road transport an appealing alternative for regional and local deliveries, particularly in scenarios where punctual and cost-effective delivery is paramount.

The air transport segment is anticipated to grow at a CAGR of 5.6% throughout the forecast period. Several prevailing trends and factors contribute to the surge in this segment. Foremost, the ongoing globalization of supply chains has considerably fueled the demand for air transportation. As businesses extend their operations worldwide, the necessity for expeditious and efficient cargo conveyance has intensified. Due to its unparalleled swiftness, air transportation has emerged as the favored choice for enterprises dealing with high-value and time-sensitive commodities. Furthermore, the thriving e-commerce sector has played a pivotal role in propelling air freight growth. In particular, online retailers heavily depend on air transportation to satisfy customer expectations for prompt deliveries. This has resulted in heightened utilization of air cargo services, especially for compact parcels and high-demand products. The ability to deliver merchandise swiftly and reliably has evolved into a pivotal competitive advantage within the e-commerce industry.

Customer Type Insights

The market is classified into B2B and B2C. The B2B segment dominated with a revenue share of 55.1% in 2024 and is projected to grow at a CAGR of 4.5% during the forecast period. Technology integration has been instrumental in driving growth within this segment. B2B customers are actively seeking technology-driven solutions to enhance supply chain visibility and control. This includes the adoption of transportation management systems (TMS), real-time tracking, and advanced analytics tools to optimize routes, reduce costs, and improve overall efficiency. Sustainability and green freight forwarders have become paramount concerns for B2B customers. Environmental considerations and regulatory pressure are pushing these customers to seek freight providers that offer sustainable transportation options. This may involve carbon-neutral shipping, electric or alternative-fuel vehicles, and the implementation of more eco-friendly supply chain practices.

The B2C segment is anticipated to grow at a CAGR of 5.2% throughout the forecast period. The growth of the Business-to-Consumer (B2C) customer segment in the market has been a significant and transformative trend in recent years. Consumer behavior has shifted substantially recently, with many expecting quick and convenient delivery options. This change has put immense pressure on freight forwarding companies to adapt and offer services tailored to the B2C market. For instance, customers increasingly demand same-day or next-day delivery options, pushing freight forwarding providers to streamline their operations and enhance delivery speed and reliability. Urbanization has played a pivotal role in the growth of the B2C segment. The concentration of populations in urban areas has created dense delivery networks, making it more cost-effective for freight forwarding companies to serve individual consumers in these regions. This urbanization trend has also led to the proliferation of micro-fulfillment centers and innovative delivery solutions designed to navigate urban landscapes efficiently.

Service Insights

The market is classified into transportation & warehousing, value-added services, packaging, and others. The transportation & warehousing segment held a dominant position in 2024 and is anticipated to reach a CAGR of 5.2% during the forecast period. Several key factors have influenced the growth of the transportation and warehousing segment in the market. First and foremost, the rapid growth of e-commerce has been a major driver for the transportation and warehousing segment. Online retailers require efficient freight forwarding solutions to manage inventory, order fulfillment, and ensure timely customer delivery. This has increased demand for transportation and warehousing services to support the e-commerce supply chain. Moreover, last-mile delivery is a critical aspect of e-commerce freight forwarding, and companies are increasingly investing in innovative solutions to optimize this final leg of the delivery process. This has created opportunities for transportation companies specializing in last-mile delivery services.

The value-added service segment is anticipated to witness the fastest CAGR throughout the forecast period. A key factor contributing to the growth of value-added services is the integration of advanced technologies into freight forwarding operations. Technologies like the Internet of Things (IoT), artificial intelligence (AI), and blockchain have empowered freight forwarding providers to offer value-added services like real-time tracking, predictive analytics, and supply chain visibility.

These services enhance efficiency, transparency, and decision-making within the supply chain. The customization and personalization of freight forwarding services have also become a prominent trend. Customers increasingly expect tailored freight forwarding solutions to meet their specific requirements. Freight forwarding companies have responded by offering customized services, including temperature-controlled transportation, product assembly, and kitting services, allowing them to cater to diverse client needs.

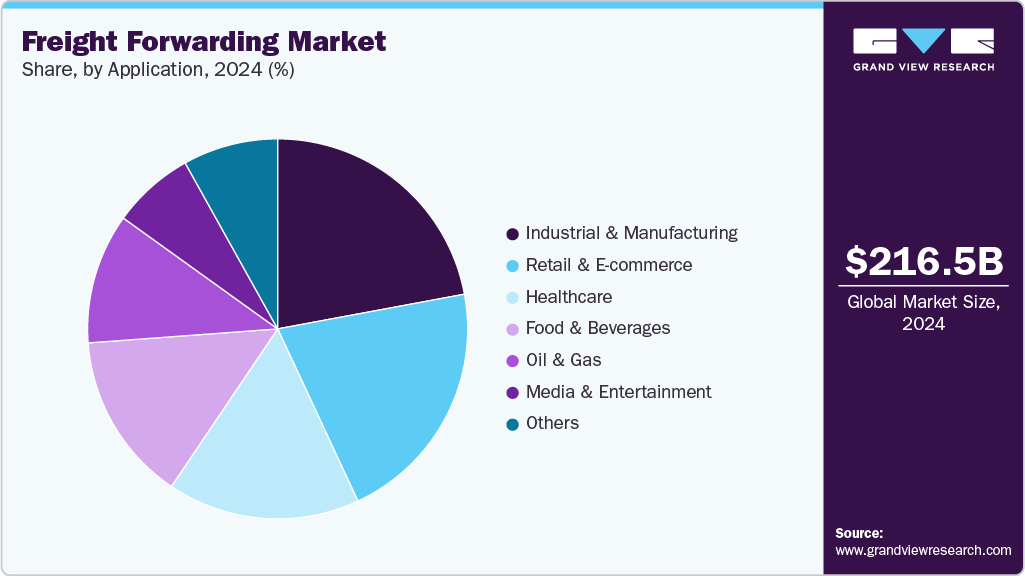

Application Insights

The market is classified into retail & e-commerce, healthcare, food & beverages, media & entertainment, industrial & manufacturing, oil & gas, and others. The industrial and manufacturing segment dominated the market and accounted for a revenue share of 22.1% in 2024. The expansion of the freight forwarding market's industrial and manufacturing application segment has been influenced by various distinctive trends and factors shaping its progression. One pivotal driver behind this growth is the escalating complexity of global supply chains within these sectors.

Industrial and manufacturing companies frequently operate globally, necessitating efficient freight forwarding solutions to oversee the procurement of raw materials, navigate the intricacies of production processes, and distribute finished products to diverse markets. Additionally, the adoption of Just-in-Time (JIT) manufacturing practices has significantly contributed to the growth of this segment. Manufacturers increasingly embrace JIT principles to minimize the costs associated with holding inventory. This approach hinges on the punctual and precise delivery of raw materials and components, which, in turn, places substantial demands on freight forwarding services to guarantee a smooth and timely transportation process.

The retail & e-commerce segment is anticipated to witness significant growth at a CAGR of 6.0% throughout the forecast period. The segment’s growth has been influenced by several specific factors that mirror the distinctive demands and challenges businesses encounter. One of the most prominent catalysts behind this growth has been the remarkable surge in e-commerce platforms. With consumers increasingly gravitating towards online shopping for convenience and product variety, retailers and e-commerce firms face tremendous pressure to devise effective and adaptable freight forwarding solutions to cater to the surging demand for their offerings.

The last-mile delivery segment has grown substantially in response to this heightened demand. The last mile, which encompasses the final stage of delivering goods to the customer, has become a pivotal focal point within retail and e-commerce freight forwarding. Companies invest significantly in technology and strategic partnerships to enhance their last-mile freight forwarding, delivery speed, and customer satisfaction.

Regional Insights

Asia Pacific freight forwarding market led the global market with a revenue share of 31.8% in 2024. Urbanization and infrastructure development have been instrumental in reshaping the freight forwarding landscape across the Asia Pacific region. The swift pace of urbanization has prompted substantial investments in modern transportation networks, freight forwarding centers, and technologically advanced warehouses, all of which have contributed to enhancing the efficiency and competitiveness of the freight forwarding industry. Furthermore, the expansion of cross-border trade has played a pivotal role in propelling this growth. Countries within the Asia Pacific have been actively involved in cross-border trade facilitated by various trade agreements and economic alliances. Notably, China's Belt and Road Initiative has significantly bolstered trade connectivity, resulting in a heightened demand for cross-border freight forwarding services.

China freight forwarding market is driven by its growing integration into global trade networks, bolstered by strategic initiatives like the Belt and Road Initiative (BRI). This expansive infrastructure and connectivity effort has strengthened regional transportation systems, enabling smoother trade flows and fostering international logistics collaboration. As trade routes continue to diversify and expand under the BRI, freight forwarding providers are seeing increased volumes and more streamlined cross-border operations.

The rapid expansion of e-commerce in India freight forwarding market, led by platforms such as Amazon.com, Inc., Flipkart Internet Private Limited, and Reliance Retail Ltd. (JioMart), has increased demand for efficient logistics and freight forwarding services. Cross-border e-commerce is also growing, requiring seamless air and ocean freight solutions to meet delivery expectations. Additionally, Government projects like PM Gati Shakti, the National Logistics Policy (NLP), and dedicated freight corridors are improving transportation efficiency. Initiatives such as the Make in India campaign and Production-Linked Incentive (PLI) schemes are boosting manufacturing exports, increasing freight forwarding demand.

Europe Freight Forwarding Market Trends

Europe freight forwarding market is anticipated to attain significant growth over the forecast period. Intermodal transport has gained prominence in European freight forwarding. This approach involves using multiple modes of transportation, such as road, rail, sea, and air, to move goods efficiently. It offers cost savings, reduces environmental impact, and enhances overall freight forwarding efficiency, making it an attractive option for companies seeking to optimize their supply chains. The emergence of digital freight marketplaces and platforms has streamlined the freight forwarding process. These platforms connect shippers and carriers more efficiently, often employing algorithms to match cargo with available transport capacity. Digitalizing freight forwarding operations enhances transparency, reduces friction, and improves customer experience.

The UK freight forwarding market continues to evolve in response to complex post-Brexit trade dynamics and shifting global supply chain demands. Since the implementation of new border controls, freight forwarders have faced persistent challenges, including increased customs paperwork and border delays, leading many businesses to diversify their European supply routes through alternative ports in Ireland and mainland Europe. The sector has simultaneously experienced rapid digital transformation, with forwarders adopting AI-powered documentation systems, blockchain for secure transactions, and IoT-enabled tracking solutions to improve efficiency and visibility across increasingly complex supply chains.

North America Freight Forwarding Market Trends

The North America freight forwarding market is driven by the accelerating digital transformation across the region's forwarding sector, with leading companies investing heavily in automation and visibility platforms. Cloud-based freight management systems, AI-powered rate procurement tools, and blockchain-based documentation solutions are becoming industry standards. The adoption of predictive analytics is helping forwarders optimize capacity utilization and routing amid volatile market conditions, while electronic Bill of Lading adoption is gaining momentum to streamline processes.

U.S. Freight Forwarding Market Trends

Supply chain resilience has emerged as another crucial driver in the U.S. freight forwarding market, particularly in response to recent geopolitical tensions, global disruptions, and fluctuating trade routes. Companies are increasingly aware of the need to mitigate risks by diversifying suppliers, increasing inventory buffers, and enhancing supply chain visibility. Freight forwarders are playing a strategic role by offering flexible, multi-modal transport options and helping clients develop more robust logistics networks. The emphasis is on agility, ensuring that supply chains can quickly respond to disruptions without compromising on efficiency or customer satisfaction.

Key Freight Forwarding Company Insights

The market is fragmented and is anticipated to witness competition from several players. Freight forwarding companies are actively investing in research and development (R&D) to enhance the efficiency, reliability, and responsiveness of their logistics and transportation services.

Key areas of innovation include integrating advanced digital platforms for real-time tracking, automating documentation processes, and utilizing data analytics to optimize supply chain operations. These companies are also leveraging emerging technologies such as cloud-based logistics management systems and geospatial intelligence to improve route planning and cargo visibility. Additionally, many freight forwarders are expanding their global logistics networks and forming strategic alliances to meet the growing demand for agile and scalable freight solutions across diverse international markets.

-

Deutsche Post AG, operating under the trade name DHL Group, is a leading global logistics and mail company headquartered in Bonn, Germany. Within its extensive portfolio, Deutsche Post AG offers comprehensive freight forwarding services through its Global Forwarding Freight division. This division specializes in air, ocean, and overland freight forwarding, providing standardized transport as well as multimodal and sector-specific solutions. Additionally, it offers customized industrial projects and customs services, catering to a diverse range of logistics needs. The company serves customers in over 220 countries and territories worldwide.

-

NIPPON EXPRESS HOLDINGS is a global logistics leader headquartered in Tokyo, Japan, offering comprehensive freight forwarding and supply chain solutions across a wide range of industries. The company provides a full spectrum of freight forwarding services, including air, ocean, and land transportation. Their air freight network is extensive, with dedicated space on more than 60 international air carriers, ensuring timely and reliable delivery. In ocean freight, they offer door-to-door global cargo transportation, catering to multinational manufacturing, distribution, and trading companies. With a robust international presence, the company operates in 57 countries and regions, managing over 3,000 locations worldwide.

Key Freight Forwarding Companies:

The following are the leading companies in the freight forwarding market. These companies collectively hold the largest market share and dictate industry trends.

- Kuehne+Nagel

- Deutsche Post AG

- DB Schenker

- Expeditors International of Washington, Inc.

- CEVA Freight forwarding

- DSV

- FedEx

- Uber Technologies, Inc.

- United Parcel Service of America, Inc.

- NIPPON EXPRESS HOLDINGS

Recent Developments

-

In May 2025, Nippon Express Co., Ltd., a subsidiary of NIPPON EXPRESS HOLDINGS, INC., announced the launch of its Vienna Consolidation Ocean freight service, aimed at enhancing export logistics from Japan to Central and Eastern Europe. This initiative is a collaborative effort with cargo-partner GmbH, another group company, leveraging its extensive network across the targeted European regions.

-

In April 2025, United Parcel Service of America, Inc. announced a definitive agreement to acquire Andlauer Healthcare Group Inc. for approximately USD $1.6 billion. This acquisition aims to enhance United Parcel Service of America, Inc.'s healthcare end-to-end cold chain capabilities in North America, addressing the growing demand for temperature-controlled and precision logistics solutions in the healthcare industry.

-

In June 2023, Kuehne+Nagel entered into an agreement to purchase Morgan Cargo, a freight forwarding company based in South Africa, the UK, and Kenya, with expertise in the transportation and management of perishable goods. This acquisition enhances Kuehne+Nagel's range of services in perishable freight forwarding. It strengthens the connections available to customers traveling to and from South Africa, the UK, and Kenya, including access to advanced cold chain facilities.

Freight Forwarding Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 225.38 billion

Revenue forecast in 2030

USD 285.60 billion

Growth rate

CAGR of 4.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mode of transport, customer type, service, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Kuehne+Nagel; Deutsche Post AG; DB Schenker; Expeditors International of Washington, Inc.; CEVA Freight forwarding; DSV; FedEx; Uber Technologies, Inc.; United Parcel Service of America, Inc.; NIPPON EXPRESS HOLDINGS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Freight Forwarding Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global freight forwarding market report based on mode of transport, customer type, service, application, and region.

-

Mode of Transport Outlook (Revenue, USD Million, 2018 - 2030)

-

Road

-

Maritime

-

Rail

-

Air

-

-

Customer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation & Warehousing

-

Value Added Services

-

Packaging

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail & e-commerce

-

Healthcare

-

Food & Beverages

-

Media & Entertainment

-

Industrial & Manufacturing

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global freight forwarding market size was estimated at USD 216.47 billion in 2024 and is expected to reach USD 225.38 billion in 2025.

b. The global freight forwarding market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2030 to reach USD 285.60 billion by 2030.

b. Asia Pacific held the largest revenue share of 31.8% in 2024, with China playing a pivotal role in driving regional market growth. Rapid urbanization and ongoing infrastructure development have significantly transformed the freight forwarding landscape across the region, enhancing connectivity and streamlining logistics operations.

b. Some key players operating in the freight forwarding market Kuehne+Nagel; Deutsche Post AG; DB Schenker; Expeditors International of Washington, Inc.; CEVA Freight forwarding; DSV; FedEx; Uber Technologies, Inc.; United Parcel Service of America, Inc.; and NIPPON EXPRESS HOLDINGS among others.

b. Key factors driving the growth of the freight forwarding market include the rapid expansion of global trade, increasing demand for integrated logistics solutions, and the rise of e-commerce requiring efficient cross-border shipping. Technological advancements such as digital freight platforms, real-time tracking, and automation are also enhancing operational efficiency and transparency. Additionally, growing investments in transportation infrastructure, free trade agreements, and the need for supply chain resilience are further contributing to the market’s expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.