- Home

- »

- Consumer F&B

- »

-

Frozen Bakery Market Size, Share & Growth Report, 2030GVR Report cover

![Frozen Bakery Market Size, Share & Trends Report]()

Frozen Bakery Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Breads, Novelties), By Form Of Consumption, By Distribution Channel (Foodservice, Bakery Stores), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-885-5

- Number of Report Pages: 148

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Frozen Bakery Market Summary

The global frozen bakery market size was estimated at USD 70.63 billion in 2024 and is projected to reach USD 95.73 billion by 2030, growing at a CAGR of 5.2% from 2025 to 2030. The increasing demand for convenience foods has become a major catalyst driving the growth of the frozen food industry.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- The frozen bakery market in the U.S. led North America with the largest revenue share in 2023.

- By product, the pizza segment accounted for the largest revenue share of 30.9% in 2023.

- By form of consumption, the ready-to-bake segment held the largest revenue share of 56.7% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 70.63 Billion

- 2030 Projected Market Size: USD 95.73 Billion

- CAGR (2025-2030): 5.2%

- North America: Largest market in 2023

Frozen bakery items, including bread, pastries, and cakes, present a convenient alternative that allows consumers to enjoy freshly baked goods without the time-consuming preparation process. This convenience factor resonates strongly with modern consumers, particularly those seeking quick and hassle-free meal solutions to accommodate their fast-paced lifestyles.The growing demand for convenience foods has become a major catalyst driving the growth of the frozen food industry, and within it, the frozen bakery sector has emerged as a key beneficiary of this trend. The modern lifestyle, characterized by hectic schedules and increased urbanization, has led consumers to seek convenient meal options that require minimal preparation time without compromising on taste or quality. In this context, frozen bakery products offer a compelling solution, as they provide convenience, longer shelf life, and the ability to be easily stored and prepared at the consumer's convenience.

One of the key drivers for the surge in demand for frozen bakery products is the convenience they offer. Busy consumers, juggling multiple responsibilities, often find it challenging to allocate time for baking from scratch or visiting bakeries frequently. Frozen bakery items, ranging from bread and pastries to cakes, present a convenient alternative that allows consumers to enjoy freshly baked goods without the time-consuming preparation process. This convenience factor resonates strongly with modern consumers, particularly those seeking quick and hassle-free meal solutions to accommodate their fast-paced lifestyles. In January 2022, research conducted by the American Frozen Food Institute (AFFI) revealed that frozen foods have gained prominence in American households, with 30% of shoppers expanding their freezer capacity since the beginning of the pandemic.

The frozen bakery industry has responded to the demand for convenience by introducing a wide range of frozen meals that require minimal preparation. From frozen pizzas to complete frozen dinners, these products offer a quick and hassle-free meal solution for consumers. Frozen breakfast items such as breakfast sandwiches, waffles, frozen bites, and pancakes cater to consumers looking for a convenient morning meal that can be prepared quickly. In August 2023, Loblaws, a Canadian supermarket chain, introduced a new line of frozen pizzas under its President's Choice private label brand. The PC Black Label Frozen Pizza line features three varieties - Margherita, Diavola, and Funghi - that are hand-tossed and made in Italy with high-quality ingredients.

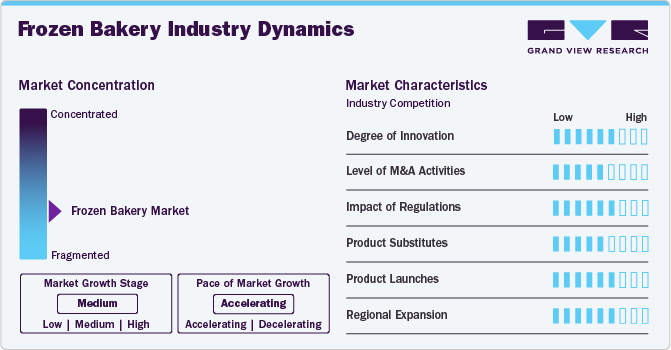

Market Concentration & Characteristics

Manufacturers in the frozen bakery industry are actively engaged in various initiatives to meet evolving consumer demands and market trends.

Innovation in the frozen bakery market is primarily driven by the rising consumer demand for healthier, premium, and convenient products. Companies are focusing on new product development, including the introduction of gluten-free, organic, and high-protein frozen bakery items.

In addition, advancements in freezing technology are enhancing product quality, allowing for better taste and texture retention. The increasing use of natural and clean-label ingredients is also a significant innovation trend as consumers become more health-conscious. Many manufacturers are investing in R&D to cater to specific dietary preferences, such as vegan and low-sugar options, which are gaining traction in the market.

The market has seen considerable M&A activity as larger companies seek to expand their market presence and diversify their product portfolios. Major players like Aryzta AG and Grupo Bimbo have engaged in strategic acquisitions to enter new geographic markets and enhance their offerings in premium and specialty frozen bakery products.

These acquisitions are often aimed at gaining access to innovative product lines or expanding distribution networks. The M&A landscape is competitive, with both global and regional players actively participating to strengthen their market positions.

The market is subject to a range of food safety and labeling regulations that impact production and distribution. Regulations related to the use of preservatives, artificial additives, and allergens are particularly important, as consumers increasingly prefer clean-label products.

In addition, compliance with regional food safety standards, such as the U.S. FDA regulations or the European Union's food labeling laws, is essential for market entry and success. Stringent health and safety standards often drive companies to reformulate products, particularly when introducing new ingredients or entering international markets.

Frozen bakery products face competition from a variety of substitutes, including fresh bakery items, ready-to-bake products, and homemade goods. In addition, the growing popularity of healthier snacks, such as protein bars and granola, presents an alternative for consumers seeking convenient food options.

However, frozen bakery products remain competitive due to their longer shelf life and convenience compared to fresh alternatives. Companies are addressing the threat of substitutes by offering premium and innovative frozen products that emphasize convenience without compromising on taste or quality.

Product Insights

The frozen pizza segment accounted for a share of 30.9% in 2023. Frozen pizzas are affordable and convenient and are available in a diverse range of bases and toppings, catering to various consumer preferences. In addition, frozen pizza options cater to a diverse array of dietary preferences, offering various bases such as traditional wheat crust, whole wheat crust, gluten-free crust, and even cauliflower crust, along with a diverse range of toppings for both vegetarian and non-vegetarian preferences, thus driving their demand among consumers.

The frozen breads segment is expected to grow at a CAGR of 4.9% from 2024 to 2030. Consumers are increasingly drawn to the convenience of frozen bread, as it allows them to stock up without concerns of quick spoilage, reducing food waste and shopping frequency and resulting in its increased adoption. The longer shelf life of frozen bread appeals to those who do not consume bread regularly.

Form Of Consumption Insights

Ready-to-bake frozen bakery products accounted for a share of 56.7% in 2023, as these products are gaining traction due to their ability to provide freshly baked goods with minimal effort and time investment. With consumers increasingly prioritizing health and convenience, market players are developing new product variants, such as healthier ingredient options, gluten-free alternatives, and innovative flavor combinations, to cater to diverse dietary preferences and lifestyles.

Ready-to-cook frozen bakery products are expected to grow at a CAGR of 5.5% from 2024 to 2030, owing to the growing demand for convenient and time-saving meal solutions. Moreover, ready-to-cook frozen bakery items ensure consistent quality and taste, providing reassurance to consumers seeking reliability and thus driving their demand.

As consumers lead fast paced and busy lives, they are opting for frozen bakery items like croissants, rolls, and breads. Manufacturers are actively diversifying their product offerings within the frozen bakery category to cater to evolving consumer preferences. In addition, the market is witnessing the entry of new companies seeking to address the varied needs of consumers in this segment.

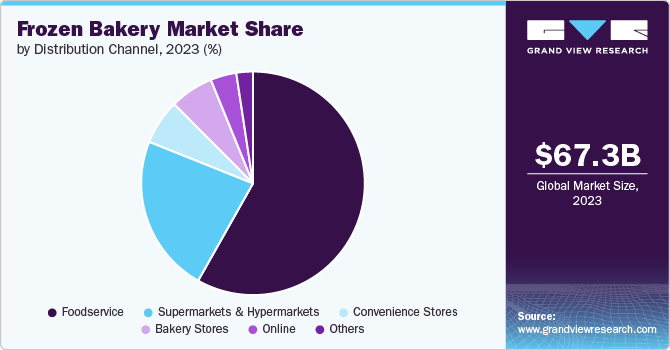

Distribution Channel Insights

The sales of frozen bakery products through foodservice accounted for a share of 58.0% in 2023. Foodservice establishments offer a wide variety of frozen bakery items, ranging from breads and rolls to pastries and desserts, providing plenty of options to choose from. In addition, they are known for their consistency in taste and quality, ensuring that their frozen bakery products maintain the same delicious flavors as their freshly baked counterparts, thus driving the sales of frozen bakery products through foodservice establishments.

The sales through online channels are expected to grow at a CAGR of 6.4% from 2024 to 2030, owing to the convenience offered by these channels. In addition, online platforms provide access to a diverse range of frozen bakery items, including specialty products that may need to be more readily available locally. This variety allows consumers to explore unique options and cater to specific dietary preferences or restrictions, such as gluten-free or vegan choices.

Regional Insights

The North America frozen bakery market accounted for a revenue share of over 38.1% in 2023. The growth of the market in North America can be attributed to several key factors influencing consumer behavior. Chief among these is the unparalleled convenience offered by frozen bakery products, which cater to the demands of modern, fast-paced lifestyles.

The rising number of professionals in the workforce, alongside the increasing preference for convenience foods, is anticipated to fuel the growth of the market. This sector benefits from an established presence in in-store bakeries, coffee chains, cafes, and quick-service restaurants, all of which are capitalizing on the advantages offered by frozen baked goods, including enhanced convenience, availability, and a wide range of product options. Consumers seeking convenient, indulgent, and on-the-go snacks are presented with a choice between fresh and frozen baked products, exerting significant influence on pricing dynamics within the market.

U.S. Frozen Bakery Market

The frozen bakery market in the U.S., including the consumption of frozen products, is driven by several factors that cater to the convenience-oriented lifestyles of modern consumers. One of the main reasons for the popularity of frozen products is their unparalleled convenience. Ready-to-bake frozen bakery items offer a hassle-free solution for individuals and families with busy schedules, providing quick and easy access to freshly baked goods without the need for extensive preparation or baking skills.

In addition, the extended shelf life of frozen products allows consumers to stock up on items, reducing the frequency of grocery shopping trips and minimizing food waste. This, coupled with the versatility of frozen products in meal planning and the assurance of quality and nutrition, makes them an attractive option for households across the country. Furthermore, the cost-effectiveness of frozen products, along with their ease of preparation and the growing emphasis on conscious consumption and sustainability, further contribute to their widespread popularity among consumers in the U.S.

Europe Frozen Bakery Market

The Europe frozen bakery market is anticipated to grow at a lucrative CAGR over the forecast period. Growing consumer preferences for convenient and grab-and-go products for breakfast have significantly boosted the morning goods segment in Europe. This trend has fueled the demand for frozen bakery products, aligning with the fast-paced lifestyles in this region. The availability of gluten-free options has played a significant role in driving market growth, appealing to consumers with dietary restrictions or preferences. Moreover, the adoption of innovative freezing technologies has enabled manufacturers to preserve the freshness and quality of bakery products while extending their shelf life, contributing to the widespread acceptance and consumption of frozen bakery items.

Furthermore, the convenience factor associated with frozen bakery products has propelled their expansion across Europe. Consumers appreciate the ease of preparation and storage offered by these products, making them a convenient choice for households and food service establishments alike. As a result, the frozen bakery market continues to thrive, with increasing variety and innovation driving its sustained growth and popularity across Europe.

Asia Pacific Frozen Bakery Market

The frozen bakery market in Asia Pacific is expected to grow at 6.5% from 2024 to 2030. The Asia Pacific frozen bakery market is experiencing significant growth driven by rapid urbanization, the rise of convenience foods, and changing consumer lifestyles. As more consumers in urban areas seek quick and easy meal solutions, frozen bakery products such as bread, pastries, and pizzas are becoming increasingly popular. The growing number of working professionals, coupled with the rise of dual-income households, has led to a shift in preferences towards ready-to-eat and ready-to-bake products, particularly in countries like China, India, and Japan. Additionally, the expansion of modern retail infrastructure and e-commerce platforms across the region has made frozen bakery products more accessible to consumers.

Another key driver is the increasing Westernization of diets, particularly in countries like China and Southeast Asia, where Western-style baked goods are becoming more mainstream. Alongside this, there is rising consumer demand for premium and artisanal bakery products, which is encouraging manufacturers to innovate and introduce healthier frozen bakery options, such as those made with whole grains, organic ingredients, and fortified with nutrients. Furthermore, the growing influence of food service channels, including quick-service restaurants and cafes, is boosting the demand for frozen bakery products, as these establishments rely on frozen goods for consistent quality and longer shelf life.

Key Frozen Bakery Company Insights

The competitive landscape of the market is characterized by a mix of global and regional players striving to capture a share of the growing demand for convenient and high-quality frozen bakery products. The market is also witnessing increased competition from private-label brands, especially as supermarkets and hypermarkets expand their in-house frozen bakery offerings at competitive prices. Mergers and acquisitions are common strategies in this market as companies look to strengthen their market position and expand their geographical reach.

Key Frozen Bakery Companies:

The following are the leading companies in the frozen bakery market. These companies collectively hold the largest market share and dictate industry trends.

- Grupo Bimbo

- Conagra Brands, Inc.

- Vandemoortele NV

- Europastry

- Kellogg Company

- Flowers Foods

- General Mills Inc.

- Monbake

- Panamar Bakery Group

- Associated British Foods plc

- Cole’s Quality Foods, Inc.

- Bridgford Foods Corporation

- Custom Foods Inc.

Recent Developments

-

In January 2024, Conagra Brands, Inc. entered a strategic partnership with global entertainment icon Dolly Parton to develop a line of Dolly Parton-branded retail food items, including frozen, refrigerated, grocery, and snack items in the Duncan Hines mixes line. This strategy will help the company to expand its product portfolio and capture a higher share of the frozen bakery market.

-

In October 2023, Kellogg Company completed the separation of its North American cereal business, resulting in two independent, public companies, including Kellogg Company and WK Kellogg Company. The Kellogg Company's business portfolio includes snacking, cereal, noodles, frozen breakfast, and plant-based foods.

-

In September 2023, Grupo Bimbo announced an investment of USD 100 million to expand the bread production line at its facility in Pilar, Buenos Aires Province, Argentina. This strategy will help the company increase its overall revenue and expand its frozen bakery portfolio in the Latin American market.

-

In August 2023, General Mills announced an investment of USD 49 million to expand its frozen dough plant capacity in Missouri, the U.S. The plant is expected to be completed in early 2024, and the facility addition will allow for nearly 1 billion pounds of frozen dough products to be produced annually. This strategy will help expand the plant area by more than 30,000 square feet and help meet the increasing demand for frozen bakery products in the food service channel across the U.S.

Frozen Bakery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 74.24 billion

Revenue forecast in 2030

USD 95.73 billion

Growth Rate (Revenue)

CAGR of 5.2% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form of consumption, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Germany; Switzerland; Austria; Netherlands; China; Japan; India; South Korea; Australia & New Zealand; Brazil; Chile; Peru; Colombia; South Africa

Key companies profiled

Grupo Bimbo; Conagra Brands, Inc.; Vandemoortele NV; Europastry; Kellogg Company; Flowers Foods; General Mills Inc.; Monbake; Panamar Bakery Group; Associated British Foods plc; Cole’s Quality Foods, Inc.; Bridgford Foods Corporation; and Custom Foods Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

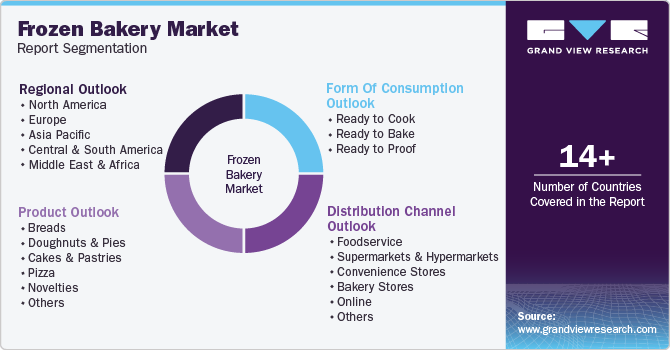

Global Frozen Bakery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the frozen bakery market report based on product, form of consumption, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Breads

-

Doughnuts & Pies

-

Cakes & Pastries

-

Pizza

-

Novelties

-

Others

-

-

Form Of Consumption Outlook (Revenue, USD Million; 2018 - 2030)

-

Ready to Cook

-

Ready to Bake

-

Ready to Proof

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Foodservice

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Bakery Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Switzerland

-

Austria

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Chile

-

Peru

-

Colombia

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global frozen bakery market size was estimated at USD 67.27 billion in 2023 and is expected to reach USD 70.63 billion in 2023.

b. The global frozen bakery market is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 95.73 billion by 2030.

b. Frozen Pizza dominated the frozen bakery market with a share of 30.9% in 2023. This is attributed to the emergence of specialty pizza products such as dairy and gluten-free.

b. Some key players operating in the frozen bakery market include Kellogg Co.; Cargill, Incorporated; Conagra Brands Inc.; Custom Foods, Inc.; Vandemoortele nv; Bridgford Foods Corporation; Associated British Foods plc; General Mills, Inc.; Europastry; Cole’s Quality Foods Inc.; and Flowers Foods.

b. Key factors that are driving the market growth include noticeable increase in popularity for processed food and rising demand from coffee shops along with the small and large scale food chains.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.