- Home

- »

- Automotive & Transportation

- »

-

Fuel And Lube Trucks Market Size, Industry Report, 2030GVR Report cover

![Fuel And Lube Trucks Market Size, Share & Trends Report]()

Fuel And Lube Trucks Market (2025 - 2030) Size, Share & Trends Analysis Report By Truck Type (Fuel Tank Trucks, Lube Service Trucks, Combination Trucks), By Capacity, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-500-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fuel And Lube Trucks Market Summary

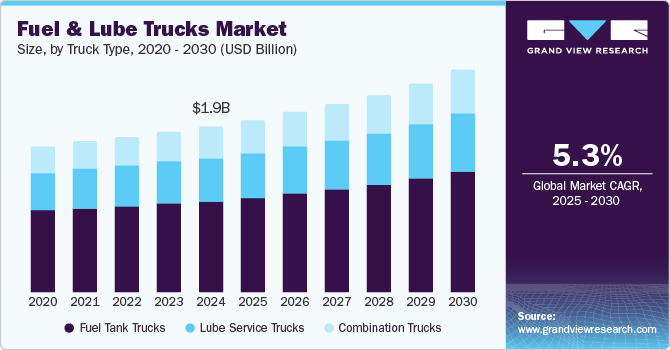

The global fuel and lube trucks market size was estimated at USD 1.86 billion in 2024 and is projected to reach USD 2.50 billion by 2030, growing at a CAGR of 5.3% from 2025 to 2030. The fuel and lube trucks industry is experiencing significant growth, driven by the increasing demand from industries such as construction, mining, agriculture, and logistics.

Key Market Trends & Insights

- The North America fuel and lube trucks industry held a dominant market share of 41.2% in 2024.

- The U.S. fuel and lube trucks industry held a dominant position in 2024.

- By truck type, the fuel tank trucks segment accounted for the largest market share of 55.1% in 2024.

- By capacity, the 15,000 to 25,000 kg segment held the largest market share in 2024.

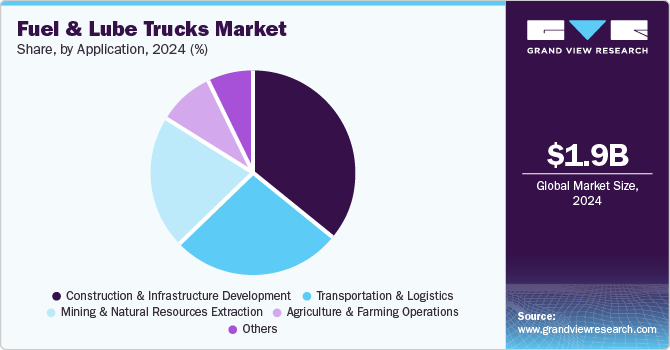

- By application, the construction and infrastructure development segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.86 Billionn

- 2030 Projected Market Size: USD 2.50 Billion

- CAGR (2025-2030): 5.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As global infrastructure development accelerates, the need for efficient and mobile fuel and lubrication solutions has become critical. Construction and mining operations, often located in remote areas, rely on these trucks to deliver fuel and lubricants directly to heavy machinery and equipment, ensuring uninterrupted operations and reducing downtime.

The rapid growth of construction and mining industries globally is a major driver for the fuel and lube trucks industry. These sectors heavily rely on heavy-duty machinery and equipment, often operating in remote areas where traditional fueling infrastructure is unavailable. Fuel and lube trucks ensure on-site refueling and maintenance, minimizing downtime and optimizing productivity. Infrastructure development projects in emerging economies and resource extraction activities contribute significantly to market growth.

Technological advancements in truck design have transformed fuel and lube trucks into highly efficient, sustainable, and smart solutions for diverse industrial needs. By integrating GPS tracking, automated dispensing, IoT monitoring, and eco-friendly features, these trucks not only meet the demands of modern industries but also contribute to a greener and more efficient future. These innovations position fuel and lube trucks as essential tools for industries focused on operational excellence and environmental responsibility. The integration of IoT-enabled monitoring systems has transformed the capabilities of fuel and lube trucks.

IoT sensors provide real-time data on fuel levels, lubricant quality, vehicle performance, and maintenance requirements. This data can be transmitted to centralized platforms, allowing operators to monitor the health and efficiency of their trucks remotely. Predictive maintenance powered by IoT ensures that potential issues are identified and addressed before they escalate, reducing downtime and repair costs. This level of connectivity also enhances decision-making and fleet management by providing actionable insights into operations.

While the fuel and lube trucks industry is growing, several restraints, including high initial costs, regulatory challenges, fluctuating fuel prices, and competition from alternative fueling solutions, can hinder market expansion. One of the primary restraints for the market is the high initial investment required to purchase and maintain these vehicles. Fuel and lube trucks, especially those equipped with advanced technologies like GPS tracking, automated dispensing systems, and IoT monitoring, come with significant upfront costs. Small and medium-sized enterprises (SMEs) or businesses with limited capital may find it challenging to justify such a large expenditure, especially when alternative, less costly fueling solutions are available.

Truck Type Insights

The fuel tank trucks segment accounted for the largest market share of 55.1% in 2024. Fuel tank trucks are essential in a wide range of industries, including construction, mining, oil and gas, agriculture, transportation, and emergency services. These industries require on-site refueling solutions for heavy machinery, vehicles, and equipment that operate in remote locations where traditional fuel stations are unavailable. The versatility of fuel tank trucks in catering to these diverse industries makes them the most widely used type of vehicle in the fuel and lube truck market.

The combination trucks segment is expected to grow at the fastest CAGR during the forecast period. Combination trucks, which combine both fuel and lubrication services in a single vehicle, offer cost-efficiency and operational flexibility for businesses that require both fueling and maintenance services. The ability to fuel and lubricate machinery or equipment with a single truck reduces the need for separate vehicles, making combination trucks an attractive option. This dual functionality enables operators to reduce fleet size, lower operational costs, and improve service delivery, contributing to their rapid adoption.

Capacity Insights

The 15,000 to 25,000 kg segment held the largest market share in 2024. Trucks in the 15,000 to 25,000 kg weight range strike a balance between capacity and maneuverability, making them suitable for a wide array of industries. This segment provides enough weight capacity to carry sufficient fuel and lubricants for large-scale operations while still being versatile enough to navigate more challenging or restricted urban environments. The trucks are widely used in construction, agriculture, and logistics, where they cater to heavy equipment refueling and lubrication needs.

The above 25,000 kg segment is expected to register the fastest CAGR during the forecast period. Trucks above 25,000 kg are specifically designed for long-distance hauling and operating in remote and rugged locations, where larger fuel and lubricant supplies are needed. In industries like mining and oil extraction, which are often situated in remote areas, these trucks offer the capacity to deliver larger volumes of fuel and lubricants without the need for frequent refueling. Their ability to cover extended distances with greater capacity is crucial for maintaining the operational efficiency of heavy machinery in these sectors.

Application Insights

The construction and infrastructure development segment dominated the market in 2024. The construction and infrastructure development sector requires a wide range of heavy machinery, such as cranes, bulldozers, excavators, and earth movers. These machines require continuous fuel and lubrication to operate efficiently in challenging environments. Fuel and lube trucks are essential for on-site fueling and maintenance, ensuring that construction and infrastructure projects can proceed without interruptions caused by machine downtime. Additionally, with the ongoing expansion of megaprojects such as highways, airports, and industrial facilities, the construction sector has a growing need for fuel and lubrication solutions that can cater to the high demands of heavy-duty machinery. The ability to provide high-capacity fuel and lube trucks ensures that these large projects can proceed efficiently without interruption, which is crucial in meeting tight deadlines and budgets.

The mining and natural resources extraction segment is expected to grow at a significant CAGR during the forecast period. The ongoing global demand for natural resources, including metals, minerals, and fossil fuels, is driving increased investment in mining projects. This includes both new mines being developed and the expansion of existing ones. As mining companies scale up their operations to meet this growing demand, the need for fuel and lube trucks that can support heavy machinery on a large scale becomes essential. Furthermore, technological advancements in mining operations, which require larger, more fuel-efficient equipment, contribute to the growing demand for fuel and lubrication services.

Regional Insights

The North America fuel and lube trucks industry held a dominant market share of 41.2% in 2024, driven by several key factors. North America boasts a well-established infrastructure for fuel and lube trucks, with a robust network of manufacturers, suppliers, and service providers. The demand for fuel and lube trucks is particularly high in industries such as construction, mining, transportation, and energy, all of which require continuous fuel and lubrication support for heavy machinery and vehicles. This demand contributes to North America's dominant market share.

U.S. Fuel And Lube Trucks Market Trends

The U.S. fuel and lube trucks industry held a dominant position in 2024. The U.S. leads in the development and adoption of advanced technologies for fuel and lube trucks, such as automated dispensing systems, real-time monitoring, and IoT-enabled solutions. These technological advancements contribute to the growing efficiency and reliability of fuel and lubrication services, further enhancing the market position of the U.S. within the global market. Additionally, the U.S. continues to invest heavily in infrastructure development and industrial growth, which drives the demand for fuel and lube trucks. As industries continue to expand and modernize, the need for fuel and lubrication services to support heavy machinery operations grows, solidifying the U.S.'s dominant position in the market.

Europe Fuel And Lube Trucks Market Trends

Europe fuel and lube trucks industry is expected to register a moderate CAGR from 2025 to 2030. The growing emphasis on sustainability and operational efficiency within European industries is driving the adoption of more advanced fuel and lube trucks. These trucks not only help reduce fuel consumption but also minimize maintenance costs and extend the life of heavy machinery. Additionally, Europe is known for its strict environmental standards and regulations, which significantly influence the market. European countries are adopting green technologies and low-emission solutions to comply with both EU-wide and national emission reduction targets. This has spurred the development of eco-friendly fuel and lube trucks that align with sustainability goals, including electric-powered trucks and vehicles equipped with low-emission engines. As a result, fuel and lube trucks in Europe are increasingly designed with a focus on energy efficiency and environmental impact reduction, making them attractive to environmentally conscious buyers.

The UK fuel and lube trucks market is expected to grow rapidly in the coming years. The U.K. government is investing heavily in industrial modernization, infrastructure upgrades, and environmental sustainability. These initiatives provide a favorable environment for the growth of the fuel and lube truck market, as companies seek to align with government priorities while enhancing their operational capabilities.

The fuel and lube trucks market in Germany held a substantial market share in 2024. Germany is home to some of the world’s leading manufacturers of fuel and lube trucks, including Mercedes-Benz, MAN, and Volvo, which are renowned for producing high-quality and reliable vehicles. The country's strong manufacturing and export capabilities position it as a key contributor to the market growth. These companies continue to innovate and develop more efficient solutions to meet the evolving demands of various industries.

Asia Pacific Fuel And Lube Trucks Market Trends

The Asia Pacific fuel and lube trucks industry is anticipated to grow at the highest CAGR during the forecast period. This robust growth can be attributed to the rapid industrialization and urbanization across the region, driving increased demand for fuel and lubrication services in key sectors such as construction, mining, infrastructure development, and transportation. The region’s expanding manufacturing base and significant investments in infrastructure projects, especially in countries like China and India are fueling demand for fuel and lube trucks.

Japan's fuel and lube trucks market is expected to grow at a moderate growth rate during the forecast period. Japan’s focus on technological advancements and automation in fleet and equipment management supports the adoption of modern fuel and lube trucks. The country’s emphasis on environmentally friendly solutions and compliance with stringent emission standards further propels the market, as industries increasingly prefer advanced, energy-efficient trucks.

The fuel and lube trucks market in China held a substantial market share in 2024, driven by the country’s large-scale industrial operations and infrastructure development projects. China's robust construction industry, fueled by government investments in urbanization and modernization, has significantly increased the demand for fuel and lubrication services to support heavy machinery and equipment.

Key Fuel And Lube Trucks Company Insights

Some of the key companies in the fuel and lube trucks market include McLellan Industries, Inc., Niece Equipment, LP, Panda Mechanical Equipment Co., Ltd., Ground Force Worldwide, and Engineered Transportation International. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships.

-

McLellan Industries, Inc. is a provider of innovative, high-quality equipment designed to meet the needs of various industries, including mining, construction, and agriculture. Key offerings from McLellan Industries include specialized products such as fuel/lube trucks, mill relining machines, and custom-built equipment that enhance productivity and operational efficiency.

-

Niece Equipment, LP is a prominent manufacturer and distributor specializing in industrial and construction equipment, known for its expertise in designing reliable and durable solutions for heavy-duty applications. The company caters to industries such as construction, mining, agriculture, and oil & gas, offering a broad range of equipment tailored to meet the diverse needs of its clients. The company’s product portfolio includes water trucks, fuel trucks, dump trucks, and other specialized vehicles designed to enhance operational efficiency and ensure safety in challenging environments.

Key Fuel And Lube Trucks Companies:

The following are the leading companies in the fuel and lube trucks market. These companies collectively hold the largest market share and dictate industry trends.

- McLellan Industries, Inc.

- Niece Equipment, LP

- Panda Mechanical Equipment Co., Ltd.

- Engineered Transportation International

- Ground Force Worldwide

- Thunder Creek Equipment (LDJ Manufacturing Inc.)

- Tankmart International Inc.

- Platinum Tank Group

- Tremcar

- Stellar

Recent Developments

-

In November 2024, Stellar announced that it had acquired Elliott Machine Works, Inc., a family-owned manufacturing company based in Galion, Ohio. This strategic acquisition aims to enhance Stellar's growth by expanding its product offerings to include Elliott Machine Works, Inc.’s range of fuel and lube trucks, thereby filling gaps in Stellar's existing lineup and enabling the company to better serve industries such as mining, construction, and oil and gas.

-

In August 2024, Thunder Creek Equipment launched new model of its fuel and service trailer (FST) series, designed for high-capacity fuel and DEF storage. This latest addition features a 990-gallon diesel tank and a 330-gallon diesel exhaust fluid (DEF) tank, specifically tailored to meet the needs of large-acreage farming operations and custom harvesters. By offering substantial storage capacities, the trailer minimizes downtime and maximizes operational efficiency, making it an ideal solution for demanding agricultural tasks.

-

In July 2023, Ground Force Worldwide and its subsidiary, TowHaul, have entered into a strategic partnership with Field Mining Services Group to enhance their presence in Australia. Under this agreement, Field Mining Services Group becomes the official preferred distributor and service provider for all Ground Force and TowHaul products across the country. This collaboration enables Field Mining Services Group to offer a comprehensive suite of mining support equipment, including solutions for fuel delivery, water distribution, cable handling, road maintenance, and material hauling.

Fuel And Lube Trucks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.93 billion

Revenue forecast in 2030

USD 2.50 billion

Growth rate

CAGR of 5.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Truck type, capacity, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

McLellan Industries, Inc.; Niece Equipment, LP; Panda Mechanical Equipment Co., Ltd.; Engineered Transportation International; Ground Force Worldwide; Thunder Creek Equipment (LDJ Manufacturing Inc.); Tankmart International Inc.; Platinum Tank Group; Tremcar; Stellar

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

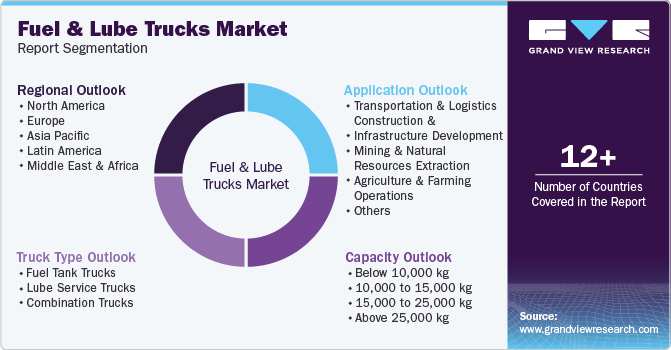

Global Fuel And Lube Trucks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fuel and lube trucks market report based on truck type, capacity, application, and region:

-

Truck Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fuel Tank Trucks

-

Lube Service Trucks

-

Combination Trucks

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 10,000 kg

-

10,000 to 15,000 kg

-

15,000 to 25,000 kg

-

Above 25,000 kg

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation and Logistics

-

Construction and Infrastructure Development

-

Mining and Natural resources Extraction

-

Agriculture and Farming Operations

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fuel and lube trucks market size was estimated at USD 1.86 billion in 2024 and is expected to reach USD 1.93 billion in 2025.

b. The global fuel and lube trucks market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2030 to reach USD 2.50 billion by 2030.

b. North America dominated the fuel and lube trucks market with a share of 41.2% in 2024. North America boasts a well-established infrastructure for fuel and lube trucks, with a robust network of manufacturers, suppliers, and service providers.

b. Some key players operating in the fuel and lube trucks market include McLellan Industries, Inc., Niece Equipment, LP, Panda Mechanical Equipment Co., Ltd., Engineered Transportation International, Ground Force Worldwide, Thunder Creek Equipment (LDJ Manufacturing Inc.), Tankmart International Inc., Platinum Tank Group, Tremcar, Stellar.

b. Key factors that are driving the market growth include the expansion of construction and mining industries and rising demand for fleet maintenance in transportation and logistics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.