- Home

- »

- Power Generation & Storage

- »

-

Fuel Cells In Aerospace And Defense Market Report, 2021-2028GVR Report cover

![Fuel Cells In Aerospace And Defense Market Size, Share & Trends Report]()

Fuel Cells In Aerospace And Defense Market Size, Share & Trends Analysis Report By Product (PEMFC, SOFC), By Application In Aerospace, By Application In Defense, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-696-6

- Number of Report Pages: 104

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Energy & Power

Report Overview

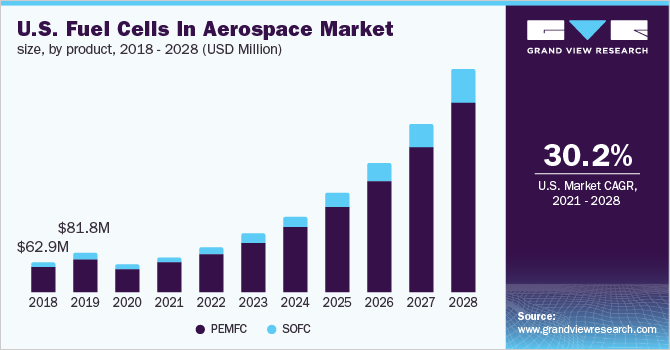

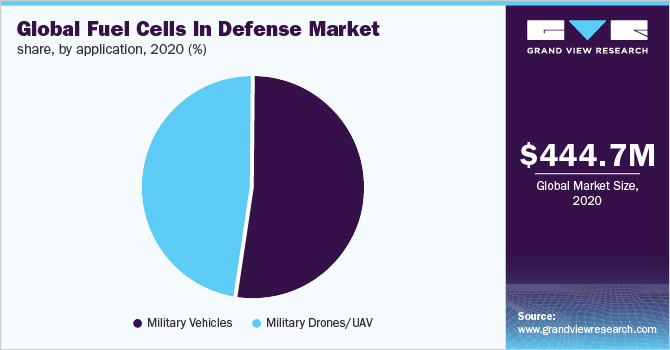

The global fuel cell in aerospace market size was valued at USD 193.87 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 30.6% from 2021 to 2028. The global fuel cell in defense market size was valued at USD 444.70 million in 2020 and is anticipated to grow at a CAGR of 10.7% over the forecast period. The North American market for fuel cells in aerospace and defense is driven by significant support from the federal government of the countries. In the European region, the U.K. is the leading market for fuel cells in aerospace and defense. A rise in demand for non-conventional energy sources is one of the key factors fostering the growth of the market. Fuel cells are one of the fastest-growing alternative solutions, primarily due to their ability to generate electricity using a variety of fuels. In addition, unlike conventional sources, they are eco-friendly in nature as their byproducts do not pose a threat to the environment.

The U.S. is among the early adopters of clean energy solutions for sectors such as power generation and transportation. It can be attributed to the increased importance given to clean energy solutions as per the energy act introduced by the U.S. government. Such acts have provided a starting guideline regarding the implementation of clean energy solutions in the country's energy sector.

The government of Canada introduced the Canadian Fuel Cell Commercialization Roadmap in 2003. The objective of this roadmap was to accelerate the commercialization of fuel cells and hydrogen technologies in Canada. This roadmap was updated in 2008 and was outlined as a significant tool for Canada to achieve a low carbon transition in the future.

The U.S. Army and U.S. Navy are among the users of fuel cells in North America. Vendors operating in the market are continuously developing components of fuel cells that are used in rotorcrafts.

Product Insights (Aerospace)

The PEMFC product segment accounted for the largest revenue share of over 85.0% in 2020. In the aerospace sector, PEMFC is widely used for transportation applications due to its efficiency, compactness, temperature range, and lifetime.

As per Honeywell Aerospace, air-cooled PEMFC is best suited for aerospace applications due to advantages such as better thermal management, the lighter balance of plant, shorter stack service life, and limited integration flexibility.

In the aviation industry, SOFC is more efficient than PEMFC in terms of output power. Boeing has initiated a feasibility study to investigate the SOFC auxiliary power unit (APU) on B737. With this technology, APU is 45% efficient in turning fuel into electricity in contrast to a gas turbine, which is only 15% efficient.

Product Insights (Defense)

The PEMFC product segment accounted for a dominant share of over 80.0% in 2020. In the defense industry, PEMFC is used in various applications such as military vehicles and military drones. The increasing sales and popularity of fuel cells in unmanned aerial vehicles (UAVs) have emerged as significant drivers for the PEMFC product segment.

The Department of Defense (DoD), Department of Energy (DOE), and NASA are interested in developing the SOFC technology as it enables efficient power systems for defense applications. The purpose is to develop lightweight logistic fuel compatible systems, power generation for battery charging, range extenders for electric vehicles, and power for unmanned aerial and underwater vehicles.

Application Insights (Aerospace)

The commercial aircraft's segment is leading the segment with a share of over 75.0% in 2020. Currently, smaller-sized aircraft with a seating capacity of 20 passengers are equipped with hydrogen-powered fuel cells. However, aircraft manufacturers are conducting feasibility studies for larger commercial aircraft. For instance, in January 2021, Airbus organized the ZEROe program, which consists of six, eight-bladed hydrogen-fuel-cell-powered pods mounted beneath the wing of the large commercial aircraft.

Vendors operating in the market are continuously developing components for fuel cells that are used in rotorcrafts. For instance, in August 2021, HyPoint specializing in air-cooled fuel cells for electric aircraft collaborated with Piasecki Aircraft Corporation (PiAC) to develop fuel cell systems for its crewed H2 helicopter.

Application Insights (Defense)

The military vehicles application segment accounted for a dominant share of over 50.0% in 2020. Vendors operating in the military vehicles market are partnering with fuel cell technology providers to launch fuel cell-based military ground vehicles. For instance, in September 2021, Kia announced to launch of its first military fuel cell vehicle in 2028, which is likely to include small and light command vehicles and heavy trucks that can be equipped with arms and troops.

Technological advancement in the field of fuel cells for military drones is expected to drive the market over the forecast period. In August 2021, Honeywell announced to develop of an innovative Beyond Visual Line of Sight (BVLOS) technology suite for light drones, which allows them to fly three times longer and with less human intervention.

Regional Insights

North America held the largest revenue share of over 35.0% in 2020 in the aerospace market. The North American fuel cell market is very beneficial for investments in various research projects that are getting commercialized. The U.S. is one of the major markets for fuel cells and is at the forefront of innovation with support from the U.S. Department of Energy (DOE). The U.S. Army and U.S. Navy are among the users of fuel cells in North America. Vendors operating in the market are continuously developing components of fuel cells that are used in rotorcrafts.

The European government has plans to considerably decrease GHG emissions. As a result, several countries in Europe have identified the implementation of innovative technologies, such as fuel cells (primarily PEMFC), as a way to meet these objectives. This, in turn, is expected to provide a significant opportunity for the fuel cell manufacturers in the market over the forecast period.

In January 2021, DLR, Germany’s aerospace center, announced that for the BALIS project, it is developing a 1.5 MW fuel cell powertrain that will be used by aircraft. The initial focus and goal of this project is the use of fuel cells in the aviation sector and emission-free air transport in Germany.

Key Companies & Market Share Insights

The market is highly competitive owing to continuous technological advancements being introduced by the existing vendors and new entrants. Industry players are focusing on strengthening their relations with system installers and are looking at collaborations and mergers as strategies to help them enhance their presence in the value chain and expand their geographical presence. For instance, in September 2021, SFC Energy AG partnered with Bharat Electronics and FC TecNrgy to investigate energy generation solutions in hydrogen fuel cells in the area of off-grid power supply for use in applications such as homeland security, civil protection, and defense. Some prominent players in the global fuel cells in the aerospace and defense market include:

-

Advent Technologies

-

Australian Fuel Cells Pty Ltd.

-

Cummins Inc.

-

ElringKlinger AG

-

GenCell Ltd.

-

Honeywell International Inc.

-

Infinity Fuel Cell and Hydrogen, Inc.

-

Intelligent Energy Limited

-

Loop Energy Inc.

-

Plug Power, Inc.

Fuel Cells In Aerospace And Defense Market Report Scope

Report Attribute

Details

Market size value in 2021 (Aerospace)

USD 249.78 million

Revenue forecast in 2028 (Aerospace)

USD 1,618.33 million

Growth Rate

CAGR of 30.6% from 2021 to 2028

Market size value in 2021 (Defense)

USD 488.62 million

Revenue forecast in 2028 (Defense)

USD 996.06 million

Growth Rate

CAGR of 10.7% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Aerospace (product & application), defense (product & application), region

Regional scope

North America; Europe; Asia Pacific; Central and South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Spain; Italy; China; Japan; South Korea; India; Australia; Brazil; UAE; South Africa

Key companies profiled

Honeywell International Inc.; Advent Technologies; Infinity Fuel Cell and Hydrogen; Inc.; Australian Fuel Cells Pty Ltd.; Intelligent Energy Limited; Cummins Inc.; HyPoint; Inc.; ITM Power; ElringKlinger AG; GenCell Ltd.; Plug Power; Inc.; Loop Energy Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global fuel cells in aerospace and defense market report on the basis of aerospace (product & application), defense (product & application), and region:

-

Product Outlook (Aerospace) (Revenue, USD Million, 2017 - 2028)

-

PEMFC

-

SOFC

-

-

Product Outlook (Defense) (Revenue, USD Million, 2017 - 2028)

-

PEMFC

-

SOFC

-

-

Application Outlook (Aerospace) (Revenue, USD Million, 2017 - 2028)

-

Commercial Aircrafts

-

Rotorcrafts

-

-

Application Outlook (Defense) (Revenue, USD Million, 2017 - 2028)

-

Military Drones/UAV

-

Military Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fuel cell in the aerospace value was estimated at USD 193.87 million in 2020 and is expected to reach USD 249.78 Million in 2021. The global fuel cells in the defense value were estimated at USD 444.70 million in 2020 and are expected to reach USD 488.62 million in 2021.

b. The global fuel cell in the aerospace market is expected to witness a compound annual growth rate of 30.6% from 2021 to 2028 to reach USD 1,618.33 million by 2028. The global fuel cells in the defense market are expected to witness a compound annual growth rate of 10.7% from 2021 to 2028 to reach USD 996.06 Million by 2028.

b. In global fuel cell in the aerospace, the PEMFC was the largest product segment accounted for 85.17% of the total revenue in 2020 as it is more durable than other product types. In addition, the military vehicles application segment dominated the global fuel cells in the defense market with a share of 52.46% of the total revenue in 2020.

b. Some of the key players operating in the fuel cells in the aerospace and defense market include Plug Power Inc., Cummins Inc, Advent Technologies, and Honeywell International Inc.

b. Key factors driving the growth of the fuel cells in the aerospace and defense market include the increasing focus on decarbonization in the aerospace industry and rising spending on military drones/UAVs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."