- Home

- »

- Consumer F&B

- »

-

Ready Meals Market Size, Share And Growth Report, 2030GVR Report cover

![Ready Meals Market Size, Share & Trends Report]()

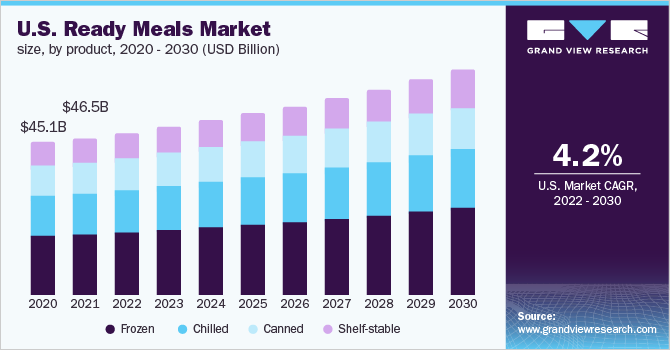

Ready Meals Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Frozen, Chilled, Canned), By Meal Type (Vegetarian, Non-vegetarian), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-529-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ready Meals Market Summary

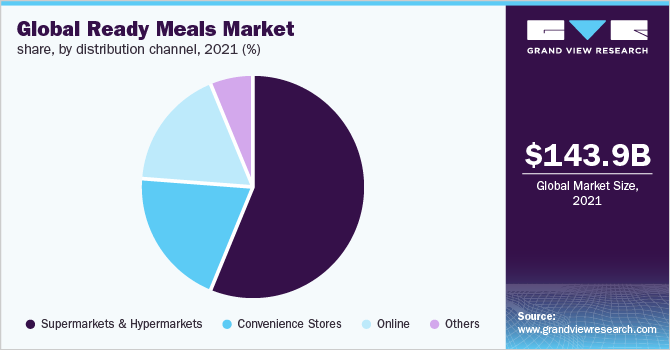

The global ready meals market size was estimated at USD 143.86 billion in 2021 and is projected to reach USD 225.28 billion by 2030, growing at a CAGR of 5.1% from 2022 to 2030. Ready meals are cost-effective alternative dishes that take less time to prepare as they are precooked and are available throughout the year.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2021.

- Asia Pacific is anticipated to be the fastest-growing regional market from 2022 to 2030.

- Based on product, the frozen segment held the largest market share in 2021.

- Based on meal type, the non-vegetarian segment held the dominant share in the ready meals market in 2021.

- Based on distribution channel, the supermarkets & hypermarkets made the largest contribution to the global market in 2021.

Market Size & Forecast

- 2021 Market Size: USD 143.86 Billion

- 2030 Projected Market Size: USD 225.28 Billion

- CAGR (2022-2030): 5.1%

- North America: Largest market in 2021

The shifting food preferences of consumers toward ready-to-eat food products owing to the busy lifestyles of working individuals as well as the hectic work schedules of college students is likely to fuel market growth.

Since the outbreak of coronavirus (COVID-19) in 2020, nearly all the countries around the world proposed country-level lockdowns, resulting in restricted movements and shutting down of public places, including restaurants and other eateries. During this time, consumers began buying and stocking up on packaged meals owing to their higher shelf life and convenience in cooking. This habit that developed because of the pandemic is likely to continue in the short term, driving the market growth.

Consumer preferences for packaged meals are constantly changing as people are looking for higher-quality ingredients, more variety, and speedier delivery. This has boosted the popularity of ready-to-eat takeaways and same-day delivery, for which, customers are willing to pay a premium. According to Eating Better’s Ready Meals 2020 Snapshot Survey, 88% of adults in the U.K. eat ready breakfasts and dinners or ready-to-cook foods and two in five people eat packaged meals every week. Such trends bode well for market growth.

Meanwhile, the rising pressure upon brands to offer products that are better for the environment continues to shift the overall concept of packaged food boxes toward more plant-based/vegan ingredients and the use of sustainable packaging with less plastic and waste. For instance, in September 2021, Walki-a company which specializes in consumer and industrial packaging launched a portfolio of trays for packaged and frozen foods, which is claimed to be recyclable in paper streams. The new trays include the Walki Pack Tray PET, with a thin PET lining that is classified as mono-material, making it suitable for recycling in paper streams.

The supply side of the market has also been changing as a result of the growing demand for ready meals, pushing restaurants, hotels, and cafes to change their business models. At the same time, this transition opens up new possibilities for retailers like supermarkets, hypermarkets, and grocers. Key supermarkets such as Walmart, Target, and Aldi have introduced or collaborated with cloud kitchens to provide packaged breakfast and dinners on their shelves. For instance, in October 2020, Finnair started selling its offerings in supermarkets by launching ‘Taste of Finnair’ at K-Citymarket Tammisto, a supermarket in Vantaa, Finland.

The growth of the online food delivery market fueled by the rapid demand and popularization of takeout-delivery platforms has complemented the demand for ready-made and semi-prepared kits for breakfasts, lunches, and dinners via e-commerce sites. For instance, in September 2020, Dutch startup Lazy Vegan launched a new Thai Green Curry frozen packaged meal and further plans to strengthen its presence in the European market by offering these products on offline as well as online platforms. The products are available in all Whole Foods Markets in the U.K., Planet Organic, As Nature Intended, and U.K.-based online food store Ocado.

Along with an urge to explore different ingredients and combinations, consumers are increasingly seeking premiumization. To cater to this segment, many key companies have been launching premium pre-packaged main courses with fine ingredients and different or original flavors. For instance, in September 2021, Irish packaged meal manufacturer Swift Fine Foods launched a new line of premium vegan ready main course boxes in the U.K. The meals include high-quality freshly made dishes such as Tofu, Garlic & Bok Choy Noodles; Black & Red Lentil Casserole; Roast Aubergine & Couscous; and Cauliflower and Chickpea Tagine.

Product Insights

The frozen segment held the largest market share in 2021 and is expected to maintain its dominance over the forecast period. The convenience of frozen food is the key factor driving the segment growth. According to the British Frozen Food Federation (BFFF) in November 2020, frozen foods were the best grocery retail category throughout 2020, outperforming fresh produce and every other food category in terms of value and volume percentage growth. Product launches in the segment are also driving the segment growth. For instance, in March 2022, FatBroccoli launched frozen packaged meals in UAE featuring locally produced 100% natural ingredients.

The shelf-stable segment is projected to register the fastest growth from 2022 to 2030. Shelf-stable meals do not require refrigeration and can be consumed at room temperature. As these are affordable, they are often referred to as emergency meals when regular food cannot be provided. Product launches in this segment are likely to fuel market growth. For instance, in January 2020, India-based pre-packaged meal startup NÜTY launched shelf-stable ready dishes using a non-thermal cold pasteurization technique through its proprietary cooking process aided by High-Pressure Processing technology. This enables the company to provide packaged food with an extended shelf life.

Meal Type Insights

The non-vegetarian segment held the dominant share in the ready meals market in 2021 and is expected to retain its lead over the forecast period. The demand for protein-rich food items such as value-added chicken nuggets, sausages, and salami among consumers has benefited the non-vegetarian segment. Consumer preference for frozen non-vegetarian packaged food is rising owing to rising hygiene issues with fresh products available in the market. Key players have been launching new products in recent years. For instance, in January 2021, India-based The Taste Company expanded its product portfolio to include non-vegetarian pre-packed meals. These are made with traditional home-style cooking methods to eliminate the need for preservatives or artificial colors.

The vegan segment is projected to register the fastest growth over the forecast period. Millennials nowadays are becoming more conscious about their health and animal welfare and are willing to pay a reasonable price for vegan products and ingredients. In response to these trends, players are launching various vegan ready meals and snacks in the market. For instance, in September 2021, BOSH! launched its first range of vegan packaged eatables in Morrisons. The product range includes Shepherd’s Pie and Chilli Non-Carne, which have been made in collaboration with packaged meal specialist Oscar Mayer.

Distribution Channel Insights

Supermarkets & hypermarkets made the largest contribution to the global market in 2021. Ready meals are on the rise in developed countries such as the U.K. and the U.S., with most supermarkets & hypermarkets, and convenience stores carrying their range of convenient ready-to-eat foods. For instance, in January 2021, independent supermarket Jempson’s launched a range of prepared meals in its local kitchen, which includes lasagna, toad in the hole, fish pie, and honey & mustard chicken.

The online distribution channel is likely to exhibit the highest CAGR over the forecast period. Pre-packaged meal brands have been experiencing a growth in the overall demand through online platforms. Major supermarkets & hypermarkets such as Walmart, Target, and Aldi also offer online delivery, which is driving the segment growth. Many supermarkets have been launching their own packaged meal brands or partnering with cloud kitchens to offer the same. For instance, in January 2022, Kroger Co. launched a new line of pre-packaged dishes in collaboration with the online grocery platform Instacart. Kroger Co. will be offering items like roasted chicken, sushi, wraps, salads, coleslaw, and mashed potatoes, which can be delivered to customers in 30 minutes.

Regional Insights

North America held the largest share of 41.4% in the global market in 2021, with the U.S. being the largest consumer of pre-packaged meals. Evolving food preferences among consumers owing to growing health awareness and concerns for food safety are driving product demand in the region. Moreover, vegan, gluten-free, and organic pre-packaged foods are deriving a lot of their value through consumer trust and their perception of the products being healthy. Ready-to-eat dishes are becoming increasingly popular due to their convenience, portability, and availability of new offerings.

Asia Pacific is anticipated to be the fastest-growing regional market from 2022 to 2030 owing to the increasing target population in the region. Moreover, growing consumer disposable income and rising awareness about ready meal products are contributing to market growth. In addition, improved living standards and rapid industrialization in emerging economies such as India will have a positive impact on the demand for pre-packaged meals. Europe is also expected to witness considerable growth in the coming years due to the introduction of innovative products.

Key Companies & Market Share Insights

The market is fragmented owing to the presence of a large number of global and domestic companies. With consumers demanding more meal varieties within segments like frozen, chilled, vegetarian, and vegan, manufacturers are focusing on product innovation to suit the new go-to health choices of consumers around the world. Players have been increasing their product supplies in supermarkets and hypermarkets amid the COVID-19 pandemic. They are also focusing on strategies such as partnerships, online advertising campaigns, innovation, and new product development to expand their product portfolio and customer base.

For instance, in February 2021, online retailer The Vegan Kind​ partnered with plant-based meat pioneers ​THIS​ to launch 100% plant-based ready meals. These include hyper-realistic plant-based chicken cooked with vegetables, herbs, and spices. Apart from this, in August 2020, ready meal manufacturer Symington’s launched its own D2C platform in response to the increase in online shopping for pre-packaged foods. The new platform would offer bundles of pasta, rice, and noodle dishes.

In February 2022, a new ready meal startup called Kitchen Prep was launched in the U.K. offering frozen healthy gourmet pre-packaged dishes. The pre-prepared meals include beef and green beans pasta in soy sauce, one-pot turkey chili with rice, and spicy cod with zoodles. It also includes a vegan range with dishes like spicy cauliflower chickpea rice bowl, sweet potato curry, and creamy leek risotto. Such offerings and strategic initiatives will have a considerable impact on the demand for and sales of ready meals. Some prominent players in the global ready meals market include:

-

Nestlé

-

General Mills, Inc.

-

Kellogg Company

-

Conagra Brands, Inc.

-

Tyson Foods, Inc.

-

Dr. Oetker

-

Nomad Foods

-

Green Mill Foods

-

Unilever

-

2 Sisters Food Group

Recent Developments

-

In June 2023, Unilever, a British multinational consumer goods company, announced of acquiring Yasso, a premium frozen Greek yogurt brand in North America to improve its yogurt portfolio.

-

In April 2023, Nestle, a Swiss multinational food and drink processing conglomerate corporation, announced of creating a joint venture for frozen pizza with PAI in Europe, competing in this competitive category.

Ready Meals Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 149.9 billion

Revenue forecast in 2030

USD 225.28 billion

Growth rate

CAGR of 5.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, meal type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; Japan; India; Brazil; South Africa

Key companies profiled

Nestlé; General Mills, Inc.; Kellogg Company; Conagra Brands, Inc.; Tyson Foods, Inc.; Dr. Oetker; Nomad Foods; Green Mill Foods; Unilever; 2 Sisters Food Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global ready meals market report based on product, meal type, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Frozen

-

Chilled

-

Canned

-

Shelf-stable

-

-

Meal Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Vegetarian

-

Non-vegetarian

-

Vegan

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ready meals market size was estimated at USD 143.86 billion in 2021 and is expected to reach USD 149.9 billion in 2022.

b. The global ready meals market is expected to witness growth at a compounded annual growth rate of 5.1% from 2022 to 2030 to reach USD 225.28 billion by 2030.

b. North America dominated the ready meals market with a share of 41.4% in 2021. This is attributed to the shifting consumers’ food preferences towards ready-to-eat food products and new product launches in the U.S. and Canada.

b. Some key players operating in the ready meals market include Nestlé; General Mills, Inc.; Kellogg's Company; Conagra Brands, Inc.; Tyson Foods; Dr. Oetker; Nomad Foods; Green Mill Foods; Unilever; 2 Sisters Food Group

b. Key factors that are driving the ready meals market growth include shifting consumers’ food preferences towards ready-to-eat food products owing to the busy lifestyle of working individuals as well as the hectic work schedules of college students.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.